Posted on 02/06/2014 9:58:14 AM PST by thackney

Corporate executives have no way of knowing what the world will look like over the next four decades as long as U.S. political strife keeps kicking up a cloud of uncertainty over the economy, former Federal Reserve Chairman Alan Greenspan said Thursday.

The fog of political war hampers executives’ appetite for long-term capital investments and explains why the U.S. economy has been so slow to rebuild after the financial crisis and recession of 2008 and 2009, Greenspan explained at the Winter North American Prospect Expo in Houston.

One ratio used to determine economic confidence — a comparison of U.S. companies’ capital expenditures and cash flow — “was a year ago at its lowest level since 1938,” said Greenspan, who ran the world’s most powerful central bank from 1987 to 2006.

“We’re five years out of the economic recession and business investment is not back yet,” he said.

The nation’s gross domestic product has grown 6 percent since the crisis, but is well below where it should be in a normal economic recovery.

Greenspan delivered his remarks moments before thousands of oil and gas executives congregated at the Winter North American Prospect Expo in Houston to do just that: Invest.

Over the next two days, oil and gas property owners will haggle with investors to sell land and producing assets to the highest bidders they can find scouting and window shopping on the floors of the George R. Brown Convention Center.

Millions of acres of oil and gas land from Texas to North Dakota and Pennsylvania and other states could be at stake as buyers seek to gain elbow room in the biggest oil boom the country has ever seen.

Oil glut could hamper economy

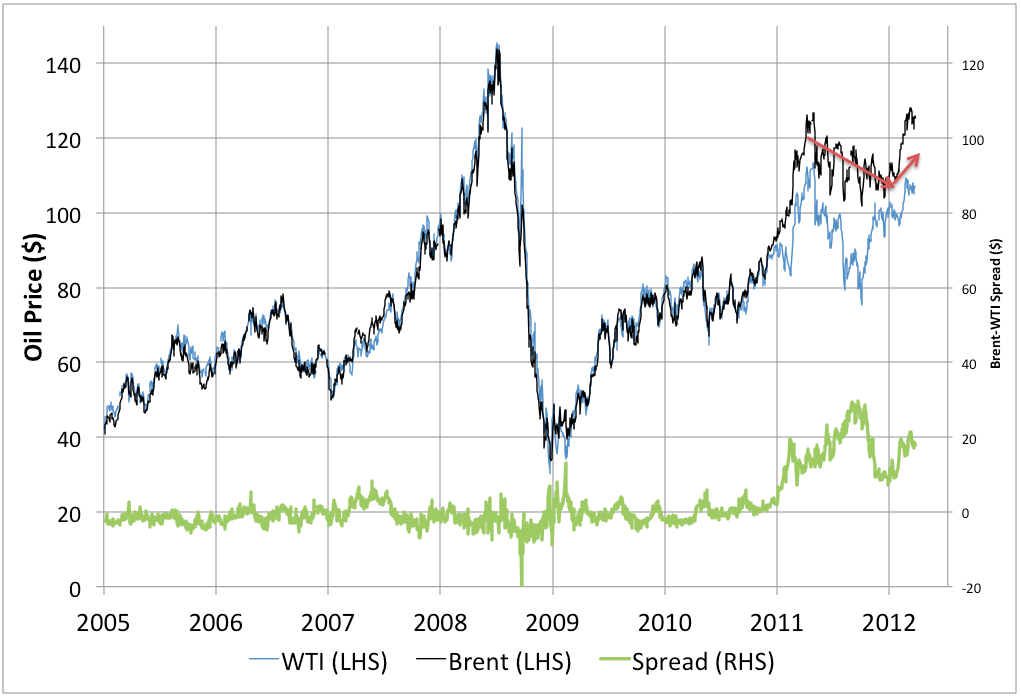

But Greenspan offered a note of caution. It’s clear, he said, that a glut in the nation’s oil supplies have started to open up a spread between international and U.S. benchmark crude prices, and that may eventually put downward pressure on the national economy.

“Oil is coming out of our ears, so to speak,” he said. “The system couldn’t digest it.”

The shale-oil boom itself is contingent on oil prices. Current U.S. and international forecasts for crude prices are “well above where they should be,” he said, adding they should be closer to levels that make new production questionable.

Hydraulic fracturing and horizontal drilling are expensive operations, but “easily profitable in light of $100 oil,” he said. “But what happens if oil prices really start to move down?”

Political concerns

Still, Greenspan said he doesn’t expect oil prices to drop significantly, but he takes other issues that impact prices, such as international stability, “very seriously.”

At home, the biggest issue remains political fragmentation. The economy has recovered faster even in past periods of division in Washington D.C. and the rest of the country, but the past few years have seen something that few periods of U.S. history have: Less dialogue across the political aisles, Greenspan said.

He recalled his time working in the Gerald Ford Administration in the 1970s, when Ford would break bread with politicians he fought with day and night.

Now they work in Congress from Monday to Thursday, and then they go home.

“It is remarkable how few dinners in Washington are fully bipartisan,” he said. “It’s not like it was 20 years ago.”

http://7d77c24d03a62043cfe4-5f6ff8e305d6142e830d07da1bf3d404.r76.cf1.rackcdn.com/1360225240_0.png

Until this gap close back up, it is a sign we have a lack of sufficient oil transportation from our cental country region.

Typical useless, mealymouth rhetoric from Greenspan. Both sides are equally culpable is his suggestion. Hey Mr. Chairman, it’s impossible to have bipartisanship when the leadership of one the parties spends a large part of its time mau mauing the other party.

Our demand isn’t taking up the slack. We are importing less.

The complication is most of the new production is inland while the cuts in imports are coastal. It is a transportation issue creating the lower WTI price compared the coastal Brent.

Hopefully we’ll get some pipeline capacity up soon. You happen to know how long it would take to get Keystone up and running?

It will greatly depend on what equipment they were allowed to and have ordered in advance of approval.

-— We’re five years out of the economic recession -—

And the oil boom is bad. Go figure.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.