This is where you can exchange some investment opinions and advice

This is where you can exchange some investment opinions and advice Posted on 09/09/2013 4:00:54 AM PDT by expat_panama

This is the Weekly Investment & Finance Thread (Sept.-9-13 edition)----

Trying to focus on the markets for today and each day and the economic news

This is where you can exchange some investment opinions and advice

This is where you can exchange some investment opinions and advice

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------

Futures are upbeat --wonderful bull market!! Just look at the news:

Weak Jobs Report 'Muddies Waters' For Federal Reserve

Economy in China Benefits From Stronger US DemandWall Street Journal - 7:46am BEIJING—China's economy showed fresh signs of resilience in August, with trade data pointing to a sustained strengthening in global demand for goods from the country.Ever since Lehman Brothers collapsed almost five years ago - the most dramatic event in an unprecedented global crisis that is still reverberating today - policy makers have laboured to fix the causes of that disaster and to pre-empt the next.

On top of that, we got Wholesale Inventories out on September Eleventh, and we got the Business Inventories report on Friday the Thirteenth. What could possibly happen?

They’ll keep “fixing” the banks and “reforming” healthcare and having that “laser-like focus” on the economy until we are all paupers, our currency worthless and every country on earth hates us.

lol! —having a dreary Monday morning are we?

yeah, just spent 30 minutes “fixing” Java. It does not play nice with Scottrade.

Ah, you and I’ve noticed the same thing. After strugggling to get them to agree I ignore JAVA’s updates as much as possible and I dread Scottrade’s automatic revisions.

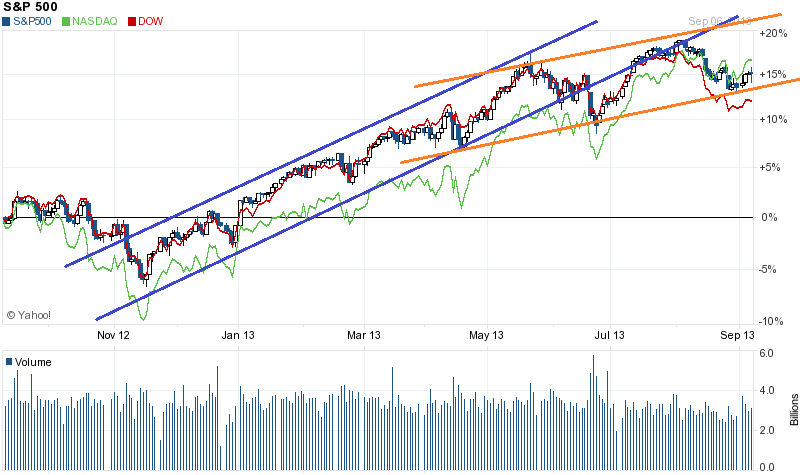

--and what I saw is that major indexes had consistent support/resistance lines from Nov12 to May13 when we shifted to new ones. That's when I spotted how even though prices still crept higher the volume was falling --bearish signal.

Signals can lie, but what's for sure is these charts are easy to do. All I did was make a chart on a website like Yahoo, right click on it -copy- and then I pasted it into MSPaint so I could draw lines on it. What would be neat is if more people here could make these and share 'cuz my bet is that different people will see different things, and I'm interested in what others can see more than what I see.

A very good morning to all! Yesterday broke records and offered direction and today's futures say the direction continues:

Uptrend Resumes As Nasdaq Logs New High 09/09/2013 06:54 PM ET - Stocks notched strong gains Monday, changing the market outlook for the better. The Nasdaq surged 1.3%, its biggest gain since Aug. 1. The index topped its Aug. 5 peak and hit its highest levels in nearly 13 years. The S&P 500 rallied 1% and closed back above its 50-day moving average for the first time since Aug. 23. Both indexes extended their win ... More »Easing of concerns over Syria boosts global stocks By TERESA CEROJANO - AP - 26 mins ago MANILA, Philippines (AP) — Global stocks rose Tuesday, buoyed by positive data from Japan and China and some relief that concerns over Syria have receded with Russia's offer to press Damascus to put its chemical weapons under international control. (full story)

Alcoa, HP and Bank of America are leaving the Dow.

huh, kind of an end of an era.

fwiw, I bot YHOO yesterday & plan on picking up others today...

I bought Yahoo years ago around 14 and change when it looked like they were going to strike some kind of deal with Microsoft.

But nothing significant happened with the price of the stock or Microsoft (I thought with MSFT as a partner, it had the potential of becoming another Google - maybe or maybe not, but that’s what I thought).

Now I’m sorry I didn’t have more patience.

Do you have a price target for this? Do you see their prospects as being bright because of M. Mayer at the helm, or another reason(s)?

In last Friday’s IBD they said YHOO was worth buying if it went over 28.7 in heavier volume, and yesterday it did and I went in w/ a half investment. Today it went up another % so I bot the other half. IBD says if it’s still a good buy before goes up 5% ($30.14 —and it’s still only $29.51) and to ‘start locking in your gains’ (translation: sell half) if it goes up say, 20% or to $34.44.

With all those rules to choose from it begins to be more of an art than a science...

fwiw, today I also bot SSNC for similar reasons.

To be replaced by Nike, Visa, and can't remember.

Thanks for the chart. I'm too upset to deal with charts, just bought back in the one I mainly play and it slipped $1 on me. And I watched it so closely and keep thinking, "this has to be the bottom." Put a lot on the line for me.

Should have sat the week out. Thanks for the chart. I'll get back to that when I can think straighter.

I'm 50 cents down now. Crazy damn market. I don't think I'm cut out for this.

Yea Alcoa has been on the Dow 54 years. About the same age as me. I guess every thing changes with time. I didn’t put up the charts, I believe our friend ex-pat did that. Kudos to him.

Don’t let the market get you down. I’m pretty new at this so I make some dumb mistakes. I get down and then work my way back and then get stupid and get down again but I’m learning. When I get down I just have to step back and think about what I’m doing wrong. My biggest problem is selling to soon. I get so hungry for a profit I sell for a small gain and then watch it go up after I’ve sold.

IWM looks strong still (got long yesterday) and since it closed pretty close to the high I've taken no $$ off the table. But still nervous for the usual reasons - gotta have a sizeable pullback anytime now, or so you would think.

It was you, btw, who got me to stop trying to outguess the market and go with what the market's showing me (or at least what I think the market's showing me). IOW, I stopped trying to fade these rallies and go with the flow, so to speak. I lost too much playing the short side when it was not really warranted.

And I thank you for that.

My pleasure; over the past few days I’ve phased about 1/2 way from cash into stocks & tomorrow will tell me if I need to keep phasing in or if I’ve been out of phase with the market —so to speak.

I like it better when things good down a long time & then go up a long time...

The other was BAC is being replaced by Goldman Sachs. BAC had been doing better lately.

I forgot to whom I was speaking. expat posted the chart. I need to work on charts. I'm starting to do better with candles but can't use them alone.

The best advice I've gotten so far is try not to lose money. Rather than we are trying to make a lot of money. I've sold too soon, the other day right on the money thanks to a chart technique i understand, it's deflating to know you could have made a lot more but a profit is better than a loss. That being said, my biggest problem is not getting the entry point right. Which is what expat was trying to show me but his are indexes, and I don't understand those yet.

Something told me not to buy this week but I see the low price anyway it closed 50 cents below my breakeven point and who knows what it will do in the morning which is when it's been taking the nosedives lately.

” Something told me not to buy this week”

With Syria hangin out there I sold off everything and was going to go shopping afterwards but now that Vacillations are US has made it apparent that he doesn’t know what he’s gonna do I went ahead and bought some IWM this morning.

We've seem to have gotten our rally back:

Stocks Rise As Uptrend Gains Traction

09/10/2013 07:58 PM ET - The stock market pressed on with its September rally, closing Tuesday with broad gains. The Nasdaq rose 0.6% and the S&P 500 0.7%. Volume jumped; it has been significantly higher since Labor Day, which tends to mark the end of slower summer trading. Apple (AAPL) slid 2% after unveiling the latest iPhone models. But technology stocks still rallied. The ... More »

--fwiw this morning's futures are flat; considering today's date that sounds good...

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.