Skip to comments.

And We're Back! Dow 14,000 Fuels a New Wealth Boom

CNBC ^

| Friday, 1 Feb 2013

| Robert Frank

Posted on 02/01/2013 3:13:45 PM PST by Mrs. Frogjerk

The next American wealth boom has officially begun.

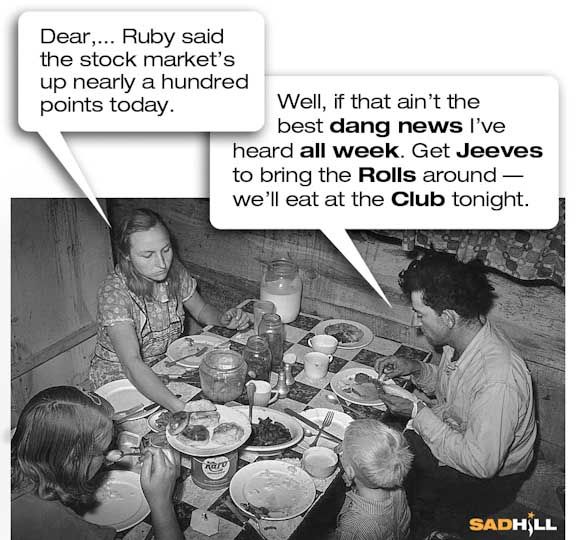

It may not feel like it for many Americans. But with the Dow breaching 14,000, shareholders and investors have recovered the more than $8 trillion in wealth lost during the recession and attained levels of paper wealth they haven't seen since the Roaring Oughts.

The stock market has gone from wealth destroyer to the nation's largest manufacturer of new millionaires and billionaires. The market moves are creating a new virtuous cycle of confidence for the wealthy. A new survey from Spectrem Group shows that millionaire confidence in the economy hit the highest level in two years, led by their bullishness on the economy and corporate earnings.

The big question now is what the next Gilded Age will look like, who will benefit and how long the market-fueled prosperity will last.

(Excerpt) Read more at cnbc.com ...

TOPICS: Business/Economy; News/Current Events

KEYWORDS: 000; 14; dow; wealthboom

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-50 next last

To: Mrs. Frogjerk

“Prices for highly prized art, wine, vintage cars, jewels watches and other collectibles are soaring past their 2007 highs.”

I’d equate that to ME stockpiling rice, beans and ammo.

We both know the end is near, we just find different things to be of ‘value’ in our immediate lives. :)

21

posted on

02/01/2013 3:57:36 PM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Mrs. Frogjerk

All you nay sayers need to read Ben Grahm’s book or better his disciple David Dreman’s book on contrarian investing.

Us contrarians are setting pretty. The fact you are whining means money is being made

22

posted on

02/01/2013 4:09:03 PM PST

by

bert

((K.E. N.P. N.C. +12 .....The fairest Deduction to be reduced is the Standard Deduction)

To: Diana in Wisconsin

I believe in a diversified portfolio. Ammo, food, water, medical supplies, tools, pint bottles of whiskey and vodka and of course the old standby - gold and silver.

23

posted on

02/01/2013 4:09:41 PM PST

by

SVTCobra03

(You can never have enough friends, horsepower or ammunition.)

To: Mrs. Frogjerk

The Vanguard Total Market Index Fund (VTI) is higher now than it was before the crash. It was up over 17% last year and is up more than 5% this year to date. You don’t have to pick stocks and pay fees. You don’t have to be rich to get in. It sure beats the 10 year CD’s at 1%.

To: Mrs. Frogjerk

This is what passes today for an "economy" : a handful of stocks fueled by high-frequency trading computers owned by politically-connected banks courtesy of cheap money provided by the printing presses of the Federal Reserve.

Meanwhile, here in the Real World, the US workforce has shrunk to its smallest levels since 1984, wage growth is negative, and interest on savings is less than zero after inflation, which the government conveniently denies is happening.

But the Obama cheerleaders at the Communicate Nothing But Crap network keep waving their pom-poms as though we were living in a new Gilded Age.

25

posted on

02/01/2013 4:13:24 PM PST

by

andy58-in-nh

(Cogito, ergo armatum sum.)

To: Mrs. Frogjerk

Any bets that it’s a bubble?

26

posted on

02/01/2013 4:15:33 PM PST

by

popdonnelly

(The right to self-defense is older than the Constitution.)

To: Mrs. Frogjerk

27

posted on

02/01/2013 4:23:31 PM PST

by

Mmmike

To: Mrs. Frogjerk

The 1% is back and on a roll. The DemocRATS are rejoicing! So much for those 99% OWS losers. LOL!

28

posted on

02/01/2013 4:24:49 PM PST

by

FlingWingFlyer

(Now Playing. Obama II - The Revenge of My Father.)

To: andy58-in-nh

“a handful of stocks fueled by high-frequency trading computers owned by politically-connected banks”

_________________________________________

I have been saying for some years now that the market is no longer your father’s stock market.

It is now mostly sophisticated computers doing the pump and dump.

I think it has little to do with reality.

29

posted on

02/01/2013 4:31:08 PM PST

by

AlexW

To: I want the USA back

In gold, the s&p is actually down.

30

posted on

02/01/2013 4:32:01 PM PST

by

gotribe

(obama = the Great Divider)

To: I want the USA back

In gold, the s&p is actually down.

31

posted on

02/01/2013 4:32:08 PM PST

by

gotribe

(obama = the Great Divider)

To: VideoDoctor

No, the new mantra is that it’s all Congresses fault.

To: All

33

posted on

02/01/2013 4:47:35 PM PST

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Mrs. Frogjerk

Gee, recovery summer all over again....what a load of rubbish.

34

posted on

02/01/2013 4:54:20 PM PST

by

GenXteacher

(You have chosen dishonor to avoid war; you shall have war also.)

To: Diana in Wisconsin

“Prices for highly prized art, wine, vintage cars, jewels watches and other collectibles are soaring past their 2007 highs.”

__________________________

I have collected antique glass & crystal perfume bottles/presentations by famous artists/design houses (Lalique, Viard, Baccarat, etc) for 40 years. I keep tabs on the current auction results. Prices realized are barely at 1/3-1/2 of 1998 book values. Sales results plummeted from their highs in 2008 and while they have rebounded in the past 18 months, they are still depressed.

OTOH, having finished the 2013 books, we were astonished to find sales were up 15% Y/Y. Costs, however, were up 30%.

I believe these folks are stockpiling the equivalent of PMs. These collectibles, they hope, will be priceless after the riots and destruction they foresee. This is their store of value. They will use their PMs to survive the harder times. The cars, wines, paintings, et al are all stashed in their country homes, aka: BOL. They will trade them among themselves, or leave them to their children and grandchildren. It’s a way to keep assets from the government.

I doubt any of them would even think of stockpiling rice, except Arborio for their risotto. Ammo? Gaia forbid!!!!

It has been good to see you back, Diana.

To: Diana in Wisconsin

“Prices for highly prized art, wine, vintage cars, jewels watches and other collectibles are soaring past their 2007 highs.”

art = kids first coloring efforts in scrapbook

wine = Ripple, Boones Farm (Strawberry Hill and Melon Ball)

vintage cars = 69 Corvette Stingray in matchbox car

jewels watches = Timex (I used to wear two Timexs until I found I had too much time on my hands)

The rich don't have anything on me.

36

posted on

02/01/2013 5:46:02 PM PST

by

BipolarBob

(Happy Hunger Games! May the odds be ever in your favor.)

To: reformedliberal

Thanks for expounding upon the simple thought of a country Girl. :)

It’s good to be back! I have missed you all. :)

37

posted on

02/01/2013 6:38:33 PM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: BipolarBob

I wouldn’t trade my life for theirs, either. Fools. :)

38

posted on

02/01/2013 6:40:54 PM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: Diana in Wisconsin

What’s a 2013 dollar wort compared to a 2007 dollar?

To: Mrs. Frogjerk

Wow, things are going so well the market is back up.

Even unemployment is up!

And so is the number of people who stopped looking for work!

The deficit and national dept are way up!

What a boom! Everything is up!

40

posted on

02/01/2013 7:18:26 PM PST

by

Right Wing Assault

(Dick Obama is more inexperienced now than he was before he was elected.)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-50 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson