Posted on 10/22/2010 3:59:53 AM PDT by blam

Shield Your Eyes: The Gold Plunge Is Continuing

Joe Weisenthal

Oct. 22, 2010, 4:00 AM

After yesterday's bloodbath, these last few hours have brought on more of the same pain for gold bulls.

[snip]

(Excerpt) Read more at businessinsider.com ...

Soon time for more.

Buy the dips. It will skyrocket in November.

I hope it keeps going down. It will give an opportunity for the regular folks that are out of the market to step back in and protect themselves if things go south with quantitative easing and we get serious inflation.

Joe Weisenthal

Oct. 22, 2010, 4:07 AM

Investor sentiment, according to AAII, is now firmly in extreme bullish mode. Everyone and their brother is a bull. Chart via PragCap:

[snip]

(Happy Days Are Here Again!)

I don’t know but I’ve been told

It’s hard to run with the weight of gold

Other hand I’ve heard it said

It’s just as hard with the weight of lead

Anyone buying gold is an idiot. I mean I could maybe under stand it a year or two ago....but when it hit $1200? I mean you don’t relax.

NOw is the time to sell not buy...

Joe Weisenthal

Oct. 22, 2010, 6:52 AM

Great chart from Deutsche Bank, via FT Alphaville, that ties a lot of loose strings together. It shows a pretty clear connection between the stock market and Deutsche's index of economic surprises.

Now is the time to sell not buy...

I bought my insurance hedge when the magic liberal from Chicago looked like he was going to con America with his Hope and Change BS, gold was in the $800's.

I will hold, not fold. It's enough $$ I can eat for quite a while, not enough to get rich.

Now is the time to buy Gold.

Not because the price has dipped, but because the US cannot repay its debts without devaluing the dollar by 75%.

The price of Gold will go to $5000/oz at least, and perhaps twice that depending on how the aftermath of the devaluation is dealt with. But its buying power will remain exactly what it is at the moment.

The buying power of anyone not in Gold (or other hard assets) will be wiped out. It’s as simple as that.

by: SeekinGold

October 22, 2010

Market fundamentals indicate a gold forecast price of $1,500 an ounce by the end of the year. Due to its recent strong rise, however, the dollar-denominated gold prices are poised for a correction. This can be a golden opportunity for investors to buy or add to their favorite precious metal stocks or their physical holdings.

Much of the recent power behind rising gold prices was the currency war. Central banks all over the world are careful and cautious about a strong currency when the economies are weak. One advantage of a weak currency is that nations can inflate their debt away. They care much less about a strong currency when the economy is healthy. The US dollar has fallen sharply, as the Federal Reserve is acting fast and bold among others.

The outlook is quite bullish for gold as the fundamentals behind it remain strong. In the short term, however, gold is overbought. The investment demand dwindles when prices hit new records repeatedly and much of the Fed’s bold actions on quantitative easing, aka printing money to buy bonds, may have already priced in.

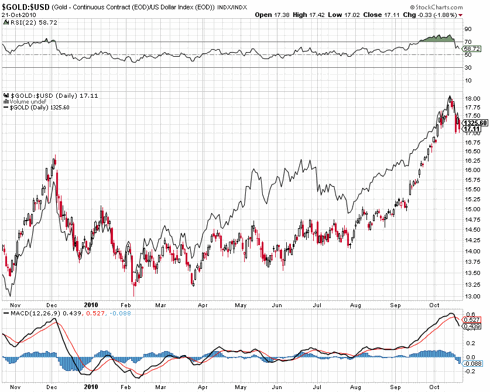

When US dollar strengthens against a basket of currencies gold loses as much as 3% and does not regain it when the dollar falls back to its previous level. The chart below indicates the overbought situation the yellow metal is experiencing in close comparison to the underlying currency, the US dollar.

I wonder who is at the controls?

October 22, 2010

Gold Price: $1,320/oz

Joe Weisenthal: Shield Your Eyes: The Gold Plunge Is Continuing

Thia gut ia unmoved by the market. He always bashes gold.

Bullcrap Insider strikes again.

“Gold is down! Buy now!”

“Gold is up! Buy now!”

“Anyone buying gold is an idiot.

NOw is the time to sell not buy...”

I will buy your gold. Please let me know asap

Duh, I’m an idiot.

Not that it matters to me one way or the other, but have you ever considered the fact that gold has not been soaring in price as much as the purchasing power of USD$ is shrinking?

Speaking strictly for my self, I look at dips in the price of gold as an opportunity to add some more bullion to the vault, hopefully before that nasty little tidbit in the ObamaCare bill requires me to fill out forms for the Feds on all gold purchases or sales of $600 or more. I guess we did need to pass it to find out what’s in it, huh. LOL

Gold historically becomes more desirable when the peoples confidence in their government diminishes. I’m just not that comfortable with the clowns we have in the cockpit right now, but as I said in the beginning, I’m an idiot, or something.

8^{D> ...(Mickey Hart Emoticon)

Buy beans and bullets...

I thought we had an understanding.

You wouldn't continue to disrupt my threads (by saying the same thing over and over again) and I wouldn't call you names.

Which is it dummy?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.