Skip to comments.

Fugitive financier arrested at U.S. border

globeandmail.com ^

| Feb. 12, 2009

| via AP

Posted on 02/12/2009 9:20:17 PM PST by smokingfrog

SACRAMENTO, CALIF. — An American fugitive accused in a $100-million (U.S.) mortgage fraud was caught at the Canadian border after taking a taxi from Toronto with $1-million in Swiss bank certificates and $70,000 stuffed in his shoes, authorities said Wednesay.

(Excerpt) Read more at theglobeandmail.com ...

TOPICS: Crime/Corruption; News/Current Events

KEYWORDS: fugitive

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Comment #2 Removed by Moderator

To: Baynative

I clicked on the link hoping it was Soros.

3

posted on

02/12/2009 9:27:56 PM PST

by

Ben Hecks

To: Ben Hecks

4

posted on

02/12/2009 9:33:41 PM PST

by

smokingfrog

(Is it just my imagination, or is the water in this pot getting a little too hot?)

To: smokingfrog

According to some recent opinions, hard working, productive men like him are only trying to protect themselves. In my opinion, he’s a thief.

5

posted on

02/12/2009 9:36:26 PM PST

by

familyop

(combat engineer (combat), National Guard, '89-'96, Duncan Hunter or no-vote, http://falconparty.com/)

To: familyop

He committed mortgage fraud. Where on earth have you seen people defend him?

6

posted on

02/12/2009 9:38:20 PM PST

by

Arguendo

To: smokingfrog

Bet the cabbie’s po’d he didn’t get his tip.

7

posted on

02/12/2009 9:51:11 PM PST

by

Beowulf9

To: smokingfrog

Here he is:

This is the html version of the file http://www.triduanum.com/memo.pdf.

Google automatically generates html versions of documents as we crawl the web.

Page 1

RESTORING INTERNATIONAL CONFIDENCE IN AMERICAN MBS/CMBS/ABSINVESTMENT SYSTEMBY: CHRISTOPHER JARED WARREN

A. Resume

Before diving into the heart of what is wrong, why its wrong, and what is needed to fix it, I must speak on my qualifications for this dissertation to substantiate my arguments. My name is Christopher Jared Warren, and in 2001 I was hired as a 19 year old to become a sales AccountExecutive for ACC Capital Holdings subsidiary, the now infamous “Ameriquest MortgageCompany”. Over the next three years of employment, I became the shining star of “portfolio retention”, a predatory division that would specialize in refinancing home owners who JUST gotloans from Ameriquest in the last 24 months. I was the number one producer in the region over 60% of the time I was there, the company sent me to management training in Orange CA twice, trips to the Super bowl twice, Hawaii and Las Vegas based on my large production statistics and paychecks. Most moths I would individually sell more then $5,000,000 in volume and bring inover $30,000 in net income……typically ore then 15 loans with more then 3 points and all rates higher then 7.00% - much higher then industry standard at the time and not to mention not bad for a 19-22 year old kid with no degree. As a 19 then 20 year old boy, my managers and handlers taught me the ins and outs of mortgage fraud, drugs, sex, and money, money, and more money. My friend and manager handed out crystal methamphetamine to loan officers in a bid to keep them up and at work longer hours. At any given moment inside the restrooms - cocaine and meth was being snorted by my estimates more than a third of the staff, and more than half the staff manipulating documents to get loans to fund and more then 75% just completely made falses tatements on 1003s regarding stated income etc to get loans funded. A typical welcome aboard gift was a pair of scissors, tape, and white out, three things a loan officer or financial professional should never need.. Of course no where in training OR in management training did this 20 year old ever learn that false statements on a 1003 were a federal offense. Overall in the two and half years I was at Ameriquest I funded over $90,000,000 in mortgages, of which more then$75,000,000 contained some sorts of material frauds undetected by management and funders. However, near the end of my employment there, I had hacked the computer systems run by EMPOWER for Ameriquest and was clearing my own funding conditions with no documentation, literally waiving file conditions as if I were an underwriter. The day I left I left with the entire customer database. I had made over $700,000 I was 22 had beat their system, had gotten paid and ripped off one of the largest private companies in the worlds entire customer database. So what to do with 680,000 Ameriquest customer private information? Well………..start a mortgage company and offer better rates and lower fees then AMC. So at the ripe old age of 22, I founded a mortgage brokerage/bank - WTL FINANCIAL INC., at 22, a fraudster trained by the best corporate environment for fraud, I built a company modeled after the movie boiler room andgot WTL licensed in OR CA, MN, CT, RI, FL as a mortgage banking company. From 2004 untilits grand 2007 collapse, WTL killed it. As a 22, 23, and 24 year old with no credentials I made

Page 2

over $2.25m all of which was spent on 24 cars(at 26 the number is only 31 total), 5 houses, drugs, 1 engagement and split, 1 300 person wedding, 2 kids. Our company boasted region-best30,000 square feet, 120 employees, and handling a monthly gross revenue over $5m. Fraud was rampant. We found investors that were not re-pulling credit reports, so we would change a 500 fico to a 700 fico, a person in foreclosure and make It look like they were never late, fake w2s,pay stubs, bank statements, verification of deposits, none of which was being re-verified. These investors, who were securitizing these assets as AAA rated were not even verifying anything in the files? I am sure that their investors were assured everything from correspondents was being audited. Every time a lender caught a file we would “fire” the employee produce termination paper work to the investor, and re-hire the employee under a different alias. Over the course of the 3 years, over $810,000,000 in mortgage backed securities originated from my companies.That’s a 24 year old selling a billion dollars in bad mbs securities which by 2008 were in default with out doubt. With the collapse of sub prime giant New Century, came our defeat, as we were too big and too stiff to be agile enough to change. So then in 2007 I diversified. I knew everything at the age of 25 about mortgage banking, origination, funding, reselling securities, underwriting. It was time to learn new things: money laundering, escrow company management, real estate, flipping, lease-backs, joint ventures, llcunit capital offerings. I found my place to learn AFG HOLDINGS COMPANY, the parent company of LOOMIS WEALTH SOLUTIONS, AFP of California LLC., AFG Technologies,and Nationwide Lending Corp(their mortgage banking division). I started as the general manager for the mortgage company, turning it around in 90 days. When I showed up they hadn’t funded aloan in 66 days, they had no warehouse line and no investors. Within 90 days NLG was funding again, with a warehouse line, investors like Indymac, Lehman Brothers, and CITI Mortgage Corp. The trick to this company was simple: AFG would partner with developers and buy realestate at 50 cents on the dollar, then sell it to his “financial consulting” members for 80 cents onthe dollar, wed appraise the properties at 100 cents on the dollar artificially inflate the purchaseprices so the loans were at 80 AFG would credit back the down and the closing costs. AFGwould net 25 points per closing and promise the buyers they would oer the mortgage payment, property management and even buy them free life insurance policy if they bought enough houses. This is what you call a classic panzi scheme because it requires exponential growth to continue. Words I never knew or understood prior to my experience there. Even in that volatile and crunching down market, fraud was still easy to execute. Another $44m funded while I managed the firm, until I got kicked out for starting my own title and escrow company. The complete operation was highly illegal and a form of a panzi scheme. Still, I had no problems or resistance in getting close to fifty million in mortgages purchased and closed. Loomis Wealthand AFG Holdings ended up getting indicted by the Department of Justice after extensive investigation by the FBI and the IRS. There is currently an investigation into my role with this firm and likely I myself will be indicted. Built a fraudster by my trainers in corporate America. Mastered the fraud. Trained others in the fraud. Paid by the fraud. Mastered mortgage banking, escrow, real estate. Every scam possible: fraud for profit, fraud to fund loans for the under-qualified, fraud of evasion of taxes, reverse flipping, flipping, false liens, software manipulation. And it utterly disgusts me. Looking back at the life I have led, I beg a higher power for forgiveness. For mercy. For I got caught up, my first corporate experience taught me fraud mixed

Page 3

with drugs and money. The very top ranks of the corporate ladders knew what was going on.“When a pool of loans gets audited they will audit less then 10% of that bulk pool, and if they find a loan with misreps we simply replace it with a loan from another pool and put the bad loanback in to another pool and hope it wont get audited”2002 Vice President of Collateral –Ameriquest Mortgage in Orange, CA. But its always the small guy, the kid, the kid off the streetwith no college degree no ethics training no nothing they teach how to do their dirt, like a gangrecruiting a minor who will only go to juvy. I was only rewarded for my actions. Trips, over 16trophies from AMC alone, prizes and huge paychecks. I am disgusted. This is the reason American Mortgage Backed Securities and ABS pools are being hammered and default rates are at heir highest level. And what has been bred is a new generation of younger fraudsters that are young, technology adapt, and much quick and innovative then their two generation older counter-part regulators and regulation authors. And it is around that final point that is the center for this memo on mortgage fraud its consequences and final solution: the disparity between the talent of the regulators and the fraudsters. The age plays into it. The ambition and drive plays into it. The technology plays into it. But still, if you could only put the correct people at the top of regulation, writing the reg manuals and enforcing them to 100% on pre-purchasing of assets by the government, you could literally cut mortgage fraud down so massively that you could see a return to below traditionally acceptable foreclosure rates, somewhere in the 1.5 – 2.5% range vs the typically accepted range of 3-5% and the current level of 13.9% and in California, FL, NV over 21%. That’s right, eliminate mortgage fraud. Completely. Forever. And if it doesn’t happen, this economic downturn which was entirely started by mortgage fraud(well get into that in a minute) will continue to plague us and housing will not get a solid footing in housing again because currently I would speculate that over 40% of mortgage securitizations today in Q1 2009 have some form of misrepresentation on them, whether detected or undetected. If you fix MBS and ABS securities, you will re-ignite performance and foreign and domestic investors will believe again in a broken system, putting back much needed cash into the system to increase liquidity, balance sheet, and the overall economic production of the nation. I helped ruin this nations economy. Almost a billion dollars of toxic assets came from me making others above me rich beyond my imagination. They asked for more and more, knowingly, and I gave it to them. Now I intend to fix it and help the best I can by sharing what I have learned and know. I am the best at what I was taught and then re-created again and again and mastered myself. I am the best man for shutting it down. Completely and forever.2. The Heart of The Problem The credit crisis. The recession. The total fall out of investors foreign and domestic fleeing from once-loved American ABS and MBS securities. The fall out of the this has spread to a lack of liquidity from home owners to corporations, affecting everything from gas to employment figures, to the auto industry. The current state of the financial markets as of Q1 09 entirely has its roots in the mortgage and real estate collapse which in turn crippled and effectively killed the credit markets. When the problems first started arising in 2006, economic experts predicted that the problem was only a “sub prime” and “alt a” problem that would stay confined to the companies like Long Beach Mortgage, Ameriquest, New Century, ABC Mortgage, Indymac, those companies that insured, purchased, and securitized loans with horrible underwriting

Page 4

guidelines. The problem was this: it wasn’t just these independent or subsidiary companies at all. Deutche Bank, Merryl Lynch, Citi Group, all were purchasing insanely high volumes of funded loans with horrible underwriting guidelines that would have made an underwriter from the 70s or80s complete scream at the top of his lungs in concern. But its not just the underwriting guidelines that caused this, because that is already fixed by Q1 09. In today’s current climate, underwriting guidelines are where they should be. Full documentation on income, lower levels of debt allowed vs your income, and more needed for down payments or more equity to be approved for a refinance. All this being done, still does not come close to fixing the problem. Now, more then ever, in this market, as an industry insider I see more fraud happening now then in 2005. More fraud. Bigger fraud. Bigger profits. More defaults and foreclosure. So the underwriting is fixed but the industry still cannot improve the performance of their mortgage backed securities.The problem is mortgage fraud has morphed, and will never ever bee a stagnate thing. The regulators, managers, qc department employees, guideline writers, and board members of mortgage lending institutions and banks are all, when averaged, over the age of forty seven. The average mortgage fraudster is in mid twenties to early thirties. Most fraudsters are complete idiots, as they are just the typical criminal, that have found a different arena to smash around in. They are the easy ones to find: first payment defaults, obvious white out on documents, 1003sthat don’t match Super pages or cant pass a Veri-tax.com Mortgage Fraud Report. The current system is good at catching these gentlemen and ladies. The problem is the 5% of fraudsters out there there are extremely intelligent, agile, and constantly innovating techniques to beat every effort of the anti-fraud forces in the banking industry. Age plays into this, because the youth is innovative and aggressive, and as we age and approach AARP land, we become less nimble in our mind, closed to new ideas. I actually had an FBI agent ask me “how in this market with all the changes is it even still possible to get cash back on a purchase”. Any FBI agent who has to ask that question, shouldn’t be involved in a mortgage fraud investigation, period. This example brings us the second problem, and that’s the individuals fighting fraud are doing it completely backwards and with the wrong skill-sets. Mortgage fraud can be, should be, and is desperately needed to be fought from the front, aggressively stopping mortgage fraud before the funding date by a special division, anation wide division, that is focused on mortgage data, title and records, and streaming information from investors, funders, and originators. Mortgage fraud currently is regulated by prosecution. This is unacceptable. Lastly there is way too much duplication in our current system of collateralized lending and mortgage securitization. This leads to poor performance, fragmented information sharing if any at all, and low securities performance. The fact is simple that with the nationalization of Freddie and Fannie that is four government-owned agencies that are purchasing and/or insuring over 96.5% of the mortgage fundings on residences in America. That is so beyond against the constitution, but mandatory in todays market. We must realize that subsidy is the savior from depression, which can easily be accepted once studied. But if the government if this country is going to be this big of a player on the nations biggest natural resource: American land and lending on that land, then it absolutely and unequivocally cannot run it like it runs most of its bureaucracy’s: inefficiently. It has to be streamlined. It has to be non-duplicated in roles and responsibilities. It has to have its own internal mechanisms of regulations and controls and checks and balances.

Page 5

Why are there THREE institutions that do the EXACT same thing for the federal government and the three boards and senior managements of those firms take out over $200m a year in compensation when the companies are losing money? Why is the performance of the securities suffer so much? Because they aren’t doing it right and haven’t been. The answer is simple: the mortgage industry fell behind the technology industry department, and never caught up, and it has cost them and now the entire country greatly, in the trillions of dollars. The philosophy is wrong: instead of regulation by prosecution it should be regulation to prevent fraudulent fundings. This has to change first and foremost. When your at war, and trust me, this is a financial war with huge consequences(fraud losses topping over ¾ of a trillion dollars in2008), you don’t wait for the opposing enemy to bomb, then invade your home towns and the nafter they have burned your bridges and farms and houses drop a nuke on your own home town to kill them. That is the equivalent of our current regulation. L et the fraudsters do fraud, they fund a bunch of bad loans, and after the losses have piled high enough then and only then do wego in a tear it all up. You have to catch them upfront. Its possible. The current staffing, regulators, and investors simply are too under-qualified, under-trained, and not coordinated with each other enough to make it happen. Their solution is fancy computer modular software that gives you “mortgage fraud scores” or “avm modules” to “reconcile discrepancies”. Its all bullshit, I have beaten those computer models time and time again and other fraudsters knowhow to as well and you will continue to see the same results if the same regulators, regulation writers, and enforces stay in place that exist today. The analysis is wrong: many times FBI agents who just got transferred from narcotic divisions or international assignments are put on mortgage fraud with absolutely no background. It has taken me ten years of learning to get to where I am and I would consider myself an extremely capable and fast learner far above average and anyone with less then five experience has no right leading or working a mortgage fraud case. Mortgage fraud cases MUST be worked by industry insiders. And while there must be oversight and traditional law enforcement structure and attorneys at the top and managing it, those insiders must be younger or show extreme signs of quick learning ability and/or demonstrate knowledge of today’s advanced fraud techniques. Its a very basic principle that each generation that comes up through the professional world takes the work from the previous generation and makes strides to improve the efficiencies, technologies, and methods of the generation before them. The industry must self regulate with law enforcement assistance with the help of the generation and industry insiders. Meaning if a majority of the fraud is being committed by 20-30 year olds inside the industry utilizing highly technological techniques why do you have 40-60 year olds who don’t understand the technology who got transferred to this type of work from interstate commerce, traditional banking, narcotics, etc? You wouldn’t and you shouldn’t. As previously stated, traditional law enforcement figures are fine for oversight and management but you must leverage the best from the other side against themselves, increasing efficiency bringing in the newer fresher though processes with a better and more concrete understanding of the business and the fraud. The bigger and more elaborate the fraudster, the better permanent asset that individual could be if flipped into a consultant and/or employee for the federal government, specifically the Department of Justice and the Mortgage Fraud tasks forces.

Page 6

The time is wrong: the FBI and DOJ are prosecuting their regulation. This is incorrect because by being reactive instead of proactive you are allowing massive frauds to occur for billions and billions of dollars in losses and damages further pushing MBS and ABS ratings into the dump, and eroding investor confidence in the securities. You regulate by doing just that, regulating. Increase efficiencies and processes, require more burden of proof prior to loan funding and re-sale on capital markets. Operate under the assumption that every mortgage application is being processed by a fraudulent borrower, loan officer, processor, or underwriter. Assume that the computer technology being used by investors and mortgage banking institutions are inadequate and are already being beaten by fraudsters, because they are. Assume nothing works and that no matter what the “representations and warrants” are of a warehouse lender, the correspondent lender, or the Freddie Mac or Fannie Mae seller, that is not good enough and there is truly no amount of net worth or security can cover a 50% default or fraud rating. Change the philosophy change the analysis, change the team and/or add a lot of new team mates, and change the timing of regulation. C. Executing Change and Expected Results, A Return to Stability in Securities Just on the platform that our new commander in chief used, the time for change is now. You can restore confidence in MBS and ABS, and REITS, and American investing by eliminating fraud. Today the guidelines have been fixed, but the fraud hasn’t, and it has worsened. As more and more loan officers go broke and more and more real estate professionals go broke they are turning to fraud to fund deals and raise money. Eliminate fraud and you lower delinquencies, get rid of foreclosures restore confidence in securities, restore confidence and the credit markets are restored, and with credit markets restored the rest of the economy will utilize much needed facilities and regain a solid footing once again. Literally you can fix the majority of the problems by regulation and eliminating fraud. Streamlining effeciencies must be the first step by merging the four government agencies into two(Freddie, Fannie, Ginnie, and HUD) into two (HUD andFreddie) and have Freddie absorb FNMA and Ginnie Mae. Immediately cutting overhead and costs by over 60% and reducing the staffing and overhead costs, hence increasing profitability for the government to help offset costs of future defaults of all the mortgages booked prior the execution of a business plan modeled after this memo. Next step is to increase the information sharing by all agencies and utilize a platform as an information verification center. MERS is a perfect government-sponsored entity is the perfectentity for this. It is already used as an anti-fraud and mortgage transferree platform by all four government investment houses, all major mortgage funding sources, and a majority of correspondent lenders. Expand its access to include title searching capabilities, access to all IRS documentation, and access to FDIC depository records and SEC holding records to verification of assets independent from the origination processes. Use this verification platform to build the security, as opposed to utilizing documentation provided by borrower and/or originator. While this will be the most expensive and very costly endeavour, it pales in comparison to the hundreds of billions of dollars spent on curing and/or selling toxic assets insured by the tax payers at a loss. Even at a cost of $1b the return on investment will be over 1000%.

Page 7

Then infuse talent to any and all federal mortgage fraud investigations currently in process, and mandate co-operation by all lenders and investment companies for the new blood to have access to files prior to funding and pipeline reviews - truly regulating pipelines and helping find criminals prior to funding. Have all Suspicious Activity Reports filed in regards to mortgage activity immediately diverted to the new task forces force teams. Just as any part of the FBI you bring in talent on every level, low level, mid level, and management. Not to replace but to act in concert, provide guidance and speciality information to assist with the cases, and identify and prevent mortgage fraud in action before fundings occur, bringing regulation to pro-active instead of re-active. Following this steps increases efficiency, saves billions of dollars, gets the right people in the right place, utilizes the talent of the people that actually know what to look for, and will bring defaults caused by fraud down to acceptable levels: 0-1%. At a maximum. This is what is wrong and how to fix it. I am the man for the job, Chris Warren, have the management experience, the banking experience, and could assist in the oversight of the most major transformation of mortgage regulation without changing one guideline and still completely eliminate mortgage fraud and restore confidence in the American dream and the securities that that very dream provides for investors. The performance of the securities improves, the funds will come back, the government can re-sell off positions in Freddie Mac, or keep possession and return to massive profitability which could act as a huge profit center to help pay for many needed budget and defecit shortfalls and provides answers for the overall performance of the national budget and economy.

Christopher Jared Warren

8

posted on

02/12/2009 9:56:03 PM PST

by

LomanBill

(Recession my Arse, I'm gonna go build something.)

To: smokingfrog

Ping for interesting reading

9

posted on

02/12/2009 10:18:17 PM PST

by

Armed Civilian

("Extremism in defense of liberty is no vice, moderation in pursuit of justice is no virtue.")

To: smokingfrog

"And what has been bred is a new generation of younger fraudsters that are young, technology adapt, and much quick and innovative then their two generation older counter-part regulators and regulation authors."

--Christopher Warren

When an entire generation has no moral compass.... that's a problem

A few years ago I was on a jury with a physics professor from UC Irvine. During the course of the trial we had lunch and he expressed how confounded he was by the level and sophistication of cheating he saw going on in his classes.

The bottom line, is that all of this is symptomatic of an underlying disease: The moral corruption of American society.

Hardly surprising - given the musings of Comrade Chairman Obama's mentor, Saul Alinsky:

“Lest we foret at least an over-the-shoulder acknowledgement to the very first radical: from all our legends, mythology, and history (and who is to know where mythology leaves off and history begins—or which is which), the fist radical known to man who rebelled against the establishment and did it so effectively that he at least won his own kingdom—Lucifer.”

--Saul Alinsky

"[A community] organizer... does not have a fixed truth -- truth to him is relative and changing. ... To the extent that he is free from the shackles of dogma"

--Saul Alinsky

10

posted on

02/12/2009 10:22:14 PM PST

by

LomanBill

(Recession my Arse, I'm gonna go build something.)

To: LomanBill

Wow! That is very telling. This guy needs to be testifying before congress to tell it like it is, instead of something like that sham hearing we saw with Maxine Waters the other day.

11

posted on

02/12/2009 10:27:33 PM PST

by

smokingfrog

(Is it just my imagination, or is the water in this pot getting a little too hot?)

To: All

"[He]...... does not have a fixed truth -- truth to him is relative and changing..... he is free from the shackles of dogma" --Saul Alinsky The epitome of an evil anti-religious satan. We are witnessing the consequences of a generation inculcated with moral relativity and situation ethics.

Looking behind Obama, Michele, Emanuel and that crew----one can discern that they see themselves as "deconstructionists"----committed to tearing down America's traditions. Every official act is dedicated to chipping away at the bulwark of American freedoms.

Republicans are not immune from this anti-American plague of religion haters........vacant humanoids who worship at The Church of Whatever Works For Me.

Cadres of self-absorbed, pukeneos squatted in the party----obsessed with religious cleansing and kicking so/cons to the curb. The loser neojerks duped the citizenry, led us over a $$trillion dollar cliff into Iraq, and gave us atrocities like Giuliani, McCain, amnesty and Eternal War.

The punkneo motto: "Everything For Us--Nothing For You."

12

posted on

02/12/2009 11:16:08 PM PST

by

Liz

(Problem with socialism is you eventually run out of other peoples money. M. Thatcher)

To: smokingfrog

>>Wow! That is very telling.

Indeed.

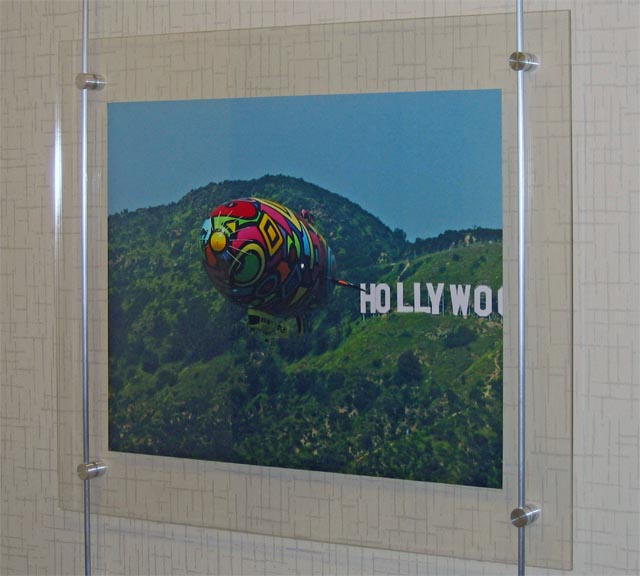

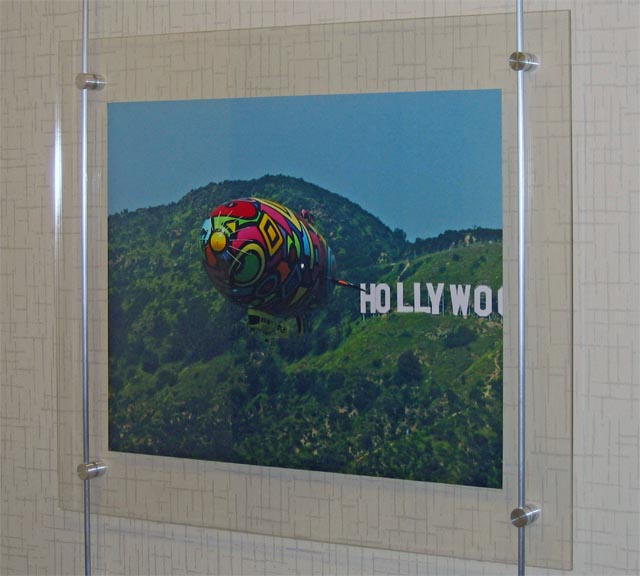

This was my desk at Argent Mortgage.

This was my desk at Argent Mortgage.

I was a Sr. Programmer Analyst on the EMPOWER loan origination software for Argent Mortgage, Ameriquest's Wholesale division. During my tenure, we managed to close a number of loopholes that were being exploited. And we at Argent heard many horror stories about the level systemic corruption at Ameriquest.

One of the more interesting loopholes, at Argent, was one, the creation of which was apparently requested by someone in Sr. Argent Management: enabling the ability in EMPOWER to modify and even completely fabricate FICO scores.

See, normaly the FICO score is recieved from various credit agencies and the fields are locked in EMPOWER, normally... unless the company using the software bought the source code and used it to change EMPOWER - which Argent did.

All loophole closing activity abrubptly ended when Argent was merged back into Ameriquest - in preparation for Ameriquest (yes Ameriquest, functionaly, not Argent) being acquired by Citi-Group.

Nearly two years ago, I provided SEC investigators with a SQL Query that would have identified every loan for which the FICO score had been falsified at Argent - and there were THOUSANDS of them.

From there, they could have ascertained the account exec for the loan....

All they had to do was execute a warrant and run the query; but to my knowledge, they never did. Presumably because Argent received "immunity" in the Ameriquest predatory lending settlement with the State's Attorney's generals.

But at least LEO finally nailed somebody; and the song Mr. Warren sings may prove quite interesting. Assuming he doesn't first come down with a case of the same lethal "Indigestion" as Ameriquest owner, and political financier, Ambassador Roland Arnall.

13

posted on

02/12/2009 11:17:34 PM PST

by

LomanBill

(Recession my Arse, I'm gonna go build something.)

To: Liz

We're in agreement with the exception of this:

>>$$trillion dollar cliff into Iraq,

Imagine if Saddam, Iran, Russia, Venezuela and others had succeeded in replacing the Petro Dollar with the Petro-Euro.

Imagine the housing bubble imploding ON TOP OF the externally directed implosion of the dollar.

IMHO, things would have been much worse, much sooner.

Protecting the Petro-Dollar alone was reason enough for regime change in Iraq; and it is our military presence there today, that continues to protect the Petro-Dollar.

In addition to all that, it would just be plain dishonorable for us not to keep this promise:

15-Mar-2003

The promise these individuals gave their lives to keep...

...and I will NOT accept that their sacrifice was for nothing.

14

posted on

02/12/2009 11:40:01 PM PST

by

LomanBill

(Recession my Arse, I'm gonna go build something.)

To: IncPen

ping for interesting read

To: LomanBill

Winner of the 2008 Best Election Night Punkneo Performance in the category of:

"I Know Nothing About this Republican Disaster."

Billy Kristol (McC campaign mastermind)

"Thank you very much. But I could not have done it without the help of all the

punkeos--David Frum, Michael Gerson, David Brooks, Richard Perle.....and

my Dearest Daddy."

"Sniffle---my Dearest Daddy (who was Giuliani's foreign policy advisor) said,

"The historical task and political purpose of neoconservatism is.....to convert the

Republican Party and American conservatism in general, against their

respective wills, into a new kind of conservative politics suitable to

governing a modern democracy."

"Sob."

"I especially want to thank punkneo Douglas Feith for faking documents on his

home computer so we punkneos could dupe the president."

"Without Doug we would not have been able to transfer trillions of US dollars

into the Mideast, into the pockets of war profiteers, which enabled Richard Perle

to startup an oil business in Iraq with his cut."

Kristol smirked: "Making Iraq safe for Perle's oil business with US tax dollars was truly a noble punkneo effort."

==============================================

COMMENTS Be aware that many senior neocons are rank opportunists who squatted in the Repub Party for their stealth purposes-----they are actually former Trotskyites who flew the coop when Stalin executed their hero.

The political entrail readings showed the crucial conservative base stayed home.........too bad the pukes "forget" to tell McC that would be one outcome of the punk-RINO bi-partisanship.

AS FREEPER TADSLOS COGENTLY POSTED: "People forget that candy-ass Kristol, and his crony, metro-sexual Brooks are the original makeover artists for McCain post-2000. They are McC's original groomers and media switch operators.....obsessed with religious cleansing of the party. Kristol at his most smirkiest---urging McCain to fire his 2008 staff, to start all over at the 11th hour, as McC's numbers tanked. Shows how how ill-conceived, advised, equipped and poorly managed McC's campaign was. But then, what else to expect from a Republican candidate made up of neopunks Kristol and Brooks." Kristol is the media poster boy for why D.C. plutocrats are completely out of touch with the rest of the country.

Watching Kristol smirking and squirming in his Fox seat on election night as McC lost was a consolation prize to this abortion of a 2008 election cycle."

16

posted on

02/13/2009 5:49:50 AM PST

by

Liz

(Problem with socialism is you eventually run out of other peoples money. M. Thatcher)

To: smokingfrog

I don't doubt that there are many young people with deficient moral compasses. However, this is the same generation which has produced many fine young people who have stepped up to serve in our armed forces at a time of war. All is not lost, but good people need to reclaim the high ground.

This young fraudster's suggestions on how to fix the mortgage mess are interesting, but I don't trust the government to fix things. Rather than create one more intrusive government function into our lives, I'd rather see the risk pushed back onto the lenders. As long as mortgage originators can package the loan and the risk and pass it along to a taxpayer-backed entity, there will be a huge incentive to cheat. I'd much rather see mortgages remain a function of the private sector, with the risk of default carried by the loan originators. To the extent the banking industry can develop transparency and standards which permit them to sell these mortgages into a secondary market, they could do so, but not by putting the taxpayers at risk via Fannie, Freddie, or their high-tech super-efficient successors. I have no faith in the government performing this function well, nor do I care to see them take on greater power or investigative capacity.

To: LomanBill

I would so like to see some of these people go to jail! The govt. wastes time and resources going after people like Martha Stewart, while Madoff, this guy and his associates are somehow able to wreak havoc on the economy.

I remember how the media made such a big deal about the Enron scandal, but that was peanuts compared to the kind of stuff we are hearing about now, and we don't see any serious investigative reporting being done about it.

Here is the follow up to yesterday's story.

18

posted on

02/13/2009 9:53:06 AM PST

by

smokingfrog

(Is it just my imagination, or is the water in this pot getting a little too hot?)

To: Think free or die

>>but not by putting the taxpayers at

>>risk via Fannie, Freddie

I don’t disagree with you; but Ameriquest and Argent Mortgage did not qualify for Fannie/Freddie underwritting.

All of the damage they did was via the securitized instruments they poisoned the economic pond with.

19

posted on

02/13/2009 12:37:13 PM PST

by

LomanBill

(Animals! The DemocRats blew up the windmill!)

To: smokingfrog

>>I would so like to see some of these people go to jail!

Yep. But where's LEO? Unfortunately LEO's been distracted keeping the country safe from terrorists - and these fraudsters knew it and took advantage by looting the unguarded hen house.

>>I remember how the media made such a big deal

>>about the Enron scandal,

There were a number of former Enron employees working at Argent mortgage. They were involved in the Enron trading systems and enabled ACCH (Argent/Ameriquest) with technology as well.

It is they who were symbolized by the stuffed Blind, Deaf, and Mute "Manager Monkey" on my desk (see photo above).

"Just shut up and code" was the order of the day; but I, and a small group of others, did not comply. Hence systemic loopholes were closed and Argent came no where near its goal of looting 80Billion in 2007, in fact they went out of business instead.

The company's "Rainbow" multicultural blimp, that they were so "proud" of, is very indicative of the attitude the corporate environment there was infested with:

Some of us pushed back with a little artwork of our own...

Ameriquest - Proud Pirates of the American Dream

Ameriquest - Proud Pirates of the American Dream

20

posted on

02/13/2009 1:00:32 PM PST

by

LomanBill

(Animals! The DemocRats blew up the windmill!)

Navigation: use the links below to view more comments.

first 1-20, 21-26 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

This was my desk at Argent Mortgage.

This was my desk at Argent Mortgage.

Ameriquest - Proud Pirates of the American Dream

Ameriquest - Proud Pirates of the American Dream