.

The US Dollar will never be the same, thank goodness. Don't think the world didn't notice when he said this. They know exactly what he's talking about.

.

Posted on 04/25/2023 9:26:54 PM PDT by SeekAndFind

The battle is on between the dollar and yuan as the world’s reserve currency. Or is there a battle at all?

The dollar will remain the world’s top reserve currency—not the yuan any time at all—and for four good reasons to be spelled out in a while.

A CNBC report early this year echoed a general sentiment that the greenback is ready for a fall as the top reserve currency by 2015. Meaning, countries will stop using our money to exchange goods, or conversely, we need to change our dollar to another currency to export or import goods.

The country’s trillion-dollar debt, the dollar’s diminishing share in global money supply, and the Feds’ quantitative easing program—print more money to stimulate the economy—have doomsters worrying about the dollar’s credibility in the face of the Chinese yuan’s growing influence.

But just last week, Reuters reported a rebuttal: the dollar is soaring as consumer spending hits a six-year high and the Feds plans to ease out its stimulus plan.

The dollar even hit a three-year high of 84.371 in the US Dollar Index, which pits the dollar against six other major currencies. Notably, the dollar rose because the euro fell during the period, the report said.

When Americans spend the US economy gets stronger, as shown in this article why buying stuff is good for the country and stashing cash under your bed is bad.

It looks like the dollar has got back to the doubting Thomases whether it still has the power to remain the world’s top reserve currency.

What’s going on? Was the dollar even in danger at some point of losing its prominence?

To be clear, and to the credit of the CNBC report, the dollar is still the major reserve currency. It holds 62% of the world’s aggregated reserve currency. In short, most of the central banks in other countries hold a lot of dollars for the capital market.

The yuan is not even among the next top four reserve currencies: the euro, yen, pound sterling, and Swiss franc.

The fear of losing the dollar seems to stem from looking at the issue from a purely economic standpoint: the recent recession, diminishing purchasing power of more Americans versus the increasing buying power of more Chinese, the manufacturing migration to China… all these talks about the inflow and outflow of cash make the currency current look like moving away from the US.

Although these concerns are rational, but there are non-economic factors to consider and they buttress the dollar.

How many people truly understand the dynamics behind the yuan? Maybe as many as the 35 members of China’s State Council.

The lack of transparency will be the main drawback against the yuan. Stability is the biggest factor why countries gravitate to the dollar, which has not been devalued ever.

The yuan, on the other hand, is tightly controlled by China, even as Western countries led by the US call for more liberalization of the yuan.

As late as last April, China was insisting on market interventions, sprucing up the yuan to avoid a disruption as the world’s second largest economy shifts from export dependence to domestic consumption.

In short, the yuan is yet to grow up, an infant that is vulnerable without the nanny government. Compare that to the dollar, which is a full-grown adult that can confidently walk in the rough streets of open markets.

Expecting China to loosen its grip on the yuan is like hoping for its Politburo to hold democratic elections soon.

The UN Population Division and Goldman Sachs predicted in 2011 that Chinese middle class will be four times larger than the American middle class population by 2030. Sure, but it is not because Americans are getting poorer; the Chinese are just getting richer. And middle class people seem to think along the same line. They want assurance from their leaders.

The political silver lining (for the US) in the rise of China’s middle class is that as they accumulate more power, they will challenge their Politburo, the main authority in China.

The uncertainty of this situation will likely pressure many rich middle class Chinese to invest in a more transparent environment like the US, not unlike the substantial migration of investments that happened from Hong Kong to Canada before the colony was handed to the mainland in 1997.

Yet another simmering issue for China is that most of its middle class are concentrated on the few, rich cities. How much stress these cities can take—we’ve seen the severity of Beijing’s air pollution—we can only imagine.

Compare that to the American middle class who are fairly spread out across the country, the opportunity to create dynamic pools of economic activities in more places is one of the country’s unrecognized but true economic strengths.

Money-wise, the rising middle class in China will spill over to the US economy. More Chinese are likely to spend in the world’s number one biggest economy (makes sense) and more US companies will sell more in world’s second biggest economy, China.

These political, demographics and economic factors only add, not subtract, to the strength of the US economy.

The yuan is already being traded directly between China and two other countries: Australia and Japan. That means, both countries do not need US dollars to trade with China.

Does it mean the yuan is gradually encroaching into the dollar reserves of other countries? Yes and no. The encroaching only goes as far as the bilateral trade between China and that other country.

In world trade, the US will exert friendly pressure to maintain the dollar as the exchange currency, and the rest of the world other than perhaps North Korea, Iran, and China will not likely mind.

A Bloomberg report last February seemed ominous: China’s total trade in goods of $3.87 trillion barely surpassed the US $3.82 trillion. It is a first when taken at face value. But the significance is easily lost when services trade is cost in; the US total trade jumps to $4.93 trillion with a surplus of $195.3 billion in that sector.

Manufacturing is China’s main strength, but world trade also involves a big chunk of financial, science, intellectual property, and information technology trade among others. For the yuan to replace the dollar in world trade, China has to go past making cheap products, it seems.

Yes, China is embarking in infrastructure development, exporting its construction and engineering to mostly developing countries. But that’s a long road to take and one that will face stiff competition from the US apart from the other reasons we mentioned above.

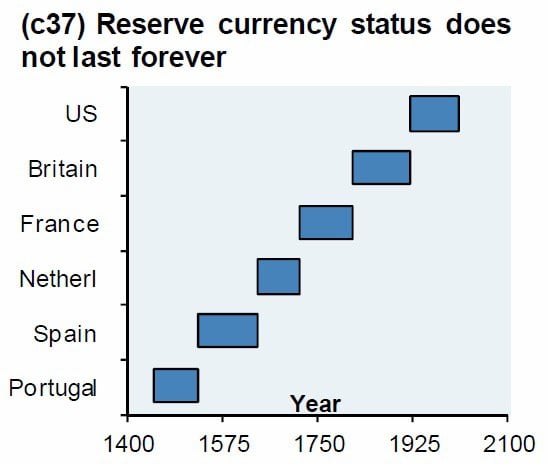

The world’s reserve currency had always gravitated to the country or empire that dominated its neighbors. The ancient Greece’ silver drachma, the Roman-issued coins, the Byzantine’s gold solidus, and the Arabian dinar were some of the dominant currencies during their respective ancient reigns.

In modern history, the Spanish silver coin and the British Empire’s pounds had exerted their influence across the globe.

There is one underlying common thread among these past reserve currencies: they are distributed mainly across their empires, an unstable grouping of colonies and conquered markets. This means that their reserve currency was dependent on their ability to maintain their empires; once their empire lost power, so did their currency.

That exactly what happened to these empires, as when Britain lost most of its colonies after the Second World War, just when the dollar took over.

As for the dollar, the landscape cannot be farther from the historical trend. The US dollar is built on the strength of a single, solid market of Americans who buy and sell stuff. That’s a huge starting point; add to that the collective historical, cultural, and political ties of the Western countries to the US.

Perhaps it is a historical first that a universal currency is being used by the largest pool of consumers who belong to a country, and more importantly, who will defend this country from outside threats.

The US dollar sits on a solid bedrock of its over 310 M population, while the yuan is spread across 1.3 B Chinese who will start demanding more rights from their government as they get richer.

Will the dollar dissipate from being a world reserve currency as the sterling pound soon? Only as probable as California declaring war on Nevada.

CONCLUSION

Make no mistake the yuan is destined to be a major world reserve currency, if it is not yet. The farthest it can do to the dollar is eat up a chunk of the world’s dollar reserves through bilateral negotiations. Other than that, the yuan, at best, will elbow out the other major currencies as a world reserve currency, but not the dollar.

Astrid Eira is a resident B2B expert of FinancesOnline, focusing on the SaaS niche. She specializes in accounting and human resource management software, writing honest and straightforward reviews of some of the most popular systems around. Being a small business owner herself, Astrid uses her expertise to help educate business owners and entrepreneurs on how new technology can help them run their operations. She's an avid fan of the outdoors, where you'll find her when she's not crunching numbers or testing out new software.

It doesn’t need to replace it. It only needs to tear it down to be successful.

It’s already on its way to doing so. 20 years ago, we hd 75% of the market using the US dollar as reserve currency. Today, it’s 45%.

The dollar won’t be replaced by the Yawn...but it also will no longer be the currency everyone uses (as in reserve currency). For each pair of countries, they’ll settle on a currency they consider safe...which will vary.

That’s what a multipolar world is...and thanks Brandon for dumping it on us.

Those who do not have faith in the dollar, and think the dollar does not have lasting strength and stability should convert their dollars to the yuan, ruble or other currencies.

Huh?! Is this the re-print of an old article written in the year 2010, or what?!

The current population of the U.S. is about 334 million!

Regards,

This article is obviously at least a decade old!

Regards,

The multipolar world was coming long before Biden. The Neocons began the process 20 years ago with their budget-busting wars. Obama also did his part.

.

The US Dollar will never be the same, thank goodness. Don't think the world didn't notice when he said this. They know exactly what he's talking about.

.

What this article indicates is that financesonline.com could not care less about providing their readers accurate or timely information. They are recycling an old article that advances the message that whoever funds financesonline.com wants distributed.

Another clue as to the age of the original article:

“The dollar even hit a three-year high of 84.371 in the US Dollar Index, which pits the dollar against six other major currencies. Notably, the dollar rose because the euro fell during the period, the report said.”

The US Dollar Index currently stands at 101.76 for the US Dollar.

https://www.marketwatch.com/investing/index/dxy

The entire article is a sad commentary on the state of financial “journalism.”

Bobl - look at global currency reserves since 1945

| Year | USD % | Next Largest currency and % |

| 1957 | 51% | GBP 36% |

| 1962 | 67% | GBP 30% |

| 1970 | 85% | GBP 9% |

| 1980 | 58% | ECU: 17% DeutschMark 13% Yen 5% |

| 1987 | 52% | ECU: 13%, DMark: 17% Yen: 9% |

| 1993 | 56% | DeutschMark 17% ECU: 9% Yen 7.5% |

| 2000 | 71% | Euro: 19% Yen 6% |

| 2008 | 64% | Euro 26% |

| 2016 | 64% | Euro: 20% |

| 2020 | 59% | Euro 21% |

As you can see it has been multi-currency for quite some time now and the US has never crossed 80% - and toda when it is 59% it is still higher than it was during the 80s

Excellent post, thank you for bringing clarity here.

What’s the bubble in today’s world?

https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

I think, note “think”, just about guessing m that it’s the real estate bubble and bitcoin

What is the date of that? (Doesn’t have to be exact; just wondering the month if that is known) - thanks in advance

The difference from the past, even recent past, is that the US cannot get away with its deficits/debt without being king of the hill. Once that changes we’ll be held accountable (which we likely deserve, but I’d like to delay it a bit).

“very revealing “typo” there, Bob”

Just cannot stop obsessing over me, I guess.

Sorry, not available.

The USA can get away for some time with it, but then interest rates will rise

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.