Posted on 01/10/2023 8:45:07 AM PST by SeekAndFind

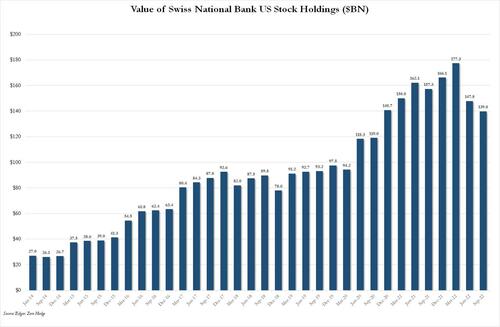

The last time we looked at the massive money-printing (literally) hedge fund that also moonlights as the Swiss National Bank, we were stunned to learn that its US equity holdings had exploded to a record $177 billion at the end of Q1 2022, orders of magnitude more than the mere $27 billion it held as recently as 2014.

Since then things haven't gone exactly as planned for the massive asset gatherer, and the value of its US equity longs has tumbled by almost $50 billion from the record high in Q1 to $139.8 billion as of Q3, a two year low... and a huge loss despite the fact that all the SNB has to do is print some more Swiss Francs, sell them for dollars and then simply buy some more stonks to plug whatever P&L holes it has.

But while we wait for the SNB's year-end 13F which should be published in about a month's time, we already know the damage suffered by the Swiss hedge fund in 2021 and it is staggering: on Monday, the SNB reported an annual loss of 132 billion Swiss francs, or $143 billion, for fiscal 2022, the biggest loss in its 115-year history as falling stock and fixed-income markets hit the value of its share and bond portfolio. The recent drop in the US Dollar also did not help.

Monday's provisional figure, which marked a reverse from a 26 billion franc profit in 2021, was far bigger than the previous record loss of 23 billion francs chalked up in 2015, and according to Reuters, it is equivalent to slightly more than the annual GDP of Morocco.

According to the bank, the bulk of the loss, or 131 billion francs, was from its foreign currency positions - a broad term used to describe the more than 800 billion francs in stocks and bonds the SNB bought during a long campaign to weaken the Swiss franc. Indicatively, the amount is also almost precisely the same as the GDP of Switzerland.

The losses accelerated as global stock and bond markets tumbled in unison - 2022 was the first year in over a century when both stock and bond market suffered double digit losses - as central banks around the world, including the SNB, hiked interest rates to combat inflation. Meanwhile, the strong Swiss franc - which rose above parity against the euro in July - also led to exchange rate-related losses.

And while the SNB lost money in pretty much everything there was one solitary asset class that generated a profit (take a wild guess which one): that's right, the SNB's gold holdings which stood at 1,040 tonnes at the end of 2021, gained 400 million francs in value during 2022.

The 2022 loss meant the central bank will not make its usual payout to the Swiss central and regional governments, it said. Last year the SNB paid out 6 billion francs. In fact, if the SNB followed similar accounting rules and logic as any other bank, it would have been wiped out with a loss that obliterated all of its equity capital. But in the magical world of seigniorage, where central banks are assumed to be able to print - again, literally - their way out of everything, the bank never loses and the SNB will continue its merry existence as if nothing happened.

Still, the loss is unlikely to have an impact on SNB policy. It hiked interest rates three times in 2022 as Chairman Thomas Jordan moved to stem high Swiss inflation, analysts said.

"The SNB's colossal losses will not change its monetary policy at all," said Karsten Junius, an economist at J.Safra Sarasin. "The high reputation of the SNB helps that it doesn't have to change anything."

Well, it may have a record loss that's bigger than the GDP of most medium-sized countries, but at least it has its "high reputation" earned courtesy of years of laborious and exhausting... money printing. And yes, because we live in a kangaroo world in which there are never any adverse consequences for colossal central bank stupidity, the SNB's monetary policy will most certainly not change at all.

“...orders of magnitude...”

Somebody is ignorant and dumb.

“Republicans”.

Not “congress” is investigating a blatant crime

This perpetuates the idea that democrats are lawless and above the law and that that is legit

Brtitbart. Blech

(Suffers Colossal $143 Billion Loss In 2022)

Chump Change

The USA suffered a colossal $1.7 TRILLION dollar loss under Nancy Pelosi and Chuck Schumer in 2022

Is their advisor Kathy Wood?

Don’t they still have all that Nazi Loot hidden away in their underground vaults ?

Is $143 billion a lot? ;-)

A miniscule gain for 1,040 metric tons of gold, having a value of approx. $57 BILLION. That's a gain of roughly one percent.

Regards,

Ukraine ping

Somebody is ignorant and dumb.]

https://en.m.wikipedia.org/wiki/Daniel_Ivandjiiski

RE: Is $143 billion a lot? ;-)

Well considering Switzerland’s GDP is $703 Billion, That’s over 20% or one fifth of the country’s GDP. That would be like the USA losing close to $5 Trillion!

Direct linking Zerohedge not allowed on Freerepublic.com. Nation and State is Zerohedge under a different name.

When the story is true, Zerohedge's spin on it is not.

Btw Bulgaria has lots of old Soviet artillery ammo stockpiled. The Ukrainians wanted to buy it. Bulgaria refused to sell. Under orders from Putin I suppose.

This is like our Federal Reserve Bank being a huge hedge fund that has lost billions.....

BTW The Federal Reserve Bank just about always returns its profits (100 billion dollar range) to the US Treasury. Last year 2022 it had no profits to return..

https://www.bloomberg.com/opinion/articles/2022-02-17/the-federal-reserve-s-impending-profit-squeeze

RE: Tyler Dyrden = Zero Hedge

So, your take is the story that Swiss National Bank list $143 billion is false because Tyler Dryden wrote it?

If so, what’s the spin that you see in the story?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.