Skip to comments.

Fed Admits Failure of ‘Plan A’ to Control Money Market Rates, Shifts Back to Repos ...

WolfStreet.com ^

| 20 September 2019

| Wolf Richter

Posted on 09/20/2019 11:35:56 PM PDT by Yosemitest

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-120 next last

To: Toddsterpatriot

That works out to a 4.7% increase per year. Yeah, you're right, forgot about about "compounding". My only point is that "CPI" appears to always be a couple % too low. And the last time I saw a "wages vs inflation rate/value of a dollar" long-term chart, wages were 3-5% behind. And "next to zero" CD & MM rates aren't helping. You'll probably say "equities", but at my age I have reasons to reduce my stock holdings. "Lending Club" is doing OK for me (5.5% over 4 years or so), but unsecured/risky...like you are a credit card issuer.

81

posted on

09/21/2019 5:15:48 PM PDT

by

Drago

To: Drago

82

posted on

09/21/2019 6:47:05 PM PDT

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

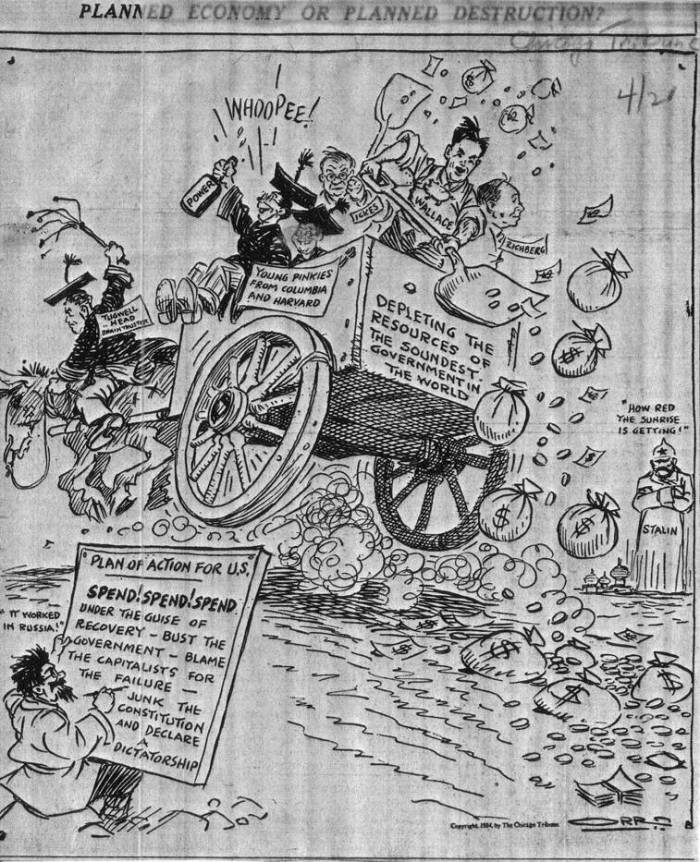

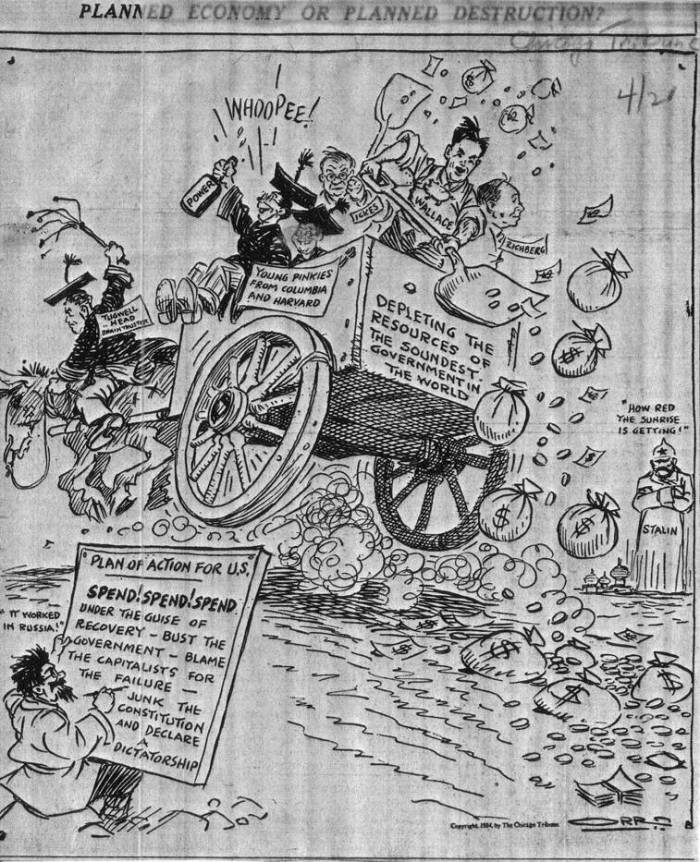

To: Yosemitest; jdsteel

“The Fed made the Great Depression WORSE”

And your proof for that claim is what, exactly?

83

posted on

09/21/2019 6:50:30 PM PDT

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: Yosemitest; Toddsterpatriot

“... the Fed should stay out of it. The free economy, left to its own reactions, will solve the problems quickly.”

Of course that’s exactly what the Fed did do in the 1930s, as Friedman and Schwartz documented extensively in their massive “A Monetary History of the U.S.”.

The 1930s Fed failed to act at all. It sat immobile and did nothing as a cascading series of bank failures destroyed fully 30% of America’s banks and money supply.

So your recommended solution was tried, not by overt design, but because the rudderless 1930 Fed didn’t know what it should do. And the American banking system, free from Fed intervention, went into a self reinforcing destructive spiral that lasted a decade and took the real economy down with it. The biggest and longest deflation in American history.

Bernanke, having learned from Friedman and Schwartz’s excellent study, did exactly the opposite of the 1930’s Fed and massively intervened to prevent a deflationary collapse. That’s what TARP, QE, and ZIRP were all about. And it worked.

84

posted on

09/21/2019 7:20:37 PM PDT

by

Pelham

(Secure Voter ID. Mexico has it, because unlike us they take voting seriously)

To: Pelham

WRONG !

Where did you get your education, from the Communists ?

They kept trying to prop up all those failing banks.

The Federal Reserve's SCREW-UP are well documented in the article

Debunking Myths of the Great Depression.

The current economic crisis is often compared to the Great Depression which lasted from 1929 until the early 1940s.

From the causes to the policy responses, there are striking similarities between the two economic meltdowns.

Unfortunately, the typical high school history teacher continues to perpetuate myths about the Great Depression.

Learning the real story of the worst economic crisis in U.S. history is important to stop it from happening again.

Listed below are rebuttals to five common myths about the Great Depression.

1. Free Market Capitalism Caused the Great Depression.

Most of us probably learned that “unfettered” and “unregulated” capitalism in the 1920s led to the Great Depression.

Some have similarly blamed capitalism for the current economic crisis.

But just like today, there was not pure free market capitalism in the 1920s.

The Federal Reserve, the central bank of the United States, was created in 1913.

Not only did the Federal Reserve fail to prevent the Great Depression but it was primarily responsible for its length and severity.

The Federal Reserve controls the money supply and would never exist in a true free market economy.

As Murray Rothbard explains in America’s Great Depression, the Federal Reserve creates boom and bust cycles that destabilize the economy.

The Federal Reserve created an unsustainable boom in the 1920s by lowering interest rates. Rothbard estimated that the money supply had increased by 61.8 percent between 1921 and 1929.

The inevitable stock market crash was a symptom of the inflationary boom.

Economist Henry Hazlitt once wrote that “worse than the slump itself may be the public delusion that the slump has been caused, not by the previous inflation,

but by the inherent defects of ‘capitalism.’”

The blame for the Great Depression should be placed on the Federal Reserve, not free market capitalism.

2. Herbert Hoover Was a Laissez-Faire President.

Many history teachers claim that Herbert Hoover was a “do-nothing” passive president who allowed the Great Depression to happen.

Quite the opposite is true.

Far from being an advocate of laissez-faire, Hoover was an extremely interventionist president.

Hoover actually intervened in the economy more than any prior president.

Herbert Hoover’s interventionist policies prolonged the Great Depression.

He doubled federal spending in real terms in just four years.

One of Hoover’s first acts as president was to prohibit business leaders from cutting wages.

He also launched huge public works projects such as the San Francisco Bay Bridge, Los Angeles Aqueduct, and Hoover Dam.

Hoover signed the Smoot-Hawley tariff into law in June 1930 which raised taxes on over 20,000 imported goods to record levels.

He raised the top income tax rate from 25 percent to 63 percent and the lowest income tax rate from 1.1 percent to 4 percent in 1932.

Despite what most of us have been taught, there was nothing laissez-faire about Hoover.

In the 1932 election, Franklin Delano Roosevelt (FDR) criticized his opponent Hoover of presiding over “the greatest spending administration in peacetime in all of history.”

His statements are seen as a bit hypocritical in hindsight since Roosevelt continued and expanded Hoover’s big government policies.

Many of the New Deal programs were based on policies already enacted by the Hoover administration.

It could be said that Hoover was the real father of the New Deal.

3. The Federal Reserve’s Tight Monetary Policy Caused the Great Depression.

Federal Reserve Chairman Ben Bernanke and the late Nobel Prize-winning economist Milton Friedman blame the Federal Reserve for the Great Depression.

But they do so for the wrong reasons.

While Milton Friedman was correct on many economic issues, he was wrong on monetary policy.

He was a monetarist who incorrectly believed that the money supply determines the level of economic activity.

In his view, an increase in the money supply will lead to more economic activity.

In A Monetary History of the United States, Friedman argued that the economy was strong in the 1920s until the year 1929 when a typical economic downturn occurred.

In A Monetary History of the United States, Friedman argued that the economy was strong in the 1920s until the year 1929 when a typical economic downturn occurred.

He believed that the economic recession turned into a depression because the Federal Reserve did not print enough money between 1930 and 1933.

Friedman and Ben Bernanke essentially blame the Great Depression on the Federal Reserve’s failure to inflate the money supply.

The real problem is that the Federal Reserve inflated the money supply in the 1920’s.

Inflationary booms induce widespread malinvestment -- bad investment decisions made under the influence of easy money and credit.

Malinvestments inevitably lead to wasted capital and economic losses.

An economic recession is actually necessary to correct all of the previous malinvestment.

At Milton Friedman’s ninetieth birthday party in 2002, Ben Bernanke even said “I would like to say to Milton and Anna: Regarding the Great Depression. You’re right, we did it.

We’re very sorry.

But thanks to you, we won’t do it again.”

He spoke too soon.

The current economic situation may not be as severe as the Great Depression — though economists such as Peter Schiff say it could get as bad.

But it's clear that the central bank was the main culprit in both financial crises.

The Federal Reserve’s expansionary monetary policy in the 1920’s caused the Great Depression,not the central bank’s “tight” monetary policy in the early 1930’s.

4. FDR’s New Deal Ended the Great Depression.

The New Deal is widely perceived to have ended the Great Depression but it actually made the economic situation worse.

The series of economic packages implemented between in the 1930s hampered economic growth and prolonged the Great Depression.

Roosevelt imposed excise taxes, harmful regulations on businesses, increased the top tax rate to 79 percent, doubled government spending between 1932 and 1940, and artificially raised wages and prices.

The New Deal created many public works projects. Contrary to what most of us were taught, public works projects do not boost the economy.

It is the classic case of the seen versus the unseen —we can all visibly see the jobs created by New Deal spending,

but it is more difficult to see the jobs destroyed by the high taxes needed to pay for the New Deal programs.

Of course, taking money away from entrepreneurs in the private sector will only hurt economic growth.

In 1931, a year before FDR was elected president, the unemployment rate was an unprecedented 16.3 percent.

By 1939, nearly two terms into the Roosevelt administration, the unemployment rate had risen to 17.2 percent.

The New Deal clearly didn’t lower unemployment like most of us were taught.

In May 1939, Treasury Secretary Henry J. Morgenthau Jr. stated that, “we are spending more than we have ever spent before and it does not work …

I say after eight years of this Administration we have just as much unemployment as when we started…And an enormous debt to boot.”

The depression would have been much shorter without the New Deal.

5. World War II Ended the Great Depression.

The facts tell a different story.

As Ludwig von Mises once wrote, “war prosperity is like the prosperity that an earthquake or a plague brings.”

WWII did stimulate certain sectors of the economy.

Men and women worked in factories to build tanks, helicopters, ships, and other war supplies.

But it is important to look at the overall picture, not just one sector of the economy.

We can visibly see the weapon production jobs created by government spending,but it is more difficult to see the jobs destroyed by taxing the private economy.

From a purely economic standpoint, the war made consumers worse off because it was often difficult or impossible to purchase the goods they needed.

The weapon factories were not producing goods and services that Americans could enjoy.

The federal government had forbidden the production of new cars, houses, and major appliances.

Due to government rationing, it was difficult to buy many goods such as chocolate, meat, gasoline, sugar, and tires.

So what did end the Great Depression ? From 1944 to 1948, the U.S. government cut spending by $72 billion — a 75 percent reduction.

In 1945, the deficit was 21.5 percent of Gross Domestic Product (GDP).

Two years later, the budget surplus was 1.7 percent of GDP.

The dramatically spending cuts and slight tax reductions boosted economic growth.

Between September 1945 and December 1948, the average unemployment rate was only 3.5 percent.

Likewise, the only way to get out of the current economic crisis is to drastically cut government spending and taxes.

85

posted on

09/21/2019 9:09:49 PM PDT

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: Pelham

So what does your own ilk think should replace the Fed as lender of last resort?

The impossible....a sound fiscal policy with balanced budgets and not giving away every penny to special interests, illegals, refugees, fraudulent disability claims, fraudulent health care claims via Medicaid/Medicare, by Congress which isn’t possible, so I guess I’ve answered my own question/changed my own mind. Given the fact that someone like Waters would be one of those members of Congress that are charged with creating such policies.

86

posted on

09/21/2019 9:45:19 PM PDT

by

qaz123

To: Yosemitest

Silver is still a bargain compared to gold.

87

posted on

09/22/2019 12:36:13 AM PDT

by

Vigilanteman

(The politicized state destroys aspects of civil society, human kindness and private charity.)

To: Yosemitest

It’s widely understood that the money supply was tightened (see my previous post) when it should have been loosened at the beginning of the Great Depression, but to blame the length and severity of that downturn on that is ridiculous.

The blame lies squarely on FDR, our first Socialist President, and a Democrat supermajority in Congress. The “New Deal” was a disaster.

You made my point. You hate the Fed for stuff it didn’t do.

88

posted on

09/22/2019 4:27:58 AM PDT

by

jdsteel

(Americans are Dreamers too!!!)

To: Pelham

Uh no every dollar that enters circulation comes with debt. A private bank called the Federal Reserve creates our currency and lends it to us at interest. We borrow our currency from them. In order to get more dollars to pay that interest we borrow more dollars into circulation. We print the paper but we don’t create the currency.

You cannot repay debt with debt. Only equity can repay debt. Trump understands this. He wants dollars created at zero interest. This is why you don’t hear him squawk about raising the debt ceiling. He understands that govt spending isn’t really what created $25 trillion in debt and that cutting govt spending will not repay our debt.

IMO Trump plans to wait until after the election and then make his move on the Fed. The easiest way with the least pain would be to simply cut the Fed out of the loop by instructing the Treasury department to issue is own debt instrument which is already legal to do and create dollars at zero or negative rates and use those dollars to pay off the debt. It would be disruptive for the banking sector but not crash the whole economy. After 2020 I would not want to have money in the big four banks.

Due to fracking the petro dollar is dying. We will not be the reserve currency of the world much longer. That is the only thing keeping us afloat. Trump understands this. Why do you think his first state trip was to Saudi Arabia?

Right now Trump is doing what he can by attacking Powell and forcing him to cut rates which puts more dollars into circulation. Trump needs those dollars to fuel his industrial resurgence. Without Trump’s constant drumbeat Powell would have kept rates up and happily let the economy hit the rocks for the 2020 election. The Feds raised rates 8 times after Trumps election. Recessions don’t just happen. The Federal Reserve creates them.

89

posted on

09/22/2019 8:30:02 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: Georgia Girl 2

A private bank called the Federal Reserve creates our currency and lends it to us at interest. We borrow our currency from them. You're wrong. No one borrows FRNs from the Fed. Not even you.

To: Toddsterpatriot

The average American has no understanding of our monetary system. 30 years in the banking and mortgage industry and I only began to understand it the past few years. But you know who does understand it? Every member of Congress. They know that under our current system the debt cannot be repaid. The only path forward is to raise the debt ceiling and continue to borrow. Thats why they don’t bother with passing a budget anymore. Its pointless. They just use CR’s en lieu of a budget.

The only objective of the Federal Reserve is to transfer wealth from the people to the banks and corporations.

91

posted on

09/22/2019 9:12:08 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: Georgia Girl 2

The only objective of the Federal Reserve is to transfer wealth from the people to the banks and corporations. Where's Andrew Jackson when we need him?

"Gentlemen, I have had men watching you for a long time and I am convinced that you have used the funds of the bank to speculate in the breadstuffs of the country. When you won, you divided the profits amongst you, and when you lost, you charged it to the bank. You tell me that if I take the deposits from the bank and annul its charter, I shall ruin ten thousand families. That may be true, gentlemen, but that is your sin! Should I let you go on, you will ruin fifty thousand families, and that would be my sin! You are a den of vipers and thieves."

92

posted on

09/22/2019 9:14:02 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: dfwgator

So true! When the Federal Reserve tells you that they are looking at a target of 2% inflation what they are really announcing is their projected profits.

93

posted on

09/22/2019 9:17:35 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: Georgia Girl 2

They know that under our current system the debt cannot be repaid.That would be the case with or without the Fed.

You never explained how much you're charged for your FRNs or where you mail your check.

To: jdsteel

95

posted on

09/22/2019 9:34:50 AM PDT

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: Toddsterpatriot

Again the US Treasury could issue their own reserve notes at zero interest which eventually would pay off the FRNs.

I urge you to go to YouTube and watch Bill Still videos which are easy to understand and will tell you in about ten minutes exactly how the Federal Reserve system operates.

96

posted on

09/22/2019 9:58:55 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: Georgia Girl 2

Again the US Treasury could issue their own reserve notes at zero interestHow are US Notes that I don't pay interest on better than FRNs that I don't pay interest on?

I urge you to go to YouTube and watch Bill Still videos

I've seen many of his videos.

Why don't you explain how much interest you pay on your FRNs?

To: jdsteel

PROOF #2 that the Federal Reserve IS RESPONSIBLE FOR CAUSING the Great Depression:

THE GREAT DEPRESSION AND THE ROLE OF GOVERNMENT INTERVENTION

The Myth: An unregulated free market and unrestricted Wall Street greed caused the Great Depression and only the interventionist policies of Franklin D. Roosevelt got us out.

The Reality: The Great Depression was caused by government intervention, above all a financial system controlled by America’s central bank, the Federal Reserve — and the interventionist policies of Hoover and FDR only made things worse.

The precise causes of the Great Depression remain a subject of debate, although, as economist Richard Timberlake observed in 2005,“Virtually all present-day economists . . . deny that a capitalist free-market economy in any way caused” it.

At the time, however, the free market was blamed, with much of the ire directed at bankers and speculators.

Financiers were seen as having wrecked the economy through reckless speculation.

President Hoover came to be viewed as a laissez-faire ideologue who did nothing while the economy fell deeper and deeper into depression,

and Franklin D. Roosevelt’s interventionist policies under the New Deal were credited with rescuing us from disaster.

Americans came to conclude that the basic problem was the free market and the solution was government oversight and restraint of financiers and financial markets.

It’s a view that the public, unaware of the consensus of modern economists, continues to embrace.

But the conventional story ignores the elephant in the room: the Federal Reserve.

To place the blame for the Great Depression on a free financial system is like placing the blame for the fall of Rome on credit default swaps:you can’t fault something that didn’t exist.

And by the time of the Great Depression, America’s financial system was controlled by the Fed.

It’s hard to overstate the importance of this fact.

The Federal Reserve isn’t just any old government agency controlling any old industry.

It controls the supply of money, and money plays a role in every economic transaction in the economy. If the government takes over the shoe industry, we might end up with nothing but Uggs and Crocs.

But when the government messes with money, it can mess up the entire economy.

The two deadly monetary foes are inflation and deflation.

We tend to think of inflation as generally rising prices and deflation as generally falling prices.

But not all price inflation or price deflation is malignant — and not all price stability is benign.

What matters is the relationship between the supply of money and the demand for money —between people’s desire to hold cash balances and the availability of cash.

Economic problems emerge when the supply of money does not match the demand for money, i.e., when there is what economists call monetary disequilibrium. Inflation, on this approach, refers to a situation where the supply of money is greater than the public’s demand to hold money balances at the current price level.

Deflation refers to a situation where the supply of money is less than necessary to meet the public’s demand to hold money balances at the current price level.

In a free banking system, as George Selgin has argued, market forces work to keep inflation and deflation in check, i.e., there is a tendency toward monetary equilibrium.

Not so when the government controls the money supply.

Like all attempts at central planning, centrally planning an economy’s monetary system has to fail: a central bank has neither the knowledge nor the incentive to match the supply and demand for money.

And so what we find when the government meddles in money are periods where the government creates far too much money (leading to price inflation or artificial booms and busts)

or far too little money (leading to deflationary contractions).

And it turns out there are strong reasons to think that the Great Depression was mainly the result of the Federal Reserve making both mistakes.

The goal here is not to give a definitive, blow-by-blow account of the Depression.

It’s to see in broad strokes the way in which government regulation was the sine qua non of the Depression.

The free market didn’t fail: government intervention failed.

The Great Depression doesn’t prove that the financial system needs regulation to ensure its stability —instead it reveals just how unstable the financial system can become when the government intervenes.

Creating the Boom

Was the stock market crash of 1929 rooted in stock market speculation fueled by people borrowing money to buy stock “on margin,” as those who blamed the bankers for the Great Depression claimed ?Few economists today think so.

As economist Gene Smiley observes:

There was already a long history of margin lending on stock exchanges, and margin requirements — the share of the purchase price paid in cash — were no lower in the late twenties than in the early twenties or in previous decades.

In fact, in the fall of 1928 margin requirements began to rise, and borrowers were required to pay a larger share of the purchase price of the stocks.

For my money, the most persuasive account of the initial boom/bust that set off the crisis places the blame, not on speculators, but on central bankers.

Prior to the publication of John Maynard Keynes’s General Theory in 1936, the most influential account of the cause of the Great Depression was the Austrian business cycle theory pioneered by Ludwig von Mises and further developed by Friedrich Hayek.

The Austrians, in fact, were among the few who predicted the crisis (though not its depth).

What follows is a highly simplified account of the Austrian theory.

For a more in depth treatment, see Lawrence H. White’s uniformly excellent book The Clash of Economic Ideas, which summarizes the Austrian theory and its account of the Great Depression.

For a detailed theoretical explanation of the Austrian theory of the business cycle see Roger W. Garrison’s Time and Money: The Macroeconomics of Capital Structure.

The Austrian theory, in the briefest terms, says that when a central bank creates too much money and expands the supply of credit in the economy, it can spark an artificial boom that ultimately has to lead to a bust.

It’s a pretty technical story, so let’s start with a simple analogy Imagine you are planning a dinner party, and you’re an organized person, so you keep an inventory of all the items in your kitchen.

But the night before your party, some prankster decides to sneak in and rewrite the list so that it shows you have double the ingredients you actually have.

The next morning you wake up and check your inventory list.

With so many ingredients available, you decide to invite a few more friends to the dinner.

Meanwhile, your kid unexpectedly comes home from college and decides to make herself a large breakfast — but it’s no big deal.

According to your inventory, you have more than enough eggs and butter to finish your recipe.

Of course, your inventory is wrong, and half an hour before your guests arrive, you realize you’re short what you need to finish the meal.

The dinner is a bust.

Well, something like that happens when the government artificially expands the supply of credit in the economy.

It causes everyone to think they’re richer than they are and, just like someone planning a meal with an inaccurate inventory list, they end up making decisions —about what to produce and how much to consume

— that wouldn’t have made sense had they known how many resources were actually available to carry out their plans.

Under the Austrian theory, the key mistake is for the central bank to inject new money into the economic system, typically by creating additional bank reserves.*

Bank reserves are a bank’s cash balance.

Just as your cash balance consists of the money you have in your wallet and in your checking account,

so a bank’s cash balance consists of the cash it has in its vault and in the deposit account it maintains with the central bank.

When a central bank creates additional bank reserves, it encourages the banks to lend out the new money at interest, rather than sit on a pile of cash that isn’t earning a return.

To attract borrowers for this additional money, the banks will lower the interest rate they charge on loans, leading entrepreneurs to invest in plans that would not have been profitable at the previous, higher interest rate.

This is a big problem.

In a free market, interest rates coordinate the plans of savers and investors.

Investment in productive enterprises requires that real resources be set aside rather than consumed immediately.

If people decide to spend less today and save more for the future, there are more resources available to fund things like new businesses or construction projects, and that will be reflected in a lower rate of interest.

But when the central bank pushes down interest rates by creating new money, the lower interest rate does not reflect an increase in genuine savings by the public.

It is artificially low — the prankster has falsified the inventory list.

The result is unsustainable boom.

The increased business activity is using up resources while at the same time people start consuming more thanks to cheaper consumer credit and a lower return on savings — there is what economist Lawrence H. White calls “a tug-of-war for resources between longer processes of production (investment for consumption in the relatively distant future)

and shorter processes (consumption today and in the near future).”

Eventually prices and interest rates start to rise, and entrepreneurs find that they cannot profitably complete the projects they started.

The unsustainable boom leads inevitably to a bust.

As Mises writes in his 1936 article “The ‘Austrian’ Theory of the Trade Cycle,” oncea brake is thus put on the boom, it will quickly be seen that the false impression of “profitability” created by the credit expansion has led to unjustified investments.

Many enterprises or business endeavors which had been launched thanks to the artificial lowering of the interest rate,

and which had been sustained thanks to the equally artificial increase of prices, no longer appear profitable.

Some enterprises cut back their scale of operation, others close down or fail.

Prices collapse; crisis and depression follow the boom.

The crisis and the ensuing period of depression are the culmination of the period of unjustified investment brought about by the extension of credit.

The projects which owe their existence to the fact that they once appeared “profitable” in the artificial conditions created on the market by the extension of credit

and the increase in prices which resulted from it, have ceased to be “profitable.”

The capital invested in these enterprises is lost to the extent that it is locked in.

The economy must adapt itself to these losses and to the situation that they bring about.

This, the Austrians argued, was precisely what happened in the lead up to the 1929 crash.(Two economists, Barry Eichengreen and Kris Mitchener, who are not part of the Austrian school and who by their own admission “have vested interests . . .

emphasizing other factors in the Depression,” nevertheless found that the empirical record is consistent with the Austrian story.)

The Federal Reserve during the late 1920s held interest rates artificially low, helping spark a boom — notably in the stock market, which saw prices rise by 50 percent in 1928 and 27 percent in the first 10 months of 1929.

Starting in August of 1929, the Fed tried to cool what it saw as an overheated stock market by tightening credit. The boom came to an end on October 29.

Magnifying the Bust

When the government sparks an inflationary boom, the boom has to end eventually.

One way it can end is that the government can try to keep it going,ever-more rapidly expanding the money supply until price inflation wipes out the value of the currency,

as happened in Germany during the 1920s.

The other way is for the central bank to stop expanding credit and allow the boom to turn into a bust.

Some businesses go out of business, some people lose their jobs, investments lose their value:the market purges itself of the mistakes that were made during the boom period.

That adjustment process is painful but necessary.

But what isn’t necessary is for there to be an economy-wide contraction in spending — a deflationary contraction.

A deflationary contraction occurs when the central bank allows the money supply to artificially contract, thus not allowing the demand for money to be met.

As people scramble to build up their cash balances, they cut back on their spending, which sends ripple waves through the economy.

In economist Steven Horwitz’s words:

As everyone reduces spending, firms see sales fall.

This reduction in their income means that they and their employees may have less to spend,

which in turn leads them to reduce their expenditures, which leads to another set of sellers seeing lower income, and so on.

All these spending reductions leave firms with unsold inventories because they expected more sales than they made.

Until firms recognize that this reduction in expenditures is going to be economy-wide and ongoing, they may be reluctant to lower their prices,

both because they don’t realize what is going on and because they fear they will not see a reduction in their costs, which would mean losses.

In general, it may take time until the downward pressure on prices caused by slackening demand is strong enough to force prices down.

During the period in which prices remain too high, we will see the continuation of unsold inventories as well as rising unemployment,

since wages also remain too high and declining sales reduce the demand for labor.

Thus monetary deflations will produce a period, perhaps of several months or more, in which business declines and unemployment rises.

Unemployment may linger longer as firms will try to sell off their accumulated inventories before they rehire labor to produce new goods.

If such a deflation is also a period of recovery from an inflation-generated boom, these problems are magnified as the normal adjustments in labor and capital

that are required to eliminate the errors of the boom get added on top of the deflation-generated idling of resources.

In short, a deflationary contraction can unleash a much more severe and widespread drop in prices, wages, and output

and a much more severe and widespread rise in unemployment than is necessary to correct the mistakes of an artificial boom.

Unfortunately, that’s exactly what happened during the Great Depression.

Three factors were particularly important in explaining the extreme deflationary contraction that occurred during the 1930s.

1. Bank failures

In my last post, I discussed how government regulation of banking made banks more fragile.

In particular, I noted that government regulations prevented banks from branching, making them far less robust in the face of economic downturns.

That remained true throughout the 1920s and ’30s, leaving U.S. banks vulnerable in a way that Canadian banks, which could and did branch, were not.

Not a single Canadian bank failed during the Depression.

In the United States, 9,000 banks failed between 1930 and 1933 (roughly 40 percent of all U.S. banks), destroying the credit these banks supplied and so further contracting the money supply.

A report from the Federal Reserve Bank of St. Louis describes it this way:

Starting in 1930, a series of banking panics rocked the U.S. financial system.

As depositors pulled funds out of banks, banks lost reserves and had to contract their loans and deposits, which reduced the nation’s money stock.

The monetary contraction, as well as the financial chaos associated with the failure of large numbers of banks, caused the economy to collapse.

Less money and increased borrowing costs reduced spending on goods and services, which caused firms to cut back on production, cut prices and lay off workers.

Falling prices and incomes, in turn, led to even more economic distress.

Deflation increased the real burden of debt and left many firms and households with too little income to repay their loans.

Bankruptcies and defaults increased, which caused thousands of banks to fail.

(The banking panics of 1932, it should be noted, were at least in part the result of fears that incoming president FDR would seize Americans’ gold and take the nation off the gold standard — which he ultimately did.

Another contributing factor was the protectionist Smoot-Hawley tariff passed in 1930, which, among many other negative impacts on the economy, devastated the agricultural sector and many of the unit banks dependent on it.)

Thanks to these massive bank failures, the U.S. was being crippled by a severe deflation, and yet the Federal Reserve — which, despite being on a pseudo-gold standard, could have stepped in (see here and here) — did nothing.

2. The check tax

Also contributing to the collapse of the money supply was the check tax, part of the Revenue Act of 1932, signed into law by Hoover.

The Act raised taxes in an effort to balance the budget, which was bad enough in the midst of a deflationary crisis.

But the worst damage was done by the check tax.

This measure placed a 2-cent tax (40 cents today) on bank checks, prompting Americans to flee from checks to cash, thereby removing badly needed cash from the banks.

The result, economists William Lastrapes and George Selgin argue, was to reduce the money supply by an additional 12 percent.

3. Hoover’s high wage policy

The net result of the bank failures and the check tax was a credit-driven deflation the likes of which the U.S. had never seen.

As Milton Friedman and Anna Schwartz explain in their landmark Monetary History of the United States:

The contraction from 1929 to 1933 was by far the most severe business-cycle contraction during the near-century of U.S. history we cover,

and it may well have been the most severe in the whole of U.S. history. . . .

U.S. net national product in constant prices fell by more than one-third. . . .

From the cyclical peak in August 1929 to the cyclical trough in March 1933, the stock of money fell by over a third.

Why is a deflationary contraction so devastating ?

A major reason is because prices don’t adjust uniformly and automatically, which can lead to what scholars call economic dis-coordination.

In particular, if wages don’t fall in line with other prices, this effectively raises the cost of labor, leading to — among other damaging consequences — unemployment.

And during the Great Depression, although most prices fell sharply, wage rates did not.

One explanation is that wages are what economists call “sticky downward”: people don’t like seeing the number on their paychecks go down, regardless of whether economists are assuring them that their purchasing power won’t change.

The idea of sticky prices is somewhat controversial, however — in earlier downturns, after all, wages fell substantially, limiting unemployment.

What is certainly true is that government intervention kept wages from falling — particularly the actions of President Hoover and, later, President Roosevelt.

Hoover believed in what was called the “high wage doctrine,” a popular notion in the early part of the 20th century.

The high wage doctrine said that keeping wages high helped cure economic downturns by putting money into the pockets of workers who would spend that money, thereby stimulating the economy.

When the Depression hit and prices began falling, Hoover urged business leaders not to cut wages.

And the evidence suggests that they listened(whether at Hoover’s urging or simply because they too accepted the high wage doctrine).

According to economists John Taylor and George Selgin:

Average hourly nominal wage rates paid to 25 manufacturing industries were 59.3 cents in October 1929, and 59.5 cents by April 1930.

Wage rates had fallen only to 59.1 cents by September 1930, despite substantially reduced output prices and profits.

Compare this to the 20 percent decline in nominal wage rates during the 1920-21 depression.

During the first year of the Great Depression the average wage rate fell less than four-tenths of one percent.

Hoover would go on to put teeth into his request for high wages, signing into law the Davis-Bacon Act in 1931 and the Norris-LaGuardia Act of 1932, both of which used government power to prop up wages.

FDR would later go on to implement policies motivated by the high wage doctrine, including the 1933 National Industrial Recovery Act, the 1935 National Labor Relations Act, and the 1938 Fair Labor Standards Act.

The problem is that the high wage doctrine was false — propping up wages only meant that labor became increasingly expensive at the same time that demand for labor was falling.

The result was mass unemployment.

The Aftermath

It’s worth repeating: this is far from a full account of the Great Depression.

It’s not even a full account of the ways the Federal Reserve contributed to the Great Depression(many scholars fault it for the so-called Roosevelt Recession of 1937-38).

What we have seen is that there are strong reasons to doubt the high school textbook story of the Great Depression that indicts free markets and Wall Street.

We’ve also started to see a pattern that recurs throughout history:government controls create problems, but the response is almost never to get rid of the problematic controls.

Instead, it’s to pile new controls on top of old ones, which inevitably creates even more problems.

And that’s what happened with the Great Depression.

Did we abolish the Fed? No.

Did we return to the pre-World War I classical gold standard ? No.

Did we abolish branch banking restrictions? No.

Instead, we created a vast new army of regulatory bodies and regulatory acts, which would spawn future problems and crises:above all, the Glass-Steagall Act of 1933, which separated investment and commercial banking and inaugurated federal deposit insurance. I’ll turn to that in the next post.

* How central banks go about conducting monetary policy has varied throughout history. Richard Timberlake explains the process as it took places during the 1920s and 1930s.

George Selgin describes the process in more recent times, both prior to the 2008 financial crisis and since.

Also listen to the first hour from (00:08:00 thru 0 0:44:30, and 00:48:00 thru 00:53:15 ) of :

98

posted on

09/22/2019 11:30:53 AM PDT

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: Georgia Girl 2

99

posted on

09/22/2019 11:34:57 AM PDT

by

Yosemitest

(It's SIMPLE ! ... Fight, ... or Die !)

To: Toddsterpatriot

You are asking the wrong questions which tells me you did not understand what Stills was saying.

Simply put debt cannot be repaid with debt. It has to be repaid with equity. Dollars created at zero interest carry no debt.

100

posted on

09/22/2019 1:35:25 PM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-120 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

WRONG !

WRONG ! In A Monetary History of the United States, Friedman argued that the economy was strong in the 1920s until the year 1929 when a typical economic downturn occurred.

In A Monetary History of the United States, Friedman argued that the economy was strong in the 1920s until the year 1929 when a typical economic downturn occurred.