Skip to comments.

Why Yuan at Seven Would Risk Further Inflaming Trade Dispute

MSN ^

| 19 May, 2019

| Enda Curran and Tian Chen

Posted on 05/20/2019 10:11:01 AM PDT by BeauBo

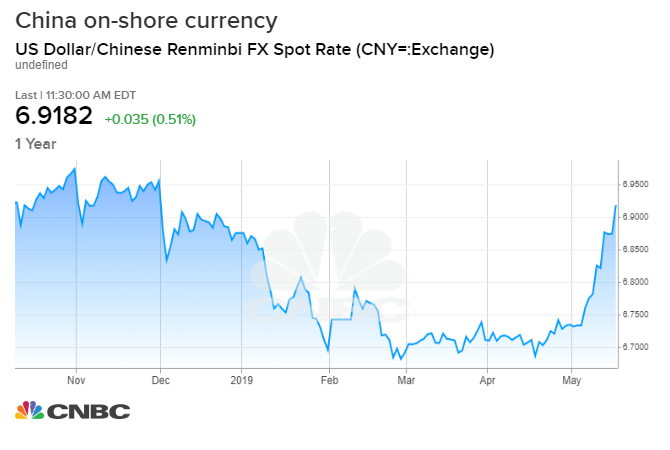

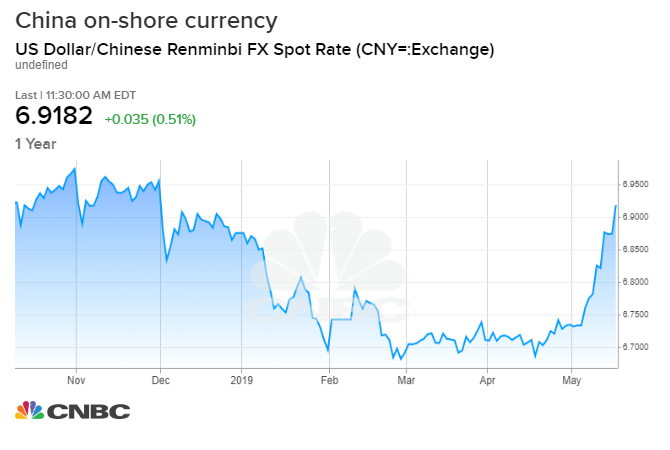

The yuan’s recent slide risks re-igniting one of U.S. President Donald Trump’s favorite criticisms of China: that Beijing weakens its currency to aid exporters. While analysts say the exchange rate is being driven by souring market sentiment as China’s economy slows and the U.S. ramps up tariffs, the slide towards 7 against the dollar comes during crunch trade negotiations. The offshore yuan has fallen almost 3% this month, making it the worst performing currency in Asia, and the onshore yuan broke the 6.9 level on Friday for the first time this year.

(Excerpt) Read more at msn.com ...

TOPICS: Business/Economy; Foreign Affairs; Government

KEYWORDS: china; currency; renminbi; yuan

There are several concerns about the Chinese currency (Yuan or Renminbi), cracking 7 to the dollar, or higher. Seven is a psychological barrier. It may not trigger any crisis, but it increases the risks. China is vulnerable to several types of cises because of their many imbalances (currency, debt, asset bubbles, stock markets). In 2015, currency devaluation led to capital flight and stock market crashes there.

- It might be viewed as currency manipulation, and trigger more trade war responses form the USA.

- A weakening currency pressures Chinese individuals and companies to get their money out of the country. (Capital Flight)

- Foreign investors in Chinese markets would lose money on the exchange rate, and could pull out. Devaluation in 2015 led to stock market crashes in China. (Market Crash)

- Investment plans could be put on hold. (economic slowdown)

- Global Stock Index funds were preparing to add Chinese stocks to their Indexes, which could be delayed - "postponing capital inflows just as China is expected to see a current account deficit and undermine a major support for the yuan." (liquidity crisis, currency crisis)

Chinese currency down 3% this month, since President Trump announced new tariffs:

1

posted on

05/20/2019 10:11:01 AM PDT

by

BeauBo

To: BeauBo

China imports mucho food and oil/gas/coal.

How low will the currency go until riots?

2

posted on

05/20/2019 10:15:48 AM PDT

by

2banana

(My common ground with islamic terrorists - they want to die for allah and we want to kill them.)

To: 2banana

China is a lot like Russia. Most of its people (millennials excepted) are very used to suffering. Life has been very stable the past decades, but they also have long memories.

Also, like Russia, they are used to doing what the government tells them to do, especially when wrapped in patriotic language. Also, some inflation can easily be hidden by the government (much as it is here)

While the USA needs to absolutely recognize and fix the unequal trade relationship with China, expecting riots is a bit too much.

China’s decline will be much more like Japan’s of the last 20 years, without quite the same level of wealth.

3

posted on

05/20/2019 10:22:25 AM PDT

by

PGR88

To: 2banana

“How low will the currency go until riots?”

They say the Government in China wants to keep their currency from weakening, and they have powerful means to manipulate it. If they let it go to 8 to the dollar, it would make up for the whole recent package of tariffs.

But you point out another major downside of weakening their currency - it comes right out of their citizens purchasing power/standard of living.

If the currency exchange rate gets out of Government control and the currency crashes, the cure (raising interest rates) could be worse than the disease, and could kill their economy.

4

posted on

05/20/2019 10:26:38 AM PDT

by

BeauBo

To: PGR88

The Chinese riot at the drop of a hat.

Look at the recent disturbances over their housing bubble deflating.

Just wait until they are hungry and cold...

5

posted on

05/20/2019 10:28:30 AM PDT

by

2banana

(My common ground with islamic terrorists - they want to die for allah and we want to kill them.)

To: PGR88

“China’s decline will be much more like Japan’s of the last 20 years”

As they are saying in China now, This may be the worst year in a decade, but it will be the best year of the next decade.

6

posted on

05/20/2019 10:28:56 AM PDT

by

BeauBo

To: 2banana

Look at the recent disturbances over their housing bubble deflating. They look at Ferguson MO, Charlotteville, or Pussy Hats in DC and think the same thing.

Anyway, I guess time will tell.

7

posted on

05/20/2019 10:30:41 AM PDT

by

PGR88

To: PGR88

Middle class folks rioting because they lost money?

8

posted on

05/20/2019 10:37:12 AM PDT

by

2banana

(My common ground with islamic terrorists - they want to die for allah and we want to kill them.)

To: 2banana; PGR88

“The Chinese riot at the drop of a hat.”

There really is something to that. There are riots or demonstrations over something, somewhere every week in China. The Government is well configured to handle them (as they currently exist), and the media shoves them right down the memory hole without a mention.

Serious riots (that really threaten the Gov’t), will require serious economic crisis. 10% or 15% likely wont do it.

The underlying imbalances are there in spades though, which could fuel such crises. So some folks in the Party are probably tuning up their mass repression plans, and refining which Military units would deploy where.

9

posted on

05/20/2019 10:37:39 AM PDT

by

BeauBo

To: BeauBo

Serious riots (that really threaten the Gov’t), will require serious government response.

Case in point Tiananmen Square.

Troops who didn't speak or understand the Mandarin dialect were brought in from remote areas.

Thousand of people who were perceived as threatening the government were crushed to a bloody pulp by being repeatedly run over by tanks and the pulp was washed down the storm drains.

End of problem, and any Chinese who publicly talks about it does so at his or her own peril.

Still, word gets around...

10

posted on

05/20/2019 11:27:21 AM PDT

by

null and void

(The press is always lying. When they aren't actively lying, they are actively concealing the truth.)

To: null and void

Troops who didn't speak or understand the Mandarin dialect were brought in from remote areas. Which is why the Left wants more "Dreamers" in the Military.

11

posted on

05/20/2019 11:30:25 AM PDT

by

dfwgator

(Endut! Hoch Hech!)

To: dfwgator

PRECISELY! Troops with no emotional or linguistic connection to the people you wish to suppress can be very handy for a would-be dictator.

12

posted on

05/20/2019 11:36:04 AM PDT

by

null and void

(The press is always lying. When they aren't actively lying, they are actively concealing the truth.)

To: BeauBo

China is running a significant budget deficit, which is likely far larger than they admit to. Their holdings of U.S. Treasuries are dwindling at a significant pace; evidence that giving price support to industries and domestic spending on citizens is a huge burden. Trump is holding all the trump cards; and he knows it.

To: WASCWatch

“China is running a significant budget deficit, which is likely far larger than they admit to.“

Exactly. And we cannot trust any of their economic stats, as they are made up.Their bad GDP and debt stats are surely far worse than stated.

They have a bumper crop of new millionaires that aren’t going to be happy losing their wealth and status. The “one child” policy has resulted in spoiled rotten boys that are now horny young men with far fewer young women.

When Trump brings the dragon to it’s knees and years pass Liberals in the future will say it was inevitable.

The biggest danger is China collapsing while the US and the rest of the world are as dependent as we have been on them.

14

posted on

05/20/2019 6:21:40 PM PDT

by

jdsteel

(Americans are Dreamers too!!!)

To: jdsteel

“The biggest danger is China collapsing while the US and the rest of the world are as dependent as we have been on them.”

Well there has been two years of warnings, and slowly ramping up tariffs, to prepare.

But as an economic divorce in earnest is approaching, China is pulling some of its dependency cards out.

They recently threatened to cut off the supply of rare earth metals to the USA. They strategically subsidized their producers to undercut prices and bankrupt the competition. The last rare earth mineral mine in the USA went bankrupt in 2015. China now produces about 60% of the world’s supply - maybe more for particular ones.

Push is coming to shove, so we may the aces they were saving for wartime get played.

15

posted on

05/21/2019 6:27:37 AM PDT

by

BeauBo

To: BeauBo

There was some good discussion on rare earth elements elsewhere on this topic.

The nice thing about capitalism is that as soon as a shortage of something happens and there is a corresponding increase in value there will be a rush to capitalize on that market, which will quickly lead to the end of the shortage.

16

posted on

05/21/2019 7:15:26 AM PDT

by

jdsteel

(Americans are Dreamers too!!!)

To: jdsteel

“The nice thing about capitalism is that as soon as a shortage of something happens and there is a corresponding increase in value”

Self regulating markets, driven by self interest and competition, efficiently balance supply and demand.

The last couple of years have seen an increase in rare earth metals extraction outside of China, so the effect of a Chinese embargo would be less of a strategic shortage of an essential commodity, and more of a big price increase.

But it can still hurt a bit more than most of their other retaliatory options. Those elements have special properties that make them key to some advanced technology.

We used to have careful management to ensure reliable availability of all commodities critical to our defense and industrial base (like the Strategic Petroleum Reserve), but those mechanisms have been systematically weakened or bypassed since Clinton came in as President. With little fanfare, some of those industrial policies have been coming back to life under President Trump. Critical minerals are once again being monitored (now by Dept of Interior), and some planning is ongoing to ensure supplies.

The fact that China was designated in the National Security Strategy as a competitor/threat by this President, has produced a cascade of such actions through the bowels of the Federal bureaucracy, so we are unlikely to caught completely flat-footed by Chinese attempts to strangle our critical supplies. Rare earth metals are probably their strongest threat on the commodities front - they themselves are much more dependent on commodities imports than we are.

17

posted on

05/21/2019 1:12:42 PM PDT

by

BeauBo

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson