https://taxfoundation.org/state-and-local-tax-deduction-primer/

You should read that. You will learn something.

For instance:

History of State and Local Tax Deductibility The deductibility of state and local taxes is older than the current federal income tax itself. The provision has its origin in the nation’s first effort at income taxation (eventually found unconstitutional) under the Civil War-financing Revenue Act of 1862, and was carried over into the Revenue Act of 1913, the post-Sixteenth Amendment legislation creating the modern individual income tax. The rationale for the original provision only comes down to us in fragments, though a fear that high levels of federal taxation might “absorb all [the states’] taxable resources,” a concern first addressed in the Federalist Papers, appears to have held sway.[10] Lawmakers sought a bulwark against the possibility that “all the resources of taxation might by degrees become the subjects of federal monopoly, to the entire exclusion and destruction of state governments,”[11] and found it in a federal deduction for state and local taxes.

While 80.55 percent of people in the $100,000-$499,999 income bracket currently itemize, claiming 6.55 percent of SALT deductions as a percentage of adjusted gross income, so do 45.63 percent of people in the $50,0000-99,999 range (claiming 3.95 percent in SALT deductions as a percentage of AGI), and 19.77 percent of those in the $25,000-49,999 range (with a 2.1 SALT deduction as a percentage of AGI).

And as the Weekly Standard said yesterday:

And as Matt LaBash further points out:

But sure, red staters, gloat in the fact that, say, Alaska, South Dakota, and Wyoming represent only 0.1 percent apiece of a state share of SALT deductions. As opposed to say, coastal blue states like California, New York, or New Jersey (19.6 percent, 13.3 percent, and 5.9 percent, respectively.) Good on you. Except that you also, if you’re being honest, have to calculate that state taxes present a complex multi-faceted picture. (When it comes to federal revenue, all of the sudden, conservative congresspersons are no longer pro-states’ rights.)

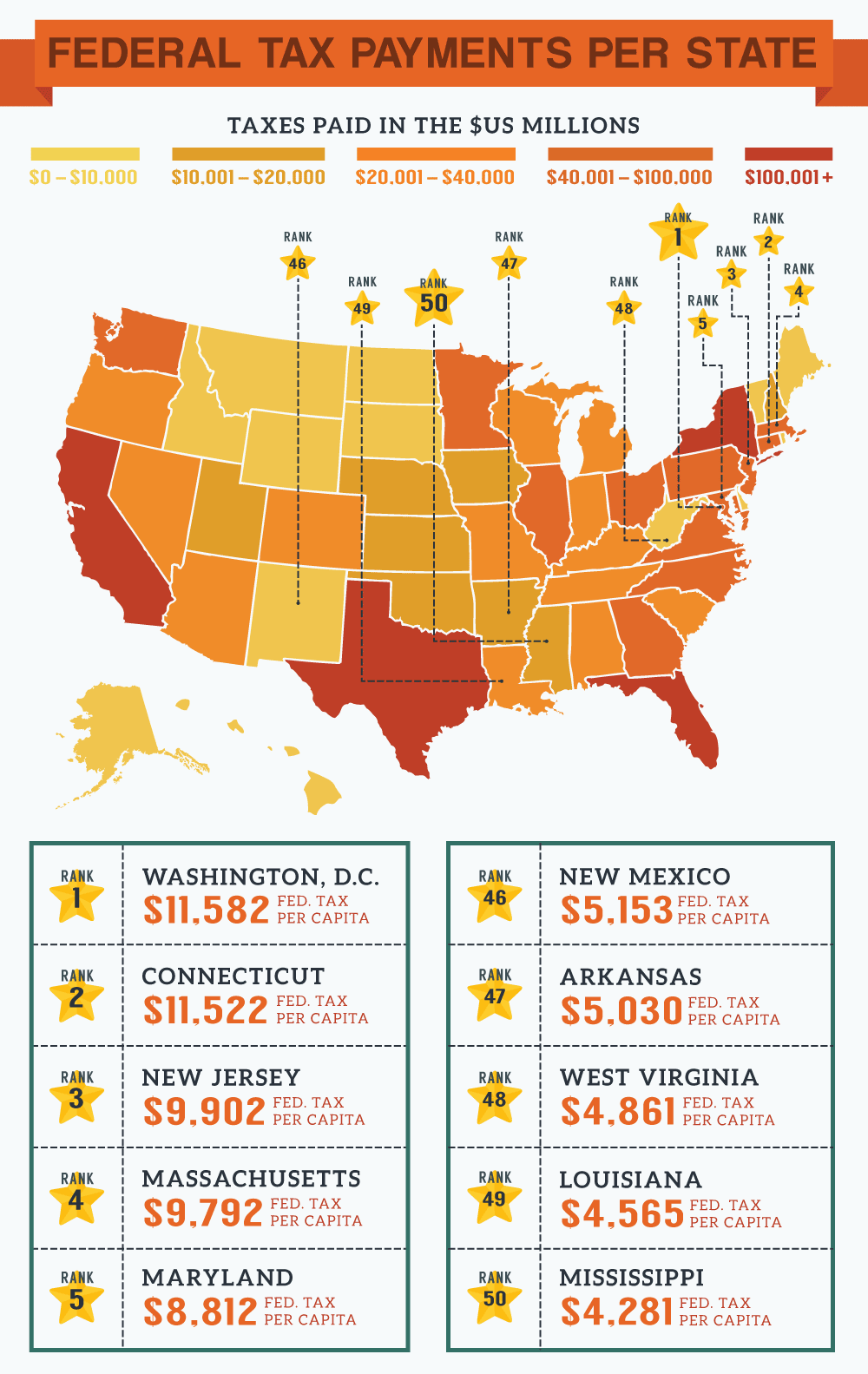

For instance, seven states pay no state income tax at all, five of seven of which went red in the last presidential election. And when Wallethub, a personal finance site, calculated which states were most dependent on federal funds, a contrarian picture emerges. The top five federally dependent states were Kentucky, Mississippi, New Mexico, Alabama, and West Virginia. Four out of five of which went for Trump. The five least dependent states? All SALT-deduction lovers who pay more than their fair share of federal taxes: California, Illinois, New Jersey, Minnesota, and Delaware. Five of five of which went blue in the last election.

Hate to break the news to you, Trump-loving Alabamans, but even the SALT-deducting hedge-fund manager in Greenwich isn’t the welfare queen that you are. Connecticut = the 42nd most-dependent state on federal finances. Alabama = the fourth most-dependent state. When calculating federal tax revenue by state, six out of the top ten payers are blue states. So despite Republicans’ haste to punish coastal blue states, who suffer higher costs of living/state taxes, and therefore benefit disproportionately from taking SALT deductions, exactly who is subsidizing who is a very open question.

there is no rational argument to be made that I should have to pay more in federal taxes on the same amount of income then you do.

Oh, so the people who claim all sorts of deductions now, from student loans, to mortgage interest, to medical expenses, to money they had to shell out to repair their homes if they were victims of natural disaster, to business expenses, and on an on and on....you don't want any of that?

Well, sorry, but that is a reality. Deductions will always be part of the tax code. And I bet you have taken one or two in your lifetime. You don't see me trying shame you and say "AHA! You took a Child Tax Credit! Why should I have to subsidize you and your child!?"

The reality here is that the GOP "plan" is screw over some American in order to pacify their furious donors, K Street Lobbyists, and give a big gift to corporations (yeah, like Apple, Google, Facebook - ones like those).

The average middle class taxpayer in CA, CT, NY, NJ, MD, or MA? They can pound sand and pay thousands and thousands of dollars more to "pay for" the huge cut for corporations.