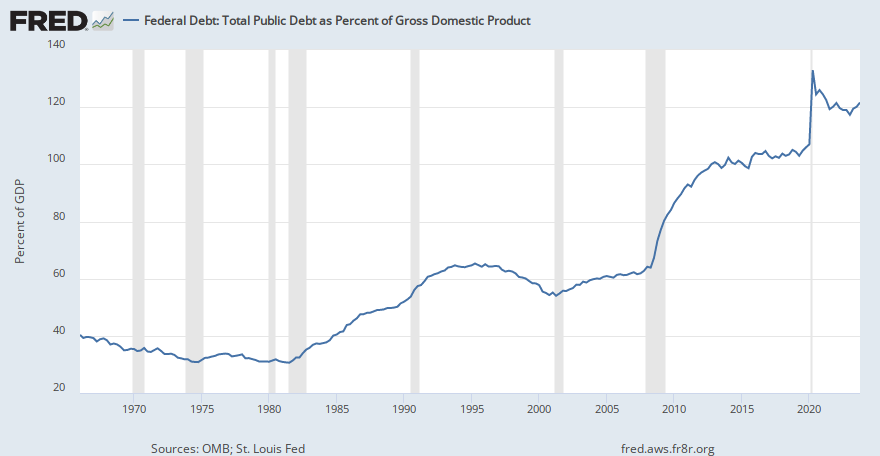

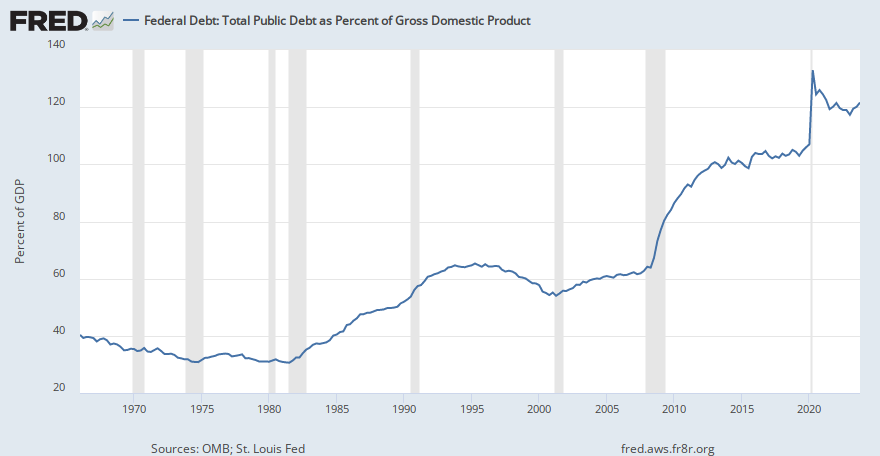

Oh gee. What happened in 2008/2009? Who was in charge? Why so much debt?

Posted on 08/06/2017 8:10:08 PM PDT by TigerLikesRooster

China’s debt surpasses 300 percent of GDP, IIF says, raising doubts over Yellen’s crisis remarks

Silvia Amaro

Wednesday, 28 Jun 2017

Global debt has hit a record level in the first quarter of this year, mainly driven by emerging markets, raising questions of whether there will be another financial crisis in the near future.

Data from the Institute of International Finance showed that global debt reached $217 trillion in the first quarter of this year, or 327 percent of gross domestic product.

"The debt burden is not distributed evenly. Some countries/sectors have seen deleveraging while others have built up very high debt levels. For the latter, rising debt may create headwinds for long-term growth and eventually pose risks for financial stability," the IIF said in its Global Debt Monitor report on Tuesday.

On Tuesday, U.S. Fed Chair Janet Yellen told an audience in London that banks are in a "very much stronger" position and another financial crisis is unlikely "in our lifetime."

The 2008 financial crisis began with high indebtedness levels by U.S. households.

But Yellen's remarks aren't' consensual.

"I think Yellen's comment -- if I am interpreting it correctly -- is a huge hostage to fortune. The words Titanic and unsinkable spring to mind," Erik Jones, professor of international political economy at Johns Hopkins University, told CNBC via email.

Casrten Brzeski, senior economist at ING said that "high debt levels mean that the debt crisis has not been solved, yet. Neither in the US, nor in the Eurozone. Increasing debt levels in Asia and other emerging market economies also show that a structural change has not yet taken place."

(Excerpt) Read more at cnbc.com ...

P!

But they have a 5 to 10% (what figures to believe?) growth rate to support it.

Not entirely. The crisis was caused by a "bubble" in the American real estate market. The bubble was "popped" by a sudden spike in energy prices, which dried up the flow of capital necessary to keep the bubble expanded. The high indebtedness of many households made them vulnerable once the real estate bubble burst.

Some body is VERY busy cookin’ da books!

Oh gee. What happened in 2008/2009? Who was in charge? Why so much debt?

“Some countries/sectors have seen deleveraging while others have built up very high debt levels. For the latter, rising debt may create headwinds for long-term growth and eventually pose risks for financial stability,”

Hmmm. Which are we? And why? Who was in charge during the 2008/2009 period until 2016?

We have been going further and further in debt for so long spending our grandkids' money that we're really just a bunch of Keynesians.

Or one leading to the other. I believe the plan is for hyper inflation, which will wipe away whole currencies - and their debts with them.

I agree with every word you say. Concerning your final point, “without a fight.” There may be more than one fight going on. The inexorable forces of debt, inequality, conflict, squabbling over resources, etc. will tend toward war. During wartime, the state suddenly gains more powers, they can nationalise and levy taxes - do all sorts of things. They can wipe the currency and tell everyone to use a new one.

We may see another world war, in our lifetime, and the outcomes are impossible to calculate.

History shows us that an economy that is screwed, soon leads to a war.

SQUIRREL!

stability to those bozos is their wallet fat from our taxes , shell game at best..

Yellen is ignorant. She is someone whose career is the epitome of the Peter Principle (rising to your level of incompetence).

The Federal Reserve meeting records during the years the U.S. housing bubble was building have Yellen (head of the Fed bank at San Francisco) in denial, up to the end. And when she finally admitted the bubble she was in denial about the systemic risk it had to the whole financial system - until all she had been denying hit.

She was the last person in the world who should have been elevated to head the federal reserve.

Now she is in denial again.

With her record, if she says a = a, you better believe that a = b.

Who is giving them the money, and why?

yup

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.