Skip to comments.

Everyone Is Worried About a Top in the Stock Market, but They Need to Chill And here's why.

The Street ^

| Jan 10, 2017 8:56 AM EST

| Avi Gilburt

Posted on 01/11/2017 3:21:14 AM PST by expat_panama

There has been more concern about the market topping last week than we have in quite some time.

We have the 20,000 level in the Dow Jones Industrial Average and 2300 in the S&P 500 just overhead, and with the Nasdaq Composite eclipsing the 5000 mark as well, it seems to make everyone looking for the market to top. But just because we are hitting round numbers in a market doesn't suggest that the market is topping.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks with serious upside potential in the next 12-months. Learn more.

As we have been noting since November, the market is rallying in what is likely a third wave, based on Elliott Wave analysis. In fact, we have traveled 200 points in two months, even though the past month has been a consolidation, while many have been looking for a market top or crash...

...the market can continue to rally in the upcoming week, then I will be moving our upper support box higher, with the low of the box being moved up by 30 points to the 2235 level.

(Excerpt) Read more at thestreet.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; markets; stockmarket

To: expat_panama

What will happen when the QE fund transfers end?

2

posted on

01/11/2017 3:36:20 AM PST

by

Libloather

(Hillary - the first female to lose TWO presidential elections!)

To: Libloather

Inevitably their will be a huge crash/correction because of the fed keeping interest rates at a minimum and it will be laid right at the feet of Trump. Once things get rockin’ economically speaking the fed will keep raising its internal lending interest rates and BOOM then the payback on 20 TRILLION dollars will have its effect prompting all types of babble and finger pointing by the bastards and bitches within the house/senate and former executive branch that allowed such huge scams and waste to occur .... #theory of monetary relativity you can’t get blood from a stone.

To: Libloather

You didn’t get the memo? They ended years ago; ah, and Obama got elected to a 2nd term. A lot’s been going on, good news too...

To: mythenjoseph

Interest rates will go up if business booms under the Trump administration. That will mean that businesses will be growing and making better earnings, but their stream of earnings will be worth relatively less because of the interest available on bonds.

Many would see this as a wash, but either up or down is definitely possible. If you think you know what will happen in the future, you shouldn’t be trading stocks.

To: expat_panama

I am so tired of these Wall Street so-called “wizards”. They have no clue what the market will do any more than you or I. If they did, they’d be billionaires. The same goes for the gold SPCULATORS!! And so many others...

6

posted on

01/11/2017 6:35:11 AM PST

by

SgtHooper

(If you remember the 60's, YOU WEREN'T THERE!)

To: SgtHooper

All this stuff is a lot easier to relax w/ by remembering that even though day to day stuff has lots of surprises, there are a few things we can be pretty sure of over the long run. Namely, that Americans are smart and are willing to work hard to make the republic grow and prosper.

That’s why I’m happy w/ investing in America w/o sweating the day to day entertainment.

To: expat_panama

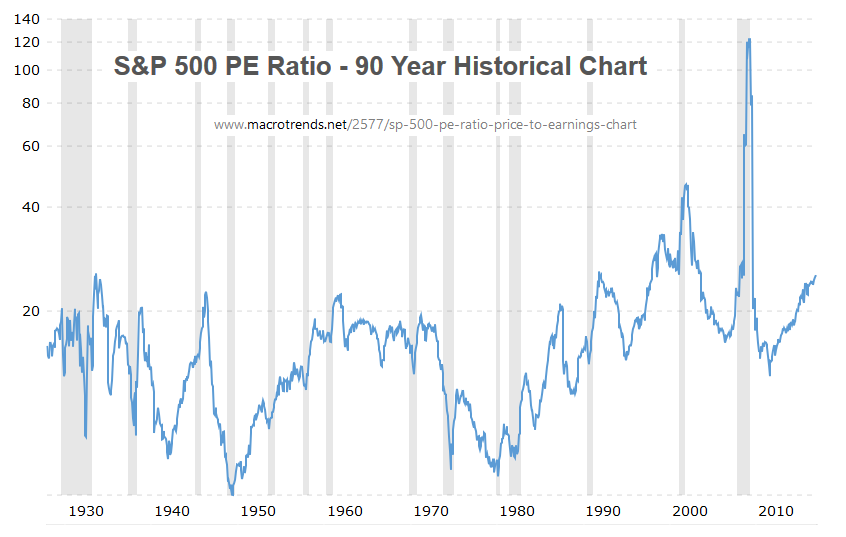

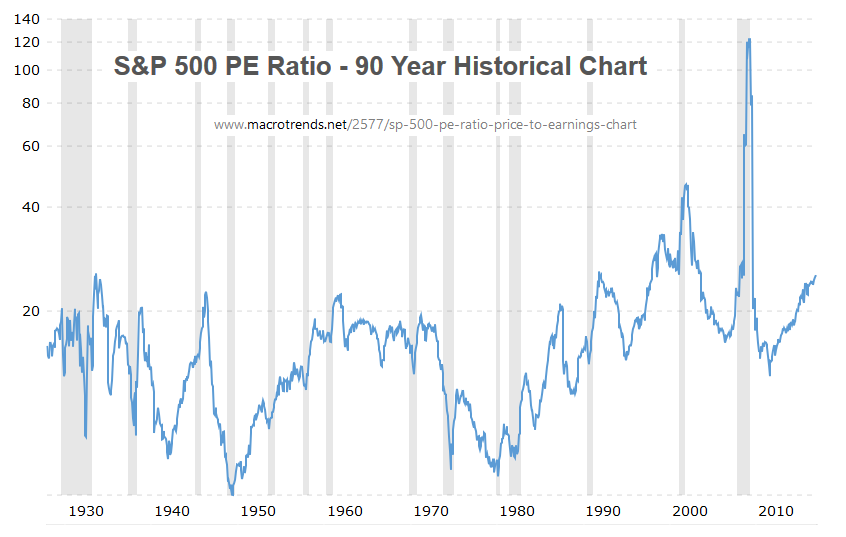

The problem with focusing only on technical analysis is the disconnect in fundamentals, brought to you by your friendly neighborhood Federal Reserve. (BTW, I am a practitioner of TA, and even a bit of Elliot Wave). This market is seriously over valued. The question in my mind is how long can this persist until valuations revert to the mean (as they always have)? Here are some S&P500 fundamentals.

The current Schiller PE is 26.05 and the 140 year Median is 14.64. The current GAAP PE is 26 (based on 6/16 trailing 12 earnings of 87.17/share), while the median is about 14.5. The S&P returns to its median historic valuation at about 1264, a drop of 1000 S&P (not Dow) points. This would be a 44% drop, and that would bring us to just average historic market valuations (not over or under valued). The market seems to think that under the Trump admin, the economy will catch up to market valuations. Hard to see that happening with the Fed tightening.

8

posted on

01/11/2017 10:15:20 AM PST

by

Weeble

To: expat_panama

9

posted on

01/11/2017 12:06:05 PM PST

by

SgtHooper

(If you remember the 60's, YOU WEREN'T THERE!)

To: Weeble

This market is seriously over valued... ...some S&P500 fundamentals.The current Schiller PE is 26.05...

There's a lot of controversy on whether stock prices in general ('the market') should be expected to fall (are 'over valued')-

→

--- but the PE ratio of the S&P500 (imho) is a horribly flawed indicator and it's certainly not about to influence where my life savings ends up. OK so the ratio does in fact seem to be rising (albeit off of falling lows) but the last time it spiked was right at the record low in early '09, one of the best buying opportunities we could reasonably expect to see in our lifetimes.

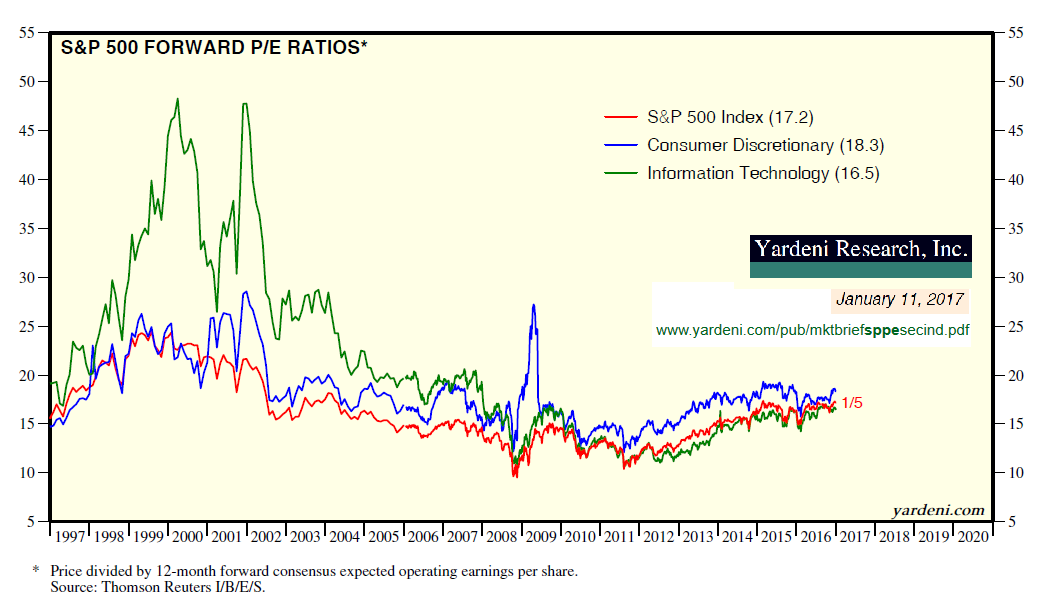

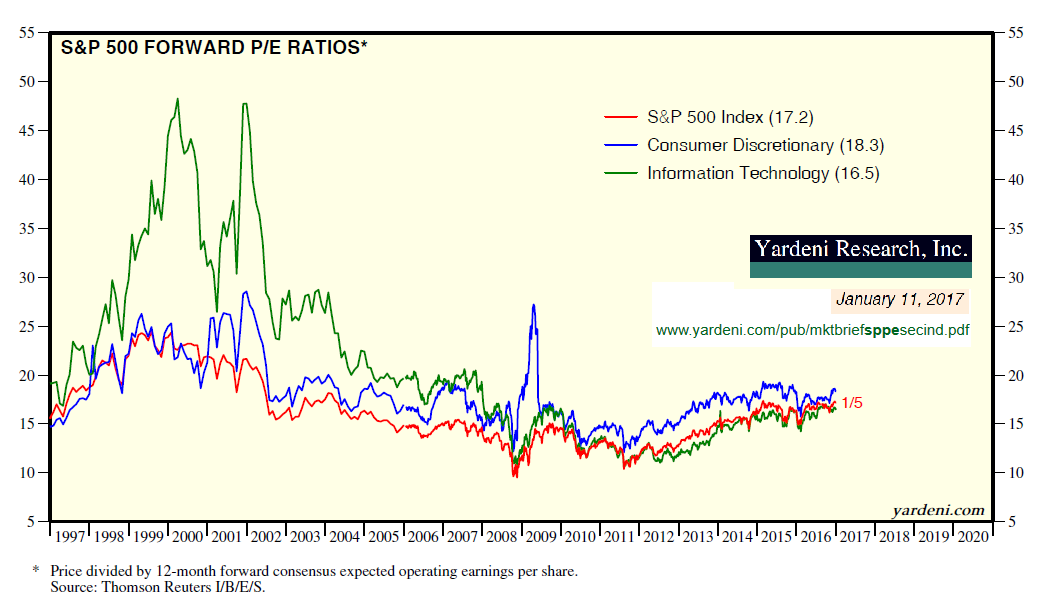

A big reason we're getting such misdirection may be the result of using a trailing PE, and we got to remember  that just because last year's earnings were bad doesn't mean that next year's stock price will be bad too. A lot of folks prefer forward PE's:

that just because last year's earnings were bad doesn't mean that next year's stock price will be bad too. A lot of folks prefer forward PE's:

← The big advantage here is that we're looking at valuations that will exist during the life of the investment, although the downside the forward numbers no matter how well thought out are basically a judgment call vs. trailing pe's (as useless as they are) which are a matter of actual performance.

To: expat_panama

You are correct in that the PE is a flawed indicator. Some great buying opportunities have coincided with very high PEs. During recessions, earnings crater, PEs rise substantially. But, recessions are a function of economic cycles, so buying during a recession, with the expectation of an economic recovery has been a sound strategy. I only use PE as an example here because it is well known. Many other valuation metrics also indicate the market is overvalued. Price to revenues, price to book, Tobin’s Q, market cap/gdp, market cap/gva are all at or near historic highs. These valuation indicators have historically been the most accurate predictor of long term future returns (as simple as buy low, sell high). But they are terrible short term timing indicators. Current fundamental valuations indicate low single digit returns over he next decade. However, that does not mean that the market won’t go higher from here and become even more over valued. We are in the longest bull market, in the weakest yet longest economic recovery and probably overdue for a correction or even a recession. But no one knows when. This market has been supported by central bank intervention and the Fed is now tightening and interest rates are rising. Other central bank (ECB, BOJ) intervention may or may not be enough to keep the market elevated. This is not meant as investment advice. Good luck :)

11

posted on

01/11/2017 6:58:18 PM PST

by

Weeble

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

that just because last year's earnings were bad doesn't mean that next year's stock price will be bad too. A lot of folks prefer forward PE's:

that just because last year's earnings were bad doesn't mean that next year's stock price will be bad too. A lot of folks prefer forward PE's: