Skip to comments.

Has the Market Bet Too Heavily on Hillary Clinton? [MORONS-BUY-STOCKS-TOO ALERT]

Barrons ^

| Oct. 6, 2016 6:52 p.m. ET

| John Kimelman

Posted on 10/07/2016 3:29:56 AM PDT by expat_panama

Recently, this Website ran a column asserting that “who is president, and from which party, has less impact on your portfolio than is often assumed.”

“What’s important, I believe, is to prevent your political biases and emotions from interfering with your investment decisions,” writes Andrew Tanzer...

...expectations about the identity of the next president have found their way into stock valuations, at times shoving aside more traditional factors such as the outlook for corporate earnings, interest rates, and the U.S. GDP...

...a number of financial pundits and journalists have attempted to weigh in on the role that the race for the White House and for control of Congress are playing on stock prices and various sectors...

...Fordham tells Bloomberg that this presidential race “feels more like an election in a developing nation where public distrust in government is high and conspiracy theories are rife.”

Even market pundit Mohamed El-Erian wonders aloud whether the market has priced in the potential risk of an electoral outcome that upsets the apple cart.

In a piece for Bloomberg View, El-Erian, the chief economic adviser for Allianz, the German financial-services firm, writes that the “atypical U.S. presidential election also exposes America’s economy to unusual political uncertainty.”

He adds that “although both candidates have signaled they wish to step back from the enthusiastic embrace of international trade that has strengthened the U.S.’s economic role in the world, Donald Trump has gone a lot further by advocating punishing import tariffs on China and Mexico. Should he win in November, and make good on the promise of trade penalties, there would be significant risk of retaliatory actions from trading partners that could raise the threat of a contraction in economic activity.”

(Excerpt) Read more at barrons.com ...

TOPICS: Business/Economy; News/Current Events; Politics/Elections

KEYWORDS: economy; investing; politics

Related:

These are all opinions. Here are some facts:

- Nobody knows nothin'.

- Stock prices are largely affected by institutional traders employed by universities, foundations, insurance companies, etc..

- Stock price trends are chaotic.

- A lot of pundits get rich by making up phony reasons why stock prices do what they do.

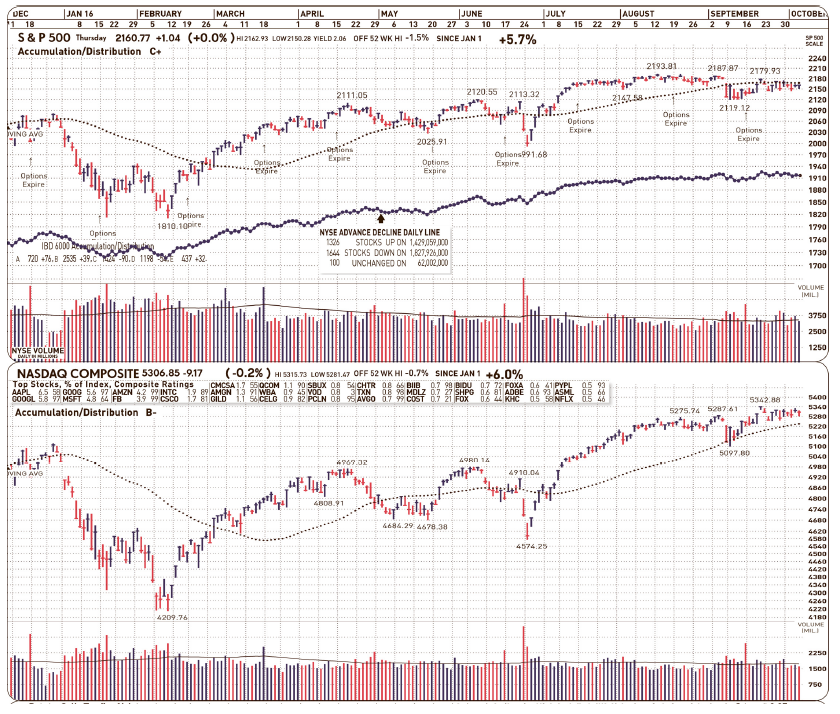

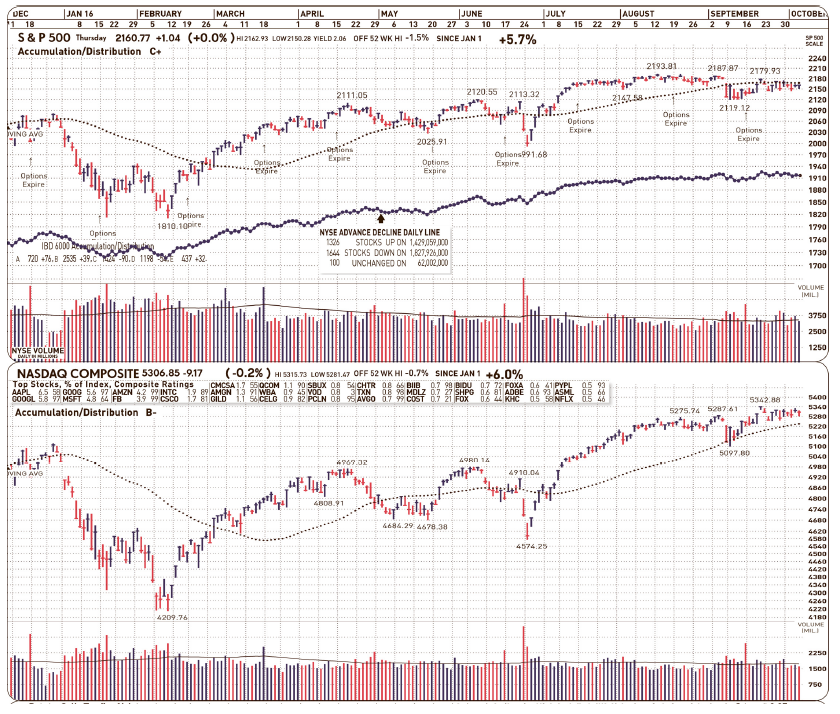

- Some folks say stocks are up, some say they're down, and some say they're scared. Here's what stock prices are:

Click, enlarge, and see how for the past 3 months stock prices have gone nowhere and trade volume's been light. The market's been AWOL.

To: expat_panama

eight years and five hundred percent increase in the nasdaw ain’t too bad.

Figuring out what to do with the old 401k in the next months...that ain’t so easy.

I think i’ll weather the 1 or 2 year fall if Trump is elected, because it will go up nicely once he gets affairs in order.

If he lets interests go where they should, it could get ugly.

But timing is HARD.

2

posted on

10/07/2016 3:39:41 AM PDT

by

dp0622

(IThe only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

Hi there, nothing happening, we may as well go back to bed.

Yesterday's stocks were flat in lower trade, and while everyone's saying that precious metals are plunging the fact is what they did is simply return to the support plateau we had in the first half of 2016.

If you can't get back to sleep there's always this stuff:

8:30 AM Nonfarm Payrolls

8:30 AM Nonfarm Private Payrolls

8:30 AM Unemployment Rate

8:30 AM Hourly Earnings

8:30 AM Average Workweek

10:00 AM Wholesale Inventories

3:00 PM Consumer Credit

--or maybe these:

How Clinton Could Make Big Econ. Impact in 1st Term - David Dayen, NR

Tech Consolidation Will Drive Next Bull Wave - Matthew Lynn, Telegraph

Building a Better World Bank - Ahluwalia, Summers & Velasco, Bloomberg

Monetary Limbo Brings Nowhere Growth - Jeff Snider, RealClearMarkets

Is the Job Market Improving Enough For the Voters? - John Crudele, NYP

Is America Still the Land of the Free? - Steve Bradley & Peter Klein, Forbes

Greens Make Green: Business of Environmentalism - Tom Nassif, TWS

To: dp0622

eight years and five hundred percent increase in the nasdHuh. All I see here is the NASDAQ up 130% and the S&P up 70%. That's about the historic average for stock price growth.

To: dp0622

The current dip in gold and silver prices is a gift!

GDX and similar are at bargain prices, IMO.

5

posted on

10/07/2016 3:54:19 AM PDT

by

Fireone

(The future must belong to those who tell the truth about Islam.)

To: expat_panama

you’re wrong. nasdaq was at 1000 8 years ago. 5000 now.

6

posted on

10/07/2016 4:08:53 AM PDT

by

dp0622

(IThe only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: Fireone

Have to check gold and silver prices!! Thanks :)

haven’t looked in maybe a year.

7

posted on

10/07/2016 4:13:44 AM PDT

by

dp0622

(IThe only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: Fireone

I am not in the loop anymore.

No chance of going back to 7 bucks in 2000?

howcome?

Honestly interested as you seem to know what you’re talking about.

What’s up with China and their silver stockpile these days

8

posted on

10/07/2016 4:16:39 AM PDT

by

dp0622

(IThe only thing an upper crust conservative hates more than a liberal is a middle class conservative)

To: expat_panama

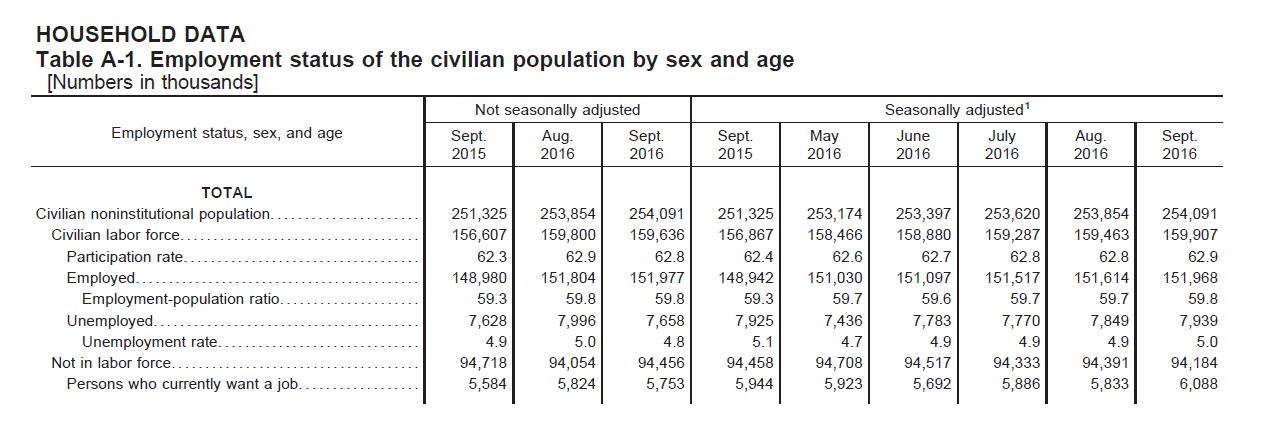

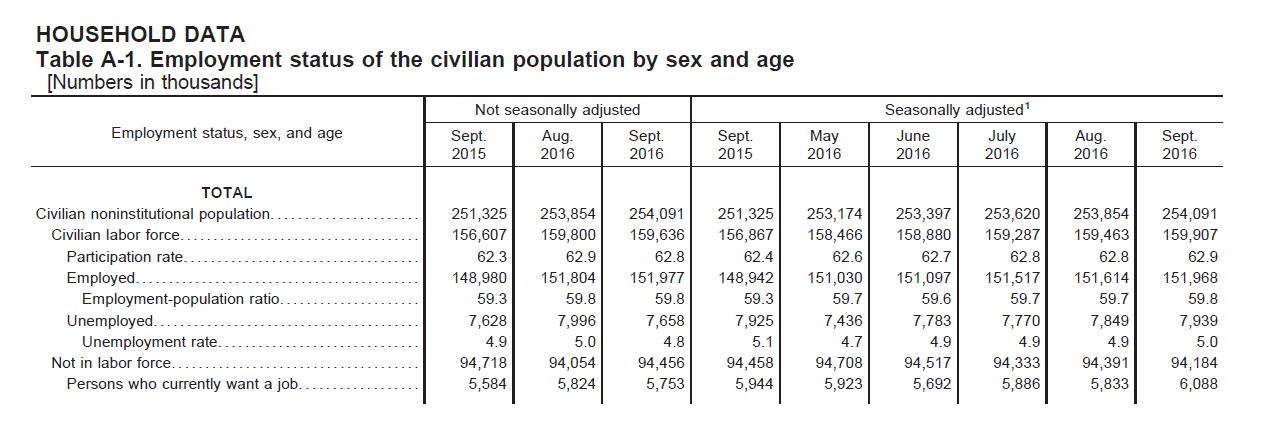

154K jobs added

Unemployment ticks back up to 5%

All good for Trump

To: expat_panama

It’s becoming clear that a whole lot of people value their political ideology more than the bottom line.

Look at the NFL. They appear ready to ride Colin Kaepernick into oblivion.

To: expat_panama; All

Read the two comments by “DANIEL FOXHOVEN”. He says he is a CPA and his comments hit the nail on the head about the disaster a Hillary election would be. Pretty thoughtful comments

To: expat_panama; All

You all already know my ‘strategery,’ but for Newbies, I’ll state it again:

*As a kid, learn about Commodities trading with your Allowance Money back when your ‘tools’ were the newspaper, the phone & a yellow No. 2 Ticonderoga. Resist the temptation to spend $ on makeup, nail polish and Teen Heart-throb magazines.

*Once you have a teenage income of your own flipping burgers, have your Dad buy you Blue Chip Stocks. Hold them.

*Finish High School, working a part-time job during the school year and crappy summer jobs. Join the military. Let the gracious Taxpayers pay for your room, board, food and college education. Try not to get shot. Invest your income in a MM or IRA. Buy your first POS car for $500.

*Work in the Real World. Take EVERY bit of matching $ your employer offers you through a 401K or IRA. FREE MONEY! Wheeee!

*Keep investing and plugging every dime into tangible assets - land and a house. (Bought my first house at 25!)

*Inherit some money from Grandpa in your 30’s. Instead of p*ssing it away on silly stuff, sink it all into PMs. And hold.

*Continue to work your butt off in the Army, and later the Public and Private sectors. Raise your kids and when they’re out of the nest, divorce your loser husband who has NOT been an asset to your financial life at all, LOL!

*Hit 50. Start to liquidate all you own, get completely out of debt and move to the country.

*Retire at 55. Live Happily Ever After. The End. :)

Sounds kind of silly looking back, but IT WORKED! Thanks to Dad & Grandpa for advice and inspiration along the way! Love you guys! *SMOOCH*

12

posted on

10/07/2016 6:27:33 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: Buckeye McFrog; All

The only reason I haven’t boycotted is because I’m a Shareholder in The Green Bay Packers, the ONLY Publicly Held Team in the NFL.

As I have so FEW vices; College and Packer football is my crack. :)

I say boycott all the games you want, but according to my Fine Print, you can STILL get your fix by watching Aaron Rogers and Da Pack.

13

posted on

10/07/2016 6:31:12 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: JonPreston

...5% All good for Trump...Political hacks can spin it anyway they want because the numbers require thinking. It was Sept. when students go back to school, summer ends, and the seasonal changes wreck havoc on the jobs numbers:

w/o the 'seasonal adjustment' the unemployment rate actually fell, but the number not in the workforce grew much more. My bottom line here is that we're still not where we want to be but we continue muddling thru.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson