Jeffrey Lacker, Federal Reserve President of Richmond, newest candidate for Arkanicide.

http://www.cnbc.com/2016/09/07/feds-lacker-case-for-rate-increase-strong-in-september.html

Nope.

Shows that Trump is right about the phony recovery.

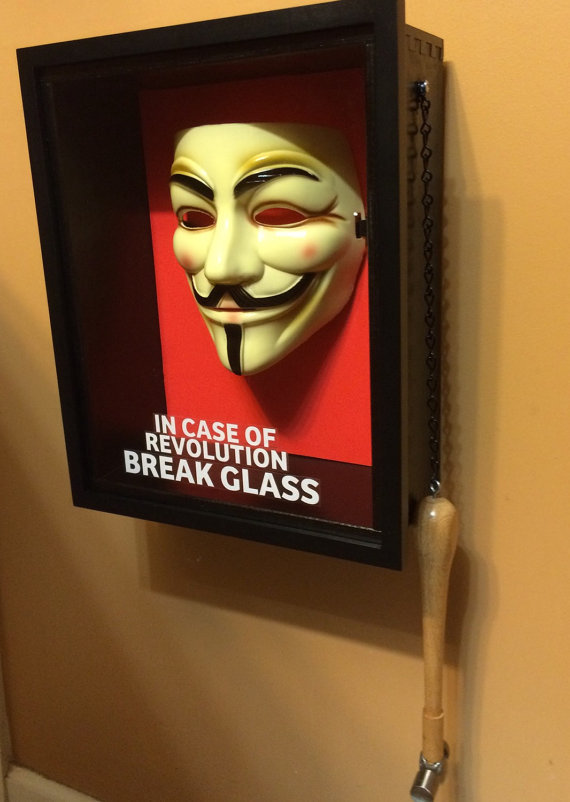

translation: Looks like Trump is gonna win. Break glass, pull lever.

We are in the worst economic depression in our country’s history, entirely due to government economic policies.

Obama/Clinton Lie is falling. Gig Time!

Any “economy” thrown into a tizzy when a bureaucrat at the Fed sneezes is not real by any definition.

Jeffrey Lacker, Federal Reserve President of Richmond, newest candidate for Arkanicide.

http://www.cnbc.com/2016/09/07/feds-lacker-case-for-rate-increase-strong-in-september.html

the economy and jobs market stinks for most Americans, the stock market is artificially propped up as the Fed keeps “printing” new currency and gives it to the largest banks to inject it into the economy (think: like the stimulants that big ‘secret service’ medic keeps injecting into Hillliary’s backside to keep her somewhat vertical)

but the big banks mostly just put the $ into the stock market because they’re afraid to lend it to most people or businesses in this extremely poor and risky economy

so the stock prices are high (along with, for different reasons, Clinton and Johnson voters), while most of the rest of American are a depression

Looks like I got my TSP all moved over to the G Fund just in the nick of time. First time that’s ever happened.

My portfolio is pretty light on equities (i.e., stocks), with no more than 16%. I’m 65 and retiring this year so I have a conservative portfolio.

S&P is up 10% for past 12 months and 4-5% this year after this dip.

The rates will be raised when Trump gets in to sabotage him. It’ll make the national debt explode and slow the economy badly. The fed will do great in the process.

How can the Fed raise rates in a great Obama 7.5 year recession???

OBAMA’S Summer of Recovery #8!

The Fed isn’t going to raise interest rates and recreate a credit crisis.

Think of someone holding onto a hot air balloon as it rises from the ground, and when they are 10 feet up they could drop and maybe be ok, although they would get a jolt when they hit the ground...then they go 15 feet up...then 20....they might survive now, but its going to hurt. Should they hang on until the balloon goes higher, when they know it will pop eventually? Might be time to let go and take the pain. Or if you are a politician just kick the can down the road...of course.

There might be a way to ease it down...but I doubt the government is smart enough to pull it off.

Market calm shattered: Dow closes down almost 400 points on rate fears

http://www.usatoday.com/story/money/markets/2016/09/09/stocks-dow-friday/90114650/

Stocks sell off, all 3 major indexes post worst day since June 24; Fed fears loom

http://www.cnbc.com/2016/09/09/us-markets.html

Does this help Hillary?

It’s to distract from Hillary

Yellen needs to ‘pit or get off the shot’..

The last thing we need is uncertainty in financial policy and the fears of a worsening effect regardless the action, if delayed or otherwise.

It seems to be the gubamint’s biggest commodity it trades in of late, instead of confidence and security.