Skip to comments.

Investors Beware of 'False Profits' In this Market

Real Clear Markets ^

| July 27, 2016

| Doug Kass

Posted on 07/27/2016 4:17:56 AM PDT by expat_panama

"Beware of false prophets, who come to you in sheep's clothing but inwardly are ravenous wolves."

-- Matthew 7:15

I try to exclude personal experiences from my diary and only include observations related to the markets. But I have to start the morning by saying that the past few days have been moving ones of monumental importance on multiple fronts for myself and my family. Let's just leave it at that.

As for Wall Street this morning, aggressive liquidity continues to buoy stocks. The money is coming from a combination of the world's central banks and historically large share buybacks, coupled with quant strategies that ignore fundamentals at the expense of share-price action and risk-based allocation. Unfortunately, these influences make the charts that technical analysts use less reliable at best -- and untrustworthy at worst.

To me, the market could be a "trap door" that's getting ready to open. Old correlations between stocks and oil prices or currencies are shifting and losing their impact in what many of the bulls see as a new market paradigm.

But profit potholes are beginning to emerge. For every DuPont (DD) that raises forward guidance, there are numerous downgrades or instances where earnings quality has weakened. For example, Gilead Sciences (GILD) and Celgene (CELG) -- which had been two popular biotech "value plays" -- were the latest to disappoint overnight, whileStarwood Hotels (HOT) missed analysts' earnings estimates rather considerably this morning.

That's part of the reason why DD my favorite large-cap long, but why I also see many other value plays that could turn into "value traps." I expect that we'll see many more earnings "accidents" in the days ahead as The Many Peaks I See multiply.

Meanwhile, the political and geopolitical backdrop that investors are for the most part ignoring remain decidedly market unfriendly. Partisanship, fiscal inertia and the callous acceptance of growing terrorist attacks all have the potential to add ever more uncertainty to stocks.

At the same time, the responsibility for world economic growth now sits precariously on central bankers' shoulders. However, their efforts have produced low and in many cases negative interest rates that create elevated price-to-earnings multiples and a dangerous reach for yield in certain market sectors.

All of the above contribute to artificial pricing in both stock and bond markets -- a phenomenon that's likely to have a relatively short half-life. After all, stocks remain in rarefied air, with the S&P 500's valuation at about 25x GAAP earnings.

Still, many investors seem to want to believe in the stock prices that they see today -- just as they want to believe in Wall Street's 21st century P.T. Barnum, Elon Musk ofTesla (TSLA) and Solar City (SCTY) .

But not me. Given all of the potentially adverse economic and market outcomes that we face, the market's risk-vs.-reward quotient seems unattractive to me.

In fact, the only thing that's keeping me from expanding my short exposure is the fact that the market's strength seems to be impervious to risk for now. Despite my personal conviction that stocks look shaky, I've decided to be reaction-oriented rather than anticipatory in a market where too many have abandoned natural price discovery.

But as the old saying goes: "This too shall pass." A return to natural price discovery could come abruptly -- occurring at almost any time.

Doug Kass is president of Seabreeze Partners Management Inc.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; stockmarket; stocks

To: expat_panama

“It ain’t worth that!”

“Yes it is!!!”

“No, it AIN’T!!”

“Well, I’m buying! It’s gonna go up,”

“I’m selling! I’m scared it’s gonna go down.”

That’s what makes a market...

2

posted on

07/27/2016 4:22:45 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

Print money. Wall Streets eats it up. Stocks go UP.

Value of my dollar plummets. All BS.

3

posted on

07/27/2016 4:22:46 AM PDT

by

Vaquero

( Don't pick a fight with an old guy. If he is too old to fight, he'll just kill you.)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Alcibiades; Aliska; alrea; ...

A very happy Fed Rate Decision morning to all! Yesterday's stocks were flat/up in higher volume, the idea being everyones' waiting for this:

7:00 AM MBA Mortgage Index

8:30 AM Durable Orders

8:30 AM Durable Orders, ex-transportation

10:00 AM Pending Home Sales

10:30 AM Crude Inventories

2:00 PM FOMC Rate Decision

Everyone but the futures traders who already say stocks will be up +0.28% --they got metals +0.44% as gold/silver nudge higher to $1,321.26//$19.69.

Meanwhile:

Sex & Fear at Bridgewater - Alexandra Stevenson & Matthew Goldstein, NYT

Clinton In Bed With Wall Street Cronies - Marita Noon, American Spectator

U.S. Auto Sales Defy All of Trump's Declinism - Joe Chidley, National Post

Trump Sets Up Debate About Bank Reform - Darrell Delamaide, USA Today

A Regulatory Plague from Austin, TX - Richard Rahn, Washington Times

$1B Dollar Shave Should Have Everyone Worried - Steven Davidoff, NYT

Brexit Knocks Confidence, Sky Hasn't Fallen - Mark Gilbert, Bloomberg

Must Watch Economic Indicators for the Summer - Simon Constable, TSC

Krugman Ought To Leave Upper West Side Occasionally - Aaron Renn, CJ

To: expat_panama

——these influences make the charts that technical analysts use less reliable at best — and untrustworthy at worst.——

har, har,har....... I guess they’ll have to return to reading sheep entrails

5

posted on

07/27/2016 4:33:24 AM PDT

by

bert

((K.E.; N.P.; GOPc;WASP ....Opabinia can teach us a lot)

To: abb

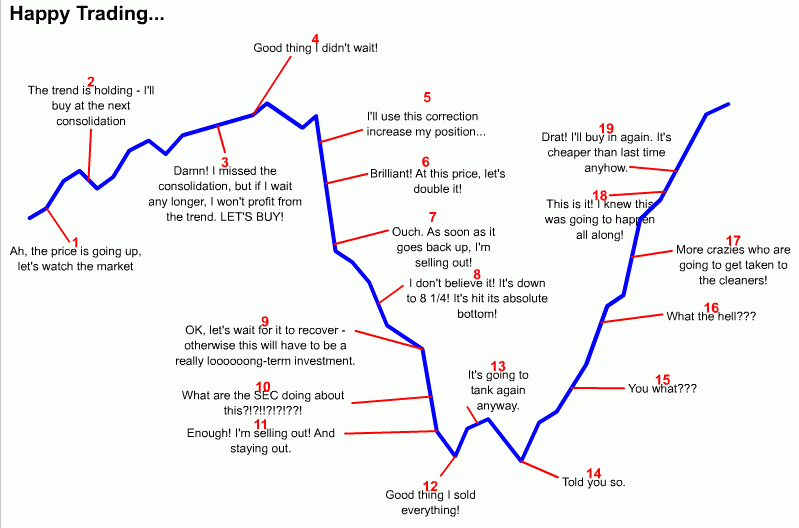

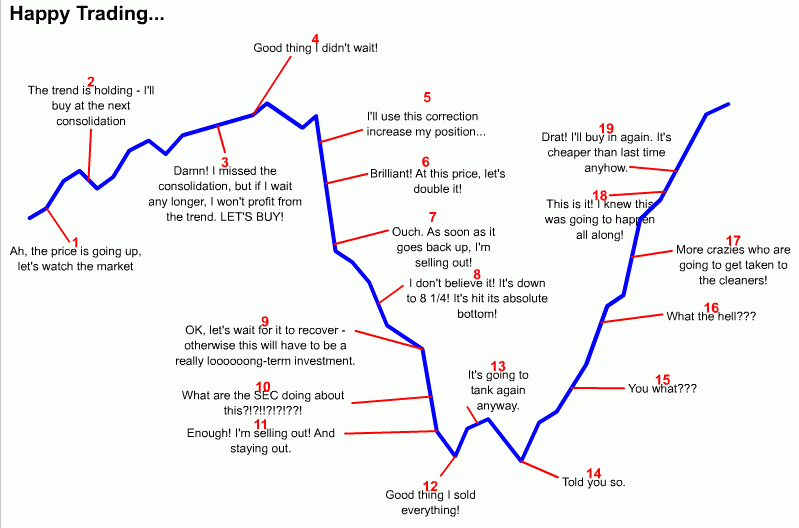

prices fluctuate and people react:

To: Vaquero

Is that why they fear Trump?

7

posted on

07/27/2016 4:40:54 AM PDT

by

steve8714

(It's Trump, or no Republican. Ever. For anything.)

To: steve8714

Yes, absolutely they fear him for that reason.

$hillary will continue the restoration of hereditary aristocracy. She’s no threat to the status quo.

8

posted on

07/27/2016 4:46:44 AM PDT

by

oblomov

(We have passed the point where "law," properly speaking, has any further application. - C. Thomas)

To: expat_panama

Bulls make money, bears make money, pigs get slaughtered.

To: expat_panama

Ignore the billions and billions in quantitative easing behind the curtain. The market is not manipulated. /sarcasm

10

posted on

07/27/2016 5:18:10 AM PDT

by

r_barton

(GO TRUMP!!!)

To: expat_panama

11

posted on

07/27/2016 5:50:23 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

how did you eavesdrop on my broker and me?

that is exactly how the conversation went... and my money goes...

you put the FU in FUnny.

12

posted on

07/27/2016 6:14:58 AM PDT

by

teeman8r

(Armageddon won't be pretty, but it's not like it's the end of the world.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson