--and every year everything goes up about 10% automtically (base line budgeting). People say Trump will cut spending. We know H promises more debt. Anyone got a link where Trump makes that promise, will stop BLB'ing, and will slash HHR and SSA?

Posted on 07/14/2016 5:01:58 AM PDT by expat_panama

...as a family grows wealthier, it is less likely to fall into deep debt, default and bankruptcy...

...the opposite is often true for the finances of individual countries -- wealthier nations may pile up proportionately more debt than poorer nations! Amid the onslaught of the Great Recession in 2010, developing countries like Mexico and Russia had smaller debt burdens than the United States, Japan and the eurozone. While the United States stacked up debt equal to about 75% of its annual output, Russia owed only 10%. When the U.S. annual budget deficit soared to over 10% of GDP, Russia's deficit was less than 4%, Mexico's was less than 3%, and Indonesia boasted a balanced budget...

...why do richer nations often pile up more debt? Why is this the logic of rich nations? Three reasons emerge.

First, because rich nations can borrow more. Banks and bond buyers are more comfortable lending to rich nations...

...Second, rich nations begin to pile up more debt because their fertility rates fall. They have fewer babies, but more senior citizens living longer. As the ratio of retirees to workers increases, they must access more goods without actually producing those goods...

...Third, as nations grow richer, the bonds that tie future generations frequently begin to fray. Who is burgled in the paradox of theft? Young people.

...The boomer will rake in $327,000 more in lifetime Social Security and Medicare benefits than he paid in federal taxes. The newborn better brace herself. She will pay $421,000 more in federal taxes than she will ever receive in future benefits...

One of my daughters recently ...

...had a retort ready. "Don't worry, Dad. I saw it on TV. Medicare will pay for it!"

The television advertisement does not, of course, explain who will pay for Medicare...

(Excerpt) Read more at investors.com ...

--and every year everything goes up about 10% automtically (base line budgeting). People say Trump will cut spending. We know H promises more debt. Anyone got a link where Trump makes that promise, will stop BLB'ing, and will slash HHR and SSA?

Off of the backs of our children and grandchildren.

Ron Paul said if we got rid of the FED we would be 17% richer. The rich countries are the target of world banks that seek to raid the treasuries of the rich country. How can you get rich form a poor country?

Good morning!

Stock indexes took a break yesterday going nowhere in lite volume. Same w/ gold/silver trading at the same ol' $1,327.75/$20.22. However this morning's futures see metals soaring (+1.19%) and stocks fading back into profit taking (-0.10%). They may be waiting for the right econ stat:

8:30 AM Initial Claims

8:30 AM Continuing Claims

8:30 AM PPI

8:30 AM Core PPI

10:30 AM Natural Gas Inventories

Other vews:

Death of Middle Class Is Worse Than You Think - Chris Matthews, Fortune

Is California Really World's 6th Largest Economy? - Carson Bruno, RCM

Dodd-Frank Is Pretty Good, and Shouldn't Be Repealed - Editorial, USAT

Sorry, You're Just Going to Have to Save More Money - Jason Zweig, WSJ

No, Markets Are Not Taking Brexit in Stride - Ben Wright, Daily Telegraph

America Has Important Post-Brexit Role - Irwin Stelzer, Weekly Standard

My first impulse was to want to see his math but that 17% probably has no math at all to it --just something he made up. Sure, making it up works just great in politics but it sucks when it comes to earning a living and having money to feed a family.

if we got rid of the FED we would be 17% richer.

I always wondered how much the FED skimmed form the Treasury. I would choose some people’s guess over actual government statistics. 5% unemployment with almost 100 million unemployed, OK. Having a private bank, the FED, running the finances of the country should be treason.

Debt makes people think they have something when they really don’t.

Debt makes people think they have something when they really don’t.

Bears repeating! ;)

Am I the only one who thinks our spending is so out of control that it’s not even REAL, anymore?

I’ll be debt free (at age 56) mid-August with the sale of my house. The FINAL thing off my plate; I cannot even conceive of how some people live their lives chained to that hamster wheel.

I’m selling my small farm (with an OLD house in need of repair) to a young couple...I KNOW they can’t afford it...they’re pre-qualified for a loan and they’re spending EVERY DIME they’re qualified for, but they’re doing it anyway.

*SHRUG*

We took advantage of the real estate bubble 11 years ago and sold out, bought a smaller retirement home for cash in the state next door and paid off our auto loan (our only other debt).

I could not imagine how well off we are, being out of debt, with nothing but current month-to-month expanses. In looking back, I fully agree with your "hamster wheel" analogy as I bought into the "get in debt and pay it off with cheaper money" nostrum.

[NATIONS W/ MORE DEBT ARE RICHER]

Correlation does not imply causation. Rich people have more debt, because they can afford more debt.

Well, it took me a while to sober up to what I was really DOING with my life. Small steps along the way, but now things are really grand.

And I now have the time and resources to build my arsenal and work on my Manifesto.

JUST KIDDING! Maybe. ;)

My Uncle did the same thing in the CA bubble about 10 years back. Sold his 3 bedroom Ranch (with cracked chimney) for $650,000! He paid $200K for it 10 years before that.

Built a house in NM with cash. He’s about 7 years older than me. Happily puttering. :)

...debt free (at age 56) mid-August...

...how well off we are, being out of debt..,

We got households and we got nations. What the article was saying was that--

...as a family grows wealthier, it is less likely to fall into deep debt... ...the opposite is often true for the finances of individual countries...

--so households and nations are different. Households last for a number of decades and nations can last for a number of centuries. Even while nations can come and go their debt lives on til it's paid; when a person dies the debts are picked out of the estate but when a nation is dissolved the new sovereign still has to cover the debts.

Nations function w/ debts. Yeah, a lot of people don't like that but reality is not subject to a vote. Before anyone says a nation shouldn't have too much debt we need to also understand that a nation shouldn't have too much military, too many laws, to many people etc. etc. either, even though nations still need these things.

If we want to make sense here we need to talk proportion, not prohibition.

I like my way better! I have also done all I can to keep my tax base low. I’m sure I made no difference in the long run, but it felt good to Starve The Beast wherever I could! :)

Yeah, I know Singapore is a tiny island country but they do a lot of things right. Some laws/practices would scale up well to big-country size, others perhaps not. A lot of their successes are largely accomplished by a good attitude & work ethic coupled with common sense.

I hope IBD was paid for this self-serving advertisement.

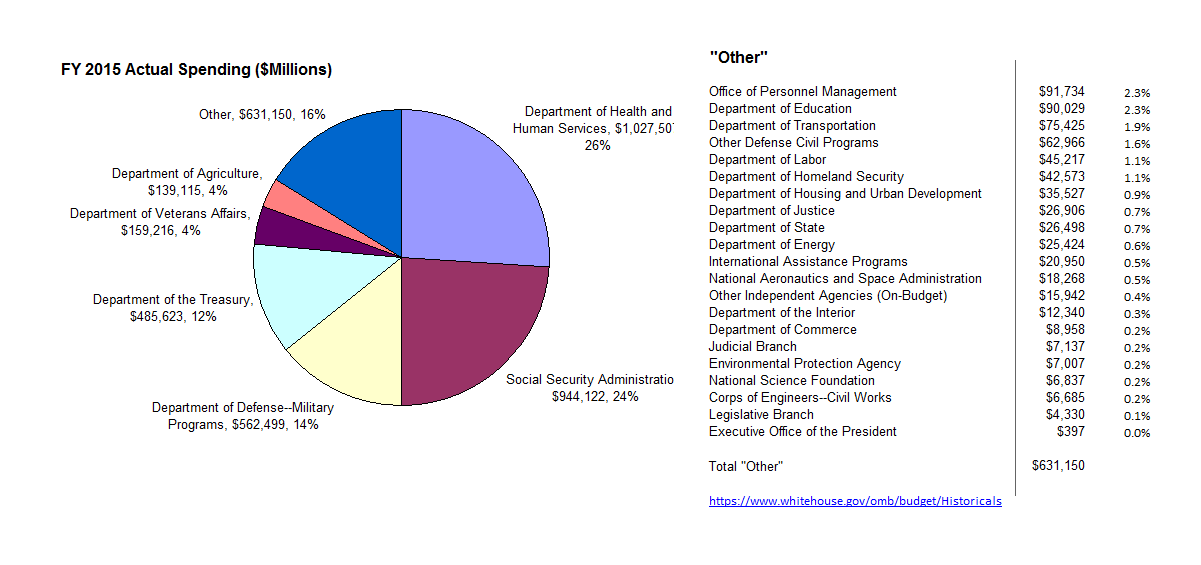

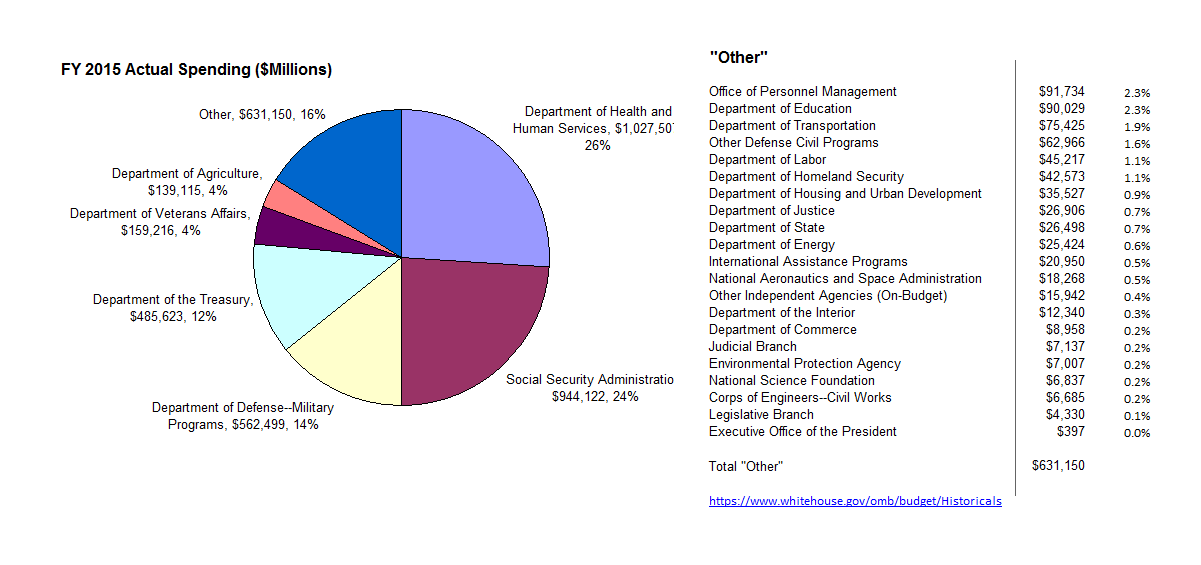

Government Spending Reference Bump!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.