Skip to comments.

Service Sector Cutting Jobs As Growth Slows To 2-Year Low [YESTERDAY: "STRONG SERVICES/MFG. WOES"]

Investors Business Daily ^

| 3/03/2016

| CIARAN MCEVOY

Posted on 03/04/2016 3:54:38 AM PST by expat_panama

The Institute for Supply Management’s Non-Manufacturing Index fell for the fourth straight month to a two-year low in February, signaling slower growth and a slight decline in jobs.

The service-sector gauge dipped just 0.1 point to 53.4, the lowest since February 2014 but...

Meanwhile, factory orders rose 1.6% in January...

Manufacturers such as General Electric (GE) and United Technologies (UTX) have suffered from a strong dollar and weak overseas demand.

A struggling energy sector weighed on staff reductions last month, as Challenger reported 61,599 layoffs, down 18% from January’s number. Energy industry layoffs were 25,051, up 24.6% from the previous month. Halliburton (HAL) announced new job cut plans last week. It has shed or will shed 22,000 employees worldwide since the price of crude oil began its collapse.

CIARAN MCEVOY

3/02/2016

Private employers added a net 213,800 jobs to their payrolls in February, up from 193,400 in January, ADP reported. The services sector accounted for virtually all of the gains, while manufacturing employment fell.

Economists expected private payrolls to rise 185,000 last month.

The services sector added 208,500 jobs, up 20% from January’s downwardly revised 174,400 jobs added...

...a “very tough” quarter for investment banking.

Manufacturing, battered by a strong dollar, weak global economic growth and an enervated energy sector, lost 8,900 jobs last month, the second-largest drop in five years. Halliburton (HAL) is among the companies who have announced fresh layoffs in recent days. Manufacturing employment rose 0.1% vs. a year earlier, the smallest gain since late 2010.

But the overall goods sector increased jobs...

ADP’s report comes ahead of the Labor Department’s employment report on Friday. Economists expect 190,000 non-farm payrolls were added in February. They see the unemployment rate holding at 4.9%.

(Excerpt) Read more at investors.com ...

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; investing; manufacturing

What --mfg. up or down? The point is not double talk from the pundits, it's the fact that our econ's in a transition and what's true one day isn't true the next.

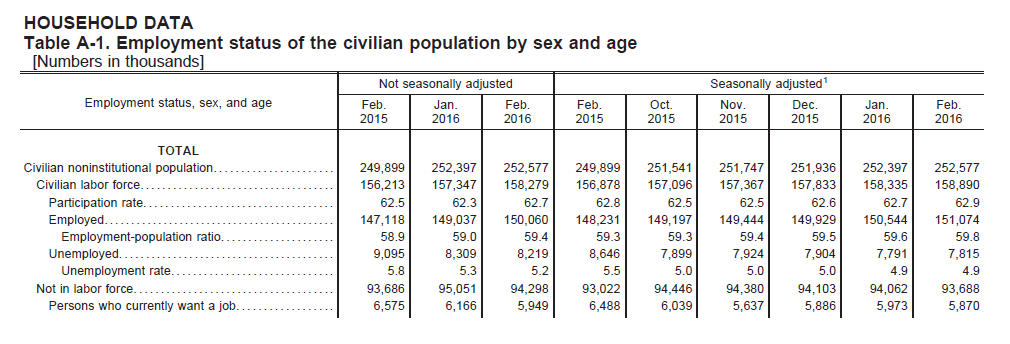

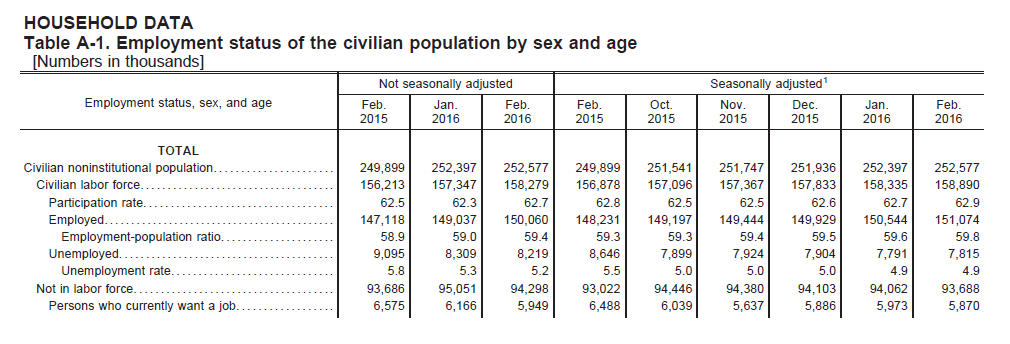

<---these are yesterday's numbers but today we got these [click pics to enlarge]--->

My take is that saying the econ is all bad is as mindless as saying it's all good. In real life we have to survive and more often than not we can prosper.

To: expat_panama

The Bush-Obama Depression rolls on...

2

posted on

03/04/2016 4:01:09 AM PST

by

Tallguy

To: Tallguy

You’re right; we’ll know when the employment situation has improved when real wages rise - and I don’t see that happening any time soon. The rosy picture painted by our overlords is such an obvious hoax, part of the false Obama legacy.

He himself knew it was BS when years ago “jobs created” was amended to “jobs saved” - which couldn’t be quantified. His other false accomplishments will also have no performance metrics: saving the environment, improving race relations, blah blah blah...

3

posted on

03/04/2016 4:14:15 AM PST

by

kearnyirish2

(Affirmative action is economic warfare against white males (and therefore white families).)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

To: Tallguy; kearnyirish2

5

posted on

03/04/2016 4:51:11 AM PST

by

PGalt

To: PGalt

4.9% unemployment.--from the BLS' (PDF) report:

Seems pretty good. You see something here that I'm missing?

To: expat_panama

Everything “looks” GRRRRRRRREAT!

7

posted on

03/04/2016 6:34:17 AM PST

by

PGalt

To: PGalt

lol —and we got the numbers to prove it too!!

To: expat_panama

9

posted on

03/04/2016 6:54:45 AM PST

by

PGalt

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson