Skip to comments.

ECB Disappoints Markets, Makes Fed Rate Hike Easier [EURO SOARS, STOCKS PLUNGE]

Investors Business Daily ^

| 12/03/2015

| JED GRAHAM

Posted on 12/04/2015 3:29:59 AM PST by expat_panama

The European Central Bank opened its money tap only slightly Thursday after raising market expectations of a more forceful move to jolt the economy out of its brush with deflation.

Instead of expanding its asset purchases beyond 60 billion euros ($66 billion) per month, the ECB pushed back the purchase program's earliest end date by six months to March 2017. It left its key lending rate unchanged but dropped the interest rate paid...

[snip]

The dollar's strength against global currencies has helped to stall the U.S. manufacturing recovery, with the latest reading on national factory activity from the Institute for Supply Management showing an outright contraction.

Fed Set To Raise Rates

As the ECB and other central banks make their monetary policies even easier, the Fed seems set to begin raising rates when it meets later this month. That may keep the dollar on the rise as investors seeking higher yields put money in dollar-based assets.

Fed Chair Janet Yellen told Congress on Thursday that the dollar's strength, along with weak global growth, has depressed exports and resulted in "a subtraction from growth."

"That makes us much more cautious in terms of raising rates," she said.

A less aggressive path by the ECB, therefore, could ease the path of U.S. rates higher.

[snip]

Euro Below $1 Next Year?

Still, the euro's snap-back rally may turn out to be short-lived.

Jay Bryson, global economist at Wells Fargo Securities, noted that his bank's currency strategists see the euro falling below $1 by next summer for the first time since 2002.

...expecting a very modest acceleration from 3% global economic growth this year to 3.2% in 2016, as contracting economies like Russia and Brazil hit bottom, and eurozone growth picks up to 2% from 1.5%.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: economy; euro; investing

Maybe smarter folks than me can see what's going on here but I feel like I'm looking at a garbled mess. All I can piece out of this is that the only thing worrying Yellen about what her precious rate hike was that it would hurt the economy which was being held back by a strong dollar that supposedly hurt our economy's exports. The EuroCentralBank is now strengthening the Euro and that devalues the dollar. That's supposed to make Yellen feel better about a rate hike.

I need another cup of coffee...

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Any morning we can be alive and wake up to is a Good Morning! Stocks tanked almost two % yesterday in rising volume and IBD calls it "uptrend under pressure". Again. Any way we look at it we had a distribution day bringing the count to NASDAQ 8 and S&P 7. Stock futures are contradictory again and we know what yesterday's disagreement led to. Metals futures are jumping (+1.33%) and gold, silver stopped falling, actually up this AM: $1,062.90, $14.21.

Huge report dump today at an hour before opening bell:

Average Workweek

Hourly Earnings

Nonfarm Payrolls

Nonfarm Private Payrolls

Trade Balance

Unemployment Rate

Nonfarm Private Payrolls

Unemployment Rate

Hourly Earnings

Average Workweek

Trade Balance

Yeah, we may not take the numbers seriously but if those folks we want to sell our investments to believe it then we got problems...

To: expat_panama

The Fed, having applied ZIRP for almost a decade with no effect other than re-inflating the stock market bubble and housing bubble no has to pretend its job is done, since the fake government stats now show fake full employment, by raising interest rates. It’s all a game of lets pretend.

3

posted on

12/04/2015 5:03:15 AM PST

by

Flick Lives

(One should not attend even the end of the world without a good breakfast. -- Heinlein)

To: expat_panama

I won’t claim to be smarter, but I sense the world is anxiously awaiting Obama being out of office.

All those various actions and numbers apparently can’t make much difference until he is gone.

4

posted on

12/04/2015 5:12:40 AM PST

by

bert

((K.E.; N.P.; GOPyes but now I must concentratc.;+12, 73, ....carson is the kinder gentler trumping.)

To: bert

...the world is anxiously awaiting Obama being out of office.The world was so anxious to have him get into office in the first place so imho they can just lump it. In another year we'll clean up the mess he's made here and the world can clean up his messes there. My concern though is that O is no where near finished making new messes at home and abroad.

To: expat_panama

I have concluded, perhaps wrongly, that Americans will juust disregard his EO’s and take them all to court while running out the clock.

He is now effectively a dead duck

6

posted on

12/04/2015 6:10:27 AM PST

by

bert

((K.E.; N.P.; GOPyes but now I must concentratc.;+12, 73, ....carson is the kinder gentler trumping.)

To: Flick Lives

...ZIRP for almost a decade with no effect other than re-inflating the stock market...That's what a lot of folks are saying. What others are seeing is that ZIRP started during deflation. The deflation ended, and stock prices when down then up and are still no better than average. My experience on these threads is that the anti-ZIRPs have made up their minds and actually looking at stock prices, inflation, and interest rates is a waste of time.

To: bert

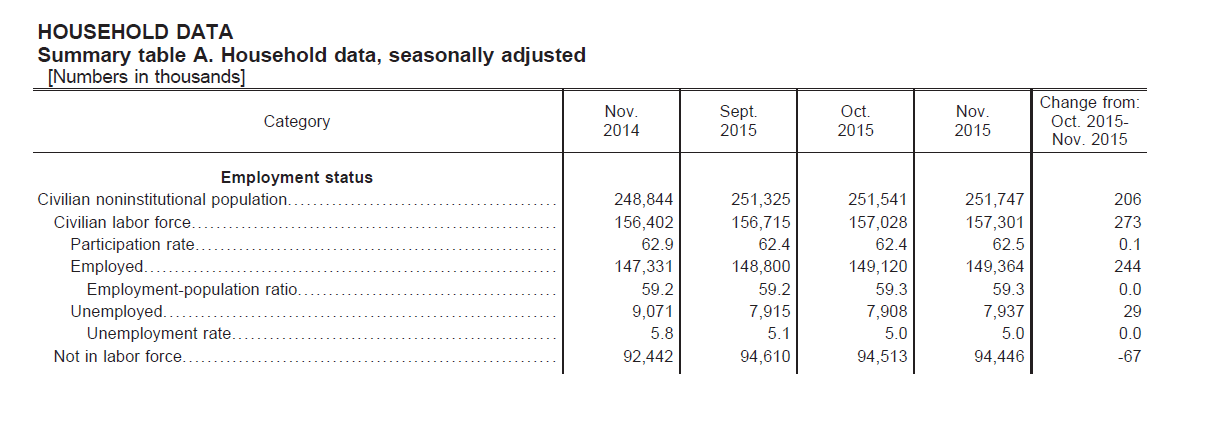

fwiw, the BLS just announced that there are more new jobs than there are new people in the population, but that still more people have joined the workforce so the number of unemployed has gone up —but not enough to raise the unemployment rate above 5.0%.

To: expat_panama

To: expat_panama

...the BLS just announced that there are more new jobs than there are new people in the population...HAHAHAHAHA. Gotta be a special kind of gullible to believe anything out of that dreamworks.

10

posted on

12/04/2015 6:31:29 AM PST

by

Stentor

("The best lack all conviction, while the worst are full of passionate intensity.")

To: expat_panama

And the Dow/S&P and Nasdaq are up.

11

posted on

12/04/2015 6:50:10 AM PST

by

sarasota

To: sarasota

To: expat_panama

Nice jump in Gold, today. I need it back to $1,200.00 in January, Please. Can you do that for me? LOL!

http://www.321gold.com/

13

posted on

12/04/2015 7:24:21 AM PST

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson