Skip to comments.

No, China's Renminbi Is Not The U.S. Dollar's Equal [IMF’s China Gambit]

Investors Business Daily ^

| 11/30/2015

| Editorial

Posted on 12/01/2015 3:17:53 AM PST by expat_panama

Geopolitics: Just as China hit economic turmoil, the IMF announced that its Special Drawing Rights basket will include China's currency, on a par with the dollar. No, it's not on a par, and this move is purely political.

China's been hankering for global "respect" for years, a function of its years of state-directed economic growth in the 8% range.

And sure, it has worked to some extent, raising gross domestic product per capita to a bit over $6,000, with Communist Party central planners earlier this month hailing the success of their latest five-year plan (yes, they still have those). It's better than the Mao Zedong era, but it's still deep in the Third World, particularly with the income inequality that plagues all socialist and crony-capitalist regimes.

That hasn't stopped China's ambition to throw its weight around global finance in places like the International Monetary Fund and its making demands of the West over global warming in Paris while doing little on its own.

[snip]

The reality is that China's currency is still nontransparent, subject to fiat moves by central planners and likely subject to big future shocks, particularly as China's growth stalls and its population stagnates.

Yet China will have more weight to throw around at the IMF, including the delicate political matters of who gets a loan and who doesn't. Communists wouldn't politicize one of those decisions, would they?

Why should China be given such power when it contributes just 4% of the SDR kitty, while the U.S. contributes 17.68%?

While votes are allocated based on contributions, this opens the gate to more prestige and influence from China all the same. The IMF should wait until China has really reformed before doing it this favor.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: economy; imf; investing

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Something that caught my eye was mention of "China's surprise renminbi devaluation. It sent shivers of fear throughout Southeast Asia's smaller trading nations, who feared competitive devaluations." What I can see is that prices are controlled by supply and demand and they can not be controlled by governments. Sure, governments can distort or delay supply and demand but imho it can't last.

To: expat_panama

Right now you have a number of Asian counties becoming ever-more influential manufacturing powers.

You meanwhile have America, ramping up the value of the dollar.

I don’t see how this current situation, is sustainable. I think this is a large part of the appeal, of Donald Trump’s candidacy.

I really do.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Uh oh. Stocks fall w/ heavier trade; headline: Stocks Fall As Big Week Of Data, Fed Speeches Begin. Anyway, good morning investors! OK, lot's of reports later but for now it's just Construction Spending, ISM Index, Auto and Truck Sales. Stock futures are mixed w/ these looking kind of up and these others a bit off. Likewise metals are off/flat, kind of 'feeling out' their new bases. Here's a pile of news; too bad these days it's all electronic and we have to go elsewhere for lining the bird cage...

Read Hillary's Lips: She Vows to Avoid Raising Your Taxes - Ira Stoll, NYS

Pfizer's Long-Term War on Taxation - Andrew Ross Sorkin, New York Times

How Uncle Sam Chases Away U.S. Jobs - Paul Mueller/Brian Brenberg, NYP

Books: How the Very Gullible Describe the New Deal - John Tamny, RCM

Where Will the Amazon Drones Land? - Greg Bensinger & Jack Nicas, WSJ

You're Fed Chairman, What Would You Do? - Barry Ritholtz, Bloomberg

To: Cringing Negativism Network

America, ramping up the value of the dollar. I don't see how this current situation, is sustainable.We agree. On top of all this the buz is the Fed's cooking up a rate hike and if so it would truly mess things up. Times like this I'm reminded that our Creator loves us because he gave us each at birth a sense of humor --and these days ya can't buy entertainment like this!

To: expat_panama

What I can see is that prices are controlled by supply and demand and they can not be controlled by governments. Sure, governments can distort or delay supply and demand but imho it can't last.True enough. In effect, however, the peg between the yuan and the dollar removed currency risk from bilateral trade, a temporary (and extremely generous) concession to China.

5

posted on

12/01/2015 4:01:40 AM PST

by

o_1_2_3__

To: expat_panama

the Fed's cooking up a rate hikeIn fact, the Fed has been "cooking up" near-zero interest rates for the past 7 years. The rising dollar is the market's rate hike, not the Fed's.

6

posted on

12/01/2015 4:05:13 AM PST

by

o_1_2_3__

To: o_1_2_3__

That was the exact thought I had, too!

The FED has become so politicized and corrupt it’s beyond redemption. It’s like they’re forcing people into stocks via artificial interest rates only to save the bacon of the crony capitalists and the politicians that enable them.

To: o_1_2_3__

the peg between the yuan and the dollar... ...extremely generous...Somehow it sounds like you're saying that the gov't of China set the dollar/yuan exchange rate at a level where the U.S. gov't gave a lot of something to them. The facts are that when a gov't creates a currency, it sets the value and when foreign currencies are exchanged the rate is set for the most part by independant traders. Please say what you mean.

To: o_1_2_3__; Original Lurker; Cringing Negativism Network

the Fed has been "cooking up" near-zero interest rates for the past 7 years. The rising dollar is the market's rate hike, not the Fed's. When we talk about the value of the dollar we don't want to confuse inflation rates, interest rates, and exchange rates. The fed struggles to control inflation by adding in/taking out dollars from the money supply along w/ tweaks on overnight bank rates. Almost all interest rates are 'controlled' by buyers and sellers. Same w/ exchange rates.

To: Original Lurker

....they're forcing people into stocks via artificial interest rates only to save the bacon of the crony capitalists and the politicians that enable them.Yes, true.

The good news is that all the skullduggery will be reported and exposed by the valiant MSM soon -- just as soon as there is a [hopefully] conservative administration. Especially if the R president appoints a new and [again, hopefully] fiscally prudent FED chairman.

10

posted on

12/01/2015 6:08:57 AM PST

by

citizen

(A government governed by acronym agencies is dangerous to life, liberty and the pursuit of happiness)

To: expat_panama

CNN painting a rosey picture with “stock futures making a decisive move higher and European markets rising in early trading”.

11

posted on

12/01/2015 6:23:30 AM PST

by

sarasota

To: sarasota

huh. [bell just rang] Stocks are up a bit. So far so good...

To: expat_panama

If memory serves, last year, before Christmas, there was a big sell off. ??

13

posted on

12/01/2015 6:50:04 AM PST

by

sarasota

To: sarasota

Just checked

the S&P for the past year and it seems right before Christmas stocks tanked, and then they soared in the week after. The only 'calendar effect' that I count on is the fact that since most stocks are traded by institutions and their managers have to please others, that they tend to buy/sell at the last minute before the reports are due to make what they got look good. That means at the end of the year (end'o'quarter too sometimes) we get a lot of turmoil that goes nowhere. Right after reports go out it all goes back the way it was --so it seems.

To: expat_panama

Thanks for checking on this. I appreciate it!

15

posted on

12/01/2015 8:56:18 AM PST

by

sarasota

To: citizen

....they're forcing people into stocks via artificial interest rates only to save the bacon of the crony capitalists and the politicians that enable them.Yes, true.

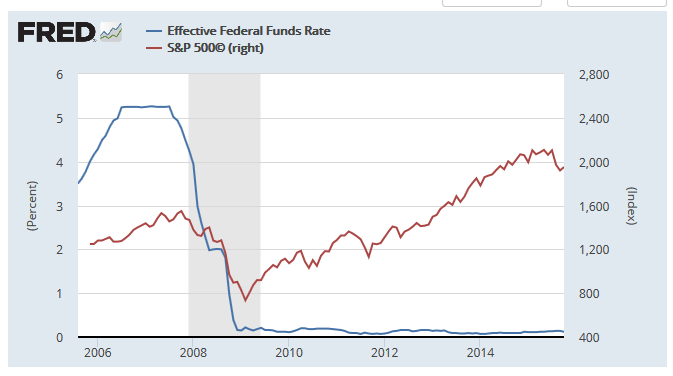

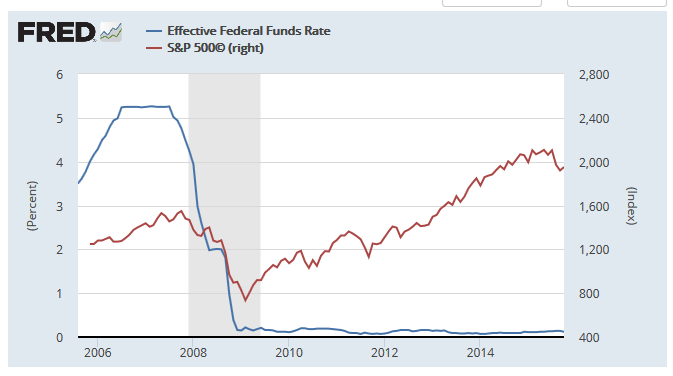

No it's not true it's crazy. The fed's interest rates don't do anything for stocks that we can count on and predict. Here's the record over the past decade:

For the first few years rates went up and so did stocks. Then rates went down and stocks went down. Then rates stayed low and stocks went down then up. The past ten years of rates going up/down/nowhere have ended w/ stocks going up --about doubling. Doubling in 10 years is what stocks have been doing for hundreds of years --centuries with the fed and without the fed.

Zirp and stocks, no discernable relationship.

To: expat_panama

17

posted on

12/01/2015 10:48:11 AM PST

by

citizen

(A government governed by acronym agencies is dangerous to life, liberty and the pursuit of happiness)

To: expat_panama

Thanks for the ping - pulling China in is a mistake... guess they don’t think so.

18

posted on

12/01/2015 11:14:35 AM PST

by

GOPJ

(https://www.youtube.com/watch?v=gKkckaZO4fw - bravest truth telling Muslim women in the world...)

To: expat_panama

I’m saying, again, that a currency peg removes the currency risk of bilateral trade.

To: citizen

I disagree.Your not saying why doesn't make you wrong and my quick arguments and slick charts don't make me right. If you do think of a way of explaining how what the fed does affects stock prices please let me know. Better still, if you got a way of making money w/ stocks based on what the fed says --that's something I really want to hear about.

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson