--and we get a solid correlation by only using values from 1960 to 1969 --before stagflation. Here's the same plot compared to another w/ data from 1948 to 2015 [click to enlarge]:

Posted on 08/13/2015 6:36:52 PM PDT by expat_panama

The idea that there's a trade-off between inflation and unemployment seems embedded in the Federal Reserve's psyche.

The Fed has not increased its benchmark federal funds target rate since 2006. It's waiting to see if a tighter labor market will push up wages and prices, so the Fed can achieve both full employment and its inflation target of 2%.

The Fed's adherence to a negatively sloped Phillips curve — predicting lower unemployment obtained by higher inflation — is a flawed model for monetary policy.

Indeed, money doesn't even enter the analysis, because the implicit assumption is that inflation is caused not by too much money chasing too few goods but by higher wages (caused by a tight labor market) pushing up costs and prices.

The Phillips curve mentality is evident in the following statement by Atlanta Federal Reserve President Dennis Lockhart:

"I think a policymaker has to act on the view that the basic (negative) relationship in the Phillips curve ... will assert itself in a reasonable period of time as the economy tightens up." He finds the logic of the Phillips curve "compelling."

Most economists would agree that even if unanticipated inflation could reduce unemployment in the short run, any trade-off is tenuous and probably will last no more than a year.

In the longer run, once expectations adjust to reality, the unemployment rate will move toward its natural rate, consistent with market forces — and there will be no permanent trade-off between inflation and unemployment.

Hayek And Friedman Saw It

More important, the stagflation of the 1970s gave credence to the idea that the Phillips curve could be positively sloped with inflation and unemployment moving in the same direction. The positively sloped Phillips curve was foreseen by Nobel laureate economist Friedrich Hayek and anticipated by Milton Friedman...

(Excerpt) Read more at news.investors.com ...

--and we get a solid correlation by only using values from 1960 to 1969 --before stagflation. Here's the same plot compared to another w/ data from 1948 to 2015 [click to enlarge]:

“The Fed has not increased its benchmark federal funds target rate since 2006. It’s waiting to see if a tighter labor market will push up wages and prices, so the Fed can achieve both full employment and its inflation target of 2%. “

This is insane. With 90+ million people out of work it’ll never happen.

Yeah. I’m amazed, I thot those guys were smarter than that...

anyway it’s past my bed time, nn!

There's a hockey stick hidden in there somewhere.

How can the Fed project anything correctly when they are using bogus numbers?

The hubris of central planners. They’re not smarter at all, just better connected.

As a smart guest on CNBC once said...

China has central planning by mathematicians, engineers and scientists, and the US has central planning by lawyers. Neither is good, but by definition we lose.

Those central planners at the FED aren’t lawyers. They’re economists and financiers and I don’t care how ‘smart’ they are. Central planning always fails. We’re in this mess due to central planning. How about a little free market for a change?

It doesn’t matter how low interest rates go, when you’re losing the jobs out the back door through bad trade policy.

Wages won’t go up while labor supply surges illegally across the border.

Raise the minimum wage, shackle energy production, give the Unions everything they want, increase taxes, continue Democrat policies and see inflation and unemployment rise in tandem.

Good morning investors! So yesterday stocks ended off a fraction with fading volume as metals also slacked off --all going into today's futures trading pointing stocks down 0.29% while metals coming back +0.21%. More 'noise' today with:

8:30 AM PPI

8:30 AM Core PPI

9:15 AM Industrial Production

9:15 AM Capacity Utilization

10:00 AM Mich Sentiment

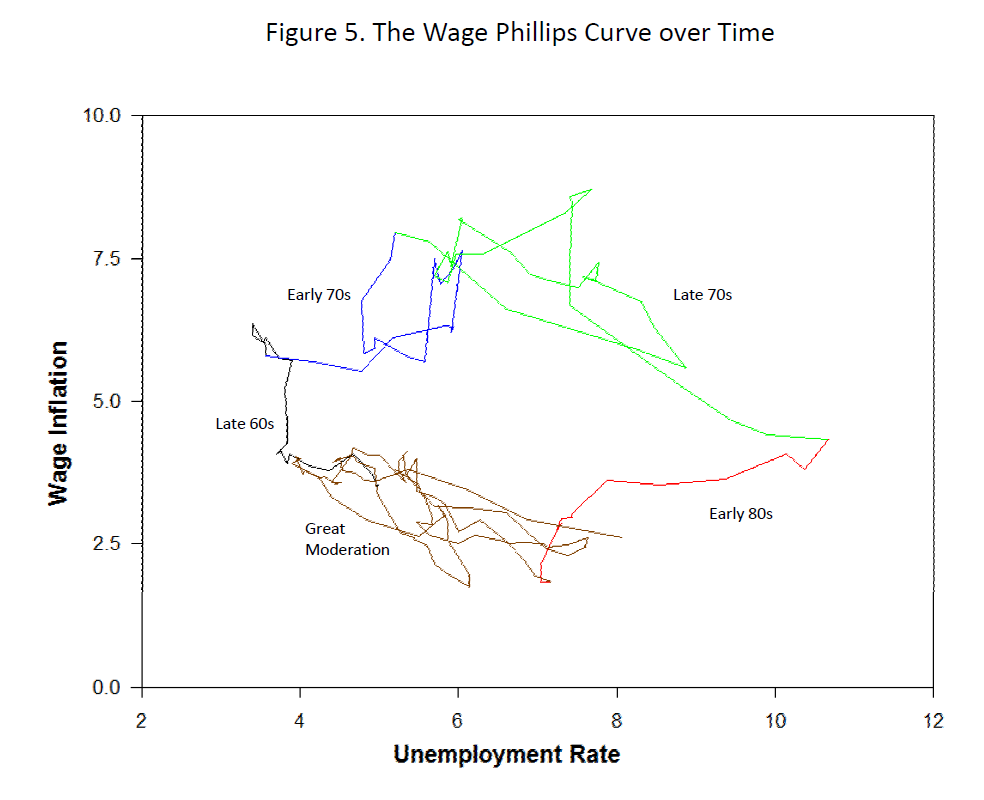

That's what I was thinking last night, but after a good night's sleep I've found that over the years a lot of 'thinking' by those smarter than everyone gone into this. Two things I was wondering about --how does this come out over time and how does this look only w/ wage pressure-- was gone into by the Fed here:

The effort is to show how policy & econ cycles mess things up.

What is the great moderation?

Ok, now gather data on the relation between the minimum wage and inflation

(asking gently so as not to piss you off)

Off the Fed stage so to speak a new economic trend in the form of cities and states increasing the minimum wage will if successful induce general wage inflation that will in turn induce general inflation of prices un related to the FED and money supply or interest rates or such financial considerations.

One wonders how the Democrat controlled cities were induced to create programs at a local level that the party was unable to achieve at a national level. This attack on the economy is a counter force it seems to the machinations of the FED

Never mind. Google is my friend.

The Great Moderation

http://www.investopedia.com/terms/g/great-moderation.asp

According to the way the dots are connected it's everything from '90 on. The data came from 2010 so maybe they thot the Obama era was 'moderate' by believing some kind of recovery was in the pipeline.. They were mistaken (imho).

That's what many decide to believe without thinking. What they're actually doing when they raise the minimum wage is not to force employers to pay more (not the legal requirement) but to prohibit employers from hiring low-value labor (stiff penalties). Bottom line here is we're not raising wages, we're raising unemployment. Any price inflation will be seen only with out-sourcing and automation where all the money ends up going.

Ah, btw I'm the very picture of tranquility as nothing but nothing ever pisses me off so keep in mind that your 'gently' cr@p's got me really ticked off that stuff frosts my cake and [breathing into a paper bag again]

In a speech delivered in 2004, Ben Bernanke hypothesized three potential causes for this period of economic stability: structural change in the economy, improved economic policies and good luck.The structural changes Bernanke referred to included the widespread use of computers to enable more accurate business decision making, advances in the financial system, deregulation, the economy's shift toward services and increased openness to trade. Bernanke also pointed to improved macroeconomic policies which helped to moderate the large boom and bust cycles of the past. Indeed, many economists point to a gradual stabilizing of the U.S. economy correlated with increasingly sophisticated theories of monetary and fiscal policy. Finally, Bernanke refers to studies indicating that greater stability has resulted from a decrease in economic shocks during this period, rather than a permanent improvement in stabilizing forces.

So two years later he gets named Fed chairman and promptly forgets all about how the 1990 to 2008 boom was caused by computers, deregulation, a shift to services, and luck.

Also consider that wages are the last thing to go up when prices are rising, due to the dollar being devalued by the government.

All the Fed is really doing is suppressing wages, and they’ve been doing it for decades. Don’t think they are doing it by accident, either, or because they are stupid. It’s intentional.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.