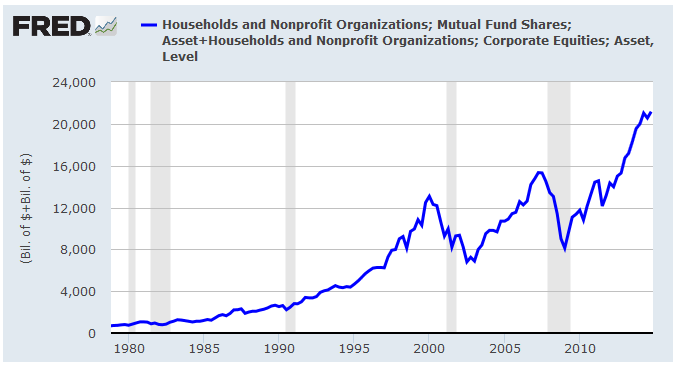

The total privately owned stocks and mutual fund shares adds up to a soaring record total $21,169,400,000 --according to the latest Federal Reserves Flow of Funds Report. Yeah I see all the hands waving --and the big question that follows has to do with population and inflation.

We went through this back on an earlier thread when the press was tootin' about how America's private wealth was supposedly at an all time high but only as a total of inflated dollars. The average American's total holdings in real dollars is still less than it was eight years ago.

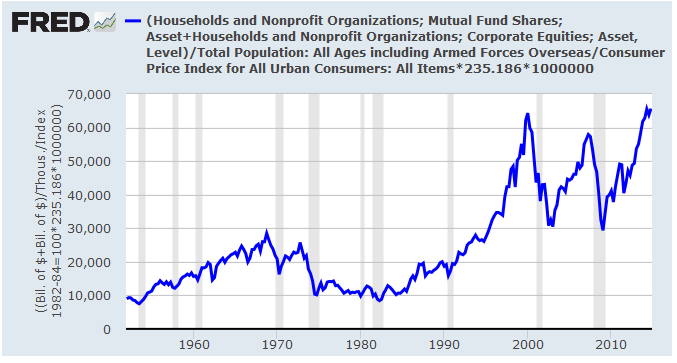

However, that's mainly because holdings in everything but stocks have been doing poorly, and looking at just the per capita real stock/mutual fund holdings we're seeing that the latest average has once again punched though to a new record high.

[insert collective "huh" here]

Did you miss the stock market rally? You're not alone

(--and here's an excerpt from the original Bankrate study:)

It's often said that a rising tide lifts all boats, but a rising tide isn't much help if you don't have a boat. In the midst of a six-year market rally, more than half of Americans don't own any stock investments at all, potentially missing out on a big investing opportunity to build retirement savings and overall wealth, according to a new Bankrate Money Pulse survey.

Sitting on the sidelinesDespite the proliferation of investment-based retirement accounts such as 401(k)s, 52 percent of Americans report not owning any stocks or stock-based investments such as mutual funds, according to Bankrate's Money Pulse survey.

That doesn't surprise Robert Stammers, CFA, director of investor education for the CFA Institute.

He says many Americans "see themselves as savers and they worry about capital preservation." Because of that, "they don't take the risk necessary to achieve the returns that they need to fulfill their long-term investment goals."

Opting out of stocks, which have historically been one of the highest-returning types of securities available to individual investors, is likely to have some harsh consequences for Americans over the long term.

"The average person has less than $25,000 saved for retirement," Stammers says. "So people certainly aren't prepared, and that's just making them less prepared."

[snip]

Methodology:Bankrate's poll was conducted by Princeton Survey Research Associates International, which obtained the data via telephone interviews with a nationally representative sample of 1,001 adults living in the continental U.S. Telephone interviews were conducted by landline (500) and cellphone (501, including 316 without a landline phone) in English and Spanish from March 19 to 22, 2015. Statistical results are weighted to correct known demographic discrepancies. The margin of error for the questions ranged from plus or minus 3.7 percentage points to plus or minus 5.3 percentage points.

[snip]

* * * * * * * * * *

Over Half Of Americans Aren't Investing In The Stock Market (Forbes)

Over half of Americans pass on the stock market (usatoday)

Stock Market Is America's Great Wealth Equalizer (investors.com/ibd)

More Than Half of Americans Are Not Investing in the Stock Market (prnewswire)

Survey: 52% of Americans not in stock market (nbcnews)

Over Half of Americans Avoiding Stocks (abcnews)

Report: 52% of Americans Don't Invest in Stock Market ... (Fortune)

Let's face it doom'n'gloom pessimism sells. The left loves is because it's the basis for all the do-gooder gov't programs they want to fund, and the right loves it in hopes that it will somehow 'prove' what miserable failures all those do-gooder gov't programs have been. Back here in the real world the rest of us have been busy making our own lives better, we create wealth, and this talk about the fruits of our labor leads into two new areas of thought now.

One is obviously the wealth-equality debate, and just what this average all time high for stock holdings means in terms of the majority of us who live on Main Street and not on Wall Street.

We know that while it's for sure the average holdings are up our Bankrate friends are insisting that the masses are broke and that the lion's share of the population still views the stock market as a 'risky scheme'. Maybe, maybe not. IMHO we still need proof and the burden of said proof is on the bankrate people. Frankly I'm not impressed so far and I'll be even less impressed when some left-winger follows up with the old globalwarming saw "aw geez, he have to raise taxes 'cuz it might be true!!!"

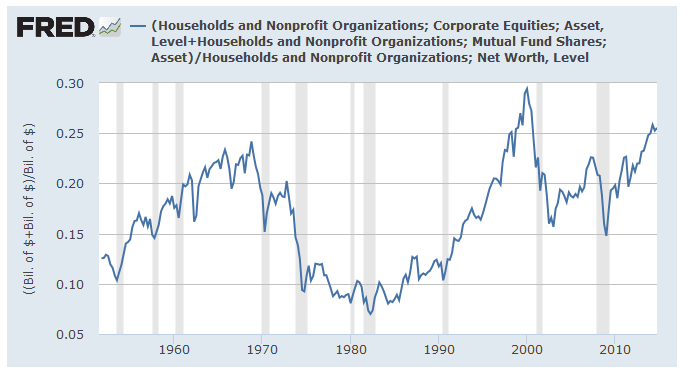

The other major area of thought we need to go through is consideration of just how significant these stock investments really are. Or aren't.

The point being that savings isn't what we're living on now and that while stocks may be a fourth of our total wealth today it wasn't that long ago that it was a twelfth.

America's personal net worth is more than just stocks, there's real estate, our land and homes are not stocks. Then again, there's also life insurance reserves, pension entitlements, and business equity --those are stocks. So now we've not gotten to the point now that the value of our businesses is most (54%) of our private assets.

Personally, my thinking is that a thousand people sitting by their phones ready to chat about the risky scary stock market, does not impress me. They can't be representative of the same United States that came into its own in the 1800's, prevailed on the world stage in the 1900's, and the current millennium it's ah..

OK so we're not done with that one just yet..

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket, economy.