Skip to comments.

Surging dollar takes bite out of US corporate profits

Associated Press ^

| Feb 21, 2015 12:06 AM EST

| Matthew Craft

Posted on 02/20/2015 9:45:51 PM PST by Olog-hai

The biggest obstacle for Coca-Cola and Pepsi these days isn’t tied to taste tests, the declining popularity of sugary drinks or even their century-long rivalry. It’s the surging U.S. dollar.

The two soda giants rely on overseas customers for roughly half of their revenue. When they turned in their quarterly results last week, both reported a drop in sales. The strong dollar made all the difference: strip it out and shrinking sales suddenly rise.

The dollar has been a source of constant complaint this earnings season. Global corporations from Avon Products to Yum Brands have said their quarterly results would have been much better if it hadn’t been for the rising dollar. For some, the currency’s strength has meant the difference between a profit and a loss.

“It has really hit earnings,” said Jack Ablin, chief investment officer at BMO Private Bank.

Over the past year, the dollar has climbed 17 percent against major currencies. The surging dollar and plunging oil prices are the main reasons analysts keep cutting their forecasts for corporate profits even though economists expect the U.S. economy to pick up speed. …

(Excerpt) Read more at hosted.ap.org ...

TOPICS: Business/Economy; Foreign Affairs; Government

KEYWORDS: corporations; liberalagenda; obama; profits; usdollar

1

posted on

02/20/2015 9:45:51 PM PST

by

Olog-hai

To: Olog-hai

Re: “The strong dollar made all the difference: strip it out and shrinking sales suddenly rise.”

Hard to be sympathetic with this claim, which has two solutions.

They can raise the price of their products in the local currency.

Or, they can hedge the value of the dollar with currency futures.

Many multi-national corporations take exactly that approach.

Why can't Coke and Pepsi?

In fact, Coke and Pepsi probably manufacture 100% of their products in the local country, which already gives them a significant price advantage.

To: Olog-hai

only if you think corporate profit depend solely on exports. What about profit from within the country? Its down because ppl are poor and couldn’t afford to buy stuff

3

posted on

02/20/2015 10:11:12 PM PST

by

4rcane

To: expat_panama

What is your view on the strong dollar. Overall I think it’ a plus but it does have some consequences.

4

posted on

02/20/2015 10:20:46 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Olog-hai

The US Dollar is King.

Everything else is Monopoly money.

To: Olog-hai

The dollar is not “surging” nor is the stock market. The economy is in shambles thanks to hussein’s confiscatory tax policies and regulations that kill corporate profits and jobs. The numbers orchestrated by the regime are lies. Even Texas is feeling the pain of the shackles the Kenyan has put on the once-free Republic.

6

posted on

02/20/2015 11:35:03 PM PST

by

re_nortex

(DP - that's what I like about Texas)

To: Lurkina.n.Learnin; All

Lower gas prices make poor people who drive less poor. On the other hand they also make oil companies and related industries less rich. If you are an investor you should diversify and go long or short as makes sense.

7

posted on

02/21/2015 12:55:27 AM PST

by

gleeaikin

To: Lurkina.n.Learnin

The major consequence in the lumber business is that the Loonie is 25% discount to the greenback. This makes it better for Canadian sawmills to sell their products here than anywhere else in the world. It has created an oversupply of lumber in the US and therefore prices are going lower. This is in spite of increased demand from the increase in housing starts. This is especially evident the closer you are freight wise to the Canadian border. The US port strike is also having an effect on the lumber market because it is almost impossible to ship anything going to Asia right now. So, supply goes up, prices go down.

To: woodbutcher1963

Gee maybe I won’t have to pay 5 bucks for a semi straight 2x4.

9

posted on

02/21/2015 4:23:17 AM PST

by

central_va

(I won't be reconstructed and I do not give a damn.)

To: Lurkina.n.Learnin

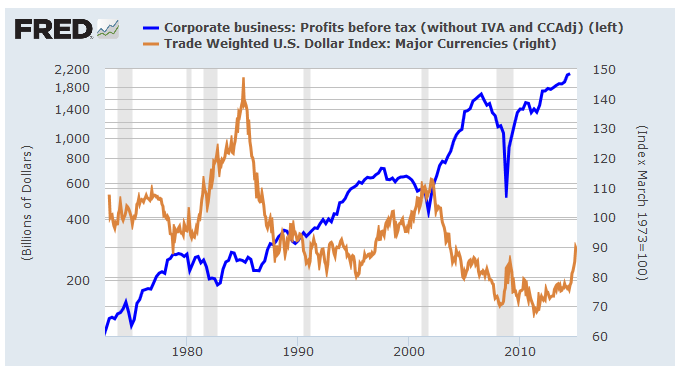

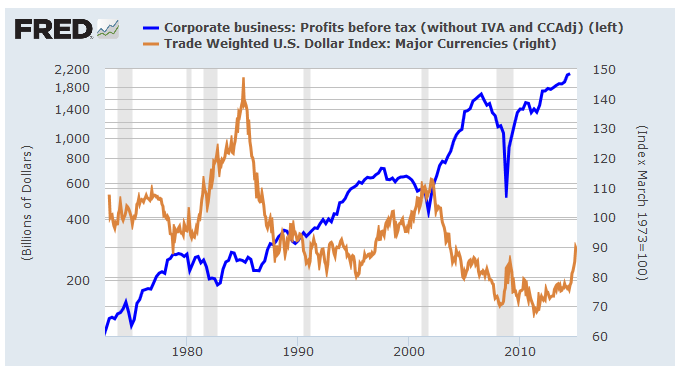

Thanks for the heads-up! It's looking like there are two issues here, one is how the dollar exchange rate interacts with U.S. corporate profits, and the other issue is why the Associated Press says the strong dollar is causing falling profits. The first one's easy, we just look:

Not much interaction; in fact profits are up a lot while the dollar's up just a bit. It's true that some corps get hurt when they can't sell products to foreigners but at the same time businesses that buy foreign raw materials for U.S. factories are helped. America has a 'trade deficit'. That means more are helped than hurt. My guess as to why the AP is saying the dollar hurts profits is that they need to sell stories and this one's believable especially to the 'profits are down' crowd. Big crowd. The right wants to believe businesses are dying and the left wants businesses to die. Those of us not allergic to good news are happy it's not true.

Ah. Also on AP's agenda is the idea that American economic problems are not because of taxes or regulations but because the U.S. dollar is stronger than ever.

To: expat_panama; woodbutcher1963

Thanks. I pretty much agree although woodbutcher1963 has a valid point. I grew up in the timber industry and have witnessed the strong dollar/ Canadian imports before. That’s one of those consequences. Your chart shows that overall there is no correlation.

11

posted on

02/21/2015 7:11:14 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Olog-hai

We’ve lost control of our currency. All other countries have to do to make their products cheaper in the U.S. is to lower their central bank rates against our treasury rates. And that’s what they’ve been doing lately to an unprecedented extent.

Why hold onto euros and buy Eurobonds when you can convert your euros to dollars, use them to buy U.S. Treasuries, and earn twice as much interest?

No wonder the number of German Mercedes Benzes sold in the U.S. has risen nine percent over the past year, or that the stock of European-based Fiat-Chrysler has risen more than 7% over the past two months.

But what can Janet Yellen do about this? If the Fed raises interest rates later this year as promised, the dollar will rise even higher against other currencies. But if the Fed does nothing, it will expose the Fed’s powerlessness to deal effectively with our own and the world’s economies.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson