Posted on 12/30/2014 11:33:06 AM PST by blam

December30, 2014

John_Rubino

Twelve short months ago, the immediate future looked like a lock. Overvalued equities had to fall, ridiculously-low interest rates had to rise, and beaten-down precious metals had to resume their bull market.

The evidence was overwhelming. Debt in the developed world had risen to $157 trillion, or 376% of GDP, by far the highest level on record and clearly unsustainable. Long-term US Treasury rates had been falling for literally three decades and despite a recent uptick were so low that the only way forward seemed to be up.

Europe and Japan were drifting into recessions that could easily morph into capital-D Depressions. The eurozone would fragment, Japanese bonds and probably stocks would crater, one or more major currencies would implode. No way to know which event would come first and in what order the other dominoes would fall, but without doubt something had to give.

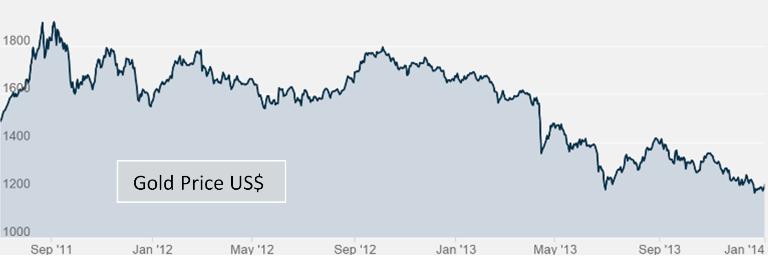

And gold, of course, had had its correction and was, at the beginning of 2014, perilously close to the mining industry’s cost of production. The last time that happened, in 2008, an epic bull market ensued — and gold-bugs were anxious for a replay.

Yet 2014 turned out to be a pretty good year for the powers that be and the economic theories that animate their behavior. Equities boomed, interest rates fell, the dollar soared, and gold ended the year below where it started. Gold miners, after a year of operating at an aggregate loss, have seen their market values crater.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

“. Which means using it as a basis for currency almost guaranteeds deflation, and the deflationary depressions that go with it. “

Well not exactly. A large portion of the money supply under the gold standard was ‘bank money’ or ‘credit money’ (not to be conflated with what we think of as credit today). It was a form of fiat money issued by banks who even printed their own currency.

There were also Greenbacks (the US Notes issue) as well as Silver Certificates. This was all part of the money supply but it wasn’t convertible to gold upon demand.

It was ‘credit money’ that was susceptible to contracting during a crisis as banks pulled in their loans. During the Depression a full 30% of the US money supply vanished as banks failed and there was no FDIC to keep depositors whole.

A gold standard per se doesn’t condemn an economy to recurring deflations, there’s many other factors at work. The history of fiat money regimes isn’t exactly replete with success either.

Because gold is money... currency never has been, is not now, or ever will be MONEY...

You are mistaken.

Petro Dollar is going up as oil price crashes, Euro’s and Rubles and all other currencies are going down and everyone in the world market are putting their money in dollars raising its value, with the dollar rising gold is dropping. Gold had to lower in value as oil prices cut in half with the dollar and oil pegged together. As soon as gold goes below $900/ounce I start buying and expect when the market finally corrects and the economy implodes gold will start to increase again. This will continue as long as the dollar remains the reserve currency and there is nothing else out there until America defaults totally on its debt and that time is coming soon.

"The fact remains that the value of gold is and always will be manipulated just like stocks."

Paper gold, derivative gold in the form of futures contracts is being manipulated right now. That manipulation is driving the price in the physical market, for now.

This kind of price manipulation was also evident recently in the crude oil market. Prices were basically set in the derivative (futures) market. Speculation drove the price. As we have seen this year the paper market could not drive the physical market forever and the true price of oil is now being discovered.

The same thing will eventually happen in the gold market. The derivatives are driving the physical price, but that will not go on forever.

"Very few people will ever have any practical use for physical gold.."

By that I take you to mean that very few people will use gold as an industrial metal. Agreed. Gold's main use is as money, specifically a store of value through time. Gold's use as money seems very practical to me, perhaps not to yourself. I hope your view prevails for a while longer.

"...(gold's) value beyond that is no greater than dollars or stocks."

Really? Then why did Holland just get over 100 tons of gold back from the Federal Reserve? Why not just get the Fed to issue the equivalent in US dollars? Why is China buying and hoarding gold instead of Apple stock or paper dollars or US treasury bills? Why is Russia still buying gold as their paper economy crumbles? What do you know that the world's central bankers do not?

“I’ve got some silver. I wish I had the cash I used to buy it.”

That is the mantra of those holding out for the return of fifty dollar silver from the Hunt brothers’ attempt to corner the market of the early 1980s. Pity the fools. ;)

Was it being manipulated on the way up?

This kind of price manipulation was also evident recently in the crude oil market. Prices were basically set in the derivative (futures) market. Speculation drove the price. As we have seen this year the paper market could not drive the physical market forever and the true price of oil is now being discovered.

Is that why gold has tanked? The paper market couldn't drive it up forever?

More likely is a year 2000-style topping action. Initial thrust down, then follow-through selling that accelerates. You have to watch the technical indicators to see that it is a top and not yet another pullback. Every time you buy a stock you need to have stop loss orders active (GTC = good until cancelled). Honor those stops. Rule #1 to investing is to limit your losses.

So I should jump into the market? I am guessing if I did, I would be in there just as the top is put in. Since irrationality sent the market up it can do the same the way down.

Been to the grocery store lately? Inflation is alive and well, and obvious to all those who are honest about it.

“Why is Russia still buying gold as their paper economy crumbles?”

The Russian central bank knows that it can’t afford to defend the ruble against further speculative attacks by selling gold, so it has decided to buy it while holders of gold will still take rubles for it.

if you were stranded on a deserted island never to be rescued which would you rather have a million dollars in gold or a million dollars in paper currency?

And you can make pretty jewelry with it. My daughter hand-crafts jewelry. The other day she showed me a small handful of gold and silver wire, cost her hundreds of dollars. She makes side money on rings, earrings, necklaces etc. She also has made origami foldings with paper money but there's no profit in that! She hammers away on metals at night and enjoys the profits. If you have gold, people will always want to wear it.

I hear that there is much more “paper gold” than physical gold, and until that bubble bursts physical gold will remain depressed.

Bingo!

LMAO!!

Great question, but how does that matter? I do not think you or I will find ourselves in that situation.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.