Skip to comments.

Good versus Bad Deflation: Lessons from the Gold Standard Era

National Bureau of Economic Research ^

| February 2004

| Michael D. Bordo, John Landon Lane, Angela Redish

Posted on 12/03/2014 2:07:21 PM PST by 1010RD

Deflation has had a bad rap, largely based on the experience of the 1930's when deflation was synonymous with depression. Recent experience with declining prices in Japan and China together with the concern over deflation in Europe and the United States has led to renewed attention to the topic of deflation.

In this paper we focus our attention on the deflation experience of the United States, the United Kingdom, and Germany in the late nineteenth century during a period characterized by low deflation, rapid productivity growth, positive output growth, and where many nations had a credible nominal anchor based on gold: circumstances which have resonance with the world of today.

We identify aggregate supply, aggregate demand, and money supply shocks using a structural panel vector autoregression. We then use historical decompositions to investigate the impact that these structural shocks had on output and prices. Our findings are that the deflation of the late nineteenth century reflected both positive aggregate supply shocks and negative money supply shocks.

However, the negative money supply shocks had little effect on output. This we posit is because the aggregate supply curve was very steep in the short run during this period. This contrasts greatly with the deflation experience during the Great Depression. Thus our empirical evidence suggests that deflation in the nineteenth century was primarily good.

TOPICS: Business/Economy; Extended News; News/Current Events; Unclassified

KEYWORDS:

I simply put the summary into paragraph form for readability and highlighted the conclusion. The paper is in pdf form at the site.

1

posted on

12/03/2014 2:07:21 PM PST

by

1010RD

To: expat_panama; Wyatt's Torch; Pelham; Chgogal

Ping to a 2004 NBER paper that is very good and defining and distinguishing between good and bad deflation.

Please share your thoughts.

2

posted on

12/03/2014 2:08:32 PM PST

by

1010RD

(First, Do No Harm)

To: blam

You might find this interesting as well.

3

posted on

12/03/2014 2:08:59 PM PST

by

1010RD

(First, Do No Harm)

To: 1010RD

4

posted on

12/03/2014 2:14:10 PM PST

by

blam

(Jeff Sessions For President)

To: 1010RD

With deflation if you have a lot of debt (home and car loans...etc) and a small savings account you are SCREWED.

But, if you are debt free with a good savings accounts it can be a great opportunity.

5

posted on

12/03/2014 2:28:23 PM PST

by

painter

( Isaiah: “Woe to those who call evil good and good evil,")

To: painter

Which is why I don’t care about the moneychangers worst nightmare, deflation. After they Inflated(stole Value)our money by 4% annually for the last 100 years, We have A LOT of Deflation to do, and I am Totally Debt Free, why aren’t you?.

6

posted on

12/03/2014 2:39:28 PM PST

by

eyeamok

To: 1010RD

Never having experienced deflation (on the contrary, having known only inflation my entire life), is there a "bad" deflation?

To: eyeamok

I'm debt free too with a decent savings accounts.

I was just saying what would happen with deflation.

8

posted on

12/03/2014 2:44:47 PM PST

by

painter

( Isaiah: “Woe to those who call evil good and good evil,")

To: painter

9

posted on

12/03/2014 2:47:03 PM PST

by

eyeamok

To: painter

Depends how bad the deflation actually gets. If you are living within your means currently and don’t have a crazy high mortgage with an equity loan to boot, most can probably get by; it will be tight to be sure, but they could manage by getting rid of cell phones, cable, eating out, entertainment and learning to cook more prudent meals at home.

I have one of my cars paid off, the other working vigorously to do so, but if it came down to it, I would turn in the second vehicle to the bank and just focus on my home and property and staying fed. Sucks for me, then again, I know I am nowhere near in bad as shape as others out there with normalcy bias not even paying attention to what is going on.

10

posted on

12/03/2014 2:48:39 PM PST

by

Ghost of SVR4

(So many are so hopelessly dependent on the government that they will fight to protect it.)

To: Ghost of SVR4

but they could manage by getting rid of cell phones, cable, eating out, entertainment and learning to cook more prudent meals at home. Quote by Marie in the movie "The Jerk" after they lost all their money:

Marie: I don't care about losing all the money. It's losing all the stuff.

One of my wife's brothers was hitting me up for a $100G loan. Says he needed it to get by. Of course I said no. He always traveled first class on planes. Season tickets to the Giants and Sharks games. He, his wife and kids traveled extensively to the best hotels, and ate continuously at restaurants, and were in debt dozens of ways. Me, my wife and kids always tried to save money, and spent sparingly and have no debt whatsoever. Well he and his wife went bankrupt, and they still go to restaurants and stores every day. And of course, complain continuously about their bad luck of being poor. Well, it ain't bad luck if someone is a moron.

11

posted on

12/03/2014 3:19:37 PM PST

by

roadcat

To: painter

But, if you are debt free with a good savings accounts it can be a great opportunity. For those who are thus personally, but are living in multiple governmental jurisdictions holding massive amounts of debt collectively, i.e. most of even the best, most prudent, of us, be very careful lest they impute their debt down to you based on their ideas regarding your ability to pay it. It may or may not be legal, but then neither was GM's bankruptcy.

12

posted on

12/03/2014 3:48:14 PM PST

by

JohnBovenmyer

(Obama been Liberal. Hope Change)

To: roadcat

wow...100G loan?? just damn.

13

posted on

12/03/2014 5:36:12 PM PST

by

Ghost of SVR4

(So many are so hopelessly dependent on the government that they will fight to protect it.)

To: 1010RD

For a recent SWAG I concluded going on the gold standard would require deflation of about 33x.

14

posted on

12/03/2014 6:00:13 PM PST

by

ctdonath2

(Si vis pacem, para bellum.)

To: Ghost of SVR4

Yes, I had given him smaller loans in the past for him to expand a cellphone business he ran, which he did pay back. But he always seemed to be a spoiled brat, always wanting the best of things. Bottom fell out, he lost his business, became a car salesman, then, shudder, a TSA agent. On a tight salary with lots of debts, but wouldn’t give up his free spending ways. My wife and I are both retired, never flaunted what we have from investments. Our message to our kids was always to spend under your means, and leave some for your senior years. Came in handy for us, as my wife is dealing with cancer. You never know what the future holds. Anyway, her brother tried to get money from my wife’s mom (his mom), as “an advance on his inheritance”. Mom also said no. My wife is trustee over her mom’s affairs. Her brother ordered new checks against her account, stole them when they were delivered. My wife monitors the accounts, saw the check order, closed the account. He got a lawyer to try and get control over mom’s affairs. Our lawyer shut him down quick, citing what he did as potential elder abuse. Yeah, TMI, but just showing you the type of person he is. Some poor are very deserving of help; some are just idiots.

15

posted on

12/03/2014 6:02:25 PM PST

by

roadcat

To: Zionist Conspirator; 1010RD

Never having experienced deflation (on the contrary, having known only inflation my entire life), is there a "bad" deflation?

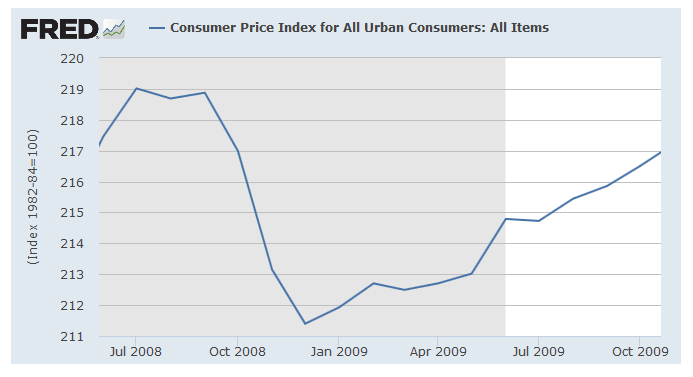

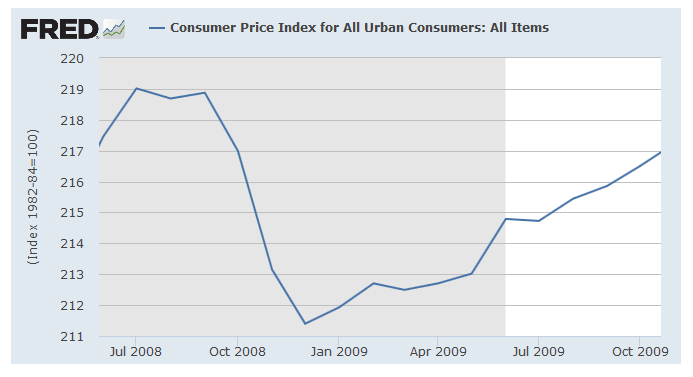

Actually you did and it made a huge mess. Most folks were oblivious and moaning about runaway hyperinflation at the time while saying it was all because bush-lied-people-died. Let's face it, too many people like shooting their mouths off while never bothering to look at what they're spouting about.

Makes me wonder though, if good deflation is lower prices, can we say that higher incomes is "good inflation"?

To: JohnBovenmyer; painter

debt free with a good savings accounts it can be a great opportunity.Deflation means lower prices and the price of labor is wages; that's why deflation means wage cuts. Virtually all economic activity requires both labor and capital, so during wide spread general deflation loans default, banks fail, capital dries up --it all adds up to massive layoffs and a severe economic collapse.

To: expat_panama

“Actually you did and it made a huge mess.”

I don’t think the deflation made the mess. I think the deflation and the mess were both caused by bubble-causing government policies.

That said, the economy is still trying very hard to deflate. Despite QE 1...n and near zero interest rates, the velocity of money just keeps dropping and liquidity is still tight. Eventually, the marginal effect of an additional dollar printed will become zero and that’s when deflation really begins.

Obama had a great opportunity to leave a positive legacy. He should have just let the deflation occur. Two years later, we would have had a recovering, healthy economy and he would have been reelected in a landslide. Instead, he reinflated the bubble, left us horribly in debt and almost entirely dependent on near-zero interest rates for treasury debt. With no way out.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson