Merry Sunday Eve to all!

Posted on 07/20/2014 4:02:51 PM PDT by expat_panama

Merry Sunday Eve to all!

This morning a neighbor who is fully invested in the stock market came down with a case of the jitters. He said with the stock market collapse almost imminent (probably just after the election was his prediction) and the dollar collapse equally so where should he put his money?

I said I would put his question up to you folks. I know he’s not fond of gold or silver and he figure jewels aren’t the way to go so any ideas you have I’ll email to him.

He’s in his 70’s and his home is free and clear.

Farmland, then rent it out.

We’re having a drought out West. Farming isn’t a good bet right now..

If he's honestly convinced that stock prices will fall then he can sell shorts. If he's also afraid to do that then he's got to admit that he really doesn't know what stock prices are going to do. If he decides there's a chance of either way then there are all kinds of ways he can hedge --half'n'half stocks/cash, stocks along side of downside options, etc.

Merry Sunday Eve to you too expat...

Anyone at that age (70s) that is fully in equities is not properly allocating assets. He should be in fixed income in the 50 to 60 percent range, depending upon his risk tolerance

When you are younger, and have time to make up for down markets, one’s assets should be more in equities. Investing for the long term will even out the down years.

But at advanced ages, when (WHEN, not IF) a down market hits and you are fully in equities, you’re risking heavy losses, with a short lifespan to make it up.

Also, one should never do drastic moves with ALL of one’s assets all at one time. Work at the margins.

Why Tesla Motors can’t sell cars in most of the United States

http://www.freerepublic.com/focus/f-bloggers/3182910/posts

Seems we got a continuing base this morning for both stocks and metals as futures see gains in metals while stocks fade a bit --complete opposite of last Friday's trade. Barring more chaos in Europe things may quiet down as our report week (CPI, Home Sales, Durables, etc) are all scheduled for Wed. - Thurs. This morning's news:

Economic Calendar:

Tuesday:

8:30 am CPI - Consensus +0.3% (+.02 ex food/energy)

9:00 am FHFA Home Price Index

10:00 am Existing Home Sales - Consensus 4.995M

Thursday:

8:30 am Initial Claims

9:45 am PMI - Manufacturing Flash

10:00 am New Home Sales (June) - Consensus +480K

Friday:

8:30 am Durable Goods - Consensus +0.6%

More on Asset Allocation

http://www.bogleheads.org/wiki/Asset_allocation

Asset allocation is one of the most important decisions that investors can make. In other words, the importance of an investor’s selection of individual securities is insignificant compared to the way the investor allocates their assets to stocks, bonds, and cash equivalents.

Rules of thumb

Although your exact asset allocation should depend on your goals for the money, some rules of thumb exist to guide your decision.[footnotes 1]

The most important asset allocation decision is the split between risky and non-risky assets. This is most often referred to as the stock/bond split. Benjamin Graham’s[6] timeless advice was:

“We have suggested as a fundamental guiding rule that the investor should never have less than 25% or more than 75% of his funds in common stocks, with a consequence inverse range of 75% to 25% in bonds. There is an implication here that the standard division should be an equal one, or 50-50, between the two major investment mediums.”[7]

John Bogle recommends “roughly your age in bonds”; for instance, if you are 45, 45% of your portfolio should be in high-quality bonds. Bogle also suggests that, during the retirement distribution phase, you include as a bond-like component of your wealth and asset allocation the value of any future pension and Social Security payment you expect to receive.[footnotes 2]

Investors choosing to increase their equity proportion, either through less conservative guidelines or a desire to increase return, should understand why they feel they have the need, ability, and willingness to take on the greater inherent risk.[footnotes 3]

All age-based guidelines are predicated on the assumption that an individual’s circumstances mirror the general population’s. Individuals with different retirement ages (earlier or later), asset levels (those who have saved enough to fund their retirement fully with TIPS, or needs for the money (e.g. college savings) would be well-advised to consider what circumstances make their situation different and adjust their asset allocation accordingly.

http://finance.zacks.com/long-term-investing-asset-allocation-8067.html

By Age

Asset allocation by age is often used by people planning for retirement with accounts such as 401(k)s. The theory behind age-based asset allocation is that a younger investor has more time to recover from losses and take advantage of potential gains, making stock market investing more beneficial. As you age, you invest more in less-volatile investments such as bonds, possibly even switching to ultra-safe investments like certificates of deposit as you reach retirement. Even at retirement, some of your nest egg may not be used for many years, so stocks still could make sense for a portion of your funds.

The best rule of thumb is to have 100 minus your age in equities. (Percent)

One thing I was going to add to the discussion is the individual’s personal situation.

For example, a retired couple that are both knocking down fat government pensions with gold-plated medical retirement plans might be able to take a little more risk with their portfolio, as they really don’t “need” their nest egg money to meet basic living expenses. That is assuming that their house is paid for, they don’t have kids in college, etc. In other words, their money is “play” money for wants instead of needs.

Conversely, people who must rely on their portfolio to generate cash for everyday living expenses must be a little more careful to not crack the egg and see the yolk run out on the floor.

But an exercise in market timing, and trying to pick the absolute top and bottom, and then deploying ALL your assets to match is mighty risky, at least to me.

All of the above assumes you’ve mastered Rule Number One.

Spend less than you have coming in.

If that rule isn’t observed, no amount of planning, market timing, stock tips, or anything else will work.

Ever.

Here’s the associated article:

Fattening Profit Margins Continue To Be The Dominant Driver Of Earnings Growth

Earnings season is under way, and one theme is clear: fat profit margins are driving earnings growth.

“[T]he majority of earnings growth we have observed so far this quarter has been a function of margins, as companies continue to operate with as few expenses as possible,” write analysts at JP Morgan Asset management.

Ever since the financial crisis, sales growth has been weak. However, corporations have been able to deliver robust earnings growth by fattening profit margins. Much of this has been done by laying off workers and squeezing more productivity out of those on the payroll.

“With earnings growth (5.5%) rising at a faster rate than revenue growth (3.0%) in Q2 and in future quarters, companies have continued to discuss cost-cutting initiatives to maintain earnings growth rates and profit margins,” said FactSet’s John Butters on Friday.

But with profit margins near record-highs, many agree that we’re do for at least some pull back.

“Looking forward, however, it is not clear that margins can continue to materially increase, meaning that the baton will need to be passed to revenues in order for earnings to continue pushing higher over the coming quarters,” said JPM.

Working faster, smarter, harder, and longer to pay for those who don’t?

Not a good long term trend. Health care costs are falling for a similar reason - no innovation and as drugs come off or patent the costs drop creating the false appearance of improvement.

The disparity between corporate profits, earnings for the top 20% of income earners and the rest of the country is driven almost exclusively by government fiscal policy at the national, state and local level.

Working faster, smarter, harder, and longer...

--which is pretty much how our loony Marxist colleagues in the press would have us see it.

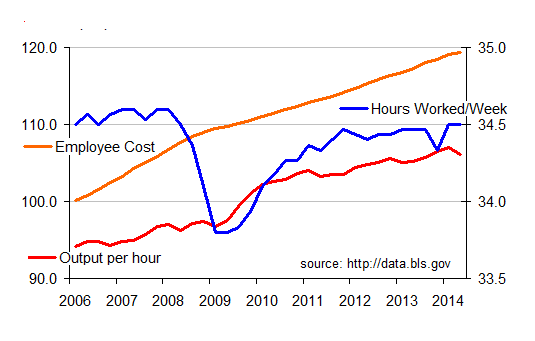

Those of us working for a living have to stick with reality, and the facts are that while the % employed is down since the '09 crisis, the workweek's been cut back while pay and productivity's increased.

Evil corporate productivity "squeezing" is for comic books. Real life means laying off cheap slow workers and keeping the expensive fast ones means wages increase w/ productivity.

While we can't argue about the facts, the reasons why are open for debate. My take is what we're seeing is typical for a big hike in min. wages during anti-business public policies.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.