Posted on 06/08/2014 6:42:22 PM PDT by Perseverando

They have a negative interest rate. You figure it out.

ask the people of Cyprus what happens when government/bankers change the bank rules and don’t want you to pull your money out of the banks

You didn’t answer the question, but then I didn’t really expect it.

Classical historians cannot explain why the bubble hasn't "burst" in 600 years. We have seen three giant leaps in prices 1400, 1700/1800, and 1980s-present. If you hold the market basket of goods constant, the burst of inflation never receded. Rather it coincides with these technological or organizational changes in society.

The Keynesians don't explain it because gov't isn't involved.

I think the term Bankster should go the way of the dodo.

The markets will be propped-up, and will continue to climb, for as long as Obama is in the White House.

After that, watch out.

Terrific article. Makes one want to weep.

Interesting because every time my wife and I have gone back to visit family over the past 20 years - prices have been higher. The deflation came in the form of business activities - infrastructure, financial, real estate. but as we are doing in the US today, prices for core necessities have continued to rise in Japan.

Japan and the US have the same issue an over-regulated, bifurcated economy - deflationary businesses outside of core necessities (ie food, fuel, utilities). with core being inflationary.

Billionaire elites are the landlords of the world. They just allow everyone else to rent some space.

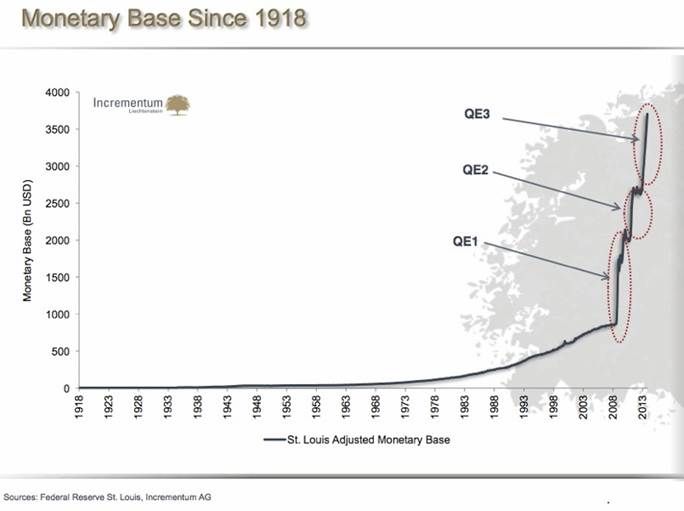

Right. And the government appoints the people who run it, and can disestablish it and cancel the debt anytime it wants to do so. But they don't have to because the Fed is creating money, buying debt and "retiring" it already. About half the bonds the government sells are bought and retired by the Fed. It's just an indirect way of printing money, and Congress can deny doing it.

No they don't. The Fed simply retires however much debt they need to. It's just a shell game that allows the government to create (nobody bothers to print it anymore) money to spend while denying they are doing so.

Wondering how many of those suicide/murdered/dead bankers of late were investment bankers.

That's my investment portfolio for the past 5 years.

QE is winding down in the government. In the private sector, the U.S. is under-going massive economic revolutions such as: Oilfield fracking, Hyper-farming, Web 3.0, Cloud Computing/storage, Big Data, Entertainment Data Streaming (e.g. HBO Go and Netflix), the private Space Race (e.g. Rutan’s Virgin Galactic and Musk’s SpaceX), Electric cars (e.g. Tesla), 3D printing, DNA Programming for medicine, Genetically Modified (GM) seeds, and Crowd-funding.

I do not share your opinion that technology, especially as it relates to economy. is all that a nation is made of. There are many other factors: Political stability, government type, homogeneity, absence or presence of war, personal freedoms, invasion and immigration, presence or absence of morals, and a faith in the currency, to name just a few.

Rome is a great example of a country that had a vast technological edge. They adapted or invented the following: The aqueduct, the connecting-rod sawmill, the screw press, the construction crane, dams, indoor plumbing, the five-pulley-crane, the ballista mounted on the cart, their platoon tactics... the list goes on.

Yet, they collapsed. Theories abound as to why, but several prominent ones are the debasing of their currency, the introduction of too many immigrants to hold societal cohesion, and others too numerous to list here.

In a much shorter time frame, Germany collapsed under Hitler. They, Germany, were the world leaders in technology, sciences, and culture. Their leaders and their policies doomed them, however.

A nation is far more than a simple economy and the technologies that contribute to it. I postulate we are likely to see something akin to a collapse for reasons that barely touch technology and economy at all.

To this point: Now, why do I think that you are going to go into Denial and Anger and the other stages of grief based on the good news that I point out above? ...because I think that the people who are depressed about the current economic revolutions are those who are under-employed. No one wants to blame their self for making too little money. It’s always easier to blame the government or a “bad economy.” Likewise, people who are under-employed think that everything costs too much. Cars are too expensive and groceries “keep going up in price.”

Dude.

You of all people should know that I am (conservatively) in the top 20% of wage earners in the country -- maybe higher.

I am certainly not gnashing my teeth and cursing others for their good fortune. I am definitely not under-employed, even in this sickly economy.

I don't know why you'd include me in this broad categorization.

Your observations are likely solid; yet nations are born and nations die, even under that framework.

I think the author make a very strong and compelling case that the government is already actively working in opposition to the people they are to serve. However, the government is very savvy, they keep proclaiming that they care and that they are compassionate... all the while they stab them in the back, steal everything they own, and maim them for life.

How utterly sad that this people is so easily fooled and willingly attach government chains to their own ankles.

> “Why won’t people simply pull their money from the bank if the interest rate goes negative?”

Because the banks won’t let them. They will put a very low limit on how much you can draw out each day (say $50 or $100 per day). That has happened recently in several other countries and happened in the US during the Great Depression.

The reason they do that is to keep money in the banks until the government decides how much of it they want to keep.

US money was devalued during the “Bank Holiday” the US had in the depression. Everything was worth less than before. More recently, the government in Cyprus was more direct. The government just took a certain percentage of the money in all the banks in Cyprus and kept it. Anyone with more than some amount (I think it was 85,000 or 100,000 euros) lost everything over that amount. The people who had less than that did not get away whole. They lost some (but not as much).

Silver dollars and stamped 1/10 oz gold bullion cubes do that.

Anything else in times of crisis will have a value that can be disputed. Think what happened when people cashed in grandma's jewelry for melt-down value. They were at the mercy of the person buying it. And gold mutual funds or certificates saying it's being safely stored.....well, that's just plain dumb.

“Japan and the US have the same issue an over-regulated, bifurcated economy - deflationary businesses outside of core necessities (ie food, fuel, utilities). with core being inflationary”

A lose-lose scenario for the middle class.

At least the Weimar Republic had full employment.

We are told we have no inflation, therefore we get no return on fixed income investments-yet anyone who buys food and household products knows prices are zooming up. Sounds like the Japanese are being lied to just as we are.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.