Posted on 06/01/2014 5:53:52 PM PDT by expat_panama

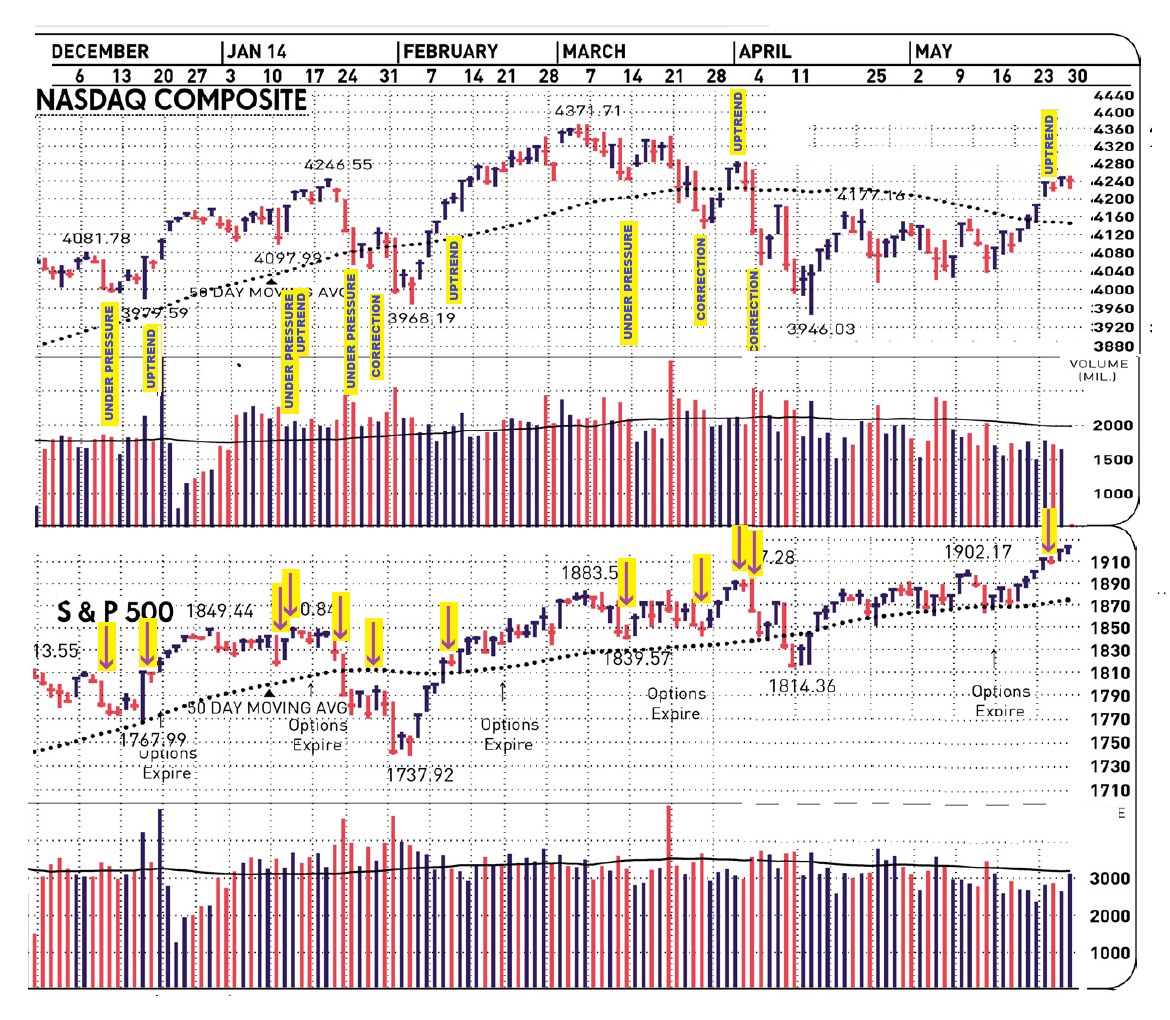

Big news this week: stock prices are officially in an IBD 'uptrend' as of last Tuesday night! We can see it on the plot to the left (click on it to enlarge).

OK, so we all can see that if we'd have sold on the 'uptrend' announcements and bought on the 'corrections' this year we'd be better off, but imho that only proves we're in a goofy backwards market. That's good; first, because now we know it's goofy, and second because we all need more entertainment in our daily lives.

In the meantime let's all memorize the eleven cognitive bias's posted last week (hat tip to Osage).

|

This is the thread where folks swap ideas on savings and investment --here's a list of popular investing links that freepers have posted here and tomorrow morning we'll go on with our--

Open invitation continues always for idea-input for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket. |

--back to work tomorrow ping...

“In the meantime let’s all memorize the eleven cognitive bias’s posted last week (hat tip to Osage).”

That was good. I recognized some things I need to work on.

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

I found this interesting

The Trade of the Century;

When George Soros Broke the British Pound

http://priceonomics.com/the-trade-of-the-century-when-george-soros-broke/

Can you put me on the ping list if possible...

done!

Happy Monday all!! Last Friday left us w/ a rally 3 days old and still alive; today both metal and stock index futures are upbeat as well. ISM index and construction spending today at 10. News of note:

World stocks rise as China manufacturing improves World stock markets mostly rose Monday after China's manufacturing expanded and two Wall Street benchmarks hit record highs.Funds Cut Bullish Gold Wagers Most This Year

Fed's Evans: timing of rate hike will depend on inflation outlook

Obama's boldest move on carbon comes with perils WASHINGTON (AP) — The new pollution rule the Obama administration announces Monday will be a cornerstone of President Barack Obama's environmental legacy and arguably the most significant U.S. environmental regulation in decades.China disrupts Google services ahead of Tiananmen anniversary

China accelerates as euro zone stumbles Reuters - 5 hours ago LONDON/BEIJING(Reuters) - Signs of an economic revival in China have raised hopes that Beijing's targeted measures to bolster growth are having an impact but a slowdown in the euro zone will increase expectations of policy easing there.

With Stocks At Record Highs, What Could Go Bad? - Greg Zuckerman, WSJ

The econ misses continue:

ISM 53.2 vs 55.5 est

Construction Spending +0.2% vs +0.6% est

Exactly! Checking to see if our thinking is good by thinking about it is a problem. Wikipedia has a bigger list of what they call 'cognitive bias' too, plus a huge pile of big words on how to deal with them, but what I eventually have to do is just look at my bottom line. If I'm making money I think the same way and if I'm not I change my approach.

Trading seems to be only slowing and not reversing; there's always the way many traders still take a 'bad-news-is-good-news' approach, that they want the Fed to lay off the rate hikes.

Holy crap how do you miss this?

“SM Mfg Survey head Holcomb says seasonal factors were applied to the May data that wasn’t supposed to be, in the process of correcting...”

Wow...

ISM CORRECTS MISTAKE: NOW SAYS THIS MORNING’S MANUFACTURING REPORT WAS A BEAT

11:28 UPDATE: ISM has updated its incorrect manufacturing report from this morning to 56.0 from 53.2.

May ISM manufacturing was reported at 53.2, a three-month low.

But on Twitter, research firm Stone & McCarthy said it believes ISM used the wrong seasonal results, and as a result, the headline May ISM reading is incorrect.

Bloomberg’s Vonnie Quinn just tweeted that ISM is in the process of correcting its report.

On its Twitter page, Stone & McCarthy has replied to users confirming they are the source of rumors regarding an incorrect ISM print.

Following the ISM report, Pantheon Macroeconomics’ Ian Shepherdson called the report “slightly disappointing.”

Earlier today, Markit’s May manufacturing PMI came in at a three-month high of 56.4, up from 55.4 in April. Along with that report, Markit’s Chris Williamson said, “With the exception of a brief spell in early-2010, output is growing at the fastest rate seen since prior to the financial crisis.”

We’ve reached out to ISM for comment, and this post will be updated as we learn more.

From zerohedge:

One can’t make this up.

Remember when the ISM’ Holcombe explicitly said moments ago in its 10 am release that “The May PMI registered 53.2 percent, a decrease of 1.7 percentage points from April’s reading of 54.9 percent” Turns out he lied, and moments after the ISM released its data, it “realized” it had used a wrong seasonal adjustment factor. We can only imagine that the ISM received a very unpleasasnt phone call...

From Bloomberg:

ISM CORRECTS MAY FACTORY INDEX TO 56 AFTER ADJUSTMENT ERROR

ISM INITIALLY REPORTED U.S. MAY FACTORY GAUGE FELL TO 53.2

S&P 500 ERASES LOSS AFTER ISM CORRECTS FACTORY DATA

In other words, blame the complete data revision on the warmer weather.

And just like that, we have even more confirmation that all the “data” is nothing but Garbage In, Garbage Ou.

NYSE MAC DESK MID-DAY MARKET UPDATE:

DOW 16,735 (+18 points), S&P500 1924 (+1 handle), Brent Crude $108.90/barrel (-$0.51), Gold $1,244.00/oz. (-$1.60)

MARKET DRIVERS: (Stocks are modestly higher and off session-lows after no fewer than two corrections were made to this morning’s ISM factory index for May. Volume remains extremely light as traders look ahead to another big jobs report and an important ECB meeting later in the week.)

• The Institute for Supply Management’s factory index rose to 55.4 in May from 54.9 in April - in line with consensus forecasts. ISM corrected the index TWICE, after initially reporting it at 53.2, then correcting it up to 56, as ‘wrong seasonal adjustments’ were cited. Hopefully, they do not change it a third time.

• According to the Census Bureau, Construction spending rose 0.2% in April, which was less than the 0.6% growth expected..

• China’s official Purchasing Managers Index number for May was better than expected, rising to 50.8 from 50.4 in April. This is good news, particularly on recent reports of weakness in the property sector and a relatively slow Q1 GDP of 7.4%.

• The euro-zone’s manufacturing PMI fell to 52.2 in May from April’s 53.4, missing the consensus forecast of 52.5.

• In a speech over in Istanbul this morning, Chicago Fed President Evans, (non-voter, dove), said that the Fed will end asset purchases this year, and officials will wait until inflation is much closer to its 2% objective before they consider raising interest rates.

Rich’s Commentary:

Hard evidence that markets react to economic data... Take a look at the minute-by-minute chart of the S&P 500, below. At 10am ET, the ISM factory index for May was reported at a ‘shockingly’ disappointing 53.2, (the experts were looking for a number closer to 55.5)... Almost immediately, as you can see from the chart, the S&P fell out of bed to the tune of about 6 handles to the downside. Then, about an hour later, the ISM guy announced something to the effect of, “Oops, we goofed on the number this morning. The index really rose to 56 for the month of May.” Looking, again, at the chart, you can see the nice rebound that ensued when the ‘correction’ hit the tape... To confuse matters even more, the same guy announced a second correction; blaming a faulty abacus for the mix-up... While we are not happy with volatility that these mistakes caused, we are thankful that they gave us something to write about in the mid-day today... Separately, we closed out the month of May on the plus-side for a fourth-straight month, with the S&P 500 +2.10% and the Dow +0.82%. Diving a little deeper; Growth outperformed Value; Russell 1000 growth was +3.12% while Russell 1000 Value was +1.46%. Ans all S&P sectors except utilities (-1.65%), ended the month on the plus-side... A quick note about Q2 earnings : the early trend is not encouraging. According S&P Capital IQ, 117 companies have issued guidance, and 103 of those issuances are negative, 13 positive and 1 in-line; bringing the negative to positive ratio to a very high 7.9. That’s not too good... By the way, Q1 is just about finished with 493 companies reporting. Earnings growth stands at +3.4%, and revenues came in at +4.0%… Moving on, the Dow remains just off session-highs on extremely low volume, with a paltry ~205M shares on the tape at this time… Internally, breadth is bullish across the board. Advancing Issues: 2124 / Declining Issues: 2069 — for a ratio of 1.0 to 1. New 52-Week Highs: 430/ New 52-Week Lows: 45… Technically, our chart-guru did a little research over the weekend and hit us with the following this morning: “stocks enter the month of June on a tear, having recorded 8 of the last 10 days ‘UP’, but even on the down days, successfully made new intra-day 2-day highs, above the prior day, while not breaching the prior day’s lows. At current levels, the trend remains quite bullish, with new weekly and monthly all-time highs recorded by both the S&P 500 and the Dow... By the way, we like the Spurs to get revenge on the Heat and take the NBA Title in 6 games... Have a tremendous day!

John’s Options Commentary : Options player are speculating on further gains in India as The Wisdom Tree India Earnings Fund (EPI) sees bullish activity this morning. With the ETF trading $22.10, a customer buys a 10,000-lot of Weekly (6/27) 22.5 calls for 35 cents. More than 17,000 contracts are now on the tape and the activity appears to be expressing the view that the EPI will trade back to its post-election high of $22.85 or higher over next 25 days. On the other hand, bearish flow takes place in the Financial ETF (XLF). With the XLF trading unchanged at $22.29, one investor bought an Aug 20-22 put spread for 38 cents, 12,800 times. Separately, a Weekly (6/6) - Weekly (6/13) 22 put spread for 6 cents, 10,000 times. The flow is apparently expressing concerns about short term weakness in the financials, as more than 63,000 puts have changed hand so far today. The most active contracts today can be found in the Japan ETF (EWJ). It looks as if an investor is rolling his long position out another month. With the EWJ trading around $11.72, the Jun-Jul 10 call spread trades for 3 cents, 100,000 times. Minutes later, the same spread trades for 3 ½ cents, 100,000 times. More than 250,000 spreads have now traded and the activity appears to reflect a bullish view on the EWJ over the next 2 months. The VIX continues to tread water today and now reads 11.77, up .37.

Economic Calendar for the Week:

Monday June 2

Charles Evans Speaks 4:00 AM ET

PMI Manufacturing Index 9:45 AM ET

ISM Mfg Index 10:00 AM ET

Construction Spending 10:00 AM ET

Tuesday June 3

Factory Orders 10:00 AM ET

Esther George Speaks 1:50 PM ET

Wednesday June 4

MBA Purchase Applications 7:00 AM ET

ADP Employment Report 8:15 AM ET

Gallup U.S. Job Creation Index 8:30 AM ET

International Trade 8:30 AM ET

Productivity and Costs 8:30 AM ET

PMI Services Index 9:45 AM ET

ISM Non-Mfg Index 10:00 AM ET

Beige Book 2:00 PM ET

Thursday June 5

Challenger Job-Cut Report 7:30 AM ET

Gallup US Payroll to Population 8:30 AM ET

Jobless Claims 8:30 AM ET

Narayana Kocherlakota Speaks 1:30 PM ET

Friday June 6

Employment Situation 8:30 AM ET

Consumer Credit 3:00 PM ET

Sector Highlights brought to you by: streetaccount.com »

Materials the best performer with the S&P Materials Index +0.6%.

• Paper and packaging space mixed. MWV +4.2% rallying after Starboard Value disclosed a 5.6% stake in a 13D filing. Fund talked up SOTP valuation and said this value is being obscured by excessive corporate overhead and conglomerate structure.

• Industrial metals a mixed bag following last week’s selloff. Seem to be some pockets of support from slightly better May manufacturing PMI out of China. However, more aggressive policy fine-tuning, which has helped cushion growth, failed to provide any support last week with the focus on the continued slump in iron ore prices. Global miners outperforming today with RIO +2% and VALE +1.4%. CENX +3.4% the standout in aluminum. Upgraded at BofA Merrill Lynch, along with AA +0.8%. Most steel names lagging. Copper names under modest pressure. Iron ore play CLF (0.4%) the big laggard.

• Precious metals stocks mostly weaker. GDX (0.7%). Recall group sold off sharply last week with the downturn in the underlying commodities. Gold was hit by a combination of deteriorating technicals, the removal of the election overhangs in Europe and Ukraine and the continued relegation of geopolitical uncertainty to the backburner.

Consumer discretionary outperforming with the S&P Consumer Discretionary Index +0.3%.

• Restaurants broadly higher. DNKN +2.3%, SONC +1.4% and MCD +1% among leaders.

• Retail mostly higher with the S&P Retail Index +0.1%. CONN +6.4% leading gains following Q1 earnings beat, with strong comps. BIG +1% outperforming; upgraded at Benchmark Company, downgraded at Barclays. SHLD (4.8%) and JCP (2%) lagging. In apparel, ARO (5.1%), EXPR (2.5%) and ANN (1.9%) among notable underperformers. CE space lagging with RSH (3%), HGG (1.7%) and GME (1.5%). Housing-related space mostly higher. WSM +0.6% initiated at Barrington Research. LL +1.2% and HD +0.8% among the outperformers.

• Media mostly higher. TWX +1.8%, VIAB +1.2% and CMCSA +0.9% among leaders, while DWA (0.9%) lagging.

• Footwear and sporting goods mixed. LULU (2.5%) and SKX (0.3%) among laggards, DKS +1.3%, DSW +1.3% and UA +0.9% outperforming.

• Homebuilders underperforming with XHB (0.1%). Group broadly lower, with HOV (1.6%), BZH (1.1%) and MTH (1.1%) among the laggards.

Healthcare in line with the S&P Healthcare Index +0.04%.

• Pharma mixed with the DRG (0.1%). BMY (2.4%) and LLY (1.1%) the notable decliners. The latter presented ramucirumab trial data at ASCO. Street noted topline numbers from the company’s REVEN revealed a modest efficacy profile, but below analyst expectations. TEVA +3% and AZN +1.5% the notable outperformers. The former appointed Sigurdur Olafsson as president and CEO of the newly established global generic medicines Group. The latter announced data comparing the efficacy and tolerability of olaparib and cediranib in combination to olaparib alone.

• Biotech underperforming with the IBB (0.2%). ASCO takeaways in focus. PBYI (21.5%) selling off after presenting phase II PB272 data at ASCO. CLVS (11%) reportedly lower on concerns about hyperglycemia associated with CO-1686 usage. CYTK (6%) underperforming after announcing additional results from BENEFIT-ALS. CYCC (5.9%) provided an update on clinical development plans for Sapacitabine. NPSP +12.4% rallying after SHPG +1% reportedly secured $5B in financing for its takeover. ARIA +6.2% outperforming after it presented phase II trial results of Iclusig, showing anti-tumor activity. AGN +1.8% higher amid reports Pershing Square is said to launch consent process for special meeting of AGN holders. PCYC +1.4% announced results from the phase III RESONTAE study of Imbruvica at ASCO. Analysts broadly positive, expecting Imbruvica to receive full approval.

• Hospitals led lower by CYH (1.4%) and THC (1%).

Financials in line with the S&P Financials Index +0.03%.

• Life insurance group outperforming. M&A headlines in focus with PL +10.3% on several press reports that Japanese life insurance company Dai-ichi Life is considering a nearly $5B acquisition of the company. LNC +1.6%, MET +1.1% and HIG +0.9% all beating the tape. Unclear to what extent rate backup is helping. Note that it does not seem to be providing much of a tailwind for banks. However, flurry of articles on bond market resilience continue to highlight upside risk for yields.

• Banks mixed with the BKX +0.03%. JPM (0.5%) the worst performer among the money center names. WFC +0.6% and STI +0.6% the bright spots in the regional space. Latter mentioned positively in Barron’s, which also had some upbeat comments on the banking group. Focused on cheap valuations, improving economy and stronger balance sheets. Recall banking group has outperformed over the last couple of weeks. Last week’s 1.2% gain came despite renewed concerns about weak trading and mortgage revenue.

Tech underperforming with the S&P Information Technology Index (0.1%).

• Software underperforming. BLOX (5.7%), JIVE (5%), FTNT (1.8%), TIBX (1.8%) and CVLT (1.5%) leading the space lower. BLOX continuing its post-earnings selloff, now down >62% ytd.

• Internet space mostly lower with QNET (0.8%) and SOCL (1.1%). YELP (3%) a laggard following a downgrade at RBC Capital, which notes less attractive risk/reward. GRPN (3.2%), LNKD (3.1%), P (2.2%) and GOOGL (1.9%) also underperforming. Note reports that GOOGL will invest $1-3B on satellites to extend internet access around the world. TWTR +1.4% and OPEN +1.4% the notable performers to the upside.

• Semis mixed with the SOX +0.2%. RBCN (6.6%) and VECO (3%) the worst performers. XLNX (1.8%) and MCHP (1.2%) both downgraded at Goldman Sachs, which also upgraded MSCC +0.7%. BRCM +8.7% topping gains after announcing its exploring a possible sale or wind-down of its cellular baseband business. The company also guided Q2 revenue in-line with expectations. MRVL +1% the other notable gainer.

• Hardware mixed. AAPL (0.8%) the notable decliner. Note that according to BTIG, the stock has fallen on the day of the Worldwide Developers Conference (today) for each of the past six years, with the average decline of 1.4%. IBM +0.7% topping gains. Barron’s cover story was on IBM’s CEO, and discussed her turnaround efforts at the company.

Consumer staples the worst performer with the S&P Consumer Staples Index (0.2%).

• Beverages mostly lower. SODA (1.2%) lagging; Longbow reduced its estimates, citing mixed demand and lower prices. BF.B +1.4% and SAM +1.1% outperforming.

• Grocers underperforming. SVU (2.1%) lagging, while TFM (2%) and WFM (1%) continue recent underperformance.

• Packaged foods and processing mixed. WSJ discussed HSH +0.1%, saying the firm will find it difficult to turn down either TSN +1.5% or PPC +0.3%. Added that PF +1.1% deal may have been attempt by HSH to draw out bids for itself. SAFM +0.8% outperforming, while DF (2.2%), THS (0.6%) and DMND (0.3%) lagging.

• HPCs and cosmetics mostly lower. CL (0.4%) and PG (0.4%) among the laggards. In cosmetics, RDEN (4.4%) continuing recent selloff, while AVP +0.1% continuing last month’s outperformance. REV (1.5%) lagging.

• Tobacco lower. LO (1.9%) underperforming, giving back some recent gains that came following news of possible RAI (0.8%) merger.

by Jason Leavitt LeavittBrothers.com July 16, 2013

From the start they had the talent and skills to navigate the market, and they simply aren’t prone to making the same dumb, repeated mistakes the rest of us do.

This is the assumption, or perhaps this is the excuse offered by losing traders. But in reality, successful traders exhibit similar characteristics that can be learned, and they do certain things that anyone can do. One of these is the topic of this essay.

INCORRECT ASSUMPTIONS

The incorrect assumption is that good traders are good at everything. Uptrends and downtrends, big ranges, small ranges, and choppy markets, big gaps or no gaps - that they can flawlessly float from one indicator to the next and from one strategy to the next as the market changes.

None of this is true. In fact the exact opposite is true.

DO ONE THING WELL

The best traders focus on doing one thing well. The best traders identify a trade, or possibly two trades, that work, that jives with their personality, and they execute over and over and over. They specialize in doing one thing very well, and they completely ignore everything else and they resist the temptation change.

It then goes without saying unsuccessful traders are painfully unfocused. They constantly jump from one strategy to the next in hopes of finding a Holy Grail which doesn’t exist. First they trade an MACD crossover system. After a month, they give up and try a Stochastic oscillator system they saw on a message board. After a month of that they try trading Fibs. Then they try Median Lines. Then they try buying dips instead of breakouts. It goes on and on, and after six months they realize if they would have just stuck with their original MACD system, they would have been just fine.

BEST ADVICE

The best advice I can give to a new trader or a struggling trader is to find a trade that works, one that jives with their personality, get good at it, and do it over and over, and do not be tempted to trade other methodologies.

If I was running a hedge fund, and I interviewed you for a trading position, the first question I’d ask is: what’s your trade? What is the single trade that works – although I know it won’t work all the time – that you are comfortable executing? I’d want to know you’re not one of those traders who constantly jumps from set up to set up desperately hoping to find something.

LIKE NO OTHER ENDEAVOR

Unlike many other endeavors, trading allows you to do this. If you were a golfer, you’d have to be good at driving and putting and a short game. You’d have to be good playing in the rain or when it’s windy.

If you play chess, you have to be good at the open, the middle game, the end game and various scenarios based on what pieces are on the board.

But trading doesn’t force you to be good at many things. As hard as trading is, trading allows you to identify certain conditions that you’re good at navigating and then permits you to only trade when those conditions are present. You can literally suck at 99% of what’s out there and still make a living trading if you get good at one or two specific set ups.

With this realization, trading isn’t so intimidating any more. You don’t have to be good at a lot of things, and you don’t have to understand much either. In your little corner of the world you can identify a simple set up that works, and then execute it over and over.

ANECDOTAL OBSERVATIONS

I’ve been running LeavittBrothers.com for almost 11 years, and I have a pretty good feel for who makes money and who doesn’t. I could pull up charts posted by successful traders and compare them to charts from three or four or five years ago, and they’d be identical - same time frame, same duration, same indicators, same parameters on the indicators, same boring stuff. But that’s why they’re successful. They do the same thing over and over. This doesn’t mean what they do always works. In a given 12 month period what they do may only work eight or nine months, but these traders have learned that it’s best to go back and forth between trading aggressively and sitting on the sidelines than it is to constantly change strategy when the one they’re using stops working.

WRAP UP

After meeting many successful and unsuccessful traders, this is the most obvious and glaring difference.

Successful traders specialize in being great at one thing.

Unsuccessful traders constantly jump from one strategy to the next.

You need to take complete inventory of your skills, your talents, your temperament and study different trading styles and pick something that works, something that jives with your personality, something you can execute and commit to becoming good at that, and completely ignore everything else.

Entries are less important than most traders think. Said another way, pinching pennies with entries will cost you dollars. Too many times I've hesitated to chase a stock 10 cents, and it cost me a couple bucks.

Often the hard trade is the one I should make while the easy trade is the one that fizzles.

The big money is made riding the big trends. You can definitely make a living shooting for little winners, but you have to nail big moves if you want to get rich (it does you no good to buy a stock at 15, sell it at 18 and then watch it rally to 45).

I don't know which set ups are going to be "good ones" and which are going to fizzle out. Anyone who says differently will probably try and sell you real estate by the Bay. Because of this, trading is somewhat of a numbers game. Get in very good set ups when the trading environment is conducive, play good defense and then let the law of large numbers work out.

There are many ways to trade the market, but there are no bonus points for trading a certain way. Traders need to take inventory of who they are and what they are and then find a trading methodology that jives with their personality. Then don't stray - stick with it. It's better to specialize in one type of trade and execute that trade over and over than be a jack of all trades (no pun intended).

Screen time does not always result in more profits. I've spent hours analyzing every angle of one particular stock and then had the trade go against me; I've also spent 10 seconds deciding to enter a stock that visually had a great pattern and an easily identifiable entry level and made a lot of money. This isn't an excuse to be lazy, but it does tell me over-analyzing isn't wise. On a related note, if you spend two hours dissecting a chart and deciding to play it, it's much harder to cut it loose when it goes against you because so much time is invested, but if little time is invested, it's fairly easy to dump it and move o.

I'm better at entering good set ups and then letting the market do the work for me than actively managing positions. In fact back when I was trading and working a restaurant job at the same time, I made more money when I worked lunch shifts (because I had no choice but to put a stop in place and let the chart play out) than when I sat and starred at my computer screen all day (because I was my own worst enemy; I did dumb things like panic when a stock went slightly against me).

I don't have to know why something happened to make money. In fact most of the time I don't have a clue. This is why I prefer story books and biographies to how-to books.

In many cases, being smart hinders progress because the smart guy tries to figure everything out; he constantly asks why. I've seen way too many smart people fail miserably at trading because they try to put everything in a nice, neat box. Don't fall into the trap.

Keep it simple. Trading isn't a game you're trying to figure out. If all I do is recognize the trend and commit to only trading good set ups in that direction, it's really not that hard to make money.

Think longer term. If I'm trying to make money right now, I'll probably lose, but if I'm trying to make X over the next couple months, I tend to be more relaxed and I trade better. Said another way, a baseball player should not try to go 1-for-3. Instead he should strive for 10-for-30 because it enables him to have a bad game here and there but still accomplish the goal.

If I enter correctly...and stick to my plan....( Plan the trade, trade the plan...) I'm better for it.

The less I mess with a trade..the better off I am..for the most part.

Trimming winners going up..has very much worked for me.

KISS really works..............I don't try to predict anything really.

One needs to be very mechanical if you are going to do what I do.................

It's simple... : )

The adventure continues with gold falling and stocks still stuck where they were last week when we were supposed to be in an 'uptrend'. Today's futures have both indexes & metals a bit down before today's reports on factory orders, and auto/truck sales. Lot going on today:

Europe stocks down, Euro holds near lows after inflation data Reuters - 9 hours ago LONDON, (Reuters) - European shares dipped on Tuesday and the euro held near 3 1/2-month lows against the dollar after a fall in euro zone inflation cemented the case for the European Central Bank to ease monetary policy later this week.

Asian stocks mostly up on China data; Europe falls SEOUL, South Korea (AP) — Global stocks were mixed on Tuesday with inflation data showing a weak recovery in Europe even as Chinese manufacturing was recovering from contraction. Associated Press5 mins ago

Gold hits four-month low, longest losing streak in seven months Gold fell for a fifth session on Monday, its longest losing streak in seven months, as rising stock markets diverted interest from bullion, and ahead of the latest European Central Bank policy meeting and key U.S. data this week. Spot gold was down 0.3 percent at $1,247.20 an ounce at 1355 GMT,… Reuters

Are Bonds Signaling a Recession, or Warning of a Market Crash? When Treasury yields fall, it generally means that investors around the planet are looking for a flight to safety. Or in the extreme cases, it signals that the economy is slowing — and bonds are supposed ... 24/7 Wall St.

Seattle council passes $15 minimum wage SEATTLE (AP) — The Seattle City Council unanimously passed an ordinance Monday that gradually increases the minimum wage in the city to $15, which would make it the highest in the nation. Associated Press

Putin Pausing as Russia Volatility Kills Trade-to-Invest Vladimir Putin ’s territorial ambitions are bumping up against financial markets. As the Russian president plots his next move on Ukraine, investors are giving his inner circle pause for thought. Since Putin annexed Crimea in March in the teeth of international outrage, Russian stocks have become… Bloomberg

Friday's Jobs Report Will Be Pumped w/PEDs - John Crudele, New York Post

The Next Four Days Could Rock Uneasy Markets - Ben Eisen, MarketWatch

European Decision That Could Dismantle Internet - Wayne Brough, RCM

The Real Slow Lane Threat to the Internet's Health - Bret Swanson, Forbes

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.