OK, another day another dollar. Yesterday's moderate volume and nowhere returns now have futures pointing to more of the same. LOTS of stuff moving in the news though...

Posted on 11/18/2013 2:46:13 AM PST by expat_panama

OK, another day another dollar. Yesterday's moderate volume and nowhere returns now have futures pointing to more of the same. LOTS of stuff moving in the news though...

Census ‘faked’ 2012 election jobs report ...the unemployment rate fell sharply — raising eyebrows from Wall Street to Washington. The decline — from 8.1 percent in August to 7.8 percent in September — might not have been all it seemed. The numbers, according to a reliable source, were manipulated. Why the Market Has 30 Percent More Upside - Jeremy Grantham, Barron's

Dow Jones 16,000 Is Not Going to Last - Anthony Mirhaydari, MarketWatchJapan economy gets fresh impetus as exports log biggest rise in three years Reuters - 7:11am TOKYO (Reuters) - A surge in car shipments spurred Japanese exports to their biggest annual increase in three years in October, suggesting a gradual pick up in global demand will help underwrite a sustainable recovery in the world's third-largest economy.Europe shares close lower as US earnings disappoint CNBC.com - 1:07am European equities closed lower on Tuesday as markets turned cautious over when the U.S. Federal Reserve might scale back its stimulus program.

Yellen reiterates support for Fed's bond buying By MARTIN CRUTSINGER - AP - Tue Nov 19, 6:14PM CST WASHINGTON (AP) — Janet Yellen says a "strong majority" of Federal Reserve officials think the Fed's low-interest-rate policies have supported a still-recovering U.S. economy. (full story)

APNewsBreak: DC to push for $11.50 minimum wage BEN NUCKOLS - AP - Tue Nov 19, 8:55AM CST WASHINGTON (AP) — The D.C. Council could vote as early as December on a bill that would raise the city's minimum wage to $11.50 an hour by July 2016, one of the nation's highest, according to a key councilmember. (full story)

“European Central Bank policy makers would reduce the rate for commercial lenders who park excess cash at the bank to minus 0.1 percent from zero, said people familiar with knowledge of the debate who asked not to be identified because the talks aren’t public.”

And here is more....

Euro dives on suggestion of negative interest rates

15.53 Here's the chart that shows how the euro reacted to news that the ECB is mulling a negative deposit rate.

Yesterday we didn't get anywhere and today's stock futures are heading in the same direction. Weird. I mean, we got lots of forces pushing but it's like they're all balanced against each other and my personal expectation is for one side to give and get trampled. News...

--& what I'm seeing is that it only does it sometimes. iow the 'fed effect' is like the 'superbowl effect' and far as absolute results go. Just the same this meme's got a lot of traction and it's how IBD and a lot of guru's are thinking. There've been a lot of times that stock prices followed a pop meme no matter how goofy.

Asia stocks sag to one-week low as China, Fed concerns sour mood 7 hours ago TOKYO (Reuters) - Downbeat China manufacturing activity added to gloom in most Asian stock markets on Thursday, while emerging market currencies faltered as the dollar charged ahead after the U.S.European Government Bonds Decline on Fed QE Tapering Outlook Bloomberg - 2 hours ago European government bonds fell, led by Germany, as minutes of the Federal Reserve's October policy meeting showed it may taper its $85 billion in monthly asset buying “in coming months” if the U.S.Fewer people traveling for Thanksgiving CNN - 12:15am (CNN) -- Fewer people are expected to travel for the Thanksgiving holiday this year. Some 43.4 million Americans are predicted to travel for the Thanksgiving holiday next week, a 1.5% decrease from the 44 million people who traveled last year, according to ...

Solid Oct. retail sales lift hopes for US economy By JOSH BOAK and MARTIN CRUTSINGER - AP - Wed Nov 20, 3:51PM CST WASHINGTON (AP) — An increase in shopping last month during the partial government shutdown suggests that the U.S. economy may be more resilient than some have feared. (full story)

Democrats launch effort to renew jobless benefits By ANDREW TAYLOR - AP - Wed Nov 20, 1:17PM CST WASHINGTON (AP) — Democrats on Capitol Hill have launched a drive to renew jobless benefits averaging less than $300 a week nationwide for people out of work for more than six months. (full story)

Larry Summers was talking about that also.

Larry Summers Gave An Amazing Speech On The Biggest Economic Problem Of Our Time

http://www.freerepublic.com/focus/f-news/3092541/posts

'Whoa' is right! I know that Switzerland has had negative rates on their debt (you got to pay 'em to get them to borrow your money!), but now we're seeing it in private debt. Thing is that no matter what political hacks say about inflation/deflation, the market has to deal only with facts. If we got deflation then we got negative interest.

Funny how so many people have been saying 'interest rates can't go any lower'...

Link - But the theoretical approach is fundamentally flawed, according to Bove. “By flattening the yield curve,” explains Bove, “Operation Twist reduces the incentive of the holders of funds to provide funds for production and real growth” by putting incentives in place for money to go short, not long.

Finally done--

---& I honestly don't see any fed influence there either, not that it's going to change any pundits' minds out there ;)

I can’t tell if you’re being serious but I’m pretty sure that chart proves that QE had an influence on the price of gold.

Today's stock futures are off slightly just like yesterday morning --which turned into solid gains. News:

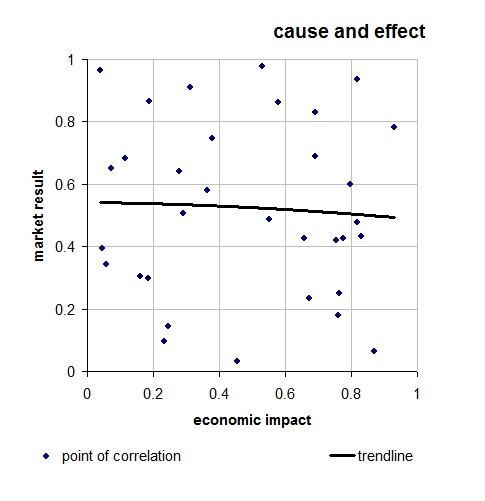

--and there are many that would agree. Just like most people on these threads say QE has a big effect on stocks. Many others will say the daily horoscope is a useful guide ("care with other's feelings is needed in case travel becomes necessary"). The human brain sees cause and effect where there isn't any. It's how we're wired. We're also able to overcome it. Here's an example of a set of data plotted:

The numbers 'prove' that the hard number show a slight downward trending --especially with the heavy grouping when the impact hits the 0.8 level. The fact is that all these data are just random numbers and random number will always include random grouplings and a random trendline. I know we can imaging QE making gold do what it did, just like we can imaging QE making stocks do what they did. The thing is that what stocks did was entirely different than what gold did.

Here're nine other correlation plots --they all look significant and they're all random.

Was not paying attention to how QE was effecting the stock market although your chart showed that the market could have started to be influenced by QE at the QE2 mark. I did think it was influencing the precious metals but then again there’s no way to know for sure.

You're absolutely flippin' right on that, & I'm thinking that you & I must be the only two people in the world (or elsewhere) that have figured out that there is no seriously convincing evidence.

Just the same, an other factor is the way prices will sometimes move because traders are making decision on what they think others will do. So whether there's an actual demonstrated correlation between QE and metals (or stocks) the fact remains that people believe there is. Like, look at all the articles on how QE controls gold! So what I'm saying is that when the fed does something, then lots of times traders will act as if there were a connection, and that can affect prices. Of course when they do, past trades show that the affect is short-lived.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.