Posted on 11/18/2013 2:46:13 AM PST by expat_panama

This is the Weekly Investment & Finance Thread (Nov. 18 - Nov. 22 edition)---- work in progress, under construction.

Keywords: financial, WallStreet, stockmarket

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me.

The list of everyone's links is here.

There are soo many good ways of doing this, by checking out the investment forums at Tradeking, Scottrade, and TDAmeritrade & others they got all kinds of ways of link investors together. The stockmarket thread at usmessageboard.com has investors posting comments 2 or 3 times per month, but the one on Ameritrade's thinkorswim platform gets comments 2 or 3 times per second. I kid you not.

Anyway, this one w/ say a handful per day is more my speed --I'm studying everyone's input on more detail (tx all for the notes) & be trying to keep everyone's thoughts in the soup.

This being a joint effort works well.

At any rate, what we can try now is a daily ping with just a vague outlook, and then the pertinent news in a separate post and then we can see which gets removed.

At any rate, what we can try now is a daily ping with just a vague outlook, and then the pertinent news in a separate post and then we can see which gets removed.

At any rate, last week was a gain capping six weeks up uptrend. This morning's futures say U.S. stock indexes are modestly up, but everything's in flow.

News in next post...

China reform plans lift world shares to six-year highBy Marc Jones. LONDON (Reuters) - World shares hit a near six-year high on Monday, boosted by signs of ambitious economic reform in China and the prospect of extended stimulus in the United States.Federal Reserve Bank of Boston President Eric Rosengren said big international banks with broker-dealer operations pose risks to financial stability, and regulators need to ensure the firms hold sufficient capital.Geithner to join private equity firmFormer U.S. Treasury Secretary Timothy Geithner, who played a central role in the government's response to the financial crisis of 2008- Business events scheduled for the coming week MONDAY, Nov. 18 (full story)A Chinese political meeting has set the tone on a range of social and economic initiatives. HONG KONG (CNNMoney). Enthusiasm swept through Chinese markets Monday as investors cheered the release of an ambitious blueprint that will guide economic ...

Smith & Wesson to eliminate 37 jobs in Maine

Pertinent reading.

http://online.wsj.com/news/articles/SB10001424052702303289904579197723195635730?mod=WSJ_hps_sections_yourmoney

Bond Investors Should Brace for Higher Rates

Rise Will Likely Be More Gradual Than Last Summer’s

http://online.wsj.com/news/articles/SB10001424052702303559504579197830356373734?mod=WSJ_Stocks_LEFTTopNews

Is This a Bubble?

As stocks Hit Records, Some Analysts and Economists Are Getting Worried. Here’s What to Do Now.

http://online.wsj.com/news/articles/SB10001424052702303559504579198572334628610?mod=WSJ_Stocks_LEFTTopNews

A Return to Internet Mania?

Some Market Observers Fear That We’re in a Bubble Reminiscent of the One We Saw in the Dot-Com Era

By Mark Hulbert

http://www.marketwatch.com/story/tech-exuberance-feeds-stock-market-bubble-talk-2013-11-17?dist=beforebell

Tech exuberance feeds stock-market bubble talk

Week ahead: 500.com IPO, Microsoft and Cisco shareholder meetings, Salesforce

--been waiting for rates to come up big time; you may have seen this--

--but my thinking is that all the fuss about spending cuts will go super crazy when we've got over a $T/year on interest outlays.

Is This a Bubble?

What happens w/ bubbles is nobody know they're there till after. Remember Greenspan's 'irrational exuberance'? That was seeveral years before the dot.com and by then all Sir Alan could talk about was how bad Y2K was.

Good morning. Thanks for all the info you bring here.

My pleasure!

Fed holdings really are high--

--but as a % total national debt held by the public--

--it was higher when Reagan was president. Problem is back then it was falling not soaring...

The market, I'm still out. Watching TWTR. Can't jump in because I have too much offline to tend to.

Checked BA right away this am because they got a huge order from Bahrain on the new ones. It did gap up this am but there was an early selloff and it's going sideways. No sense in getting into that.

Nothing seems priced right. I'll wait. I think we are in a bubble but still nothing attractive for people to put their money in.

In my ST email notifications, I got a list of all the companies Vanguard uses. I'll start a watchlist on those; some I already had but need some fresh air in this. I think they're probably good companies but buy and hold and we should be due for a big pullback I would think.

Flat yesterday ("milestones" notwithstanding), and flat this morning. Good Morning! Lot's of controversy (as usual) over future market direction. We got headlines in next post again in deference to admin needs, pls let me know if we want the headline post to be pinged to the list (everyone's pings) or just to the thread (to 'all').

OECD cuts global growth forecasts Financial Times - 23 minutes ago The OECD on Tuesday knocked almost half a percentage point off its forecasts for global growth this year and next, blaming a slowdown in emerging markets, brinkmanship over the US debt ceiling and concerns over the Federal Reserve's tapering for the ...

8 things to know about the 2013 bull marketU.S. Stock Market Nears Milestone Heaven - Adam Shell, USA Today

Market Milestones Feed Into Fear of Bubbles - Patti Domm, CNBC

Why I'll Soon Be Dusting Off My Bear Suit - Avi Gilburt, MarketWatch

Years ago farm income was a big part of our taxes and it varied so much from year to year we were always exempt from the withholding penalty. Our manager (we had a spread in north Texas) sometimes used options hedges to control price uncertainty, other times he'd just simply sell the un-grown crop to the buyer (Del Monte iirc) and lock in a sale price months before harvest, but everything was so dynamic.

Stock uncertainty maybe a bit of a headache, but farm management seems more like a migraine when compared to stocks. The stock trend uncertainty battle you've got w/ buying in is what we all work with. A lot of us use two tools, one is to make our moves in less painful increments (buy partially into just one or two stocks at a time and then 'pyramid' up). Another technique is to write down buy/sell rules in advance. I mean, nobody likes downside risk but you also don't want to watch a percent increase every week until to next year you got the Dow at 25000 & you're still asking 'when?'. The solution is to just say: "OK, I'll buy 10% if it goes up 1%". Or something like that; what matters is it's a clear concious decision.

You can always tweak/change the rule later but risk stays with a muzzle on.

The chattering class on this morning’s news alluded to several “investment advisers” who are suffering from fear of heights and mentioning earlier busts after booms.

TC

How are the chicken feather & tar futures looking for next year?

Unless I missed it, the article didn't really answer the question as to whether or not investors should care about bitcoin. Most Owing to ignorance, I never paid much attention to it because I thought it was only a passing fad.

Also, I'm not clear on how one could use bitcoin to their currency diversification advantage and/or to position themselves for the very probable coming dollar collapse.

Any thoughts/point of view on this?

lol! OK, they're only there because some producer's focus group wanted to hear that dribble, but the big picture now--

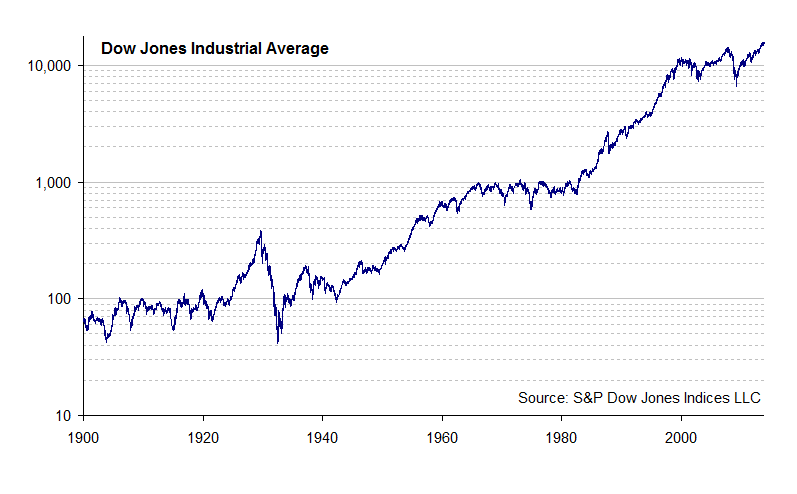

---is whether this is 1978 (with yet another drop) or 1982 (the beginning of a 18 year tenfold gain).

Neither am I, as far as practical terms go, although in impractical terms it's terrific! I mean, it's got your money, your IT, your stick-it-to-the-govt, --like it's got something for the whole family!

Seriously, all I've been able to gather is that it does seem to fit a niche need for certain intl or online transactions, but as a medium of exchange it's going to have to prove itself a stable currency first. I mean, I don't even know of any national government that's been able to please everyone on that account.

Sure feels a lot like 1978 to me...

But, then again... we’ve never really had Fed pumping like this! I’m re-trenching for a short-term dip... but, I doubt it will last long. I expect another leg up by year end.

I’ve moved out of my high beta’s... like FB, and NFLX.

Actually, back in 1978 the fed held a bigger % of the total national debt than it does today. Dollar amount's bigger now for debt and fed holdings but the % didn't fall until well after Reagan got elected.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.