Source: U.S. Energy Information Administration.

Posted on 10/27/2013 3:13:00 PM PDT by ckilmer

October 27, 2013 | Comments (3)

The one thing you see in the energy section of any news publication is the price of oil. Most of the time, it will give some doom-and-gloom reason that has little to do with the price of oil, or it will be some analysts making claims that oil will be double what it is today, or that it will drop 20%-30%. The most fascinating part of these prognostications is that they rarely give any real reason. A great example is a quote from Peter Flynn in an interview with Bloomberg, where he gives his reason that oil prices are going to drop:

We've crossed the Rubicon when we crossed that $100-a-barrel threshold; now the fundamentals are heavy, and people are starting to try to protect their oil position on the downside.

It sounds as if he's saying is oil prices are going to drop because people are afraid they'll drop, and that the sacred number of $100 is the tell-all sign. So the reason oil prices will drop has no correlation with what's going on in at the oil fields or at the gas pump -- just "heavy fundamentals." Does anyone understand what "heavy" fundamentals even means?

There's a reason oil prices in the U.S. could drop and bring the nation's oil boom to a screeching halt, and it's easier to understand than "heavy fundamentals." Let's look at what this very real threat and what we can do to prevent it.

The cork in the bottle

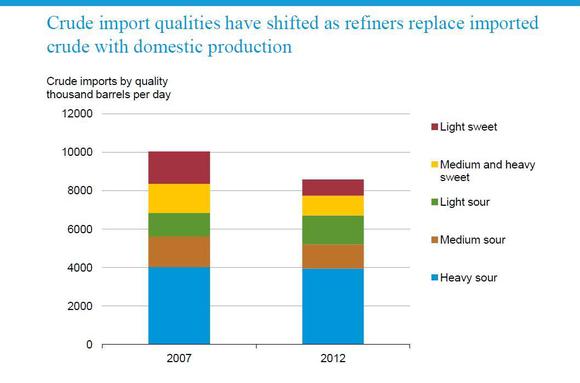

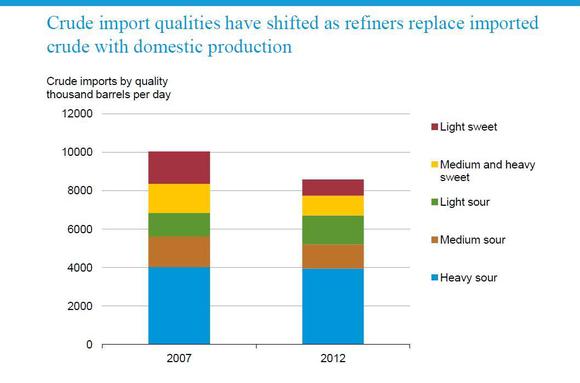

The U.S. oil boom has resulted in a massive uptick in light, sweet crude production. This has been a dream for refiners, because these types of oil typically command the highest prices and cheaper, domestic sources have taken a large chunk off their feedstock bills. But U.S. refiners need more than light, sweet oil, and the nation is coming very close to its total refining capacity for this type of oil.

Source: U.S. Energy Information Administration.

And here's where the problem lies.

Since the oil embargo of the 1970s, the U.S. has banned the export of domestic crude. Up until now, no one probably noticed, but within the next 12 months, light, sweet crude production could outpace refinery capacity. If this were to happen and the U.S. were to maintain its export ban, then we could see a severe drop in oil prices as producers fight to get their crude in the door at U.S. refiners.

The first victims

Each shale play in the U.S. is unique, and all of them have different economics, so let's do a comparison of three major shale and tight oil drillers in the U.S. -- EOG Resources (NYSE: EOG ) , Pioneer Natural Resources (NYSE: PXD ) , and Continental Resources (NYSE: CLR ) . Each of these three companies more or less represents one of the nation's three major shale oil formations. EOG is the top driller in the Eagle Ford, and Continental in the Bakken. Pioneer's largest production comes from the Permian Basin.

| Company | Realized Prices for Oil (Q2 2013) | Cash Margin Per Barrel of Oil Produced (Q2 2013) |

|---|---|---|

| EOG Resources | $103.73 | $40.25 |

| Continental Resources | $88.50 | $52.51 |

| Pioneer Natural Resourcces | $90.82 | $37.50 |

Source: Company presentations and 10-Qs.

Even though the price for oil is about $100 in the U.S., that doesn't mean companies are all able to realize that price. The issue with the Bakken is that its location makes transportation costs greater, and therefore the price realized at the well is less than, say, EOG's resources in the Eagle Ford, which is the next-door neighbor to the heart of America's oil refining capacity. At the same time, though, the well economics in the Bakken make for very attractive cash margins, and it's not unique for Continental. Kodiak Oil & Gas (NYSE: KOG ) has cash margins on its production -- which all comes from the Bakken -- of greater than $61 per barrel produced.

In the event that we were to reach the light, sweet crude refining capacity and no crude exports were allowed, it's very likely that all oil prices would fall, and it's also very possible that places such as the Permian and the Eagle Ford could see the biggest difference in price. Both of these regions primarily supply Gulf Coast refiners, while the Bakken has the ability to move more than 1 million barrels per day via rail, which could serve the East Coast and West Coast refiners more easily.

Using the prices realized on crude, the amount of money that can be made per barrel of crude, and the current flows of oil, it's possible that some of the disadvantaged regions in the Permian and Eagle Ford could be some of the first regions to see major downturns in production and profitability if oil prices were to decline.

What a Fool believes

When looking at investing in U.S. oil and gas for the long term, rarely should you take the prophecies of oil-price oracles into consideration. There are, however, some real market drivers that could affect price, and it's those that you should keep an eye on. The ability for the U.S. to export light, sweet crude is one of those drivers. If we were to be able to start exporting oil as the market commands, then a severe drop in domestic oil prices is not as likely. If we were to maintain the course we're on, though, we could see some companies, including EOG and Pioneer, suffer because of it.

How about if refinery capacity gets maxed out, we see refineries do well because the crack spread (difference between refined and raw products) goes up? And then, after a few years, we see some EPA relaxation allowing new refining capacity to be built?

Anybody who thinks the price of oil will drop has not been paying attention to the Iranian nuclear story. They go nuclear NO oil will leave the Persian Gulf unless they get paid to let it go. That fee will be high.

In December of 1941 the Japanese attacked Pearl Harbor. At that point our military could only be described as woefully inadequate due to political considerations.

Our great nation mobilized. Our factories built planes, ships, tanks and the arms of war. If we lost one we built three more. Four years and 8 months later Japan and Germany were smoking cinders with a population that had been beaten and subjected. We did not treat the defeated as serfs nor enemy. We rebuilt the nations of our former enemies. Today they are our stout allies.

The point is our great nation can do just about anything necessary if the political class will get off our backs.

Dropping the export ban to keep oil prices high will not be a popular vote in Congress.

The greatest threat remains—the democrats.

Dropping the export ban to keep oil prices high will not be a popular vote in Congress.

........

I don’t know what I think about the matter either.

The trouble is that the USA has plenty of refining capacity. but much of it is not designed for light sweet crude which the USA is now pumping up. But rather heavy sour stuff.

I don’t know why the refiners can’t convert their refineries so that they can handle the light sweet crude.

We’ll see.

/johnny

When I opened this thread, I was thinking JugEars.

Still might not be a bad idea. Somewhat higher gas prices but more exports, jobs and earnings. Might be time to live up to our free market talk.

Hint: ‘Hussein’

The quietest thing going on in the Bakken right now is a move towards automating drilling.

That would eliminate that annoying employment boom in the red states of ND and TX.

The BIGGEST threat to ALL industry in America including the oil

industry is the government. Especially the current administration

and the all out war it is waging against America in their quest to

destroy America.

Agreed.

And that sure seems to be a situation where no country is willing to take a stand.

I agree with what you said.

Free enterprise is not popular with Congress.

While it’s true that no new refineries have been built in the US since 1976, there has been expansion and modernization of existing refineries. Just driving down I-37 in Corpus Christi, this week I saw lots of new facilities being built in the refineries.

Stop posting to me.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.