I mostly agree with everything you wrote, except for your last sentence.

You’re right to insist on a more precise operational definition of deflation. In my response to 1010RD, I was focusing on his point that deflation (defined narrowly as steadily lowering prices) isn’t necessarily bad. We have had many historical precedents.

The good times toward the end of the 19th century, which 1010RD alluded to, were mainly the result of huge increases in productivity owing to the building of transcontinental railways. The overall economy also grew at an impressive rate, although overall prices dropped by about half.

The parallel between the laying of railway tracks, and the revolution in computing and telecommunications technology is obvious.

The key factor is the level of demand — which is also given prominent mention in most definitions of deflation. Overall demand did not decrease in the late 1800’s, and thus there was not excess (overall) capacity, with it’s resulting job losses, etc. that comprise the deflationary spiral. The same could be said about the last couple of decades of the 20th century. Aggregate demand in the tech sector has increased dramatically, at the same time that prices have been dropping by (about) half every three years. (Much could also be said about the gold standard that was operating in the 19th century, vs. fiat money managed by central banks.)

We are currently seeing new deflationary pressures coming from the energy sector (of all places!) — with shale oil and gas, fracking, oil sands, etc. Lower prices for energy will, in effect, put more money into the pockets of consumers (in oil-consuming nations, at least). It will lower prices of products of every other sector. Lower energy prices add to our real wealth, just as building railways and the internet have done. So long as aggregate demand doesn’t fall, we might enjoy a long period of “good” deflation (once again, narrowly defined to focus on lower prices — and leaving out the bad stuff). IOW, deflation is not necessarily a bad thing — just as a moderate amount of inflation can be a good thing.

I’ll come back to my original point: the author is some combination of: stupid, lazy, ignorant, or disingenuous to suggest that there is anything “new” about economists worrying about deflation.

post 90 1010RD a very healthy economy with persistent deflation.... ...like the US in the 1800s, post 115 USFRIENDINVICTORIA ...deflation (defined narrowly as steadily lowering prices) isn’t necessarily bad. We have had many historical precedents. The good times toward the end of the 19th century, which 1010RD alluded to... ...overall prices dropped by about half.

OK, if everyone wants we can use this inflation definition (from here):

de·fla·tion (d -fl

-fl

sh

sh n)

n)

n.A persistent decrease in the level of consumer prices or a persistent increase in the purchasing power of money because of a reduction in available currency and credit.

The American Heritage® Dictionary of the English Language, Fourth Edition copyright ©2000 by Houghton Mifflin Company. Updated in 2009. Published by Houghton Mifflin Company. All rights reserved.

--but let's please stop changing it. Next we need to quit tossing out historical records which (like the definitions) sound made up and arbitrary. Here's a website we can use and y'all are welcome to share another if someone thinks they got a better one, but they got to either 'splain why first.

Here are the general price indexes during America's first century and a half in half century jumps:

| year |

cpi |

average annual inflation |

| 1774 |

7.82 |

|

| 1824 |

9.35 |

0.4% |

| 1874 |

11.04 |

0.3% |

| 1926 |

17.7 |

0.9% |

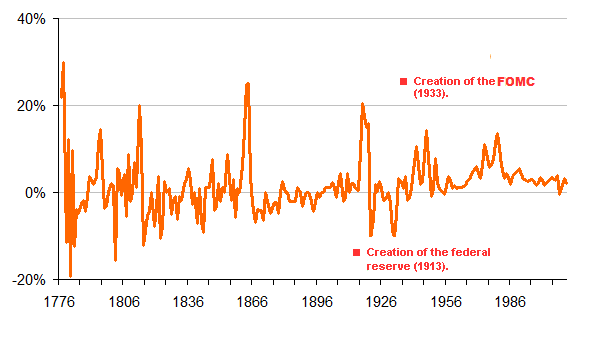

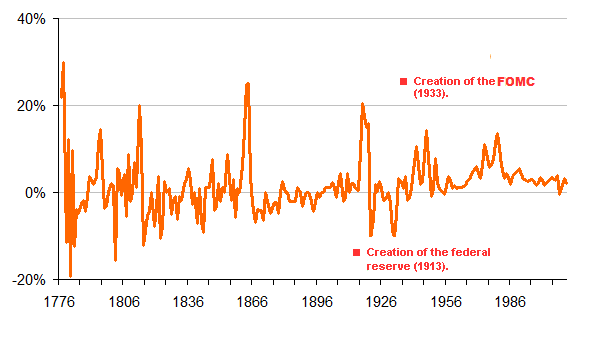

There was no "persistent deflation" with any of those time periods, and "overall prices dropped by about half" is simply not there. Long range prices were flat. Of course, nobody works one day, gets paid 50 years later, and buys food after another 50 years. The historical record of year over year general prices trends was all over the place --ranging from 30% inflation one year to a 19% deflation in another. Crazy. Absolute living hell. Now look at how price stability increased as Congress used the Fed for regulating money's value:

OK so y'all are not happy with how Congress is coining Fed regulated money. I've yet to hear what y'all do want, but let's understand that most people don't want it back the way it was.

-fl

sh

n)

n.A persistent decrease in the level of consumer prices or a persistent increase in the purchasing power of money because of a reduction in available currency and credit.