That's interesting! It isn't easy going Galt.

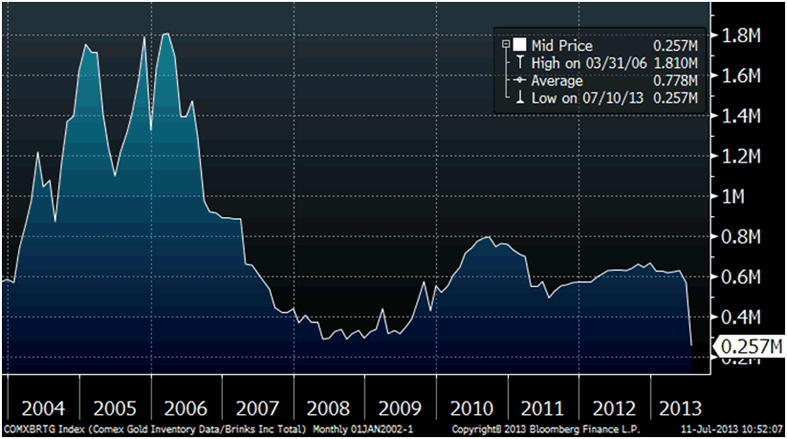

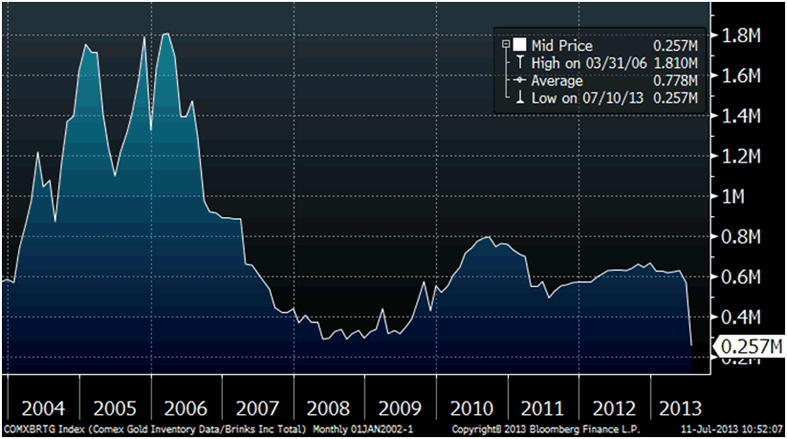

Comex Gold Inventory Data/Brinks Inc Total:

Posted on 07/11/2013 6:04:17 AM PDT by SteelToe

China is increasingly giving signs that a hard landing could be in the cards, as the government cracks down on financial excesses and overheating markets amid a global slowdown. If the world’s second largest economy were to slow down dramatically, it would have a substantial effect on commodity prices, given China’s outsized influence in those markets. Under an extreme scenario, oil prices could drop to around $70 per barrel while copper prices would collapse 60%. On the flip side, gold would potentially benefit from a steep sell-off in renminbi-denominated assets, according to Barclays BCS +0.28%’ economics research team.

After several months flying below the radar, China erupted into the scene over the past several weeks as a dangerous liquidity squeeze seemed to threaten the integrity of its financial system. Amid low inflation, Chinese economic data gave further troubling signals on Wednesday, as exports contracted 3.1% in June, marking their first drop in 17 months. While imports fell 0.7%, commodity imports took a steeper tumble, contracting 5.2%.

(Excerpt) Read more at forbes.com ...

Good for us or does that mean a war with Taiwan?

That's interesting! It isn't easy going Galt.

Comex Gold Inventory Data/Brinks Inc Total:

A hard landing is coming for China?

Why, oh why, did they EVER embrace a market economy? Don’t they know that that involves monetary risk, and may even lead to (gasp!) capitalism?

Did the authors of the “new China” not realize the mischief they were setting loose? Now their own people will be expecting to get some share of the total wealth of the State. And isn’t that just feeding greed, and its evil twin, poverty?

< /sarcasm >

Welcome to the real world, China. And to its uncertainties and challenges. But pay attention to what is happening in the US, and refrain from trying to “fix” things.

Our gas price went from $ 3.37 to $ 3.45 overnight.In S. Jersey no less.

A China led deflation could make world banks unstable and the derivatives overhang unstable>

This fear would make people buy gold as a bank run hedge. Bank runs and mutual fund runs will look different than in the 1930s but you would lose savings in that you would be blocked from withdrawing all your money. You would only be allowed to withdraw half or a third. Your money would not be yours to use. It would be used to prop up the system even though it is still in your name

Look at the 50s/60s boom/bust or the 70s/80s boom/bust

Goldpimper

The man with the Madoff touch

Swindles so much

They call him

Goldpimper....

my thinking too. oil prices that are too low prevent alternate oil sources to be explored because it isn’t worth the cost. oil prices that are too high can cauise a glut because consumers will figure out ways to use less.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.