Posted on 06/04/2013 1:37:36 PM PDT by blam

If the Economic Recovery Is Strong, Why Are Lumber Prices Falling?

Economics / Economic Recovery

Jun 04, 2013 - 07:05 PM GMT

By: InvestmentContrarian

Sasha Cekerevac writes: As we all know, the stock market is in record-setting territory. One would think that this must mean the economic recovery engineered by the Federal Reserve is surely in place, but it’s not. I believe that the economic recovery is far from being assured.

The shocking thing to consider is how many trillions of dollars the Federal Reserve has pumped into the economy, and yet all we have to show for it is this very weak economic recovery. To me, this means that the underlying strength of the economic recovery without the Federal Reserve’s support would be much weaker.

While on the surface it appears that the economic recovery is taking place, I believe that without the support of the Federal Reserve, we would see a substantial drop in economic activity. Much like a balloon filled with air, the economic recovery needs a constant injection of stimulus otherwise it would deflate completely. That’s not what I would call a strong foundation to build upon.

There appear to be new signs of the fragility of the current economic recovery. One of the strongest sectors that have benefited from the Federal Reserve’s monetary policy is housing. Naturally, lower interest rates increase affordability for buyers, all else being equal.

There is a lot of news about strong year-over-year home price gains and activity among homebuilders in construction. Yet lumber prices are telling a contrary story.

Chart courtesy of www.StockCharts.com

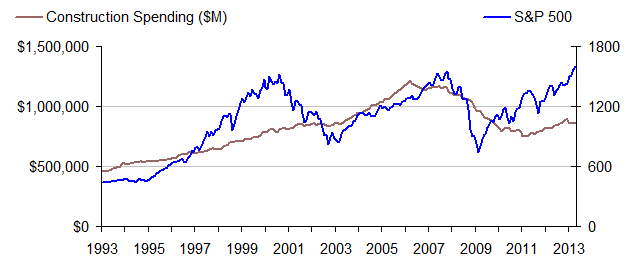

The chart above shows lumber prices against the S&P 500. Lumber is one of the more volatile commodities, yet it has shown over the past few years that it does have a correlation

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

Dr Copper isn't very happy either.

Dr Copper isn't very happy either.

BULLISH! Low lumber prices —> lower priced new homes —> more home sales —> more earnings for homebuilders, appliance manufacturers, building supply companies —> higher stock prices!

....and MORE MEXICANS!.........

BULLISH! More Mexicans —> more crime, hit & runs, drugs, tuberculosis —> more windows repaired, more replacement big-screen TVs sold, more car sales, more pharmaceuticals prescribed —> higher stock prices!

(Oh I can do this all day, I watch CNBC.)

More Mexicans -—> More DEMOCRAT VOTERS -—> more Democrats in office -—> more Mexicans.........rinse, lather , repeat.......

BULLISH!

I think you misspelled it... doesn’t the I come after the H? And where’s the T?

:-)

As an amateur furniture maker, I remember in 2008 thinking that maybe I could catch a break on lumber because of the economy. I was wrong.

Lumber has been pretty high for a while. At least, it seems like it.

I had a workshop built in Nov-Dec 2009. Lumber (and labor) were very affordable, at least compared to a few years previously.

One is that despite what is supposed to be a bad economy, every restaurant you go to, and every store such as Old Navy, Macy's, or Penney's you go to is packed with people buying. The standard answer around here is, "They are all using credit." Except that stats show that credit use is actually down, and that people are actually saving a very slight bit more. Home starts are up, then down, but not in recession territory.

Jobless claims hover in the same zone, suggesting to me that those who have jobs have ok jobs, those who don't have unemployment.

The $17 trillion national debt has NOT created the hyperinflation that by all market models should be hitting. I've now heard for almost a decade that it's coming "any day" and that it's inevitable, all the while gold and silver continue to languish. Gas prices are $3.50 or so, higher than in 2000 for sure, but not at $8.000 where hyperinflation should have them.

The stock market has done well---everyone thinks its in for a big correction---but every time it dips people see buying opportunities. In short, there are some very big, and serious, disconnects between pure market theory and what keeps happening that cannot be explained by "manipulations" of a few Soros-types or by Bernanke.

If the Economic Recovery Is Strong, Why Are Lumber Prices Falling?

Darn it, gosh darn it... And here I remember reading not to long ago, (couple of days), how “homebuilders” were having a hard time finding workers to build homes.

So who is lying? Probably all of them.

--and that construction spending and stock prices really have nothing to do with each other.

LS post 11 ...stock market has done well...

That's what I've been hearing from people who don't buy stocks, but normally stock indexes double every dozen years or so. Right now the S&P is only slightly higher and NASDAQ is lower than 2000 levels.

Debt doesn't create inflation. In any case interest rates, the only market measurement of future inflation, have been perverted into an "economic stimulus" but in reality low rates are an economic drag. The game will continue until there is 1) actual inflation and/or 2) default and massive deflation.

It is a very bad economy. High levels of consumer spending do not -- contrary to the neo-Keynesians -- indicate a strong one. It is business spending that matters and the GDP equation takes little notice of that.

Businesses are in hunker-down mode. Outside of oil and natural gas, manufacturing is retracting and retail is stagnant. Consumers don't drive the economy; entrepreneurs [AKA capitalists] do.

In the absence of business expansion, the Bernanke-dollars are looking for returns in the stock market bubble. There really is an explanation.

http://srsroccoreport.com/the-great-bamboozle-selling-garbage-for-a-premium/the-great-bamboozle-selling-garbage-for-a-premium/

THE GREAT BAMBOOZLE: Selling Garbage For A Premium

"This is actually the right time to be buying precious metals while exiting positions in stocks and bonds. "

People are forgetting that price involves the intersection of supply and demand. This article focuses on demand and ignores supply.Supply is coming back on stream and catching up to demand.

That does not make sense. The lack of supply/lumber would cause price increases. We're seeing price decreases.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.