Posted on 02/23/2013 11:58:09 AM PST by blam

Sorry Bears, We're In A Secular Bull Market

February 22, 2013

by: Jonathan Verenger

I know some people will view this article as a sure sign that the top is in. Keep in mind, however, that I have been a raging bull since July 2009 when I realized that the market wasn't coming back and was ignoring bad news permanently. In the almost 4 years since, we have had numerous things thrown at the market and yet it has crept higher and higher. The latest negative news are the fears of sequestration, a supposed all time high in bullish sentiment (more on that later), a crash in Apple (AAPL) being a sure precursor to pain in the overall market, and fears about supposed currency wars.

Misguided Gurus

For the past 4 years now the general public has missed huge gains in the market because of their own bias clouding objective thinking and because of the excessive fear spread by bloggers and the media alike. From Porter Stansberry's ridiculous calls for the End of America to Bob Prechter's ongoing claims of imminent collapses in the market to the latest diatribe from Marc Faber about how the markets have peaked (didn't he say that in 2009, 2010, 2011, and 2012?), the general investing public has been bombarded by these seemingly eloquent and smart "gurus" whose short thesis is so well thought out and convincing. As Laszlo Birinyi often says, the "short thesis is always the more articulate one". But facts are facts. And speaking of them, let's look at the facts.

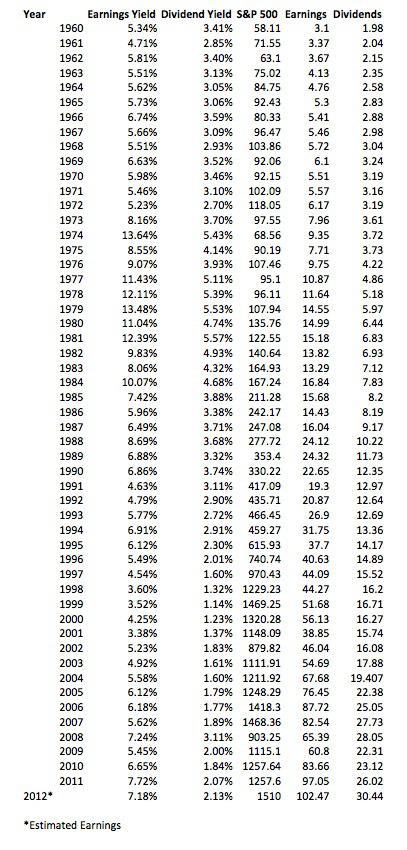

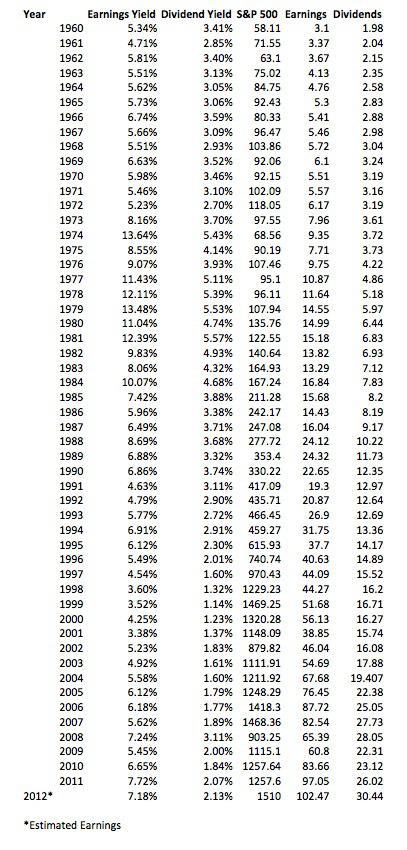

Historical S&P Data

Take a look at the data below, which includes the earnings yield, dividend yield, price of the S&P 500 at the end of the year, S&P 500 earnings, and dividends for the past 53 years.

(snip)

(Excerpt) Read more at seekingalpha.com ...

Bingo! It’s thin air. Take your profits before it bursts.

Not to mention that many of us took two massive hits that have resulted in our totals being about n60% of what they were projected to be if the "bubbles" hadn't popped. I'm just gun-shy and afraid if I reengage, it will be for another slap down that I can't afford at my age.

Abb and Blam....... Do Freepers get any better?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.