That's why they are called "wise".

On a more timely note, I wonder what the calories-per-acre is for:

Posted on 11/17/2012 7:24:39 AM PST by blam

The Smartest Investment Of The Decade

by Simon Blackon

November 12, 2012

Here’s something crazy to think about.

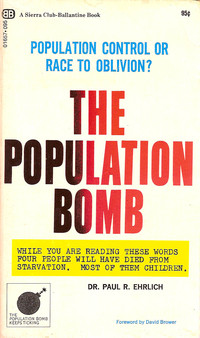

Roughly 200,000 people were born today. That’s net world population growth, births minus deaths.

Each one of them constitutes a new mouth to feed. And when they come of age, those 200,000 people will consume, conservatively, about 1,250 Calories per day. Collectively, that’s 91.25 billion Calories per year for the entire 200,000 people that were born today.

Where will they get that food from?

Consider that a cup of rice contains about 300 Calories. An average annual rice harvest yields about 150 bushels per acre, or about 6.7 million Calories per acre of rice grown each year.

In very simple terms, it will take 13,600 acres of cultivated, producing rice land to generate the necessary Calories to feed the 200,000 people that were born today. That’s roughly the size of Manhattan.

Tomorrow, another 13,600 acres will be required to feed the people born tomorrow. And the next day. And the day after that.

This is a conservative estimate. Obviously people eat other things besides rice. Corn has an even lower caloric yield per acre. And as people move up the food chain into dairies and meats, the amount of Calories per acre takes a huge nosedive.

Across Asia in particular, hundreds of millions of people are now being lifted out of abject poverty and into the middle class. As I’ve traveled around the world to more than 100 countries, I’ve seen this with my own eyes– people having disposable income for the first time ever.

As people’s individual wealth levels increase, their dietary habits tend to change as well. Suddenly they start consuming more expensive foods… ‘luxury’ foods like beef. And by comparison, beef yields only about 1.1 million Calories per acre.

Simultaneous to the rapid increase in demand for food, the world is also experiencing a declining trend in supply. Water shortages, loss of topsoil, weather disasters, land development, and insane government policy are all contributing to tightening food supplies.

Perhaps most importantly, though, is the effect of monetary policy. Central bankers around the world continue to print more money. That’s all they know how to do, as if the path to prosperity is paved with paper currency conjured out of thin air.

All of those trillions of dollars, euros, yen, and renminbi end up somewhere… and such monetary inflation has been a huge force in driving up food prices. In fact, just over the last few years, we’ve seen record prices from corn to wheat to sugar to ground beef to milk.

Increasing demand. Tightening supply. Destructive policy. All of these point to a long-term trend in food. And the trend is enormous. The best case scenario is steep food prices. The worst case scenario is severe shortages.

This makes agriculture probably THE place to be over the next ten years, perhaps seconded only by shorting major currencies like the dollar, euro, and yen.

There are a number of ways to invest in agriculture… ETFs, futures, food production companies, agriculture equipment companies, food technology companies, etc. But in my view, there is no better way to make a long-term agricultural investment than owning high quality, productive land.

Like owning physical gold, farmland gives you not only the financial upside of rising agricultural prices, but also the personal assurance of a guaranteed food supply.

Later this week, I’d like to discuss different places in the world where it makes sense to own farmland. Some of my recommendations may surprise you

Its good to be a farmer these days.Owning your own farm is even better.

The worst case scenario is what it has always been - socialists destroying the ability of people to create wealth. If we were not hampered by government and the enviro-whackos who are making our lives miserable, people would find a way to feed all of us.

I don’t know about buying farmland. It seems to be forming a bubble. I don’t think anyone knows what the future will bring.

A garden is GOOD. ;-)

That's why they are called "wise".

On a more timely note, I wonder what the calories-per-acre is for:

Yup. At this point buying land is a better investment than buying gold IMO.

Depends on where.

If overpopulation is the problem, chasing dwindling food resources, neither gold nor land nor stockpiles is a certain solution.

In the WTSHTF scenario, you WILL be overwhelmed, specially in any country outside home base, the US.

The author ignores all of the government subsidies and policies that are inflating land prices in this country. Once our government has screwed up agriculture as bad as it has health care it will confiscate farm land.

Remember what happened to the Kulaks.

“And by comparison, beef yields only about 1.1 million Calories per acre. “

But, in mountainous states like mine, those acres can be on the side of a hill, where cattle can graze but rice or corn can’t be grown.

It’s a big time bubble. $10,000/acre + now in some areas of the midwest. All because of ethanol and entirely unsustainable. Farmers in Asia, India, and South America are all beginning to modernize their methods so we will probably be deluged with ag production before too many years pass. Now is a fantastic time to be selling farmland, IMO.

When I was a kid in the 1960s, my teachers told me that by 1980 there would be no more gasoline. They said pollution would be so bad that mothers would not be able to breast feed their babies. The seas would be overfished and empty of life. You could not go outside in the rain because the rain would hurt you. We would be packed together like sardines in a can. They scared the crap out of us. Yet, none of the fears materialized. I’ll give the devil his due that abortion killed off a lot of people, but it didn’t kill off as many as my teachers thought needed to die. What happened? All that fear, and for what? 30 million dead people? What a crock. If there was any justice in this country, my old teachers should be standing in front of a tribunal.

The current crop should be standing before a tribunal.

Before investing in commodities, track how commodities are doing in the market. Use the chart at the top of the page, with a few drop down menus, to see how corn, for example, is acting for the past month, or the past year.

http://money.cnn.com/data/commodities/

Even at the height of the Dust Bowl and the Great Depression, America’s remaining farms were producing so much food that taking it to market to sell cost more than the food itself.

Buy nonperishable foods you'll actually use eventually, whether shtf or not, and if you have the ability to invest, know that it's a distortion creating a temporary opportunity. Don't fall into a commodity-bug cheering it on long term, it's not a long term investment. You'll get burned and burned badly.

Again, this is just my opinion. The only certainty is uncertainty over the past several years, and into the foreseeable future. This creates profit opportunities for the alert but they come and they go, sometimes rapidly.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.