The simple fact is that those record receipts occurred in 2007, with those tax rates in place.

There are a number of factors that drove reduced receipts in 2008, chief among them the impact of the Dem’s mortgage scheme and the bursting housing bubble.

So you conclude that the Bush tax cuts effected revenues positively because they reached a high in 2007 during the housing bubble. Following is my conclusion from this link:

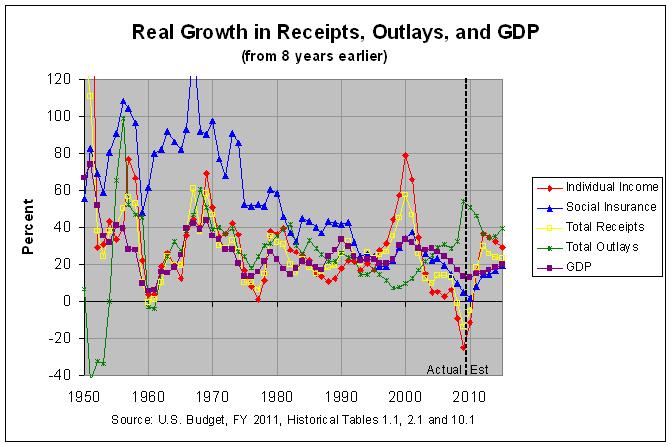

The actual numbers and sources can be found at recgro8y.html. As can be seen in the second table and graph, real individual income tax receipts declined 25.06% from 2001 to 2009. Even total receipts declined -13.93% over that period. Finally, real GDP grew just 13.36% from 2001 to 2009. This was the lowest real GDP growth over any 8-year span since 13.33% from 1966 to 1976. Hence, although it's been just about eight years since the 2001 tax cut and six years since the 2003 tax cut, the evidence to this point is that the Bush tax cuts decreased revenues over what they would have been, at least over the short term. This was true even in my prior analysis based on data through 2007, before the financial crisis of 2008.

We can let the readers decide (if there are any!) which conclusion makes more sense.