Skip to comments.

What difference does Obama's 'Buffett Rule' make?

Blog ^

| 4/12/12

| Political Math

Posted on 04/13/2012 5:54:08 AM PDT by Dudoight

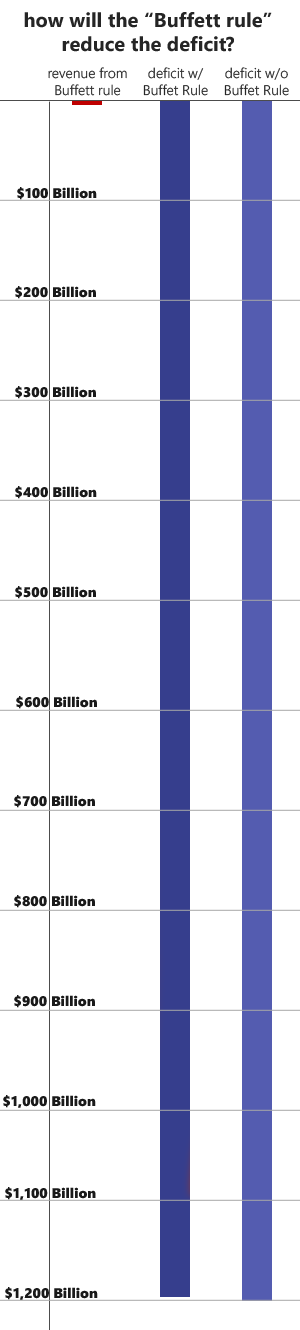

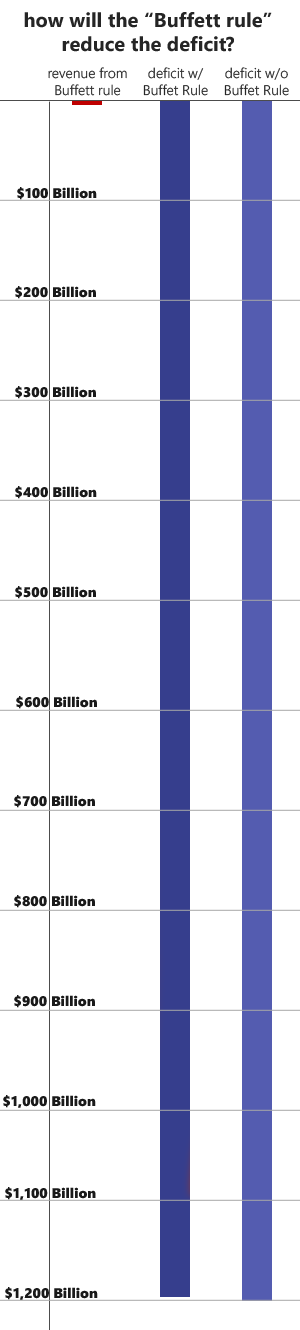

President Obama and Democrats have been talking up the Buffett Rule (a minimum 30% tax on people making over $1 million per year) for some time now. So what kind of difference does the Buffett Rule make?

I've seen revenue estimates between $30 billion and $40 billion over 10 years, but what kind of difference would that make in the scope of government finances?

Not too much.

(Excerpt) Read more at politicalmathblog.com ...

TOPICS: Business/Economy

KEYWORDS: buffetrule

1

posted on

04/13/2012 5:54:13 AM PDT

by

Dudoight

To: Dudoight

Scroll down to the second graph. I would post it but don’t know how.

Everyone needs to be made aware of the reality of this Buffet Rule.

Our problem is SPENDING...not insufficient Taxes.

2

posted on

04/13/2012 5:57:30 AM PDT

by

Dudoight

To: Dudoight

All the Buffet Rule would do is pave the way for it's faulty logic to be spread out to other income levels. You can just imagine Obama saying to the next level of income below the "Buffetts," --

"It's not fair that we only tax the rich, those earning $500,000 per year have done really well under our system...asking them to pay at least 25% isn't asking too much..." And so it would continue, right on down to those making $250k, then $100k. It'll stop when he reaches critical mass: his magic bottom 51% of the voters.

3

posted on

04/13/2012 6:16:33 AM PDT

by

Lou L

(The Senate without a filibuster is just a 100-member version of the House.)

To: Dudoight

Our problem is SPENDING...not insufficient Taxes.

Apparently completely lost on the left end of the political scale.

What is one supposed to think of those who profess ever increasing revenues are the answer to everything?

IOW give more of what the left has been spending so that they won’t spend as much?

Tax cuts for the rich? Sounds just horrible, until one injects a little truth, tax cuts for taxpayers, keeping in mind that the tax payers are subsidizing the great 47 percent who don’t have any skin in the game.

I’m not sure what impending financial disaster, out of control government at every level is capable of producing, but if we don’t some how reign in the insane spending on things government should not be involved in, much less those things authorized, we are sure to find out and frankly the nation will be wishing we had gone for solutions rather than blaming one side or the other.

4

posted on

04/13/2012 6:21:55 AM PDT

by

wita

To: Dudoight; ding_dong_daddy_from_dumas; DoughtyOne; calcowgirl; Gilbo_3; Impy; stephenjohnbanker; ...

It’s a purely election year political argument to beat over the heads of Republicans.

But here’s the trap, once we argue that it won’t collect much revenue(which it wont) even by static CBO estimates that assume NO change in behavior, then it’s hard to make a convincing argument that it will hurt the economy. But right now that is the only argument Republicans are using.

There is another argument asking if those that pay no Federal income taxes are paying ‘their fair share’, but Republicans seem unable to use that one to their favor either.

5

posted on

04/13/2012 6:24:25 AM PDT

by

sickoflibs

(Obama : "I will just make insurance companies give you health care for 'free, What Mandates??' ")

To: Dudoight

"Scroll down to the second graph. I would post it but don’t know how."

The libs aren't smart enough to know that even animals are smart enough to move out of the way when they know they are a target. Never mind people who are smart enough to become gazillionaires. So, I would bet a cyber-nickel that if it's ever instituted: 1.) Warren Buffett won't pay more taxes under the "Buffett Rule", and 2.) Gov't revenues will decrease and US debt will increase.

So IMO, it's much worse than the above graphic!

6

posted on

04/13/2012 6:33:55 AM PDT

by

Sooth2222

("Suppose you were an idiot. And suppose you were a member of congress. But I repeat myself." M.Twain)

To: Dudoight

Why stop at 30%? If imposing a 30% tax on the rich will bring in 30 billion in revenues, then imposing a 100% tax on them would bring in 100 billion in revenues, right? (sarc, s/b obv).

Nothing proves the Laffer Curve more than conceptualizing the 100% tax, which would result in ZERO revenues to the government (unless we plan on enslaving the rich and forcing them to work for nothing). So in reality, the 30% tax could very well put us on the downward sloping side of this curve and result in less, not more, revenues to the government.

7

posted on

04/13/2012 6:44:13 AM PDT

by

zencycler

To: sickoflibs; Dudoight; DoughtyOne; calcowgirl; Gilbo_3; Impy; stephenjohnbanker

There is another argument asking if those that pay no Federal income taxes are paying ‘their fair share’, but Republicans seem unable to use that one to their favor either.That would be a real political trap (even though it make would sense to reasonable voters) for the GOP to fall into. Imagine they proposed eliminating EIC (welfare) for those not paying income tax, for example.

Obama would:

1) Rub his eyes to check his vision

2) Clean out his ears

3) Rub his hands and smack his lips at the welcome news

4) Call his political team in to think up new ads, speeches, and bumper stickers, and watch the GOP squirm as their polls plummeted.

8

posted on

04/13/2012 7:14:29 AM PDT

by

ding_dong_daddy_from_dumas

(Fool me once, shame on you -- twice, shame on me -- 100 times, it's U. S. immigration policy.)

To: Sooth2222

WOW...how did you do that? Thanks. It needs all the exposure we can give it!

9

posted on

04/13/2012 7:25:29 AM PDT

by

Dudoight

To: ding_dong_daddy_from_dumas; Dudoight; DoughtyOne; Gilbo_3; Impy; stephenjohnbanker

RE :”

There is another argument asking if those that pay no Federal income taxes are paying ‘their fair share’, but Republicans seem unable to use that one to their favor either........

That would be a real political trap (even though it make would sense to reasonable voters) for the GOP to fall into. Imagine they proposed eliminating EIC (welfare) for those not paying income tax, for example”

Obama calls Republicans out for opposing those like Buffet being forced ‘to pay their fair share’, or as he says :"Asking them to pay their fair share".

As I recall I proposed HERE that Republicans put a bill up for a vote that makes it even easier for those like Buffet to pay more voluntarily AND be publicly recognized for it, via a website. And call it the “I think I should pay more fairness act” It could include credit card payments, online bank bill payments that all can be set to periodic payments, just to make it easier.

That would be a gimmick worthy of Obama’s Buffet gimmick. But they wont. Instead they just cling to the claim that Buffet paying more in taxes would break the recovery so he must pay less in taxes even if he makes fun of Republicans for it, which is a indefensible argument.

The 50% that don't pay Federal income taxes that Obama says pay too much already definitely scare Republicans. Add them to government employees, minorities, union workers, children of illegals, and now white women maybe, and you got a one party country, like Maryland is a one party state.

10

posted on

04/13/2012 8:09:06 AM PDT

by

sickoflibs

(Obama : "I will just make insurance companies give you health care for 'free, What Mandates??' ")

To: sickoflibs; ding_dong_daddy_from_dumas; Dudoight; DoughtyOne; Gilbo_3; Impy; stephenjohnbanker

” Gov’t revenues will decrease and US debt will increase.”

More money left offshore..

More money not used for working capital/expansion

More unemployment

11

posted on

04/13/2012 9:40:00 AM PDT

by

stephenjohnbanker

(God, family, country, mom, apple pie, the girl next door and a Ford F250 to pull my boat.)

To: sickoflibs; Dudoight; ding_dong_daddy_from_dumas; DoughtyOne; calcowgirl; Gilbo_3; Impy; ...

” There is another argument asking if those that pay no Federal income taxes are paying ‘their fair share’, but Republicans seem unable to use that one to their favor either.”

The Republicans should just hire you and me, to explain their positions, then they could go back and hide. This is so easy for me that I could write the script in an hour : )

12

posted on

04/13/2012 9:47:46 AM PDT

by

stephenjohnbanker

(God, family, country, mom, apple pie, the girl next door and a Ford F250 to pull my boat.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson