Posted on 12/31/2010 7:08:26 AM PST by FromLori

What will happen to the financial system if US interest rates keep rising? That is a question many investors are pondering, given the recent sharp upward swing in US Treasury yields. There is plenty to fret about: higher rates could hurt US homeowners, for example, as well as delivering more pain for struggling municipalities.

However, there is another sector that investors should watch: commercial real estate. During the past three years, the CRE sector has not generally grabbed much attention, because events there have not been as dramatic as in subprime (in 2007-08) or sovereign debt markets (in 2010)

But the recent turbulence in Ireland, where the banks were devastated by CRE exposure, is a potent reminder of the potential for property loans to turn sour. And it is just possible that echoes of this problem might be seen elsewhere in 2011.

For one dirty secret in the financial world is that the lack of drama in the CRE sector has partly arisen because banks on both sides of the Atlantic have been “evergreening” loans – or in essence extending the maturities – and practising forbearance to avoid recognising losses.

Banks and borrowers have been able to conduct such evergreening because interest rates have been at rock bottom. But if rates rise, this evergreening will be harder to maintain. What makes this doubly pernicious is that any rise in rates might hit just as the sector is heading for a wave of refinancing.

To understand this, look at some numbers compiled by the Institute of International Finance, the Washington-based banking lobby group. The IIF calculates that in March 2008, there was about $25bn worth of pre-crisis investment grade commercial real estate in distress. By March this year, however, that number had exploded to $375bn (and has probably swelled since).

(Excerpt) Read more at ft.com ...

Cant get in without registering

Yes you can, by typing in the title on Google search and then clicking on the first link the entire article appears same thing with WSJ if you don’t have a subscription (TBI ran an article one day on how to read those lol).

Related info...

Yikes a lot of our smaller banks that got Tarp have CRE loan’s from the article...

“Thus far, the banks have “dealt with potential delinquency problems in part by extending loans until 2011-13”, the IIF notes. Or, in layman’s terms, they have swept it under the carpet. But while this avoided defaults, the IIF reckons that about $1,400bn of CRE loans must be refinanced before 2014. Alarmingly, “nearly half of these are at present ‘underwater’, ie have mortgages in excess of the current value of the property”, it adds.”

For more information on Tarp Banks...

“Arthur Wilmarth, a George Washington University law professor and expert on banking regulation, said a lot of smaller TARP recipients are burdened with risky commercial-real-estate loans tied up in troubled strip malls and the like, and that makes it hard for them to raise new capital. “A lot of them are in kind of a frozen position,” he said.”

http://www.frumforum.com/smaller-bailed-out-banks-still-in-trouble

“Pro Publica has been maintaining a list of bailout recipients, updating the amount lent versus what was repaid.

So far, 938 Recipients have had $607,822,512,238 dollars committed to them, with $553,918,968,267 disbursed. Of that $554b disbursed, less than half — $220,782,546,084 — has been returned.

Whenever you hear pronunciations of how much money the TARP is making, check back and look at this list. It shows the TARP is deeply underwater.”

http://bailout.propublica.org/list

I’m confused. Zero tells us that the financial crisis is over. Am I supposed to believe Zero or my lying eyes? Happy New Year, BTW.

hey...

have you got a link to that post?

I don’t trust that lying Kenyan I trust facts.

Thank You HAPPY NEW YEAR TO YOU AS WELL AND ALL FREEPERS!

New threat?? That’s like saying Islam is a new threat. This threat is at least several years old.

Guess if they didn’t add the word “new” it would have been a bit less sensational.

Sorry, I was unable to capture the link that didn't demand a registration.

The FDIC is deeply involved in covering up the bank insolvency—because they don’t have the cash to close the insolvent banks.

The FDIC has not covered up for Village Bank of Virginia. They are in deep.

But hey, the recession ended 18 months ago. All is well in Barry Soetoro Village.

Do you mean the main article from FT? If you are a subscriber the link for this story should work if not you can type in the title on Google search and click the first article and you can read it all that way.

Type below into Google

Commercial property loans pose new threat

“The FDIC is deeply involved in covering up the bank insolvency—because they don’t have the cash to close the insolvent banks.”

Yes and eventually it won’t be able to be as the article calls it “swept under the rug”

Commercial property default rate rises

http://www.bizjournals.com/kansascity/news/2010/11/30/commercial-property-default-rate-rises.html

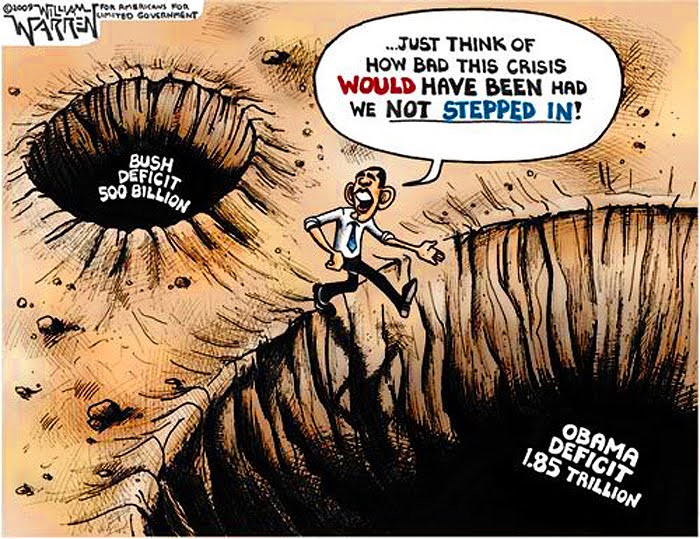

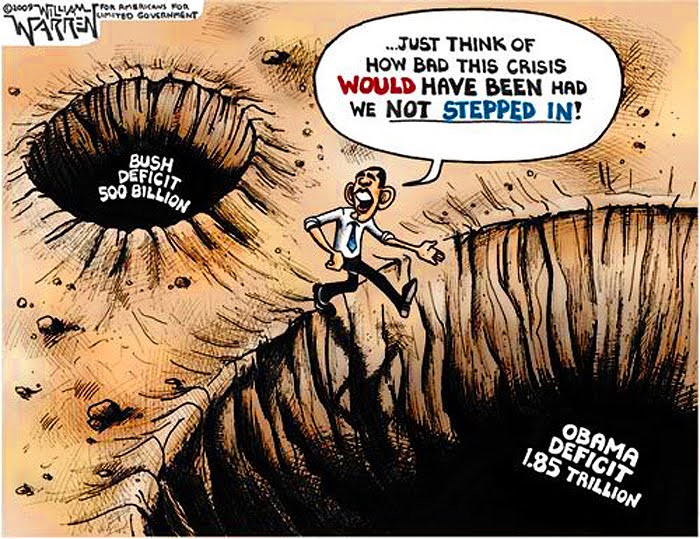

Great cartoon. Its true unfortunately.

I knew you were being sarcastic sorry I didn’t mean to come across like that to you, it’s my disdain for him. I do the same thing change the channel the sound of his voice is like the scraping of finger nails on a chalkboard to my ears unbearable.

I think all of us here, except the Trolls, have absolutely no use for this fool and his clowns. The upside to the Obozo Administration is that millions of people now realize that they were duped. May the Lord bless you and your family this New Year!

Commercial real estate has been overpriced for a long time. Many businesses fail because of high flooring costs. Not only that, but zoning ordinances against manufacturing in rural areas are wrong. If you want revenues, get rid of those zoning ordinances.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.