Skip to comments.

Gold Bears Are Wrong, Smart Money Isn't Selling

Minyanville ^

| 07/27/2010

| Toby Connor

Posted on 07/28/2010 7:01:18 AM PDT by SeekAndFind

Last week I was told that we were going to see more gold weakness in the days ahead because big money had to sell their positions. Folks, smart big-money traders don’t sell into weakness. These kinds of investors don’t think like the typical retail investor who's forever trying to avoid drawdowns. Big-money investors take positions based on fundamentals and then continually buy dips until the fundamentals reverse. The fundamentals haven’t reversed for gold so I’m confident in saying that smart money isn’t selling its gold, it's using this dip to accumulate.

With that being said, there are times when big money will sell into the market and it's why technical analysis, as used by retail traders, often doesn’t work. They sell into the market to accumulate positions. Let me explain.

When a large fund wants to buy, it can’t just simply start buying stock like you or I would. Doing so would run the market up, causing it to fill at higher and higher prices. Unlike the average retail trader, smart money attempts to buy into weakness and sell into strength (buy low, sell high). In order to buy the kind of size it needs without moving the market against itself, a large trader needs very liquid conditions. Ask yourself, when do those kind of conditions exist? They happen when markets break technical levels.

If big money is selling it's because it's trying to push the market below a significant technical level so all the technicians will puke up their shares. By running an important technical level it can cause a ton of sell stops to activate, allowing it to accumulate a large position without moving the market against itself in the process. We saw this very thing happen in the oil market recently and also in February as gold bottomed.

Technical traders wrongly assume these breaks are continuation patterns but the reality is that very often they're just smart money “playing” the technical crowd so they can enter large positions. The key to watch for is an immediate reversal of a technical break. When that happens you know there was someone in the market buying when everyone else was selling. Nine times out of 10 it was smart money.

At that moment everyone is jumping on the bear side for gold. Remember we saw this exact same sentiment in the stock market three weeks ago. I knew the bears were going to be wrong simply because the market was way too late in the intermediate cycle for there to be enough time left for a significant decline.

The gold bears are going to be wrong also and for the exact same reason. It's just too late in the intermediate cycle for there to be enough time left for anything other than a minor decline.

The reason, of course, is that gold is still in a secular bull market. In bull markets you buy dips.

Also, the dollar, with the break below 82 this morning, is starting to show signs that it's now in the clutches of the three-year cycle decline. Every Gold C-wave so far in this 10-year bull market has corresponded to a major leg down in the dollar. I'm confident this C-wave will inversely track the dollar’s move into that major cycle low due early next year.

Sentiment wise, gold has now reached levels more bearish than at the February bottom. That means gold is at risk of running out of sellers.

Finally, and most importantly, it's simply too late in the intermediate cycle for gold to have enough time for a significant drop. This is the 25th week of the cycle and the intermediate cycle rarely lasts more than 25 weeks. That puts the odds heavily in favor of a major bottom either sometime this week or next. And don't forget, gold is about to move into the strong demand season. Like clockwork, gold invariably puts in a major bottom in July or August before the run up into the strong fall season.

The bears are going to be wrong again.

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: bearmarket; bullmarket; gold; inflation

Navigation: use the links below to view more comments.

first 1-20, 21 next last

To: SeekAndFind

I didn't buy gold as an "investment," so I could care less what the price fluctuates to day by day. When the bottom drops out, and all the indicators are there (

The Patriot's Flag - Links to "The Meltdown") ... then gold won't even have a "price" because the dollar will be meaningless.

2

posted on

07/28/2010 7:05:42 AM PDT

by

ThePatriotsFlag

(http://www.thepatriotsflag.com - The Patriot's Flag)

To: SeekAndFind

Gold is highly manipulated just like everything else so the big guys can make profits.

3

posted on

07/28/2010 7:13:22 AM PDT

by

mountainlion

(concerned conservative.)

To: SeekAndFind

Much of this analysis assumes, IMHO perversely, that traditional investing assumptions have not changed. Of course, they have and are continuing to evolve. Anybody who claims they know what is happening and what will be happening down the road, is simply selling snake oil. Tying gold to anything the dollar may or may not be doing is like predicting demand for oranges on demand for apples.

The dollar has no intrinsic value. Of course, precious metals do. Certainly the price of gold may decline, but it will never be zero. The dollar, relatively effortlessly, will not be worth the paper its printed on.

I’m always amused at those people who have an almost pathological fear of precious metal investment.

4

posted on

07/28/2010 7:23:03 AM PDT

by

dools007

To: SeekAndFind

Never buy gold on the advice of someone wiling to sell you his.

The time to buy is when you STOP hearing all those commericals on the radio

I missed taking my own advice when it fell to 262 some years ago (7 or 8)....grrrrrrrrrrrrrrrrrrrrrrr and i had cash too

5

posted on

07/28/2010 7:26:32 AM PDT

by

Mr. K

(Physically unable to proofreed (<---oops! see?))

To: SeekAndFind

Bookmark for later reading

6

posted on

07/28/2010 7:26:32 AM PDT

by

patriot preacher

(To be a good American Citizen and a Christian IS NOT a contradiction. (www.mygration.blogspot.com))

To: SeekAndFind; TigerLikesRooster; FromLori; blam; dennisw; Southack; Travis McGee; jiggyboy; ...

Last week I was told that we were going to see more gold weakness in the days ahead because big money had to sell their positions. Someone wake me up when China and India begin selling their megatons.

Until that happens, it can't be said that "big money" is selling Au.

7

posted on

07/28/2010 7:27:49 AM PDT

by

AAABEST

(Et lux in tenebris lucet: et tenebrae eam non comprehenderunt)

To: SeekAndFind

I want to make sure that I throw it out there just so everyone knows, YOU CAN’T EAT GOLD.

8

posted on

07/28/2010 7:47:03 AM PDT

by

FightThePower!

(Fight the powers that be!)

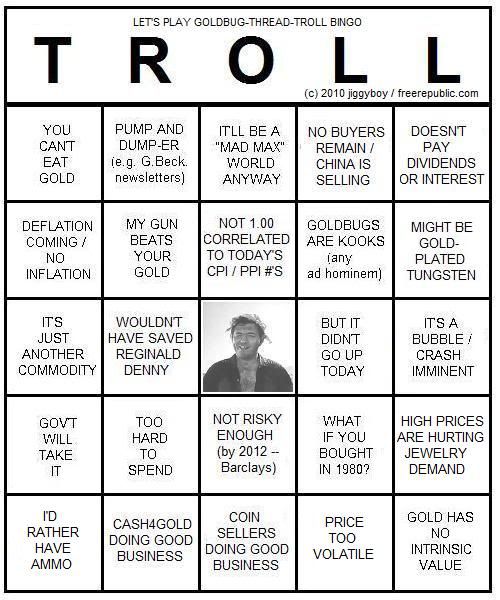

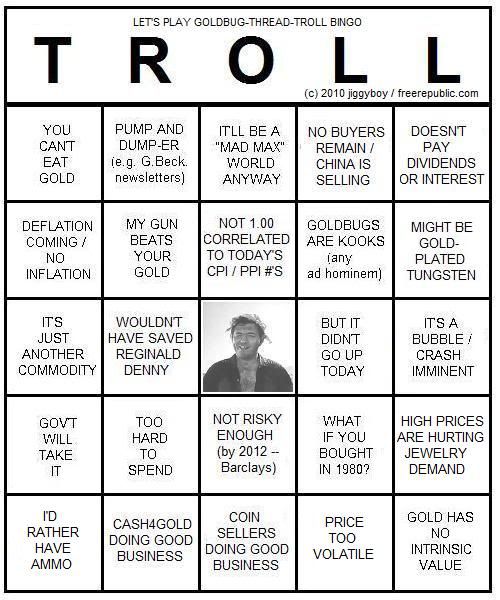

To: jiggyboy

We need your bingo card please.............

9

posted on

07/28/2010 7:49:20 AM PDT

by

OB1kNOb

(When all else fails one must, "Release the Kraken!")

To: AAABEST

I think gold is entering a bearish phase similar to when it hit lows ($750 etc) from September 2008 to March 2009 during that deflationary phase. Deflation hurts gold unless the deflation is so spooky that people are worried about a currency collapse of the US dollar on FOREX markets or that people are worried about a currency recall along with issuance of a new currency. Then you could have a gold rush despite deflation. The gold market is very small (worth five billion or so) so it can easily spike upwards due to panic buying

I'm not seeing US inflation today. We are going into deflation so gold will deflate and silver go down even more which it already has. Gold is down $90 from the high of $1262 just 6-7 weeks ago (?).....I'm sure silver is down more on a percentage basis

10

posted on

07/28/2010 8:09:47 AM PDT

by

dennisw

(Sarah McLachlan in 2012)

To: SeekAndFind

"If big money is selling it's because it's trying to push the market below a significant technical level "

Yeh, right, selling because it attempts to influence the market. And, according to this conspiracy theorist, all institutional investors are technical traders. What an idiot.

11

posted on

07/28/2010 8:33:12 AM PDT

by

TopQuark

To: FightThePower!

Last I looked you can't eat dollar bills either. At least with gold, you can use it for other purposes (like jewelry or for teeth, etc.)

To: Mr. K; jiggyboy

Never buy gold on the advice of someone wiling to sell you his.

That’s a pithy variant of an absurd anti-gold cliche.

It’s absurdity is revealed when you substitute any other goods or investment for “gold.”

Retailers retail. They encourage others to buy. But they’re not selling their investments, they are in a continual process of buying and selling, and making money on the spread (mark-up), not on market fluctuations.

On the other hand, I don’[t buy shoes based on the advice of Nordstrom salesmen. I buy them because I need them on my feet, and they are comfortable, durable, and a good value compared to alternatives.

So I guess you statement has nothing against gold, only against those (you imagine) who are buying for no other reason than that a retailer tells them too.

Of course, when someone raises alarm over a dubious scenarios that probably doesn’t exist, in order to discredit others, we call that “straw-man rhetoric.”

13

posted on

07/28/2010 9:01:05 AM PDT

by

Atlas Sneezed

(Anything worth doing, is worth doing badly at first.)

To: Beelzebubba

If the person was making and selling gold for a profit, i would buy from him

but when someone has a handul of gold and wants to sell it to you because he tells you it will go up in price, it is not ‘pithy’ to wonder why doesnt he keep it hisself

I have been tracking this stuff for 20 years. when all the commericals appear on the radio to ‘buy gold now’ the price soon goes down.

14

posted on

07/28/2010 10:52:01 AM PDT

by

Mr. K

(Physically unable to proofreed (<---oops! see?))

To: Beelzebubba

And reatailers dont sell you shoes promising you that they will be worth more later.

15

posted on

07/28/2010 10:54:01 AM PDT

by

Mr. K

(Physically unable to proofreed (<---oops! see?))

To: Mr. K

Like Beelzabubba has already said, gold retailers make money on the spread, not by holding onto gold for years in the hope that it will go up, that is what investors do. The business models for buying and selling gold as a dealer and buying and selling gold as an investor (especially a retail investor) are very different..

To: Mr. K

If all I knew was the guy who wanted to sell told me, I guess I agree with you, and would want to hear that he was selling not as an investment, but because he needed the cash for something else.

17

posted on

07/28/2010 2:52:03 PM PDT

by

Atlas Sneezed

(Anything worth doing, is worth doing badly at first.)

To: Mr. K

No, but every single investment retailer does.

18

posted on

07/28/2010 2:53:39 PM PDT

by

Atlas Sneezed

(Anything worth doing, is worth doing badly at first.)

To: PA Engineer; blam; TigerLikesRooster; Cheap_Hessian; CJinVA; Jet Jaguar; OneLoyalAmerican; ...

Better-late-than-never Goldbug ping

By request, it looks like it's time for another round of...

Mail me to get on or off the Free Republic Goldbug Ping List.

Mail me to get on or off the Free Republic Goldbug Ping List.

19

posted on

07/29/2010 10:38:03 PM PDT

by

jiggyboy

(Ten per cent of poll respondents are either lying or insane)

To: SeekAndFind

20

posted on

07/30/2010 4:22:25 AM PDT

by

blam

Navigation: use the links below to view more comments.

first 1-20, 21 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Mail me to get on or off the Free Republic Goldbug Ping List.

Mail me to get on or off the Free Republic Goldbug Ping List.