Posted on 06/07/2010 7:40:17 PM PDT by blam

Arthur Laffer Is So Full Of It -- Here's What Tax Cuts Really Do To The Economy

Asha Bangalore, Northern Trust

Jun. 7, 2010, 9:20 PM

In the post below, Asha Bangalore of Northern Trust responds to Art Laffer's WSJ op-ed demanding more tax cuts. The title above, of course, is ours (Asha's far too professional and polite for a title like that). Asha's title is "Missing Elements" of Mr. Laffer's Incomplete Story.

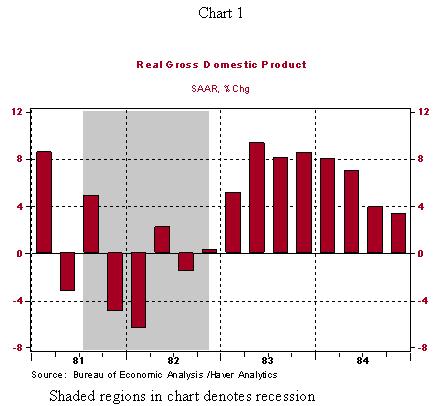

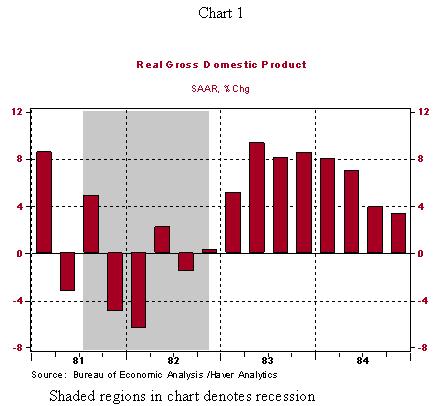

Mr. Laffer illustrates his arguments about tax cuts and the positive impact on economic growth with the Reagan tax cut experience (see chart 1, replication of chart in Mr. Laffer's article) in today's Wall Street Journal (Arthur Laffer: Tax Hikes and the 2011 Economic Collapse - WSJ.com) and he predicts a dire economic situation if the Bush tax cuts are allowed to expire at the close of 2010.

Stepping forward from Laffer's utopic economic era, why did the economy post noticeable growth after tax increases were implemented in 1993? The recession ended in March 1991 and the banking system was beset with issues, which delayed the robust recovery until later. A revival of bank lending led to the self-sustained growth witnessed despite the tax increases instituted in 1993 by the Clinton administration. If Laffer's thesis about tax cuts is valid, why did the U.S. economy record the weakest period of economic expansion following the Bush tax cuts of 2001 and 2003? The evidence from tax cuts is essentially not as strong as Mr. Laffer's leads the reader to believe...

[snip]

(Excerpt) Read more at businessinsider.com ...

Me too.

9/11 mean anything to these fools?

9/11? Whuzat?

Of course this is correct.

We should tax at 100% then everything would be perfect.

Just think how prosperous we would be.

So we were all told that Bush was a buffoon for telling people to spend after 911 . . . when are we going to be told by the MSM that Obama is a fool for -in light of the spill in the gulf- telling people to go to the beach

Two words: WELFARE REFORM. The biggest cuts in Government Spending in the last 50 years occurred because of WELFARE REFORM, this has been well documented.

This is what happens when you ask someone who barely speaks f'ing english (Asha Bangalore) to analyze the American economy and our economic models. This guy's a moron.

Northern Trust actually employs this idiot? They actually are a well managed company but they are HQ’ed in.... Chicago.

September 11th, 2001. That's why. Asha, you're a complete moron.

I’m a 14th generation white American capitalist...I don’t take instruction from an Indian....on economics, or anything else.

Uh, could it be that the Democrats and RINOs spent all the new revenue and then borrowed more?

Northern Trust does a great job with my folk’s money, but they do have a vested interest in high taxes, since high taxes mean that people need help structuring their assets to minimize taxes.

But hey, 2011 isn't that far away, so we shall see.

The 1993 tax cut came just at the start of the computer revolution. The economy grew despite it because there was a whole new sector added to the economy.

Remove the tech boom and bubba would of been a one term bust.

Obama told people to go to the beach??!!

What’s he trying to do, kill us??

“If Laffer’s thesis about tax cuts is valid, why did the U.S. economy record the weakest period of economic expansion following the Bush tax cuts of 2001 and 2003?”

1. The BILLIONS of dollars of cost associated with the attacks of 9/11.

2. A 2 front war in the middle east.

3. Hurricane Katrina (and Ivin and several others in the early 2000s that devestated the Gulf Coast).

4. Doubling of oil prices.

5. Bailout of the banking scoundrels.

6. Being overun by illegal aliens.

Need I go on?

Correct. One of the few trust companies that has good returns. Bessemer Trust is another.

DING DING DING! No more calls folks, we have a winner.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.