Skip to comments.

Atlas Vacant - The Commercial Real Estate Bust

mybudget360.com ^

Posted on 07/30/2009 8:49:07 AM PDT by Kartographer

The commercial real estate bust is going to be legendary. We are talking trillions of dollars. The attention of Americans is being pulled away by massive market volatility that has seen the S&P 500 shoot up 44 percent in four months. Yet the U.S. Treasury and Federal Reserve have kept their eye on this market and have started examining a “Plan C” focused on bailing out this industry even before major problems occur. The new preemptive doctrine of bailouts. That is, they want to saddle the taxpayer with further burdens on some of the most speculative bets known to humankind.

(Excerpt) Read more at mybudget360.com ...

TOPICS: Business/Economy

KEYWORDS: bubblebrust; thecomingdepression

Some VERY scary graphs here

To: Kartographer

The vacancy rates in 2003 and 2004 were still quite a bit higher than today, but the trend is alarming.

Check out Marc Narosny’s comment. Starts out coherently and then drifts into Kum Ba Yah land. Where do these people come from?

To: Kartographer

It is all a like. The Real Estate Short ETF fund (Symbol: SRS) which shorts real estate is in the tank — going DOWN. So, real estate must be about to pick up.

3

posted on

07/30/2009 9:10:14 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: Kartographer

It is all a lie (spelling?). The Real Estate Short ETF fund (Symbol: SRS) which shorts real estate is in the tank — going DOWN. So, real estate must be about to pick up.

4

posted on

07/30/2009 9:10:32 AM PDT

by

MeneMeneTekelUpharsin

(Freedom is the freedom to discipline yourself so others don't have to do it for you.)

To: RightInEastLansing

The vacancy rates posted in the first graph are high, but not terribly out of line. Some of these graphs are misleading because the y-axis isn't set to a proper scale. If the vacancy rate goes from 10% to 15% and you're only showing 0% to 20% on the y-axis of your graph, then yes -- the change will look alarming.

From a personal standpoint, I think a 15% office vacancy rate is the "norm" over the long term. If I own a million square feet of office space in multiple markets across the U.S., then I would expect 15% of the space to be vacant at any given time. And if I owned a single office unit in a small building that cannot be subdivided, then I would expect it to be vacant about 15% of the time.

Having said that, I do believe we're in for some serious consolidation in the commercial real estate market . . . not because the vacancy rate is high, but because for a lot of properties the high vacancy rate is affecting commercial real estate that had been overpriced when purchased or built in the first place.

5

posted on

07/30/2009 9:19:41 AM PDT

by

Alberta's Child

(God is great, beer is good . . . and people are crazy.)

To: Kartographer

6

posted on

07/30/2009 9:20:29 AM PDT

by

SueRae

To: Kartographer

7

posted on

07/30/2009 9:20:59 AM PDT

by

mr_hammer

(“Gold is the money of kings, silver is the money of gentlemen, debt is the money of slavery)

To: Kartographer

If things get bad they will get bad after Christmas shoping. If consumers are not spending big this Christmas, lots of retailers will fail.

8

posted on

07/30/2009 9:26:19 AM PDT

by

jpsb

To: MeneMeneTekelUpharsin

The Real Estate Short ETF fund (Symbol: SRS) which shorts real estate is in the tank — going DOWN. So, real estate must be about to pick up. ProShares "ultrashorts" do not actually short, but use derivatives and leverage to simulate a larger short. This has high expenses which I think are taken out by diluting the stock. So even if you are right about the direction of the underlying securities, you can lose money. If you think real estate is going up, shorting this ultrashort is a good way to play it because the expenses then work in your favor.

9

posted on

07/30/2009 9:29:53 AM PDT

by

Reeses

(Leftism is powered by the evil force of envy.)

To: Kartographer

Some VERY scary graphs here

Here are some more:

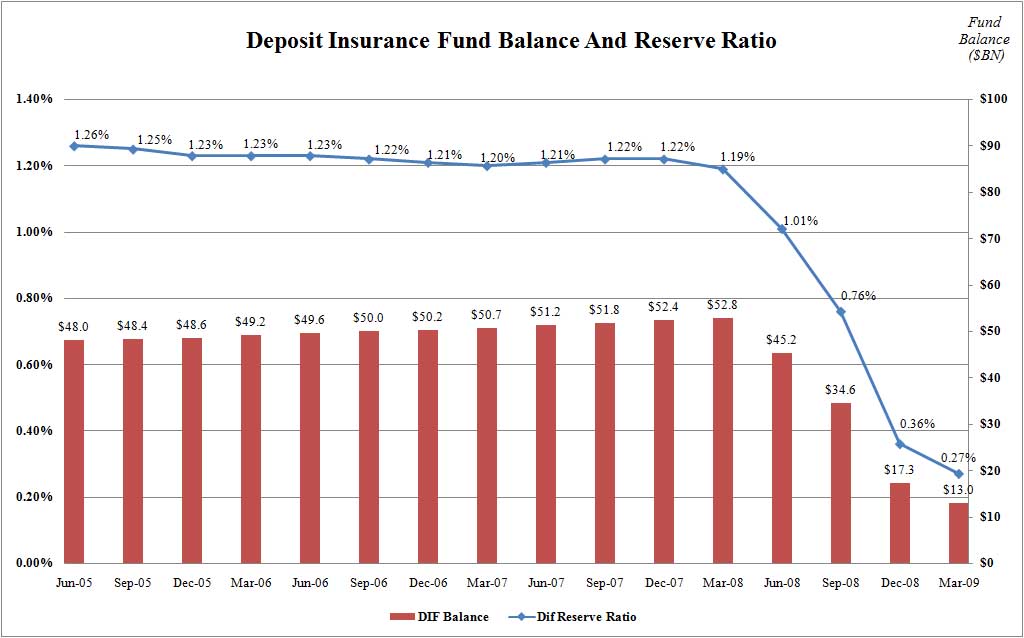

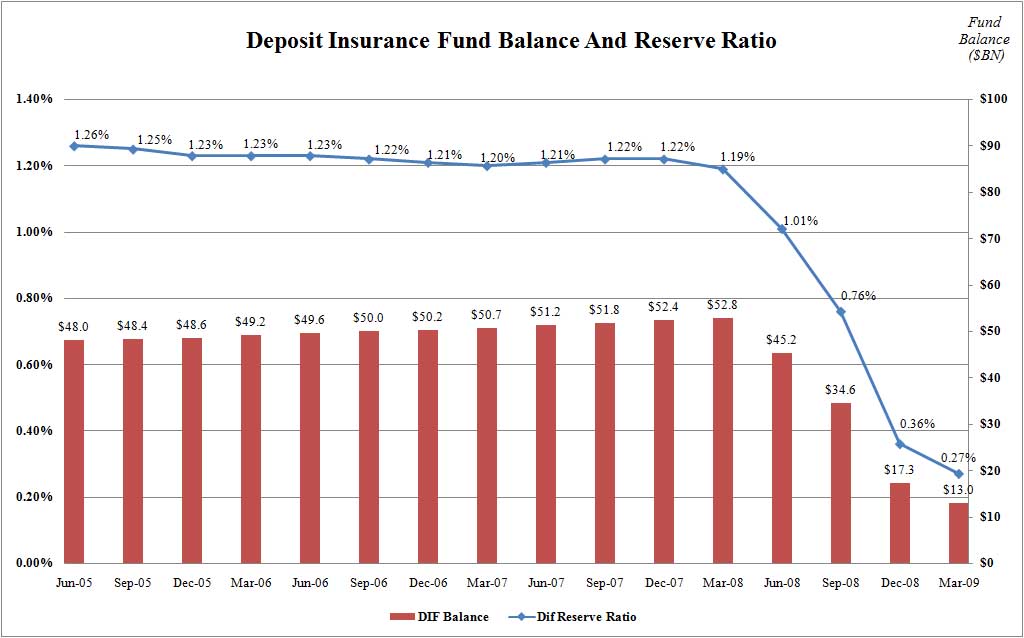

Within months, the Second wave of foreclosures will start kicking in, while the FDIC Deposit Insurance will have dried up because the public does NOT want more Bailouts, as inflation starts to spike due to piles of HARD cash sitting in the Federal Reserves (and the Treasury needing to increase bond interest rates to attract 5- to 30-year-bond buyers)...

$300 Billion in Foreclosures since October; $1.4 Trillion between now and Fall 2012 ...

Most likely, the FDIC Deposit Insurance funds have dried up since Mar 09 -- it just hasn't been disclosed to the public yet...

The US Treasury is printing money like mad, and the public wants NO MORE BAILOUTs.

10

posted on

07/30/2009 9:34:58 AM PDT

by

BP2

(I think, therefore I'm a conservative)

To: Kartographer

“they want to saddle the taxpayer with further burdens on some of the most speculative bets known to humankind.”

What with!!??!

11

posted on

07/30/2009 9:40:37 AM PDT

by

Slimey

To: BP2

Many adjustable rate mortgages are resetting all right: to a lower interest rate. Some borrowers are looking forward to a reset. The commercial borrowers are in more serious trouble though because their loans expire with balloon payments due.

12

posted on

07/30/2009 10:21:02 AM PDT

by

Reeses

(Leftism is powered by the evil force of envy.)

To: Reeses

The Treasury is having a hard time selling notes — there was a story that they had hard time selling 5-year-notes just yesterday.

To make the sale of notes more enticing to the big investors, the Treasury admitted yesterday they will probably have to increase interest rates on those notes, which increases the interest rate to borrowers here in the US.

That, of course, affects refi’s. If you don’t have enough equity toward a down payment, or the cash on hand, refinancing isn’t really an option — most of the upcoming foreclosures are Alt-A and Option-ARM borrowers.

Unemployment at 9.5% (and rising) isn’t helping either ...

13

posted on

07/30/2009 11:02:37 AM PDT

by

BP2

(I think, therefore I'm a conservative)

To: Kartographer

I’m closing on my Kentucky rural property next week. I am wierded out by my feelings that I may be too late. If it get’s to closing I have effectively crossed the finish line.

14

posted on

07/30/2009 11:04:25 AM PDT

by

RobRoy

(This too will pass. But it will hurt like a you know what.)

To: MeneMeneTekelUpharsin

You’ve started editing posts the same way I do now: Just repost with changes... :)

15

posted on

07/30/2009 11:05:51 AM PDT

by

RobRoy

(This too will pass. But it will hurt like a you know what.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson