Skip to comments.

FDIC Chief Raps Rescue for Helping Banks Over Homeowners

Wall Street Journal ^

| 10/16/08

| Damian Paletta

Posted on 10/15/2008 9:00:41 PM PDT by marshmallow

WASHINGTON -- Federal Deposit Insurance Corp. Chairman Sheila Bair on Wednesday criticized the federal government for failing to take more aggressive steps to prevent Americans from losing their homes, highlighting a rift between her and other senior U.S. officials over terms of the $700 billion rescue package.

The government plan will help stabilize financial markets but it doesn't do enough to address home foreclosures, the root of the crisis, she said in an interview with The Wall Street Journal.

"Why there's been such a political focus on making sure we're not unduly helping borrowers but then we're providing all this massive assistance at the institutional level, I don't understand it," she said. "It's been a frustration for me."

Ms. Bair didn't single out government officials or leaders, but her criticisms brushed on decisions made by both the Bush administration and Congress. For example, she described painstaking efforts made by lawmakers in crafting the federal Hope for Homeowners program to make sure it limited resale profits for borrowers who received affordable home loans.

(Excerpt) Read more at online.wsj.com ...

TOPICS: Business/Economy; News/Current Events

KEYWORDS: civilservants; fanniemae; fdic; fraud; freddiemac; sheilabair

To: marshmallow

Well, somebody's got to pick your socialist poison for you.

I have two young'uns who could use the help, but both of them recognize that they threw the dice and came up craps.

My heart goes out, because all they wanted was a house for their family. But they chose, not wisely.

We'll see if there is a cavalry on the horizon.

2

posted on

10/15/2008 9:05:23 PM PDT

by

Chaguito

To: marshmallow

Today Barney Frank again defended against ACORN/CRA reform.

The market crashed.

Coincidence?

It's not hard for the rest of the world to see we have pumped over a Trillion Dollars into a system that has no desire for reform.

Nobody did anything wrong.

Do you have to be a completely corrupt, mentally-ill dumbass to join the DC crowd?

3

posted on

10/15/2008 9:17:32 PM PDT

by

FlyVet

To: marshmallow

>One of the things we need to do is slow down foreclosures,” he said. “The chairman of the FDIC, who has to pick up a lot of the pieces when banks fail, is certainly entitled to make such a statement.”

how do you slow down foreclosures when some cannot afford the house?

or, now with the unemployment rate going up, one loses a job?

the job search will be longer than usual.

4

posted on

10/15/2008 9:19:30 PM PDT

by

ken21

(people die and you never hear from them again.)

To: marshmallow

Last week the Seattle Times had a story about foreclosure auctions, and discussed a 3 BR 1 bath home that had been foreclosed for $495,000. They were offering it at a $150,000 discount, and there were no takers.

Obviously that market has a lot of adjusting to do, but the point is there are a lot of houses like that all over the Country. Imagine having 20-30 empty houses in your immediate neighborhood.

McCain nailed it tonight when he said that you don’t benefit if your neighbor’s house is sitting vacant. But until all of those vacant houses sell to someone who can afford to pay a reasonable mortgage on it, this crisis will not end. And the fact is that banks are the ones who are holding those defaulted and foreclosed mortgages, and they have to find some way to properly re-value those homes and get them re-sold.

There is nothing in this package for this homeowner, because I and the vast majority of other homeowners are in a stable 30-year mortgage at a reasonable interest rate. We’re sitting on equity in the mid 30% range, as opposed to an ARM mortgage for 125% of the value of an overpriced house.

McCain also said tonight in his opening remarks that homeowners are all victims of Wall Street greed and inaction by Congress. That may be partially true, but many Americans are the victims of their own greed, and they ignored the risks when they signed those mortgages...

5

posted on

10/15/2008 9:51:26 PM PDT

by

Bean Counter

(Stout Hearts.....)

To: marshmallow

This is the same bimbo that seized Wamu and gave it to JPmorgan a couple weeks ago wiping out billions from investors.

6

posted on

10/15/2008 10:25:53 PM PDT

by

Proud_USA_Republican

(We're going to take things away from you on behalf of the common good. - Hillary Clinton)

To: marshmallow

The government plan will help stabilize financial markets but

it doesn't do enough to address home foreclosures, the root of

the crisis, she said in an interview with The Wall Street Journal.

Funny, Ms. Bair was all sweetness and light when she spoke today

at The Bernanke Dog-And-Pony Show.

If she's really ticked...time to resign.

I'm sure she'll get plenty of love for doing her part to elect

Lord Obama.

7

posted on

10/15/2008 10:32:02 PM PDT

by

VOA

To: marshmallow

Meanwhile McCain is in full pander mode demanding we do everything possible to increase home prices again. Home prices are still very very inflated over historical norms, nothing is going to increase home prices but a full recession/expansion economic cycle.

Please read the entire blog post at Housing: It's about prices ...

--------------

"Our economy and our markets will not recover until the bulk of this housing correction is behind us."

Treasury Secretary Hank Paulson, Sept 7, 2008

So when will the "bulk of this housing correction" be behind us? Right now prices are still too high.

Here are a few ways to look at house prices: real prices (inflation adjusted), price-to-rent ratio, and price-to-income ratio.

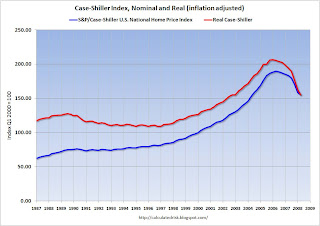

The first graph compares real and nominal Case-Shiller Home Prices through Q2 2008 (real is current index adjusted using CPI less Shelter).

Click on graph for larger image in new window.

Click on graph for larger image in new window.

In real terms (red line), the Case-Shiller National Home price index is off 25% from the peak. Real prices are now back to the Q4 2002 level (nominal prices are back to mid-2004).

This suggests real prices, based on the Case-Shiller index, could fall substantially, perhaps 15% to maybe even 30% more. This decline would probably be some combination of falling nominal prices and more inflation. And prices could definitely overshoot to the downside.

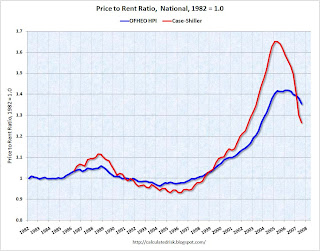

The second graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used. This graph is from this earlier post.

The second graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used. This graph is from this earlier post.

8

posted on

10/16/2008 12:31:43 AM PDT

by

JerseyHighlander

(Obama wants to raise taxes and kill babies. Palin wants to raise babies and kill taxes.)

To: marshmallow

From today’s NYTimes:

http://www.nytimes.com/2008/10/16/business/economy/16housing.html?_r=1&oref=login

“One reliable proxy of housing values — the ratio of home prices to rents — indicates that in many cities prices are still too high relative to historical norms.

In Miami, for instance, home prices are about 22 times annual rents, according to analysis by Moody’s Economy.com. The average figure for the last 20 years is just 15 times annual rents. The difference between those two numbers suggests that a home valued at $500,000 today might be worth only $341,000 based on the long-term relationship between prices and rents.”

9

posted on

10/16/2008 12:36:07 AM PDT

by

JerseyHighlander

(Obama wants to raise taxes and kill babies. Palin wants to raise babies and kill taxes.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Click on graph for larger image in new window.

The second graph shows the price to rent ratio (Dec 1982 = 1.0) for both the OFHEO House Price Index and the Case-Shiller National Home Price Index. For rents, the national Owners' Equivalent Rent from the BLS is used. This graph is from this earlier post.