Posted on 08/05/2008 7:21:49 PM PDT by TigerLikesRooster

Everybody Gets a Trophy

Economic perils of the Nanny State

BY TONY ALLISON

Let me take you to a magical land called NannyState, where once upon a time everyone was happy, inflation was low and real estate always went up. Or did. Times are a’ changing in NannyState and all is not well.

Everyone was elated in NannyState in 2002-2006, because real estate really went up. Way up. There was no need to sacrifice or save because you could buy a home with no money down. Everyone could enjoy the American Dream! In fact, banks offered a 125% loan so you could upgrade the house and take a nice vacation. Everyone deserved the opportunity to buy McMansions and drive Hummers. NannyState made sure interest rates were low, and inflation was “under control” and money was plentiful. Life was great!

False Facades

Unfortunately, those years were much like visiting a Hollywood western movie set. It was an economy of false facades propped up by a few 2x4’s behind the scenes. The decades of misallocations, distortions and bubbles were beginning to take a toll. However, NannyState still wants desperately to keep up appearances. High interest rates are mean-spirited. So is inflation. If it can keep the inflation figures low (even if they are fudged), everyone will feel better.

NannyState believes the public can’t deal with hard times and must be continually lied to in order to preserve a false prosperity. The truth is slowly dawning on some citizens anyway, and they are not amused.

A Growth Industry

If everyone is going to be able to get a trophy, then continued growth is a necessity. More government jobs are created every year in NannyState. It doesn’t produce anything that will add to the nation’s wealth, so it diligently issues more rules, laws, regulations and programs to justify its existence and create the need to hire more government workers. It is a very successful growth industry and its prospects look bright for continued growth in the future. NannyState is insatiable.

Bailouts R Us

NannyState seeks more control over the economy. Although charged with the good intentions, it constantly interferes with the self-correcting mechanisms that make a free market economy dynamic and productive. But the ends justify the means because it would never want to endanger the self-esteem of millions of registered voters.

Bailouts of Fannie Mae, Freddie Mac and Bear Stearns, as well as stimulus checks and housing bills are all part of the NannyState vision for the future. Trophies for everyone! Unfortunately, NannyState doesn’t produce anything (except inflation). It can only give everyone a trophy until the till is empty, or keep printing money until the cost of trophies, and everything else, is through the roof. The odds favor the latter scenario.

The Central Bank of NannyState is at the center of the problem. By printing money in increasing amounts and throwing it at every economic hiccup for the last twenty years, they created imbalances and bubbles. When the bubbles popped more money was printed to “paper over” the resultant mess. So by wanting to cushion the blow of the downside of the business cycle, the NannyState central bank, buckling under intense political pressure, has made the imbalances and dislocations much worse. Fixing the mess will be the job of future politicians and central bankers. Most of the current group will be in comfortable retirement when the real heavy lifting is necessary.

Trillions in Future Promises

The great NannyState safety net is looking a little stressed-out. It has promised to pay over $50 trillion in future decades (unfunded mandates) for Medicare and Social Security costs. This number is subject to rise considerably in the future as inflation devalues NannyState dollars. Unfortunately, it has no idea how it will pay for these programs, but perhaps taxing the “rich” their fair share and making greedy oil companies return some of their obscene profits would be a good start. As for the rest of the money, well, the NannyState dollar is the reserve currency of the world. So it can just print the money and give it to everyone who needs it, right?

The Tipping Point

Alas, NannyState sometimes forgets that Joe Citizen has been paying Social Security and Medicare taxes for years, or even decades. But it needed that money for other programs and trophies. That money is gone. NannyState has an issue with balancing its checkbook. It can’t.

Eventually when too many people either work for NannyState or rely on it for their survival, a tipping point will be reached. It wants to grow ever larger, but its engine (taxpayers and the private sector) will eventually be too small to move its enormous girth. It may ultimately collapse under its own weight. Since NannyState borrows over $2 billion per day from foreigners to keep chugging along, the risks are growing. But it won’t grind to a halt without a fight. Printing money in unlimited amounts will keep things going for a good while.

Collective Denial

There is a collective denial between NannyState and its citizens. The people have lived the good life for decades on the back of foreign savings and the toil and sacrifice of earlier generations. Well, the party is wrapping up and denial is staring into the face of reality.

Reality is often times not pleasant, and NannyState wants to avoid unpleasant choices. It has run up a $9.5 trillion debt (soon to be higher) trying to satisfy everybody, and of course get incumbents reelected. The “leadership” of NannyState has never said “No! Enough! Stop spending and start saving!” NannyState has never been able to stop spending itself, so it figures why should it demand that its citizens do so? That would be unpleasant!

Steps to Avoid a Hangover

If the citizens of NannyState do not wish to wake up with a severe hangover after the party, there are certain steps that will likely help alleviate the discomfort.

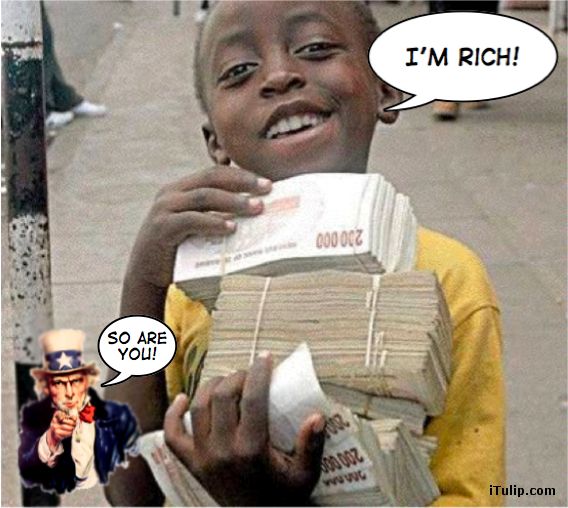

The Road to Zimbabwe

Unfortunately for NannyState, no nation in recorded history has ever been able to print, consume and govern its way to lasting prosperity. It seems unlikely that NannyState will be the first.

“The Road to Zimbabwe” is not a Bob Hope and Bing Crosby road show. Hyperinflation, even created with good intentions, is not prosperity; it is economic enslavement. And a mantle full of trophies will never buy you an ounce of freedom. In the long run, when everybody gets a trophy, everybody loses.

Today’s Market

Stocks ended lower Monday, though off earlier lows, as a slide in oil prices weighed on energy and commodities-related stocks a day ahead of the Federal Reserve's decision on interest rates.

The Dow Jones Industrial Average finished down 42.17 or 0.4%, at 11,284.15, off an earlier low of 11,221. The S&P 500 Index was down 11.30 to close at 1,249.01. The Nasdaq also ended lower, losing 25.40 to close at 2,285.56.

Crude-oil futures closed at their lowest level in three months after briefly dropping below $120 per barrel, as government data showing a spike in U.S. inflation rekindled worries about the world's largest economy and demand for oil.

Gold for December delivery dropped $9.60 to close at $907.90 an ounce on the New York Mercantile Exchange after trading as low as $903. The contract hasn't seen levels this low since June 25th.

Wishing you a good evening,

Ping!

That is the best explanation I’ve seen, simply stated in a way most folks can understand, of what’s going on.

Seriously, what does one expect when the Chairmen of the Federal Reserve’s nickname is “Helicopter Ben”. That being derived from his belief that economic problems can be solved by printing $$ and throwing it out from a helicopter. We get exactly what we deserve.

Amenping.

That explanation could be made into a whimsical musical or opera then maybe even Hollyweird might understand the issues.

Socialism works!

Everyone in Zimbabwe is a Billionaire!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.