Skip to comments.

Hidden inflation

Scripps Howard News Service ^

| 7/12/2007

| BONNIE ERBE

Posted on 07/14/2007 11:02:40 AM PDT by bruinbirdman

I usually try to be timely, but this week in this column I admit I'm way behind. I unearthed a report released more than two years ago, but which contains such informational dynamite, its contents are worth dissecting even two years hence. So here goes.

I've often wondered why inflation is so clearly rampaging well beyond levels reported by the federal government. Case in point: On a fairly regular basis I buy 10 pound bags of carrots at my local Harris Teeter grocery store. When I started buying them two summers ago, a 10-pound bag was retailing for $3.99. It is now selling for $5.99.

I'm sure each and every one of you, dear readers, has a similar story. Or many, many, many such stories. How did we get to the point where $4 isn't shocking as the tab for a cup of coffee (or a coffee drink, as renamed by Starbucks.) How is it that when regular gas drops from $3.50 per gallon to $2.85 (as it recently did at my local gas station in suburban Washington, DC) we feel as if we're getting a bargain?

I've racked my brain trying to reconcile Labor Department reports of inflation running in the 2-3 percent range, while watching as housing, food, clothing, and transportation costs rise by double digits each quarter. Is the government hiding something? I'm no conspiracy theorist, so that explanation seems not to fit.

Here's one explanation, however, that might. In January 2005, Bear Stearns issued a report on America's growing underground labor force. It said in relevant part:

"The growing extralegal system in the United States has distorted economic statistics and government budget projections. The stealth labor force has enhanced many of the economic releases that investors follow closely. Payroll numbers understate true job growth and inflation has been artificially dampened by this seemingly endless supply of low-wage workers.....Real estate prices have been boosted by the foreign population infusion. The productivity miracle may be exaggerated because the government is incorporating the output of millions of illegal immigrants but not counting their full labor input."

In other words, illegal immigration and the underground, cash economy it creates has become so powerful a force, it artificially dampens inflation rates, boosts real estate inflation (putting home ownership beyond the ken of young Americans) and reduces the wages of the average American.

Wow, that's blockbuster news. This part of the report was barely publicized when it came out two years ago. Reporters noted its finding that there are something like 20 million illegal immigrants in the United States, compared with the popularly-cited 10 million figure. A Google search on the Internet revealed references to the inflation finding in Barron's and the Wall Street Journal.

The inflation finding should have been trumpeted on the front pages of the nation's major newspapers, on cable networks and on news Web sites. Instead, it was fairly buried. Did major news outlets bury this angle fearing its contents were not politically correct? Perhaps. But the American public may be getting the message nonetheless.

The U.S. Senate recently killed President Bush's signature effort at immigration reform that would have, in essence, granted amnesty over time to those here illegally. Senators reacted to polls showing the legislation was wildly unpopular with the American public.

Perhaps the public is beginning to wake up to the U.S. environmental destruction wrought by unfettered illegal immigration. The equation is simple. More people equals more development and consumption, more pollution and less open space.

Now we have another, this time financial, equation to contemplate. Unfettered illegal immigration boosts inflation while hiding the effects from the general public. Bear Stearns' experts could be wrong. But I doubt it. By "outing" this hidden impact of illegal immigration, let's hope we build the political will to end it, or at least slow it down.

TOPICS: Business/Economy; Culture/Society; Government; News/Current Events

KEYWORDS: economics; govwatch; inflation; thedismalscience

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-95 next last

To: RipSawyer

My salary in 1982 was $200/wk. However, as an employee at the small family-run business, I was paid before the owners were (i.e., if they were paid, it was out of the funds remaining after I and the other employees had been paid).

To: ProtectOurFreedom

Good grief....don’t sound hysterical. Coins ADD UP to DOLLARS.

42

posted on

07/15/2007 5:58:37 AM PDT

by

Suzy Quzy

(Hillary in '08.....Her PHONINESS is GENUINE !!!!)

To: RipSawyer

"There are always ways to beat it."I see this was not addressed.

yitbos

43

posted on

07/15/2007 3:01:19 PM PDT

by

bruinbirdman

("Those who control language control minds." -- Ayn Rand)

To: bruinbirdman

Birdman, you said:

“My house is up 100%, my portfolio has doubled in the last 5 years. It is good to stay ahead of inflation.”

You aren’t beating inflation:

1) The money supply (M3) has doubled in the last 5 years

2) gasoline has more than doubled in the last 5 years

3) food prices have more than doubled in the last 5 years (http://money.cnn.com/2007/06/19/news/economy/commodity_prices/index.htm)

I can confidently say that prices will probably be up at least another 100% 5 years from now in 2012.

You don’t say what’s in your portfolio, but unless it’s energy and other commodities, you won’t be beating inflation for the next 5 years either. And good luck trying for another 100% appreciation on your house by 2012 too.

To: Mase

“Fortunately, the people who manage interest rates are smart enough to ignore these folks.”

A very strange statement. Would you trust the government or a cartel (the Fed) to set the prices of energy, food, labor, healthcare, etc? Or would you prefer the free market set the prices of these things? History has shown that socialism fails because centrally planned economies cannot factor in all the variables to price things correctly, the way free markets can.

What do you think the price of money is? It is called “interest rates”. Interest rates should be set by the free market, as they were before the Fed.

In addition to its central planning gig, the fed’s other main job is to “sell” the $US by understating inflation. Core or Headline, it doesn’t matter, the published inflation rates are far below reality.

To: richalessi

History has shown that socialism fails because centrally planned economies cannot factor in all the variables to price things correctly, the way free markets can.

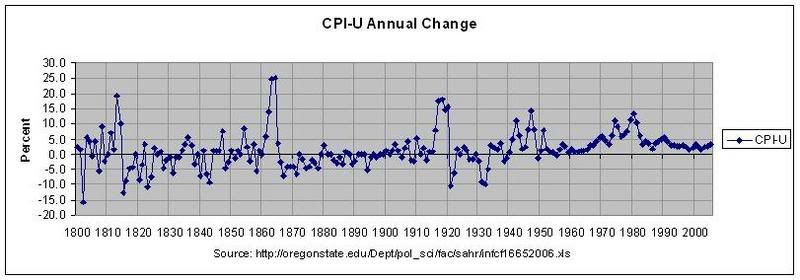

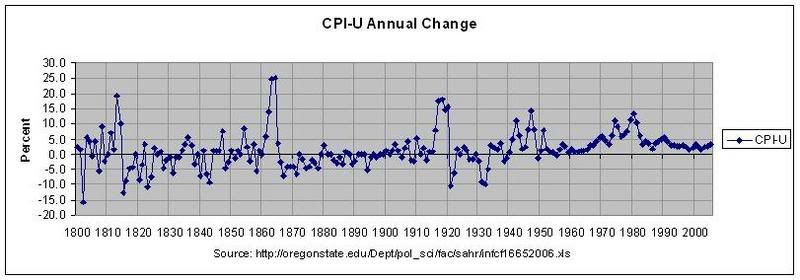

Yeah, just look at all that price stability we had under the gold standard. The Fed has done a pretty good job managing monetary policy through interest rates since 1982. That stability has helped create the environment for capital formation and innovation that has made our economy and net worth dramatically increase since.

In addition to its central planning gig, the fed’s other main job is to “sell” the $US by understating inflation. Core or Headline, it doesn’t matter, the published inflation rates are far below reality.

Is that why our the 10-year T-bill is yielding just 5%? Because inflation is so much higher than what's being reported? All those people who make money buying and selling bonds, who have access to so much information, are all, in reality, losing huge amounts of money because they don't know what the real rate of inflation is? But you do? Sorry. That horse doesn't ride.

46

posted on

07/19/2007 9:35:39 AM PDT

by

Mase

(Save me from the people who would save me from myself!)

To: richalessi

USDX .8025 yesterday. Upside resistance .8050. Next support for the dollar .72 (fairly weak). Then the next is USDX .55.

The appreciation of assets are coming out faster than they can accummulate. Unless the fED acts to raise rates, which will kill the buisness cysle, we are headed to .55. That is not a place where any of us want to be.

To: Mase

You didn’t answer my question. Do you think interest rates should be centrally managed or set by the free market?

I don’t know that commenting on tbond prices would be helpful. If you don’t think inflation is higher than 5%, you also are not likely to understand the reasons why bond rates are not higher (hint - if you want to “set” or “control” interest rates, you buy bonds to keep rates down. look at the balance sheet of the fed and see how their inventory of bonds has been piling up. they are printing money to buy these bonds - this will cause yet more inflation)

To: richalessi

You aren’t beating inflation: Maybe the people who think the rate of inflation is +15% annually don't have any idea what they're talking about.

1) The money supply (M3) has doubled in the last 5 years

Is that based on supply or demand? Is all that money staying in the US? Do you know the components of M3? Many of the components have nothing to do with the supply of money available for spending. Besides, the Fed has used interest rates, rather than money supply, to spearhead monetary policy for about 25 years now.

2) gasoline has more than doubled in the last 5 years

3) food prices have more than doubled in the last 5 years

First of all overall food prices haven't doubled over the past five years. That's nonsense. As long as the available money supply doesn't increase faster than our GDP growth there will not be inflation. People who spend more for gas and food will spend less on other things. As Friedman said: Inflation is always and everywhere a monetary phenomenon. Inflation is caused by too much money chasing after too few goods.

I can confidently say that prices will probably be up at least another 100% 5 years from now in 2012.

Based on what, you're feelings? I suppose you also know where interest rates are going. LOL

You don’t say what’s in your portfolio, but unless it’s energy and other commodities, you won’t be beating inflation for the next 5 years either.

Corporate earnings are at record highs but the only way to beat inflation is with commodities? How much food do you keep in your survival shelter?

And good luck trying for another 100% appreciation on your house by 2012 too.

If inflation increases 100% over the next five years so will value of his home. Doesn't inflation increase the value of tangible assets? Or is our imminent economic collapse going to make all assets valueless?

49

posted on

07/19/2007 9:56:12 AM PDT

by

Mase

(Save me from the people who would save me from myself!)

To: Mase

“Is that why our the 10-year T-bill is yielding just 5%? Because inflation is so much higher than what’s being reported? All those people who make money buying and selling bonds, who have access to so much information, are all, in reality, losing huge amounts of money because they don’t know what the real rate of inflation is? But you do? Sorry. That horse doesn’t ride.”

One more piece of advice for you:

Keep all your assets in cash, earning 5%. Check back with us in 5 years and see if you can purchase the same amount of energy, health care, food, higher education as you can today. You’ll then understand that central planners frequently hold “real” interest rates below the rate of inflation.

If you don’t want to wait 5 years to find out how poorly cash is holding up its purchasing power, do a thought experiment and roll back 5 years ago to 2002. If you had kept any amount of cash earning the sub-5% interest rates of the time, do you think you could buy the same amount of goods today?

To: richalessi; Toddsterpatriot

You didn’t answer my question. Do you think interest rates should be centrally managed or set by the free market? I did answer your question. If by the "free market" you mean the gold standard, you can plainly see from my chart that except for a few hiccups, the Fed has done a much better job of creating price stability (especially since '82) than we had under the gold standard. I like what works.

I don’t know that commenting on tbond prices would be helpful. If you don’t think inflation is higher than 5%, you also are not likely to understand the reasons why bond rates are not higher

You predict 100% inflation over the next five years and you think all those smart folks in the bond market are buying 10-year bonds so they can lose their asses?

(hint - if you want to “set” or “control” interest rates, you buy bonds to keep rates down. look at the balance sheet of the fed and see how their inventory of bonds has been piling up. they are printing money to buy these bonds - this will cause yet more inflation)

Again, all those people buying long term debt are doing so, oblivious to what's so obvious to you, to lose money? I think those people are a lot smarter than you give them credit. Knowing what you know must have made you a wealthy person indeed.

51

posted on

07/19/2007 10:07:12 AM PDT

by

Mase

(Save me from the people who would save me from myself!)

To: Mase

#1 (question on M3). Your questions indicate you don’t know what M3 is. Would take to long to explain, go read up on it.

#2 (food prices). Your implied definition of inflation is actually correct, which is why I’m surprised you missed the point. Inflation is in fact the growth of money over and above the growth of goods and services (GDP). Now, if we know M3 is growing at GREATER than 10%, but GDP is quoted as 2-3%, then we know by definition that there is inflation.

#3 (prices up another 100% in 5 years) - see comments on #2. All that money that is being printed and is currently being held outside the US will come home (examples: China sinking $3billion into hedge funds) and will drive up prices.

#4 (housing) - housing is deteriorating because the “monthly payment consumer” is not able to make the payments on his ARM loan. Defaults are increasing drastically - read up on the 2 Bear Stearns CDO hedge funds that just went to $0 this week. They held mortgage derivatives

To: Mase

LOL!!!!!! I guess I’m done here...you are a lost cause.

“the Fed has done a much better job of creating price stability (especially since ‘82) than we had under the gold standard. I like what works.”

To: richalessi

(hint - if you want to “set” or “control” interest rates, you buy bonds to keep rates down. look at the balance sheet of the fed and see how their inventory of bonds has been piling up. they are printing money to buy these bonds - this will cause yet more inflation)Why don't you show us the Fed's balance sheet? Prove your point.

54

posted on

07/19/2007 10:14:11 AM PDT

by

Toddsterpatriot

(Why are protectionists, FairTaxers and goldbugs so bad at math?)

To: Iris7

A standard version of "the CPI (amongst other government indexes) are fiction."Shadow Stats? That guy is funny!

55

posted on

07/19/2007 10:22:34 AM PDT

by

Toddsterpatriot

(Why are protectionists, FairTaxers and goldbugs so bad at math?)

To: Toddsterpatriot

To: richalessi

What do you think the price of money is? It is called “interest rates”. Interest rates should be set by the free market, as they were before the Fed.Interest rates are still set by the market.

57

posted on

07/19/2007 10:25:49 AM PDT

by

Toddsterpatriot

(Why are protectionists, FairTaxers and goldbugs so bad at math?)

To: Toddsterpatriot

He knows his stuff, it’s good that he’s sharing.

To: richalessi

Looks like exponential growth to me.

(hint - if you want to “set” or “control” interest rates, you buy bonds to keep rates down. look at the balance sheet of the fed and see how their inventory of bonds has been piling up. they are printing money to buy these bonds - this will cause yet more inflation)

You think $800 billion in bond purchases, $300 billion since 9/11, would be enough to pull the "true" interest rate from 15% (your rough inflation rate in post #44) down to 5%? In a $13 trillion economy? That's funny!

I wonder how much extra debt was issued since 9/11? I guess if you issue $200 billion and the Fed buys $100 billion, in your mind that would keep rates below the "true" rate?

59

posted on

07/19/2007 10:35:16 AM PDT

by

Toddsterpatriot

(Why are protectionists, FairTaxers and goldbugs so bad at math?)

To: Toddsterpatriot

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-95 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson