Skip to comments.

SNAP Reform and Unhealthy Food and Beverage Taxation to Reduce the Need for Medicaid

self

| 08/04/2017

| Brian Griffin

Posted on 08/04/2017 10:05:45 AM PDT by Brian Griffin

There was an article in the Summer 2017 issue of "Good Medicine" that suggested removing SNAP ("food stamp" replacement) program eligibility for sweetened beverages, desserts, red meat, cheese, salty snacks, candy and sugar for health reasons.

I support such SNAP eligibility removals, except for red meat or cheese. I'm not so sure that red meat or cheese should be removed from SNAP eligibility since so much of American agricultural land is only suitable for raising red meat/dairy product animals.

That issue in "Good Medicine" also reported on the MIND diet to reduce Alzheimer's risk.

The MIND diet was also reported on at:

http://www.express.co.uk/life-style/health/833166/dementia-symptoms-uk-diet-mind-memory-loss-food-Mediterranean

My feeling is that Americans who think they might live long enough to get Alzheimer's or have had colon cancer might wish to avoid eating red meat after reaching about 50 years of age.

Leftist programs like Medicaid clearly aren't going to be eliminated by Republicans, so the best thing to do is to reduce their costs.

Taxing unhealthy food will both cut Medicaid costs and allow beneficiaries of federal programs to contribute to the Treasury when their financial circumstances permit.

Taxing people with high incomes like doctors and dentists all across the USA even more would drive up medical costs as they adjust their prices, partially counteracting federal health care payment coverage subsidization.

Normally, I would prefer to shift up the 15%/27% income tax transition to a higher amount so there would not be a total increase in federal taxation, but since the deficit is so high and welfare programs are running amok, that would not be sound policy at this time.

Remember, a lot of these taxes won't collect much revenue because food will be made less unhealthy to avoid taxation.

INDUSTRIALLY-PACKAGED FOOD PRODUCT TAXES

These taxes are levied on and shall be remitted by the manufacturer or importer on industrially-packaged food products:

1. a Fat Tax of four cents per gram of fat (solid at 60 degrees Fahrenheit)

2. a Food Oil Tax of two cents per gram of food grade oil (liquid at 60 degrees Fahrenheit)

3. an Added Sweetener Tax of one cent for each gram of added sugar and/or other carbohydrate source sweetener, tripled if the product is baby food. Raisins shall be considered to have 70% of their weight in sugar for taxation purposes.

4. an Industrially Sweetened Food Product Tax of two cents per ounce for each package containing added sugar and/or other carbohydrate source or artificial sweetener

5. an Industrial Food Product Sodium Tax of two cents per ounce of food if the sodium content is more than:

a. .15% of the weight of the food until January 1, 2020

b. .15% less .01% for every two years after 2017 down to .10% effective January 1, 2030

The basic Fat Tax shall not be applied to unsweetened bottled/powdered milk or industrially-packaged meat.

[It would be too hard to compute the tax on pork chops - see the Prepared Meal Ground Meat Fat Tax,]

[ Ground Meat Fat Tax, Sausage Tax and Cold Cut Fat Tax below.]

[There are meters that measure the fat content of hamburger.]

The Fat Tax shall be applied at 1/8th the rate above to butter in packages of butter.

[Butter is normally applied to surfaces and not used throughout.]

When fat and oil are one, the Fat Tax shall be the one applied to the weight of both.

The Fat Tax and Food Oil Tax on packages of margarine and food grade oil shall be only 1/4 the amounts above, with packages of extra virgin olive oil of less than 8.5 ounces with flow restrictors being exempt.

[People need to have small amounts of fat and oil in their diet so they can absorb certain vitamins.]

If the product contains:

1. meat, up to 5% of the weight of the uncooked meat in fat shall be exempt from the Fat Tax

2. dairy, 50% of the fat from milk in unsweetened products shall be exempt from the Fat Tax

3. fruit, the amount of sugar naturally in the fruit shall be exempt from the Added Sweetener Tax

4. vegetables, the amount of sugar naturally in the vegetables shall be exempt from the Added Sweetener Tax

BULK SUGAR TAX

A Bulk Sugar Tax of three cents per ounce of sugar is levied on and shall be remitted by the refiners and importers of all forms of bulk sugar.

This Tax shall be appropriately credited to the Added Sweetener Tax.

[So domestic sweet goods makers aren't discriminated against.]

BULK CORN SYRUP TAX

A Bulk Corn Syrup Tax of three cents per ounce of corn syrup is levied on and shall be remitted by the refiners and importers of all forms of bulk corn syrup.

This Tax shall be appropriately credited to the Added Sweetener Tax.

INDUSTRIALLY-PREPARED PACKAGED SNACK TAX

These taxes are levied upon and shall be remitted by the manufacturer or importer of any industrially-prepared packaged snack food:

1. a Snack Fat Tax of four cents per gram of fat and/or oil over 10 grams in a retail-size package.

2. a Snack Sweetener Tax of one cent for every gram of sugar and/or other carbohydrate source sweetener over 20 grams in a retail-size package. Raisins shall be considered to have 70% of their weight in sugar for taxation purposes.

3. a Snack Sodium Tax of ten cents per gram of sodium, with retail-size packages of less than 300 mg. of sodium being exempt from the snack sodium tax

Industrially-prepared packaged snack food shall be defined for this Act as food that is made industrially using a denaturing transformative process, has added fat/oil/sugar/sodium, is packaged, is ready to eat and the majority of which is not likely to be eaten at a table by Americans.

BUNDLED SNACK SURTAX

A Bundled Snack Surtax of 100% of the underlying Industrially-Packaged Food Product Taxes shall be levied on and remitted by the bundler (retailer, manufacturer, etc.) on all bundles of packaged snack foods.

The Bundled Snack Surtax shall be applied to all types of bundling, including financial and physical.

Retail two-for-one deals and all other types of retail combo offers, including of different brands or types of packaged snack foods, shall be considered bundling.

Placing a taxed packaged snack food "on sale" shall be considered bundling.

INDUSTRIALLY-MADE SWEET BEVERAGE, BEVERAGE SYRUP and BEVERAGE CONCENTRATE TAXATION

The Beverage Calorie Tax shall be levied on and be remitted by the manufacturers and importers of sweet beverages, beverage syrups and beverage concentrates.

These shall be subject to the Beverage Calorie Tax:

1. carbonated beverages containing a sweetener

2. non-carbonated beverages containing a sweetener, such as punch

3. fruit-based juice

4. lemonade

5. limeade

6. other beverages containing an added natural or artificial sweetener

7. concentrates and syrups for sweet beverages

but these shall not be considered a sweet beverage for this tax:

1. 100% vegetable juices

2. milk, except for that to which a sweetener has been added

3. 100% wine, sweet from what was on the vine

A tomato shall be considered to be a vegetable and not a fruit with respect to the Beverage Calorie Tax.

The Beverage Calorie Tax shall be one cent for every 10 calories of product

plus one cent for every 10 calories of production/importation in retail containers of over 12 ounces

plus one cent for every 10 calories of production/importation in retail containers of over 24 ounces.

The Beverage Calorie Tax shall be phased in in 1% increments every 12:01am every Sunday starting January 3, 2018.

[The almost two-year long phase-in is to discourage people from stocking up on soda, which would be counterproductive.]

Importers shall use the time a shipment clears US customs for tax computation.

BEVERAGE PHOSPHORIC ACID TAX

The Beverage Phosphoric Acid Tax shall be one cent per ounce of beverage in a container and ten cents per ounce of beverage syrup in a container.

This tax is levied on and shall be remitted by the manufacturer/importer of beverages and/or beverage syrups in containers.

[Phosphoric acid is very bad for teeth. It is used to make colas.]

BUNDLED BEVERAGE SURTAX

A Bundled Beverage Surtax of 100% of the ultimate Beverage Calorie Tax, Beverage Phosphoric Acid Tax amount(s) shall be levied on and remitted by the bundler (retailer, manufacturer, etc.) on all bundles of industrially-filled beverages.

The Bundled Beverage Surtax shall be applied to all types of bundling, including financial and physical.

Retail two-for-one deals and all other types of retail combo offers, including of different brands or types of beverages, shall be considered bundling for the purposes of this surtax.

Placing a taxed beverage "on sale" shall be considered bundling.

OVERLY SWEETENED INDUSTRIAL BREAD TAX

A Overly Sweetened Industrial Bread Tax of five cents per ounce on bread made with more than 2% by dry weight of sugar and/or other natural or artificial sweeteners,

including but not limited to honey, molasses, high-fructose corn syrup, corn syrup, sucrose, fructose and fruit juice

is levied on and shall be remitted by the industrial producers of bread,

including that of grocery store chains when the bread is not made in-store.

It shall not apply to:

a. retail store level bakery-made bread, even by grocery store chains, when the bread is made by mixing ingredients, kneading, letting rise and baking.

b. bread baked with raisins and/or candied fruit having a weight (per baked batch) equal or exceeding that of other sweet stuff.

[Commercial bread often contains about 6% of its weight in sugar and equivalents.]

RETAIL STORE GROUND MEAT TAXATION

A Ground Meat Fat Tax is levied on and shall be remitted by retailers offering ground meat for sale:

1. ground meat containing 22% of more fat, $3.50/pound

2. ground meat containing 17% or more and less than 22% fat, $2.50/pound

3. ground meat containing 12% or more and less than 17% fat, $1.50/pound

4. ground meat containing over 8% and less than 12% fat, eighty cents/pound

[Ground meat with over 10% fat probably shouldn't be sold at retail since many consumers don't cook it in a way that removes much of the fat.]

Ground meat used for sausage or cold cuts shall be taxed as sausage or meat cold cuts.

SAUSAGE TAXATION

A Sausage Tax at the same rates is levied on and shall be remitted by:

1. retailers offering sausage for sale and

2. restaurants on the sausage bought/used

COLD CUT TAXATION

A Cold Cut Fat Tax is levied on and shall be remitted by the manufacturers and importers of cold cut products, manufactured or imported, at the rate of $10 per pound of fat contained in them.

READY-TO-EAT/PREPARED FOOD TAXATION

These taxes are levied after December 31, 2018 and shall be collected and remitted on all ready-to-eat/prepared food products (including snacks) which are sold at any one price at the consumer level by the seller, including at restaurants, gas stations and stores of all types:

HIGH-CALORIE PRICED-PRODUCT PURCHASE TAX

A High-Calorie Priced-Product Purchase Tax of twenty-five cents per ready-to-eat/prepared priced product purchase estimated to contain more than:

1. 800 calories if sold from 11am to 2am at a restaurant that is one of a chain of over ten

2. 900 (estimated) calories if sold from 11am to 2am at a restaurant which is not part of a chain of over ten

3. 500 calories at all other businesses and times

Baked goods with less than 2% sugar and/or equivalent(s) by dry weight and produce that has not been denatured shall have their calories exempted.

Restaurants that are not part of a chain of over ten shall be exempt from the Tax on food they make until January 1, 2020.

Chains of over ten restaurants shall indicate to consumers which priced menu products are subject to the Tax by putting a special character such as an asterisk after the name or price of the product on menus and menu boards.

The FDA shall prepare regulations for how restaurants may estimate calories by August 1, 2018.

Items subject to a financial incentive (such as a (possible) discount/rebate/prize) when purchased together shall be taxed under this section as a single-priced product.

FRIED FOOD TAX

A Fried Food Tax of fifty cents per ready-to-eat/prepared fried food item.

[Enjoy that fried chicken or those fries and give Uncle Sam 50 cents to pay for coronaries.]

[Those that love fish & chips would pay $1.]

SALAD DRESSING TAX

A Salad Dressing Tax of twenty-five cents per purchase/order of salad after January 1, 2018 when served with salad dressing materials of over 300 calories (or such is available without a related prior request of wanting "over 300 calories" of salad dressing material).

PREPARED MEAL GROUND MEAT FAT TAX

A Prepared Meal Ground Meat Fat Tax of fifty cents per serving amount of eight ounces, or less:

1. when ground meat of over 22% fat content is used and the majority of it was not removed by industrial level food preparation, or

2. when ground meat of 12% to 22% fat content is used and the meat is not cooked to render out the majority of its fat or the meat is not cooked on a rotisserie or grille or equivalent in which fat can readily drip and/or drain downward and away from the meat, or

3. when ground meat of over 8% and less than 12% fat content is used and the normal method of food preparation doesn't normally remove at least 30% of it or the meat is not cooked on a rotisserie or grille or equivalent in which fat can readily drip and/or drain downward and away from the meat

I know you most of you would not like these taxes, but the federal government costs about $4 trillion (~$13,000 per US resident) per year to run. Yearly federal deficits still hover close to $500 billion per year.

I'm sure you would like substantial tax money to come from Medicaid beneficiaries (when they are able to pay) and not mainly your income tax payments.

Medicaid costs about $550 billion per year, or about $4,000 per year for each of the about 140 million workers in the USA.

Medical care and products are expensive. One heart attack might easily run up a medical tab of tens of thousands of dollars.

The high cost of Medicaid requires substantial taxation.

Averaged over the whole USA, one billion dollars of unhealthy food (and beverage calorie) taxation would reduce premiums and the need for other taxation by several billion dollars.

TOPICS: Business/Economy; Food; Health/Medicine

KEYWORDS: food; medicaid; snap; tax

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-45 next last

To: Brian Griffin

Another idiot

...just give people rice, beans, veggies, chicken (or some cheap meat) and make them cook their own damn meals

2

posted on

08/04/2017 10:09:47 AM PDT

by

goodnesswins

(Say hello to President Trump)

To: Brian Griffin

They need to make all processed food ineligible for SNAP. Red Meat and Cheese are A-OK. LFHC is the way to get healthy, lose weight and drastically reduce diabetes as well.

3

posted on

08/04/2017 10:13:42 AM PDT

by

rb22982

To: Brian Griffin

Some folks need a word tax.

4

posted on

08/04/2017 10:16:35 AM PDT

by

Larry Lucido

(Take Covfefe Ree Zig!)

To: Brian Griffin

No taxes but I do agree food stamps etc should not be used for pop, beer, candy, cigarettes, fast food. PERIOD. Like another poster I would rather we give out food instead of food stamps.

5

posted on

08/04/2017 10:16:41 AM PDT

by

McGavin999

("The press is impotent when it abandons itself to falsehood."Thomas Jefferson)

To: Brian Griffin

Granted, mathematically NO GOVERNMENT PROGRAMS ARE SUSTAINABLE.

That said, remember how much we HATED Mooch 0bama telling us and our kids what or what NOT to eat?

I would like to see more strings attached to food choices for those getting SNAP, though. Government programs are NEVER going to go away, so we may as well make them as undesirable as we possibly can - make SNAP more like WIC where you’re limited on the things OTHERS PAY FOR so your offspring won’t starve.

And, FWIW, the Little Libertarian in me is jumping up and down and having a tantrum right now. She wants NONE of this. NONE OF IT! ;)

6

posted on

08/04/2017 10:18:33 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set!)

To: Brian Griffin

“Don’t tax you, don’t tax me, tax that man behind the tree.” The late Sen. Russell B. Long, (D, LA)................

7

posted on

08/04/2017 10:21:02 AM PDT

by

Red Badger

(Road Rage lasts 5 minutes. Road Rash lasts 5 months!.....................)

To: rb22982

>>

They need to make all processed food ineligible for SNAP.That would reduce the size of the herd in more than one way.

It would also reduce profits for the pharmasurance syndicate, and associated "investors".

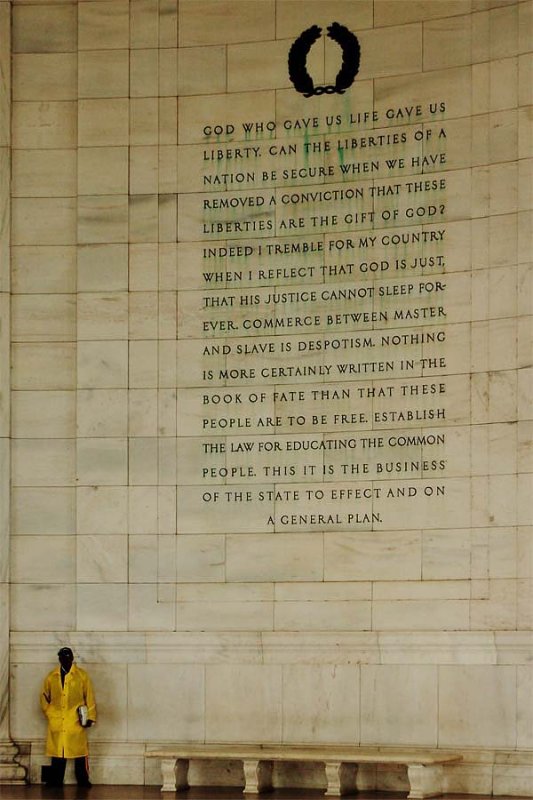

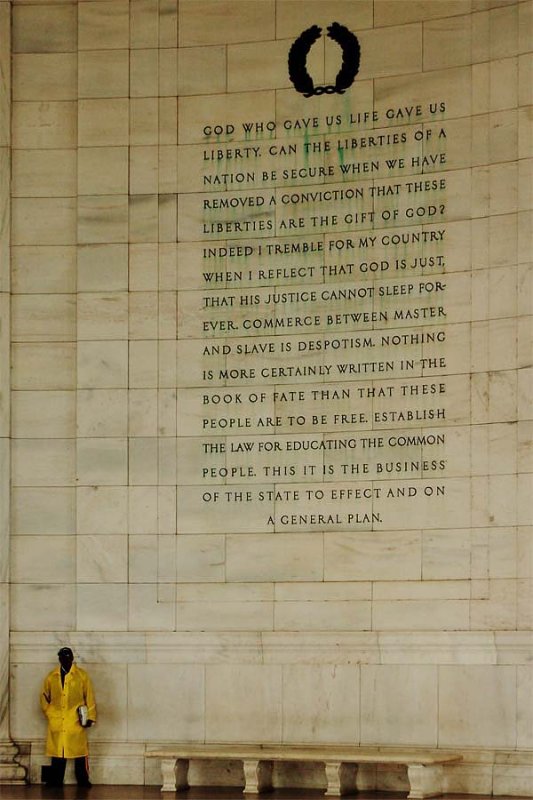

"COMMERCE BETWEEN MASTER AND SLAVE IS DESPOTISM...

...EDUCATE THE COMMON PEOPLE"

--Thomas Jefferson

8

posted on

08/04/2017 10:23:13 AM PDT

by

HLPhat

(It takes a Republic TO SECURE THESE RIGHTS - not a populist Tyranny of the Majority)

To: Brian Griffin

I rent to the “poor.” They smoke, drink, and do drugs. They are not interested or concerned about their health. They would turn down a healthy meal for the convenience of sitting on the couch and munching comfort food. They weren’t raised with healthy food and don’t care what food costs. They are completely different in their attitudes from what we in the middle class think. None of the taxes achieve the ends the do-gooders plan. The plans just bring more misery.

To: McGavin999

I used to think that, but I’m becoming more inclined to let them be allowed to purchase anything that will shorten their lives. I’m sick of supporting them.

10

posted on

08/04/2017 10:23:34 AM PDT

by

FrdmLvr

("A is A. A thing is what it is." Ayn Rand)

To: Brian Griffin

One hundred percent of the idiots who spew the no read meat line need to go teach in Japan for several and see their level of anemia in person.

That isn’t genetic.

11

posted on

08/04/2017 10:28:16 AM PDT

by

MrEdd

(Caveat Emptor)

To: MrEdd

I concur.

I'm also in favor of disallowing red meat for SNAP, after watching EBT users buying $14/lb steaks that I haven't been able to afford in years. If they must have it, then cap allowable meat prices @ $5/lb. That's still a high enough ceiling to get the mid-grade leaner ground beef.

To: Larry Lucido

See his Freeper page? Yowser

13

posted on

08/04/2017 10:48:44 AM PDT

by

goodnesswins

(Say hello to President Trump)

To: Brian Griffin

Only registered and inspected vegan food stores should be eligible for SNAP.

14

posted on

08/04/2017 11:05:17 AM PDT

by

arthurus

To: Brian Griffin

It will be labeled as a “racist law”.

15

posted on

08/04/2017 11:10:55 AM PDT

by

AppyPappy

(Don't mistake your dorm political discussions with the desires of the nation)

To: Brian Griffin

Yer just a regular ole government supremacist aren’t ya?

16

posted on

08/04/2017 11:13:14 AM PDT

by

Lurkina.n.Learnin

(I'm tired of the Cult of Clinton. Wish she would just pass out the Koolaide)

To: Brian Griffin

Of course they go too far.

Just eliminate highly sugared products from SNAP.

If the kids want sweets the parents can make them. It’s not like they’re too busy doing anything productive.

17

posted on

08/04/2017 11:16:16 AM PDT

by

mrsmith

(Dumb sluts: Lifeblood of the Media, Backbone of the Democrat/RINO Party!)

To: Brian Griffin

the screwball forgot to tax the air we breath. . . .

18

posted on

08/04/2017 11:20:38 AM PDT

by

Godzilla

( I just love the smell of COVFEFE in the morning . . . . .)

To: Brian Griffin

My feeling is that Americans who think they might live long enough to get Alzheimer’s or have had colon cancer might wish to avoid eating red meat after reaching about 50 years of age. “

—

Absolute nonsense.

.

.

19

posted on

08/04/2017 11:23:03 AM PDT

by

Mears

To: Larry Lucido

“Some folks need a word tax”

I believe it is important to express ideas in full detail.

Health care payment reform has failed so far simply because the politicians hadn’t thought it out fully and discussed reform in detail.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-45 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson