Posted on 04/23/2009 7:53:43 PM PDT by TigerLikesRooster

Tipping Point for U.S. Treasuries?

If the day comes when the U.S. Treasury bond auction fails, it will be too late to react. With some help from the mass media, the situation is likely to get very ugly. Markets move faster than ever and once a tipping point is reached, you’ll be like every other sheep at the slaughterhouse. Seeing the signals and preparing for this potential calamity may end up being the next major investing opportunity or wealth destructive event of our lives.

Because the magnitude of its potential impact is so great (some say 50% devaluation of the USD and/or interest rates in the high teens), anyone with significant USD denominated savings should answer the key questions for themselves - even if it is simply to dispel the fear the possibility creates. At what point will the U.S. government run out of debt capacity? What are the factors that tell us when this is likely to occur? And, what is the chain reaction that follows?

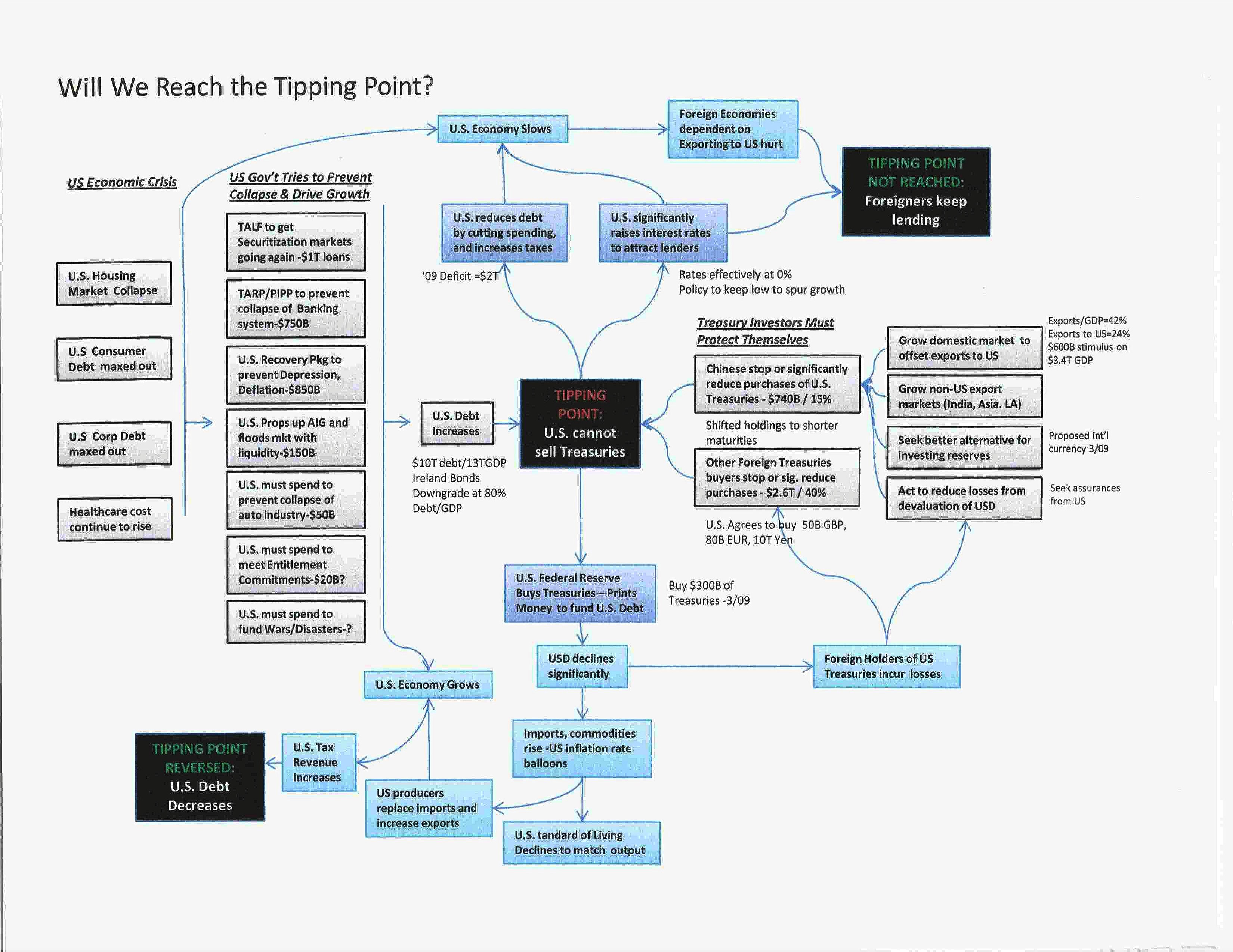

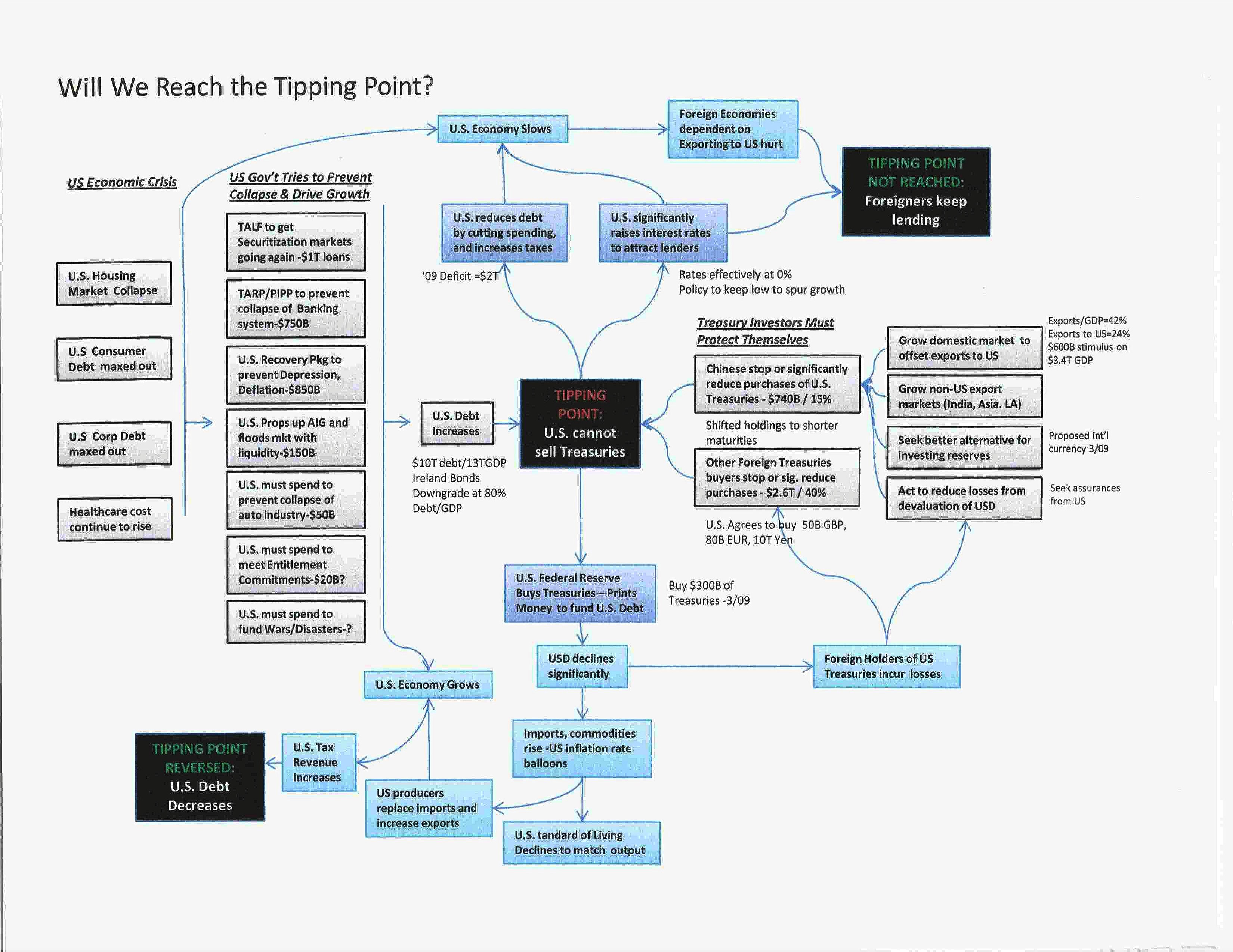

To begin to answer these questions, I’ve attempted to map out the cause and effect flows that would lead to a tipping point in Treasuries. The chart below starts to identify and quantify (where possible) forces and events that can lead to a tipping point. So many different factoids are thrown around on this topic that without some framework to evaluate the issue, it is easy to get confused. This is my effort. I hope to improve it over time – feedback and facts are welcome.

(Excerpt) Read more at seekingalpha.com ...

Ping!

-~~Ludwig Von Mises

Third week of October, 2009. Be prepared.

jiggygirl and I are working on buying a house just so we are big debtors when the high interest rates and hyperinflation wipe out savers.

Any yellow shiny (heavy) metal under your mattress?

Lol.

I was lucky and was able to transfer from my dept at work. I work for a global ali co. Went from trading to a desk grudge. Same pay, same pay grade. I feel relived.

Can anyone trace or determine if banks are swapping dollars for foreign currency?

I think they fully expect this scenario. Here’s what they’ll do: dump their dollars for yen, yuan, or even Euros. When the dollar crashes, convert back to the devalued bucks to pay off their bad paper.

I think the administration is cooperating.

I was thinking September...

I think Treasury or Fed is doing it.

If we just "print money" the Chinese will balk at buying treasuries. It's the equivalent of giving them back a lot less than they bargained for... Also if we go the "print money" route, they'll switch to a new reserve currency - along with the rest of the world.

Like a story I heard about some South American home owners during periods of hyperinflation. Some of them were paying off their mortgages early because the postage was costing more than the mortgage payment and they got tired of paying for the stamps.

bookmark, (for when I find my glasses)

Fuel costs will double, at least, overnight, maybe $10 per gallon ?

Food costs will follow.

But I like your tagline.

We could have a few years of deflation before the hyper kicks in - that'll wipe our almost everyone.

1. The south west corner of the diagram makes no sense. How is incurring & encouraging MORE (bad) debt - liar loans for mortgages, bailouts to GM’s nursing home, etc - going to “grow” the economy?

The US g0v’t’s bailout policies are like the “policy loans” China used to engage in. They weren’t REALLY “loans,” just welfare checks (wealth transfers using inflationary finance) to state-run industries to give people something to spend, funny (fiat) money...

2. I don’t like blue box near top: “increases taxes.”

Gloomdoom ping.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.