Posted on 02/28/2022 5:34:22 AM PST by blam

Goldman Warns Of Stagflationary Commodity Supply Shock On Ukraine, Raises Near-Term Brent Forecast To $115

One look at the surge in oil, gas and various other commodities like wheat, confirms what everyone by now knows: unleashing hell against Russia in the form of the nuclear SWIFT option coupled with central bank sanctions may crush the Russian economy but it will also will lead to a harrowing price shock for ordinary citizens across the globe coupled with the worst stagflationary episode in years.

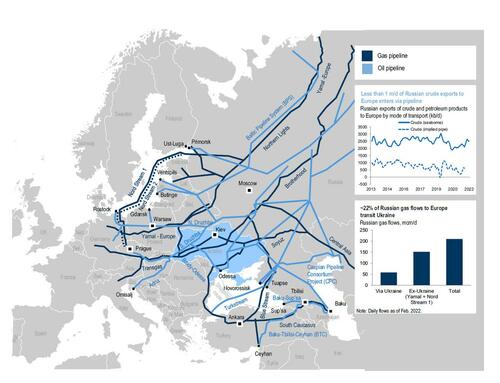

As Goldman writes in a late Sunday note, Western sanctions on Russia are set to tighten significantly after the announcement on February 26 to bar selected Russian banks from accessing the SWIFT international payment system as well as to target its Central Bank’s reserves. While details on the implementation of these additional sanctions have not been released, with carve-outs likely still allowing for energy and food trades, Goldman warns that “the hurdles that these sanctions will create for financial payments are likely to exacerbate the recent Russian commodity supply shock, already visible as Western and Chinese traders halting shipments.”

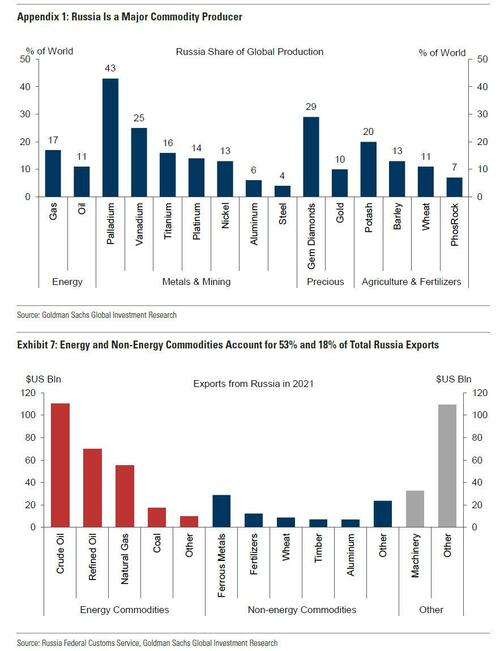

But what is critical to Goldman’s view, is that commodity markets need to reflect not only these difficulties in paying for Russia’s exports but, with little left to sanction, the risk that Russian commodities eventually fall under Western restrictions, an outcome no longer being ruled out by the US administration. Barring a breakthrough in peace negotiations, Goldman warns that “this leaves commodity prices having to rally sharply as we see demand destruction as now the only significant remaining balancing mechanism, with Russia a key exporter of most commodities that were already facing exceptionally tight inventory levels and low spare production capacity.”

What does this mean for commodities?

Well for oil, Goldman says this represents $110/bbl to $120/bbl short-term price upside should 2 to 4 mb/d of demand destruction be required to compensate for a commensurate one-month loss of Russian exports. Behind this significant upside scenario is that the price induced shale supply response would no longer be a suitable rebalancing mechanism for such a potential large and immediate supply shock, with Russia’s crude and petroleum product exports of 7.3 mb/d, 6 mb/d of which clears through the now shut seaborne market.

Furthermore, even a redirection of oil flows to the East as many believe will happen, would still tighten global markets, as it would require a 12-day increase in transit time, the equivalent to the loss of 90 million barrels. The pipeline nature of gas flows to Europe, limiting shippers’ liability, and the ability for European consumers to ramp-up flows from contracted volumes, suggest a greater downside risk to Russian oil than gas exports in the short-term.

The only potential short-term supply response would need to come from OPEC, as a surge in Saudi and UAE production as well as a lift of Iran’s US secondary sanctions would likely lead to a 2 mb/d increase in supply over the next couple months, with a coordinated global SPR release helping bridge the gap. Here Goldman caveats that while such an outcome becomes increasingly likely the more Russia is ostracized from the global economy, driving core-OPEC, Iran and the West closer together, it would nonetheless come at the expense of a complete depletion of the global oil market’s spare capacity, still warranting much higher oil prices.

Amid these considerations, the range of near-term price outcomes for commodities has become extreme, given the concern of further military escalation, energy sanctions or potential for a cease-fire.

So, in the very short-term, Goldman now sees risks skewed to significant further upside and is raising its 1-month Brent price forecast to $115/bbl (from $95/bbl previously), with even more upside risks on further escalation or longer disruption. And even if near-term price volatility reaches unprecedented levels, the bank’s longer-term bullish under-investment thesis remains intact and reinforced by these events.

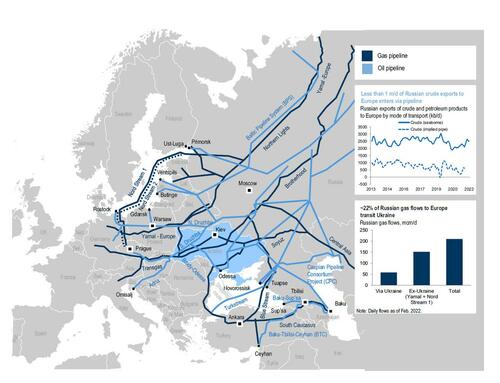

Besides oil, Goldman also expects the price of consumed commodities that Russia is a key producer of to rally from here – this includes oil, European gas (and hence aluminum), palladium, nickel, wheat and corn. In the case of agricultural prices, this reflects the fact that Russia and Ukraine represent nearly a quarter of global wheat and corn exports in the face of already tight inventories, with diesel farming input costs set to rally and with potential for disruptions to global fertilizer exports given Russia’s significant market share.

Shifting to gold, the bank writes that the outlook for the precious metal price is harder to call in the short-term, but still bullish medium-term. On the one hand, gold’s unique role as the currency of last resort will likely be apparent if restrictions on Russia’s Central Bank accessing its offshore reserves leave it leveraging its large domestic gold stockpiles to continue foreign trade, most likely with China. However, on the other hand, the required large sales of gold at below market prices, given the limited appetite outside of China for such trade settlement, would emphasize its potential limited scale in the future, with few other countries able to use gold as such a currency of last resort.

Ultimately, Goldman concludes that “the recent escalation with Russia create clear stagflationary risks to the broader economy, driven by higher energy prices, which reinforce our conviction in higher gold prices in coming months and our $2,150/toz price target.”

Away from gold, industrial metal flows out of Russia have also been reduced sharply over the past week as western buyers remain similarly hesitant in the context of sanction uncertainty and escalation. Even with trade exemptions, it is unlikely that metals export volumes will normalize quickly, with heavy logistical disruptions to metals flows through the Black Sea, both from Ukraine itself but also Kazakhstan and Uzbekistan (which are important routes for copper and zinc). With materially reduced export volume out of Russia, Kazakhstan and Uzbekistan, all the base metal markets will face accelerated tightening in the near-term against a backdrop of already multi-year low visible inventories. This will support a further rally in prices across physical premia, flat price and timespreads. Aluminium and nickel stand as the most exposed base metals given Russia’s significant supply role. .

Biden Admin can stop any rise of WTI beyond 100/bbl with a pen and phone. Reopen Public Lands, Alaska and gulf oil lease sales and 40/bbl scarcity tax will evaporate.

Russia has banned the export of ammonium nitrate (AN) from Feb. 2 to April 1, in a widely-expected move by the government as it seeks to guarantee affordable supplies for domestic farmers following the spike in global fertilizer prices.

Ammonia gas, one of the key materials in AN production, has seen prices rise more than fivefold since October 2020. Rising costs for natural gas, a key input of AN production, have also impacted AN prices. Those higher prices have forced farmers to reconsider their nitrogen fertilizer usage, favoring legumes such as soybeans, which require less nitrogen fertilizer than corn and wheat. Ammonium nitrate is one of two main sources of nitrogen fertilizer, with the other main source of nitrogen being derived from urea.

...

Russia represents around two thirds of the world’s annual 20 million mt ammonium nitrate production, most of which is used in fertilizers to improve yields for crops such as corn, cotton and wheat.

The Food and Agriculture Organization of the United Nations expects total nitrogen fertilizer production to be around 190 million mt in 2022, according to its most recent market outlook published in 2019. Non-nitrogen fertilizers can also be produced from phosphoric acid and potash, and the FAO put production of those two substances at 64 million mt and 65 million mt, respectively.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.