Posted on 02/04/2019 9:05:23 AM PST by SeekAndFind

We Baby Boomers timed it perfectly. We came of age during in an era of plentiful jobs and relatively high wages. Public pensions were generous. Stock, bond and home prices were low, and have since risen strongly, enriching anyone who managed to save regularly. College was (by current standards) insanely cheap, allowing us to upgrade our skills with minimal sacrifice.

The result was a generation with high average net worth and, at first glance, a great shot at a comfortable retirement.

But that’s an illusion, for several reasons.

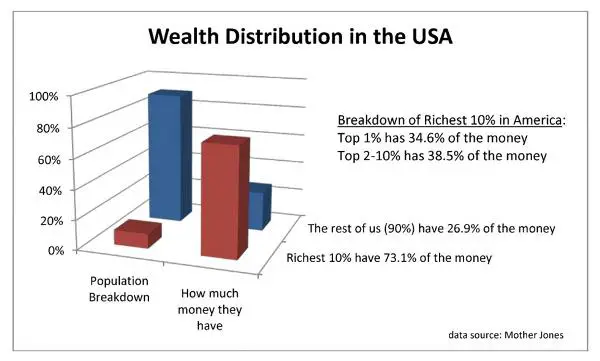

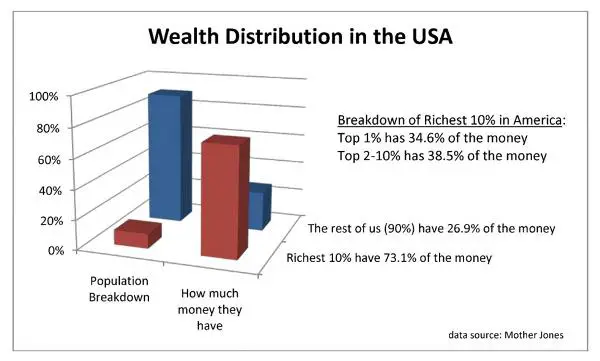

First, the “average net worth” stat masks the fact that many Boomers didn’t actually do much saving. All those outrageous wealth inequality charts include retirees, which by definition means that most Boomers have been harvested by the 1% along with their kids and grandkids.

Second, public sector pensions (as just about everyone knows by now) don’t have anything like the resources needed to actually pay current and future retirees what they’ve been promised. When those plans start imploding in the next recession, benefits will be cut dramatically. See here, here and here for the grisly details.

And this morning the Wall Street Journal added to the list with a feature on how (of all things) Boomer student loan balances are exploding:

Over 60, and Crushed by Student Loan Debt

One generation of Americans owed $86 billion in student loan debt at last count. Its members are all 60 years old or more.

Many of these seniors took out loans to help pay for their children’s college tuition and are still paying them off. Others took out student loans for themselves in the wake of the last recession, as they went back to school to boost their own employment prospects.

On average, student loan borrowers in their 60s owed $33,800 in 2017, up 44% from 2010, according to data compiled for The Wall Street Journal by credit-reporting firm TransUnion. Total student loan debt rose 161% for people aged 60 and older from 2010 to 2017—the biggest increase for any age group, according to the latest data available from TransUnion.

Some are having funds garnished from their Social Security checks. The federal government, which is the largest student loan lender in the country, garnished the Social Security benefits, tax refunds or other federal payments of more than 40,000 people aged 65 and older in fiscal year 2015 because they defaulted on student or parent loan debt. That’s up 362% from a decade prior, according to the latest data from the Government Accountability Office.

Student debt is one of the biggest contributors to the overall increasing debt burden held by seniors. U.S. consumers who are 60 or older owed around $615 billion in credit cards, auto loans, personal loans and student loans as of 2017. That is up 84% since 2010—the biggest increase of any age group, according to the TransUnion data.

The borrowing buildup has upended the traditional arc of adult life for many Americans. Average debt levels traditionally peak for families headed by people aged 45 to 54 years old, according to the Employee Benefit Research Institute based on data from the Federal Reserve’s Survey of Consumer Finances. But between 2010 and 2017 people in their 60s, like most other age groups, accelerated their borrowing in nearly every category, according to the TransUnion data.

Seniors are finding they have to work longer, holding onto positions younger adults might otherwise receive. They’re relying on credit cards and personal loans to pay for basic expenses. People 65 and older account for a growing share of U.S. bankruptcy filers, according to the Consumer Bankruptcy Project; unlike most consumer loans, student debt is rarely dischargeable in bankruptcy.

Perhaps the most surprising element of this surge is the rapid run-up in student loans, an issue that used to be mostly concentrated among young adults. Changes made in the wake of the last recession help explain the shift.

In the years after 2008 banks and other private student lenders began tightening underwriting standards for their loans, requiring more parents to sign on to student loans along with the student borrower. Cosigning makes the parents equally responsible for paying back the loan, resulting in a lower credit score and crimping their ability to borrow if they or their child miss a payment.

In recent years, private lenders including SLM Corp., better known as Sallie Mae, and Citizens Financial Group Inc., have increased their focus on parents. They’ve rolled out student loans that are just for parents who want to pay for their kids’ college education. The loans’ main pitch includes the possibility of a lower interest rate for parents who have high credit scores than what the federal government charges on its own parent loans; it also allows parents to spare their children the burden of debt by taking it on themselves.

Another problem: The federal government caps the dollar amount of loans that undergraduate students can borrow for college, but no caps exist for the aggregate amount that parents can take on. That has contributed to parents increasingly borrowing to cover the gap between tuition costs and the amount of free aid and loans their children receive.

The federal government disbursed $12.7 billion in new “Parent Plus” loans during the 2017-18 academic year, up from $7.7 billion a decade prior and $3.3 billion in 1999-2000, according to an analysis of Education Department data by Mark Kantrowitz, publisher of Savingforcollege.com. Its underwriting standards are generally looser than banks and other private lenders, making it easier for more applicants to qualify. Parents on average owed an estimated $35,600 in these loans at the time of their children’s college graduation last spring, according to Mr. Kantrowitz. They owed nearly $6,400 on average (not adjusted for inflation) in the spring of 1993.

There’s so much to hate about this situation: The fact that the government and private sector lenders are “targeting” seniors for student loans; the fact that soaring senior debt has “upended the traditional arc of adult life” for so many; and last but definitely not least, the fact that this is happening during a long economic expansion. In the coming recession, retiree borrowing will soar, along with the attendant stress and anger. We Boomers might find ourselves back where we started during the Vietnam War, in the streets protesting an outrageously predatory government.

And the death spiral birth rates(an absolute must to keep the Ponzi schemes rolling) are adding to the catastrophe.

“We came of age during in an era of plentiful jobs and relatively high wages”

Uh, maybe front end Baby Boomers. By the mid-70’s, those of us in the mid-50s cohort faced 16% interest rates, 10% unemployment, out of control inflation, oil embargos and closing factories. This was the reason Reagan was elected: he was the first MAGA candidate, promising to end all this crap.

Ouch!!!! I am 62 and get continual robo calls from marketers trying to "help" me with my student debt.

My stock answer:

1- I am 62 years old (which to me gives the implication that it is a ridiculous notion that I might still have student debt

2- I tell them that I NEVER HAD any student debt. That is not entirely true because I borrowed $2,500 in 1979 to finish up, but I had it paid off in a year.

I guess I owe them an apology. They know the score better than I, and I am a banker. I have never had a lot of confidence in my generation, and this confirms that I was correct.

Not all baby boomers spent all they made and more. Those that didn’t are having a comfortable retirement.

Another article about why people who took college loans were taken advantage of and need to have them forgiven?

Are these the same baby boomers who gave us Clinton and Obama?

“We Boomers might find ourselves back where we started during the Vietnam War, in the streets protesting an outrageously predatory government.”

Go for it,Boomers——reality is tough./s

.

A problem of our own making. We as a society have been willing to transfer our wealth to the Marxist ponytailed professors with no questions asked. For decades people have been writing about larceny and people just kept paying the random. Too late to cry about it now. It’s a heavy task master and he must be paid.

Now, about that “free” tuition....

My retirement has been fine so far and I expect that to continue. I paid my college loan off almost 50 years ago. A college education is WAY over priced today. Over priced, politicized and too often lacking in actual education.

Yes I graduated from college in a recession 1974. Thankfully college was relatively cheap back then. I love my kids. Started 529 accounts for them as babies. I would never do a parent plus loan.

Part of the problem is that parents have their kids going to colleges they can not afford. Mine went private and left with loans of 29k not bad. But I have friends who signed parent plus loans owing 100k. Just so they could have a nice college sticker for the car.

I laugh when I get those those calls about my student debt. I worked my butt off as a banker 35 years. I am a big saver. When friends were wasting money at bars I was saving part of my salary, all my profit sharing. I love being retired. I don’t owe anyone a dime.

And the death spiral birth rates(an absolute must to keep the Ponzi schemes rolling) are adding to the catastrophe.

Another thing that I've long thought would be an issue is that those who do have liquid assets like stocks, bonds, and mutual funds are eventually going to find that they might ultimately do worse off with them when it comes time to liquidate them to finance their retirement, given the demographic facts on the ground. What happens in a market where you have more sellers than buyers?

Baby Boomers were born from 1946 and 1964. There is a big difference in what the early boomers and late boomers grew up in. I am a 46 boomer and took a total of $2500 student loans to get through BS and MS degrees in a state college with a wife and a child. Started teaching with a annual salary of $6300 (take home $353 month). Paid off student loans in 2 years. Trouble with many boomers with high student loan debt still today is what they did with the loan money when they got it. In the 70s and early 80s students were enrolling in college, getting a lot of loans, buying new cars with it along luxury things and living high. Then many dropped out or flunked out of college and never got a degree which was important in getting many good jobs back then. High debt low income. Early boomers who are now retired seem to be doing much today than late boomers still working.

Good for you. I spent 25 years as a state safety and soundness regulator. Been on the banking side for 14 years. A divorce in 2001 (not of my choosing) and a drug addict son the last 5 or 6 years has kept me from being able to retire, but I am making progress. I don’t mind hard work. Just wish I could have held on to more of it, and I would have had it really been left up to me. Not bitter about it, but disappointed in the way life turned for me.

Did a little research of the numbers.

At the tail end of my U. of Iowa liberal arts quest in 1960, resident tuition was $240/school year.

In 2018 resident tuition for the school year is $7,486.

$100 of 1960 dollars adjusted for inflation equates to approximately $850 in 2019.

You don’t have to play around much with the math to realize what a colossal rip off colleges have become.

Good point.

I’m doing well in retirement; when I was in school Dad gave me a copy of “The Richest Man in Babylon”. Its key lesson was, “A portion of all you earn is yours to keep.”

(I know the original says `part’ but portion fits better)

So I learned to save and invest. Lived like the VW ad that said, “Live below your means” (my first car was a ‘56 Bug).

Before that my favorite cartoon character was the fabulously wealthy Scrooge McDuck, who could squeeze a nickel until it screamed.

Anyway, all’s well that ends well. My wife and I have been blessed.

College debt? Uncle Sam gave me an ROTC scholarship. Then he sent me to Vietnam.

;^)

I think you hit the nail on the head.

I too am a very late boomer, served in the military, and then went to get a degree. I watched as fellow students acquired more loans and had lavish spring break vacations, purchased stereo equipment and other such depreciating assets. I also watched in horror as tuition essentially rocketed into orbit as Pell grants and other “free money” corrupted the system. Finally, guys who loaded up on tuition debt and then dropped out. Saw that too and that could only be financially catastrophic.

Having said all that, there is no reason people should be willing to become indentured servants for a sheepskin. It’s ludicrous. I have kids (who are debt free) and have demanded that they not go into debt for college. No way am I going to allow them to put themselves in a huge financial hole by the time they are 22!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.