Posted on 12/09/2014 2:28:07 PM PST by Kartographer

Wall Street has for some time attempted to put taxpayers on the hook for its derivatives trades. I highlighted this a year ago in the post: Citigroup Written Legislation Moves Through the House of Representatives. Here’s an excerpt:

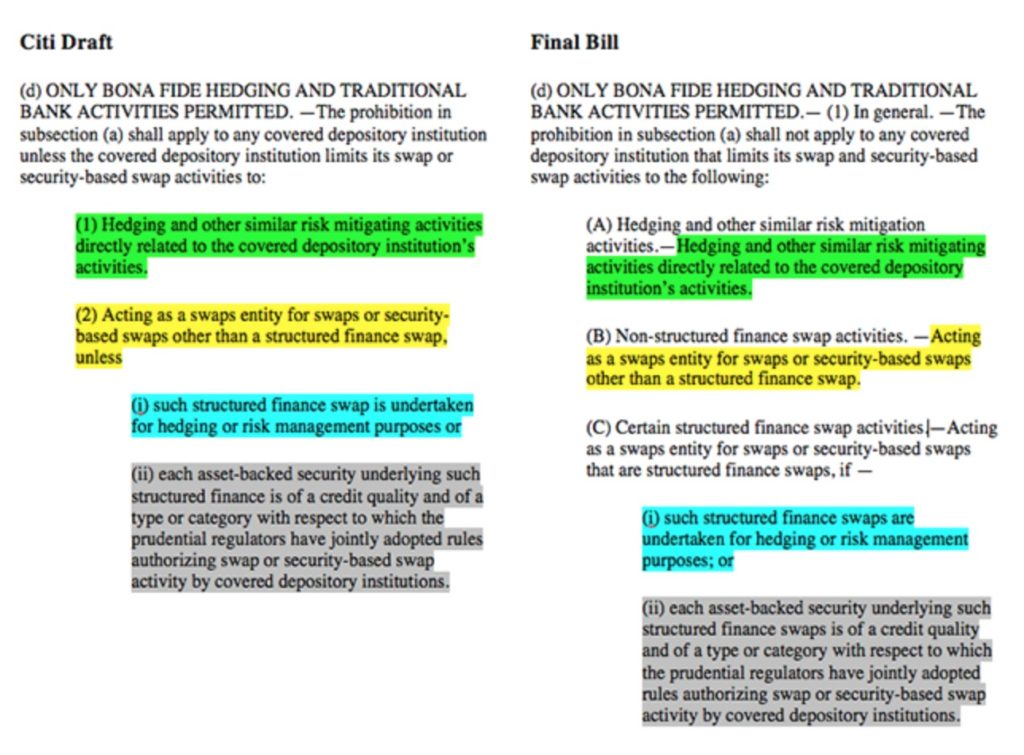

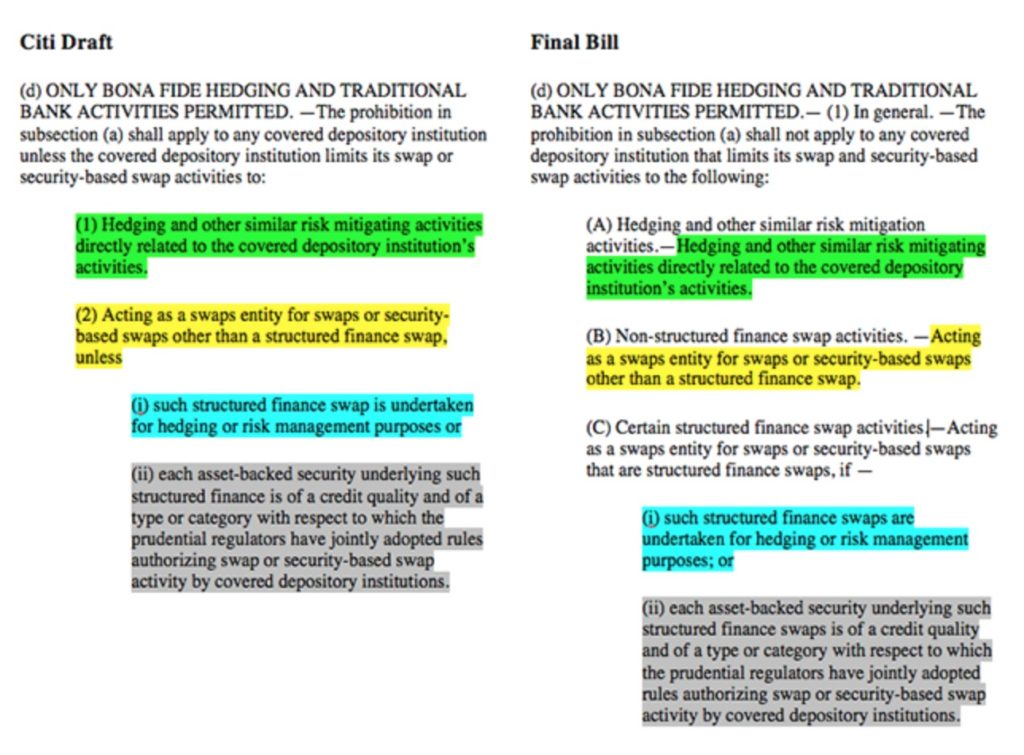

Five years after the Wall Street coup of 2008, it appears the U.S. House of Representatives is as bought and paid for as ever. We heard about the Citigroup crafted legislation currently being pushed through Congress back in May when Mother Jones reported on it. Fortunately, they included the following image in their article:

(Excerpt) Read more at zerohedge.com ...

Ping!

Clearly the analysis must be very reliable.

The article has some very specific accusations that if true, mean that the banks are indeed putting us on the hook for their derivative games. There are excerpts of the bill along with the former Goldman employee congressman pimping it.

The article was very specific, is there something you can falsify for us?

Endless.

But don’t worry, there are plenty of people right here on FR who will tell you we’ll “make a profit” off of bailing them out.

The Federal Reserve (and its member banks) are the foundation of Progressive Government in the USA.

Sorry, but we are, as a matter of fact, already on the hook. Remember what happened in 2008? TARP, Bailouts, and 5 years of QE to rebuild bank balance sheets. Whether legal, or not - it happened, and will happen next time too.

We already are on the tab for failed businesses on Wall Street.

Well, what were their options, really? They were faced with every bank and financial institution going broke, which would have doubtless been followed by the bankruptcy of every major corporation in the country. I am not surprised they did not go for that approach.

Bailouts and asset confiscation along with lengthy prison terms?

Do you understand the difference between the two drafts? Or do you depend on MJ to parse it for you?

What happened at the G20 in Australia on Nov 16th was they signed in agreement a contract with large banks that your investments like a 401k, large savings over-—I think it was 85,000 Euro but don’t quote me, it could have been dollars...would be BANK CAPITAL ON PAPER. That means you don’t get it back, no longer covered by FDIC.

This is when anther stock market crash comes and the banks are in trouble like with derivatives (now) and anyone planning to retire will not get their money back.

That is the gist of what Obama went to G20 to do for the USA...NO ONE WILL HAVE MORE THAN A CERTAIN AMOUNT OF MONEY WHEN THE SMOKE CLEARS....CRASHES ARE NOT ACCIDENTAL.

Your language is steeped in Democrat invective as well.

Derivatives are not "games" - they are a risk management tool.

If FDIC-backed assets are at risk (and by definition they always are, since those deposits are always invested in loans, and loans are always exposed to interest rate volatility) then the custodians of those assets should be able to use risk management tools like interest rate swaps to help preserve or increase their value.

It's common sense.

I meant to ping DR to the above post.

Your language is steeped in ‘Bankster’ invective as well.

stephenjohnbanker a good example of what we talked about earlier.

” But don’t worry, there are plenty of people right here on FR who will tell you we’ll “make a profit” off of bailing them out.”

LOL......good one!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.