Posted on 03/22/2012 1:05:10 PM PDT by geraldmcg

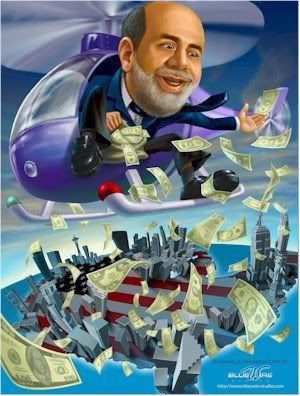

Federal Reserve Chairman Ben Bernanke is giving lectures on the University Circuit attacking the proposal for the U.S. to return to a gold standard. In his contempt for honest money, Bernanke argued that government monopoly money is more valuable than gold!

In his incredulous argument Bernanke said that the strength of a gold standard is its greatest weakness because if the money supply is determined by the supply of gold, it cannot be ‘adjusted’ (a.k.a. manipulated by the Fed and politicians) in response to changing economic conditions."

That’s the whole point! Our founding fathers intentionally implicitly mandated that money had to be gold or silver. That way the scoundrels couldn’t rob the citizens blind, as they are doing today.

Swiss America Chairman Craig R. Smith is conducting a national Talk Show interview tour to conteract Bernanke's wrong-headed thinking about money and what's best for our economy. Craig is particularly critical about Bernanke's attempt to brainwash today’s brightest business students as to the "virtues" of fiat money and to the folly of gold.

Smith contends that politicians and bankers have always resisted wearing the 'golden handcuffs' which our Founders thoughtfully established in the U.S. Constitution.

Cut from the same inflationary paper money cloth is Timothy Geithner, who when testifying before Congress this week was pressed by Rep. Trey Gowdy (R-SC) about how much the debt ceiling would need to be raised to meet all of the current and long term obligations? He would not answer. So the Congressman asked would it be $20 trillion? $50 trillion? More?

Geithner again would not answer the question, but would only offer "a lot...the number would very uncomfortable.” The chairman of the hearing was heard repeating Geithner's answer "Uncomfortable, uncomfortable".

Are you uncomfortable letting Craig Smith on your Talk Show to give the sober facts about unbacked paper money vs. a true gold standard? If not, give us a call.

ABOUT CRAIG SMITH… “The Face of American Small Business”

Craig R. Smith is an author, commentator and popular media guest because he instantly engages audiences with his common-sense analyses of local, national and global trends.

The Founder and Chairman of Swiss America Trading Corporation, Craig for 30 years has helped many thousands of people hedge against the problems of a weakening U.S. Dollar.

A monetary expert, Craig is the author of numerous books and articles including The Inflation Deception: Six Ways Government Tricks Us...and Seven Ways to Stop It! (June 2011), Crashing The Dollar: How to Survive a Global Currency Collapse (2010) and Craig is also author of The Uses of Inflation: Monetary Policy and Governance in the 21st Century, a major White Paper published in February 2011. Recent media clips: www.craigrsmith.com

Really?

Well,that’s the point isn’t it now, Benny boy

The gold standard would prevent the deflation caused by Keynesian deficit policy, and it would prevent the inflation that Keynesians need to counteract the deflationistic deficits.Without deficits and inflation statists would hardly be able to function.

“How do you expect us to control your money if we go back to a gold standard? We wouldn’t be able to manipulate markets, trading, inflation or anything like that. We’d have no use for large portions of federally funded beauracracies. Do you know how many jobs would be lost? It would put people out of work as their government funded positions were no longer needed! Is that what you want?”

:O/

“...cannot be ‘adjusted’ (a.k.a. manipulated by the Fed and politicians) in response to changing economic conditions.”

####

Politically driven and/or economically vacuous “adjustments” made by HUGELY overrated Ivy Leaguers is what has the US fiscally, in its current downward spiral.

That said, Bernanke, I’m sure your lying, obfuscating propaganda fits in very well on the Commie “university circuit”.

I might be wrong here, since I'm no expert on gold standards, but I suspect Ben is wrong here. When we had a privatized money supply (notes were issued by private banks), they backed their notes with gold, but at any given time they only held a fraction of the gold necessary to back their notes. So there is still a fractional reserve system that creates money supply growth and contraction. The difference is that it puts some limits on money supply growth and contraction. If your regulated minimum fractional reserve is some number K (0 < K < 1), then you can only issue at most 1/K units of notes. Conversely, you won't issue a lot less notes than the total amount of gold in your reserves.

With the current system, there are no bounds whatever.

Gold and gun makes for a polite society. It’s a question of insuring money.

Bernanke is a sack of lying burping scum from a bottom of a pond. Every day banks hedge with gold and other assets, thus, in other words, Bernanke is hiding 2 things:

1. MAssive Fed Fraud or fraud done on the fed. (we are getting screwed and he is cooking the books and not letting us know, much like the Rogue Trader).

2. Bankruptcy of the system and the denial of good industry the agency of money and competing currencies in favor of fiat globalist schemes for CEO punk political aggrandisement... and Romney is the perfect animal sucker for this kind of ponzi LDS cult.

Wow. I must say it is difficult to manipulate something that is fact and not created from nothing like the paper from a printing press. It is also more difficult to manipulate people with gold in their hand than those that you make promises to from paper wishes.

What Obama promised and could not yield, Bernanke made sure it would be yielded for the rest of Zero’s agency.

Liberals in Congress got a “carte blanche” from Bernanke in exchange for Bernanke sitting there and doing their bidding. These people sold their souls to satan for 5 min of fame.

Those two are traitors. One might screw the other or they work together... we are never sure in gay relations, one cloth himself while the other just takes it.

The original game sold for $2....they sell for $20 now. The price can only go up.

Wait for the Monopoly money bubble to burst now....you heard it hear first.

He doesn’t _believe_

He and other MrBigs were/are eager to get us into this mess. This mess is the only weapon by which USA can be destroyed: money out-of-thin-air (MOOTA).

Mr. G and B and the rest, providing the ongoing solutions to debt, borrowing more (debt) MOOTA, know what they’re doing. They seek a categorical change in USA and the world and can’t get there too soon. It must look like an accident or some sheeple will worry. Most of them, taught in _modern_ finance, fully emersed in MOOTI correctness, will not know what hit them.

I’ll add Mr Savage to the list of those emersed therein.

Mass delusion is the new way of man.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.